Bitcoin (BTC) experienced a notable surge, rising over 3% to surpass $97,000 on May 7th. This rally has sparked considerable interest and speculation about Bitcoin’s future trajectory. This article breaks down the key factors contributing to this price increase and examines the potential for further gains.

Key Factors Fueling the Bitcoin Price Rally

Several elements have converged to propel Bitcoin’s recent price surge:

- US-China Trade Deal Optimism: Hints of renewed trade talks between the US and China have injected optimism into the market. US Treasury Secretary Scott Bessent expressed a desire to avoid decoupling, signaling a potential for easing trade tensions. This prospect has boosted risk appetite across various markets, including cryptocurrencies. However, skepticism remains, with predictions markets assigning a relatively low probability to a trade deal by June.

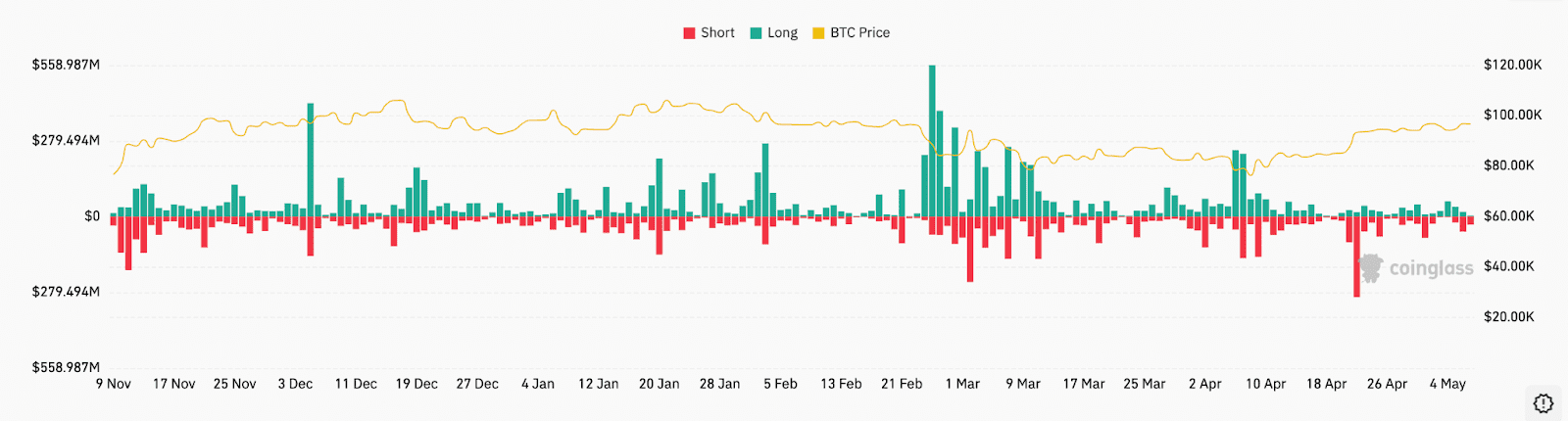

- Short Liquidation Squeeze: A significant amount of short positions, totaling over $83 million, were liquidated in the derivatives market. This occurs when the price moves against short sellers, forcing them to buy back Bitcoin to cover their positions, further driving up the price. The volume of short liquidations indicates strong upward momentum.

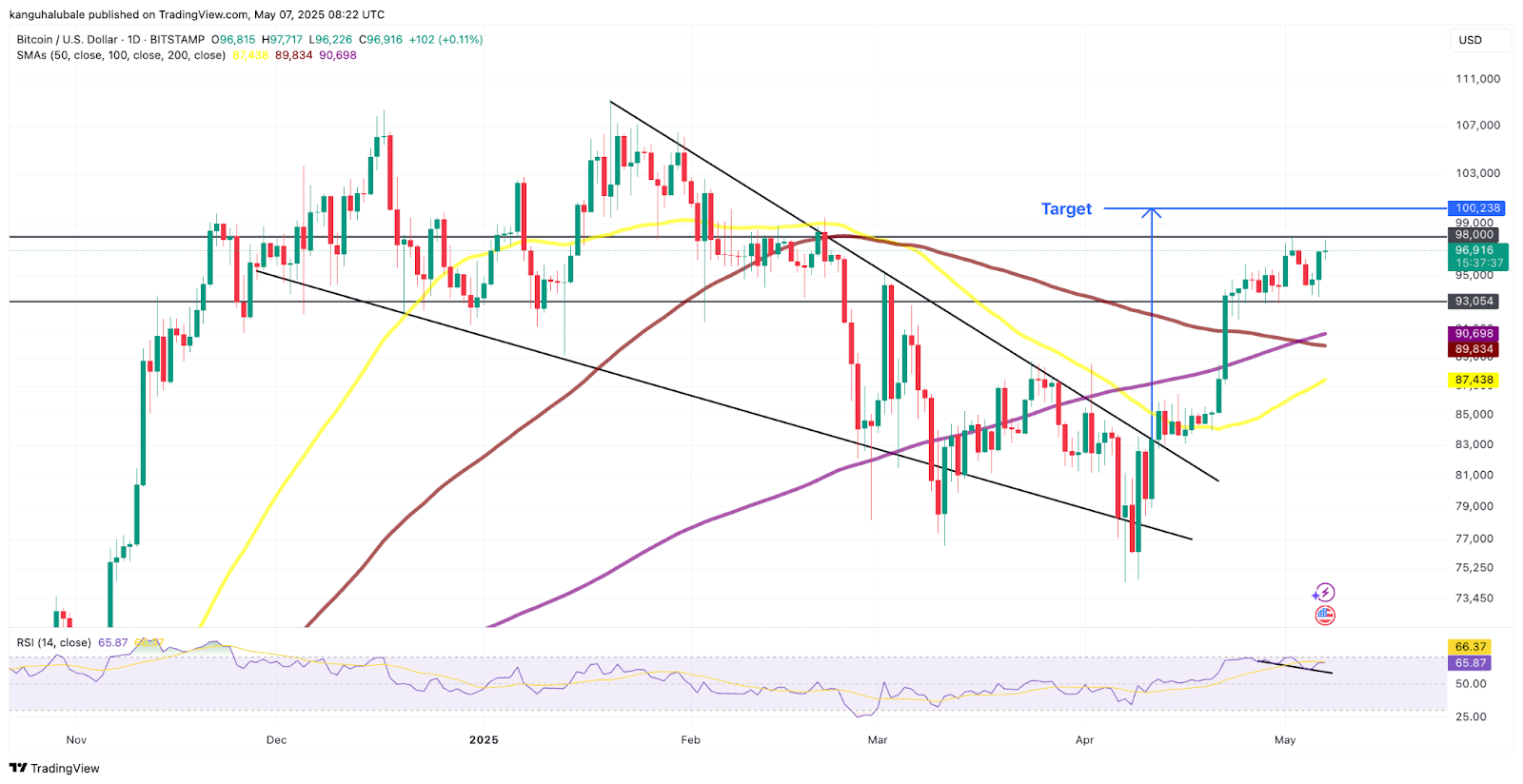

- Bullish Technical Pattern Validation: Bitcoin’s price action is validating a falling wedge pattern, a classic bullish reversal signal. The price has also reclaimed crucial support levels, reinforcing the potential for further upward movement.

Diving Deeper into the Drivers

US-China Trade Talks: A Catalyst for Risk-On Sentiment

The possibility of a US-China trade agreement has instilled a sense of optimism in global markets. The potential reduction in tariffs and trade barriers could stimulate economic growth and reduce uncertainty, benefiting risk assets like Bitcoin. However, it’s important to note that the likelihood of a deal remains uncertain, and market sentiment could shift quickly based on further developments.

The Impact of Short Liquidations

The liquidation of short positions plays a significant role in amplifying price movements. When a large number of short sellers are forced to cover their positions simultaneously, it creates a buying frenzy that can accelerate the upward trajectory of the price. This phenomenon highlights the power of market dynamics and the impact of derivatives trading on Bitcoin’s price.

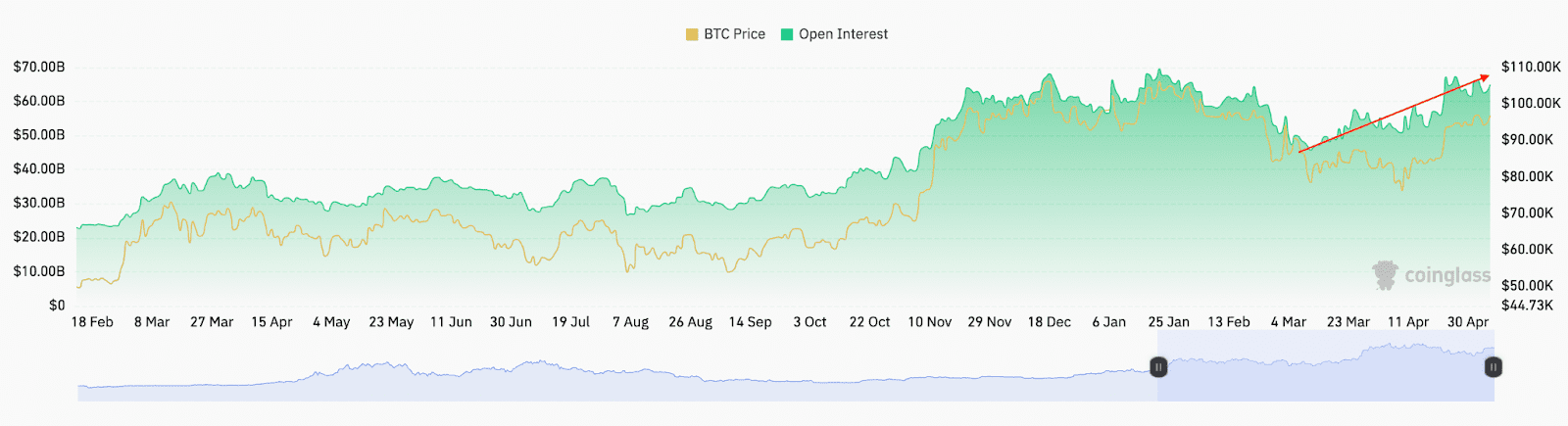

Bitcoin’s open interest (OI) has also climbed steadily over the last 30 days, up 26% from $50.8 billion on April 8 to $64.4 billion. BTC OI has jumped by 4% over the last 24 hours, reflecting increased trader participation.

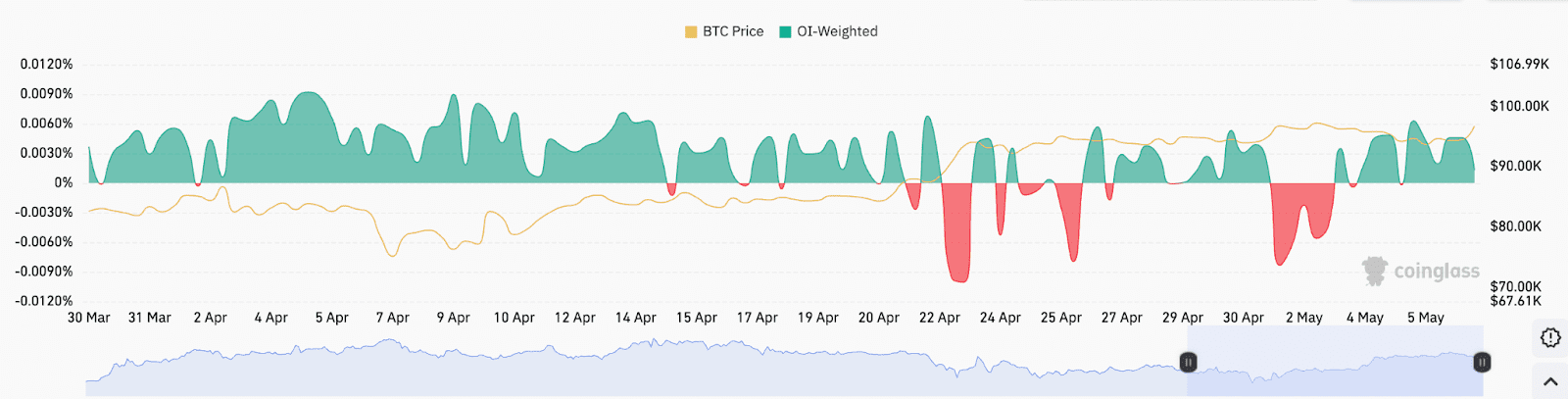

Although the funding rate briefly flipped negative on May 5, it increased to 0.0046% on May 7, suggesting a stronger bullish conviction.

The Bullish Falling Wedge Pattern

From a technical analysis perspective, the validation of a falling wedge pattern suggests that the downtrend may be coming to an end and a potential reversal is underway. This pattern, combined with the reclaiming of key support levels, strengthens the bullish outlook for Bitcoin.

What’s Next for Bitcoin?

Bitcoin faces a key resistance level at $98,000. A successful break above this level could pave the way for a move towards the technical target of the falling wedge, around $100,200. However, a bearish divergence from the Relative Strength Index (RSI) indicates a possible weakening of momentum. A daily close below $93,000 could trigger a pullback towards the $90,000-$87,000 range.

Furthermore, the upcoming FOMC meeting and the Federal Reserve’s decision on interest rates will be crucial for Bitcoin’s trajectory. Market participants are closely monitoring the Fed’s stance, as any shift in monetary policy could significantly impact risk appetite and market volatility.

Conclusion

Bitcoin’s recent price surge is a result of a confluence of factors, including optimism surrounding US-China trade talks, significant short liquidations, and the validation of a bullish technical pattern. While the potential for further gains exists, it’s essential to remain aware of potential resistance levels, market indicators, and macroeconomic developments that could influence Bitcoin’s price. As always, conducting thorough research and exercising caution is crucial when navigating the cryptocurrency market.