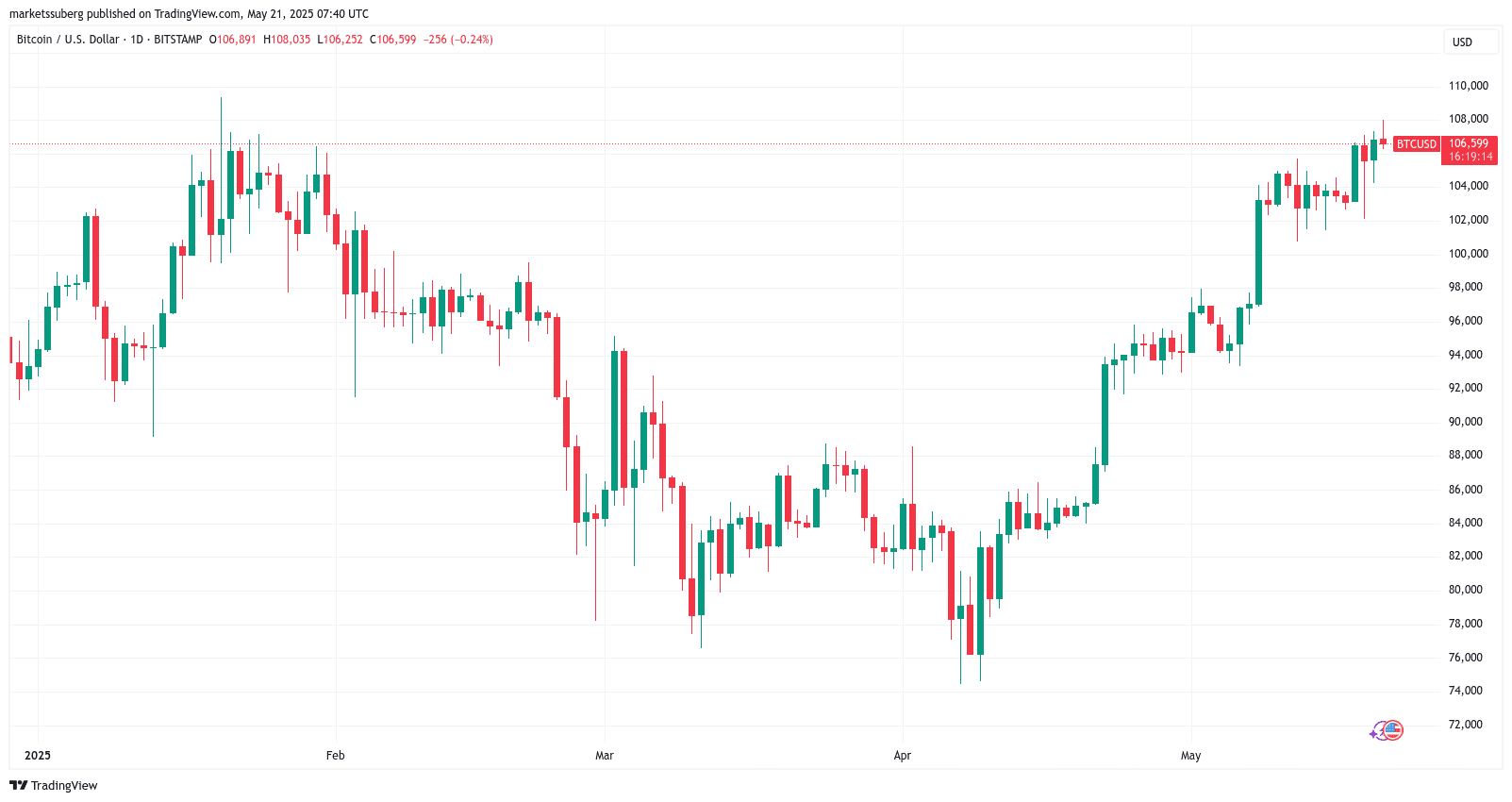

Bitcoin (BTC) has recently experienced a significant surge, breaking past $108,000 for the first time in four months. This surge has fueled speculation among traders and analysts about the potential for new all-time highs and a possible ‘blow-off top’ scenario.

Key Takeaways:

- Bitcoin’s Recent Surge: BTC surpassed $108,000, reaching its highest level since January.

- Support Levels: Key support levels are identified around $90,000 – $106,000, although a retest of these levels is becoming less probable.

- Upside Targets: Analysts predict a near-term upside target of $128,000, referring to it as a potential ‘blow-off top.’

Analyzing Bitcoin’s Current Trajectory

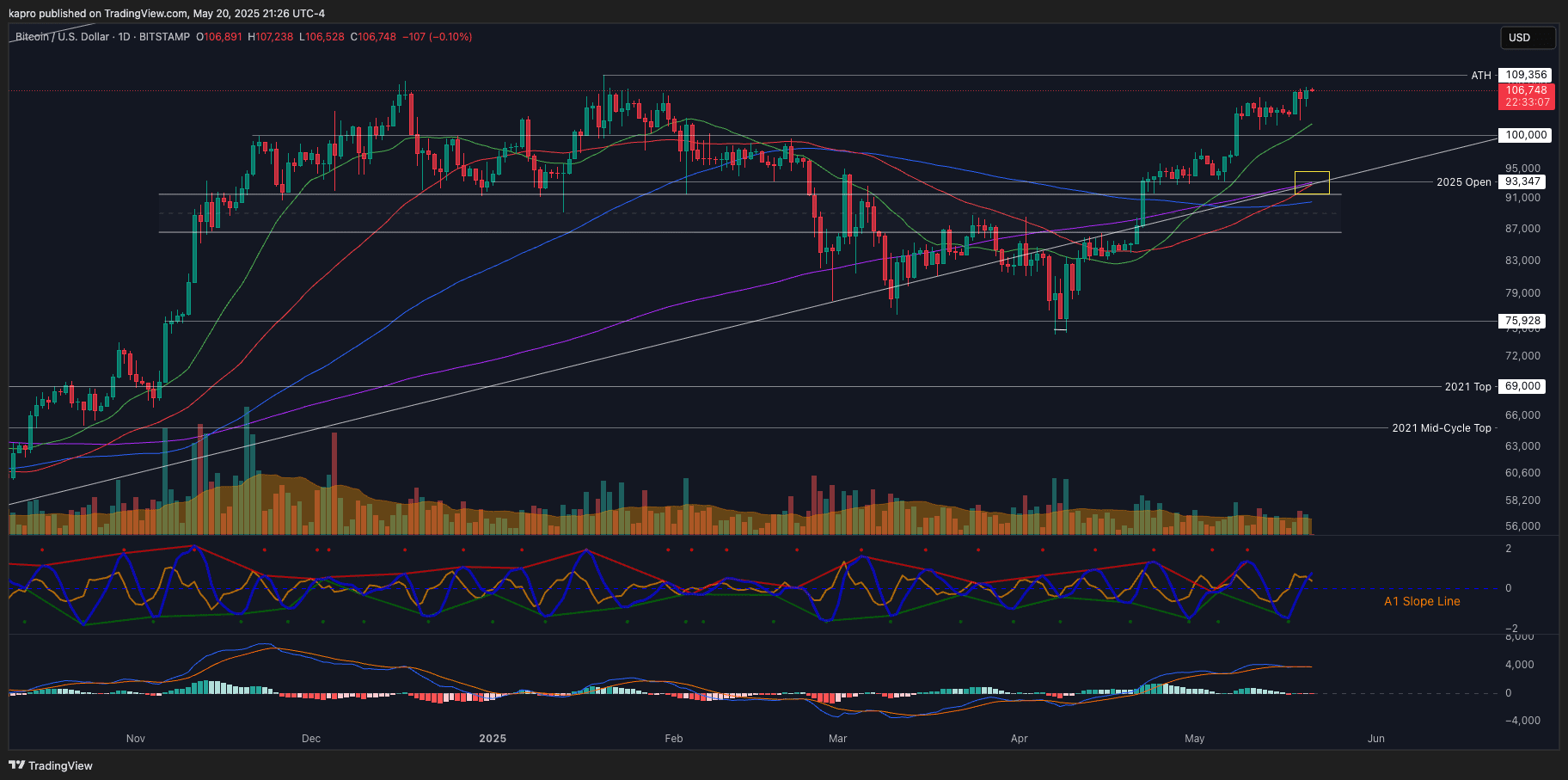

Bitcoin’s recent price action has positioned it less than 1.5% away from reaching new all-time highs. The cryptocurrency is currently navigating a crucial psychological resistance barrier, reminiscent of its performance in January.

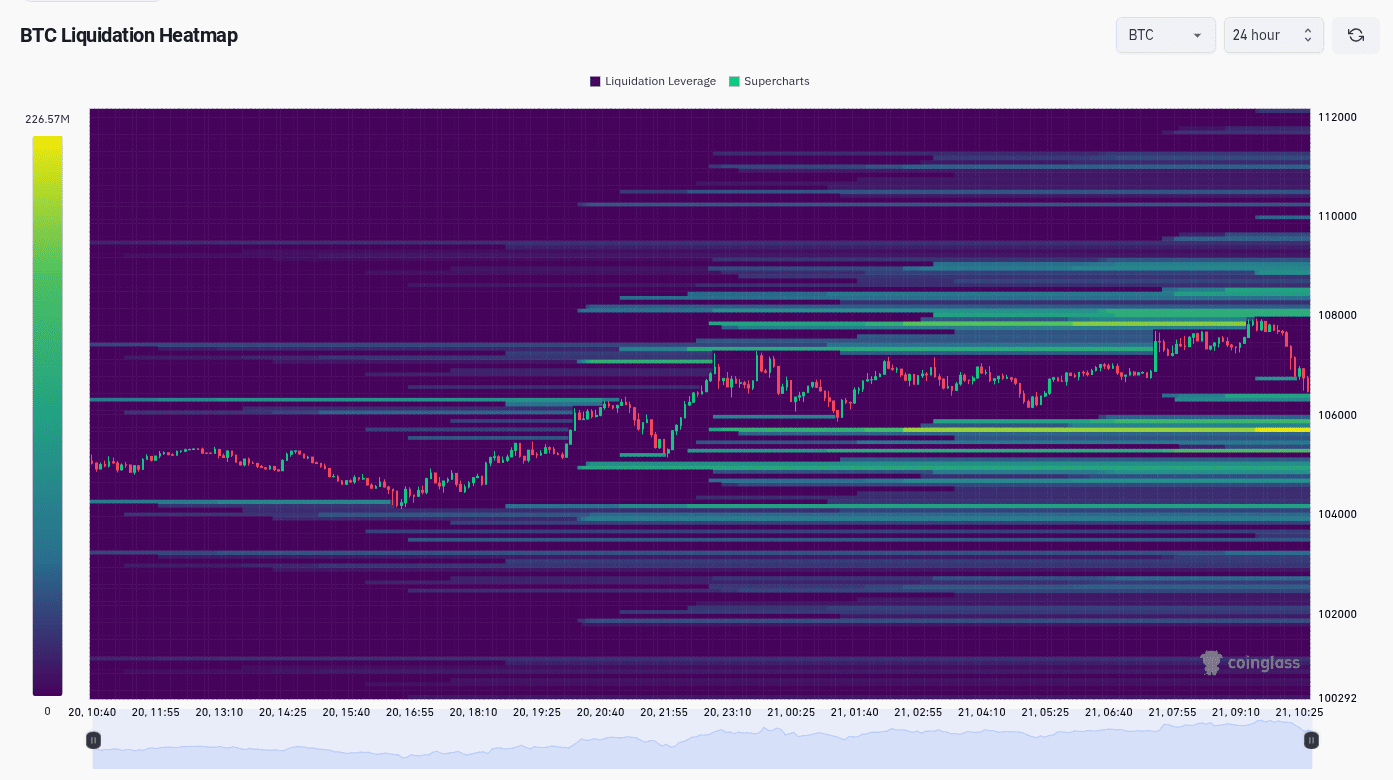

Volatility has increased, with BTC/USD experiencing rapid price fluctuations around the $108,000 mark. Traders are actively adjusting their positions in response to these movements.

Expert Opinions and Predictions

Several analysts have weighed in on Bitcoin’s current market dynamics, offering insights into potential support levels and price targets:

- Keith Alan (Material Indicators): Highlights moving averages (MAs), the $100,000 level, and the 2025 yearly open as potential support retest zones. He notes the 21-day MA at $101,640.

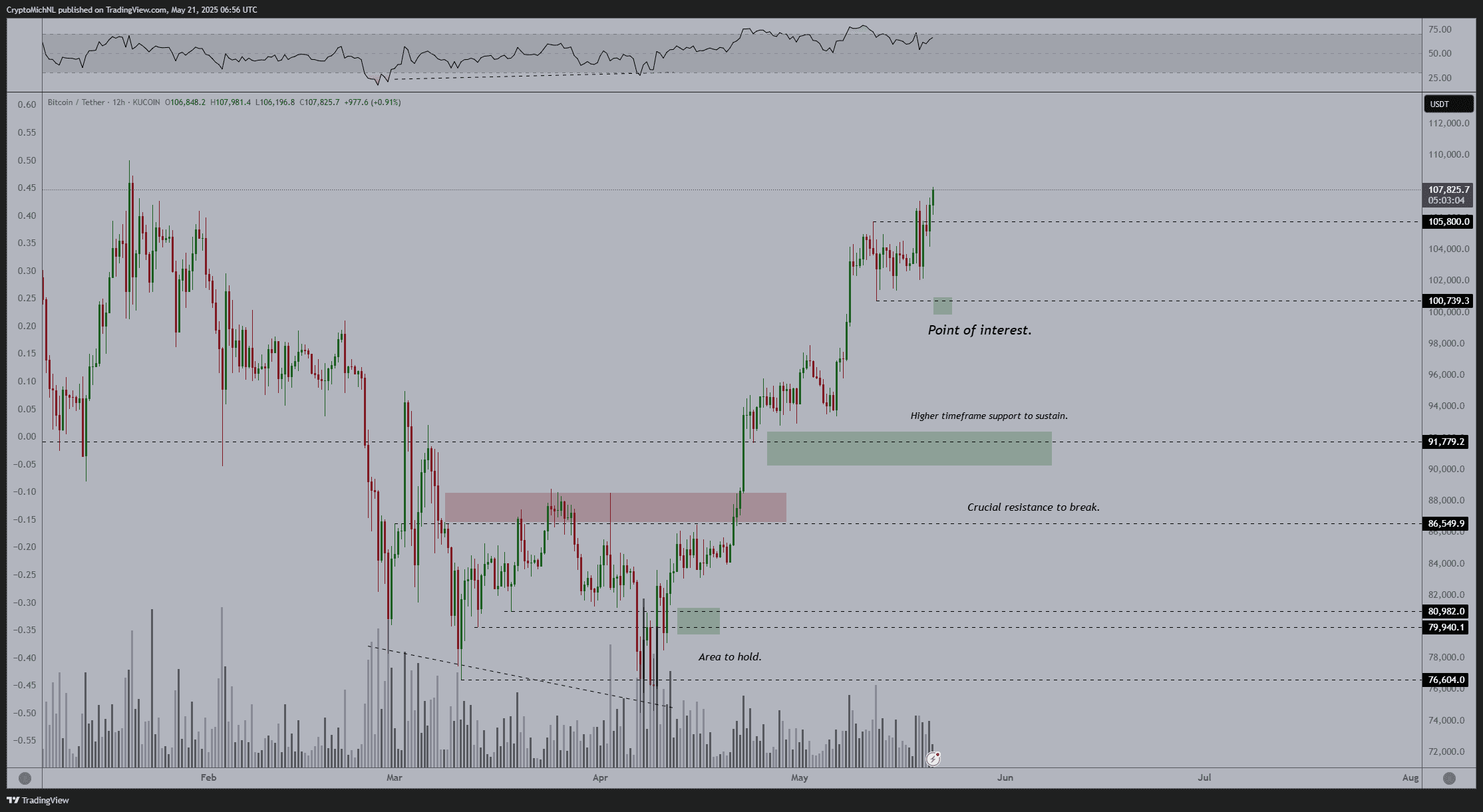

- Michaël van de Poppe: Identifies $91,800 and $100,700 as key support levels, with the latter being a significant ‘point of interest.’

- Merlijn The Trader: Sets a short-term price target of $116,000, anticipating a breakout from a consolidation pennant.

- Henry: Predicts a ‘blow-off top’ at $128,000 and identifies support areas at $105,000 and $96,000.

Alan suggests that a deeper retracement to support would strengthen Bitcoin’s overall recovery, improving the likelihood of sustaining higher levels in the future. He sees consolidation in the current range as a positive sign before the next upward movement.

What is a Bitcoin ‘Blow-Off Top’?

A ‘blow-off top’ is a chart pattern that signifies an extremely sharp and rapid increase in price, followed by an equally sharp decline. It often occurs at the end of a prolonged bullish trend and is driven by excessive speculation and euphoria. In the context of Bitcoin, the $128,000 target is seen by some analysts as a potential culmination of the current bullish momentum.

Factors Driving Bitcoin’s Surge

Several factors are contributing to Bitcoin’s recent price surge:

- Institutional Adoption: Increasing interest and investment from institutional investors are driving demand.

- ETF Approvals: The approval of Bitcoin ETFs has made it easier for investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

- Halving Event: The Bitcoin halving event, which reduces the reward for mining new blocks, creates scarcity and upward price pressure.

- Macroeconomic Factors: Inflation concerns and economic uncertainty are driving investors to seek alternative assets like Bitcoin.

Conclusion

Bitcoin’s surge past $108,000 marks a significant milestone, fueling predictions of new all-time highs and a potential ‘blow-off top’ at $128,000. While the cryptocurrency market remains volatile and subject to risk, the current momentum and positive sentiment suggest a promising outlook for Bitcoin in the near term. Investors and traders should closely monitor key support levels and price targets to navigate the evolving market landscape.