Bitcoin’s Recent Surge: A Balancing Act

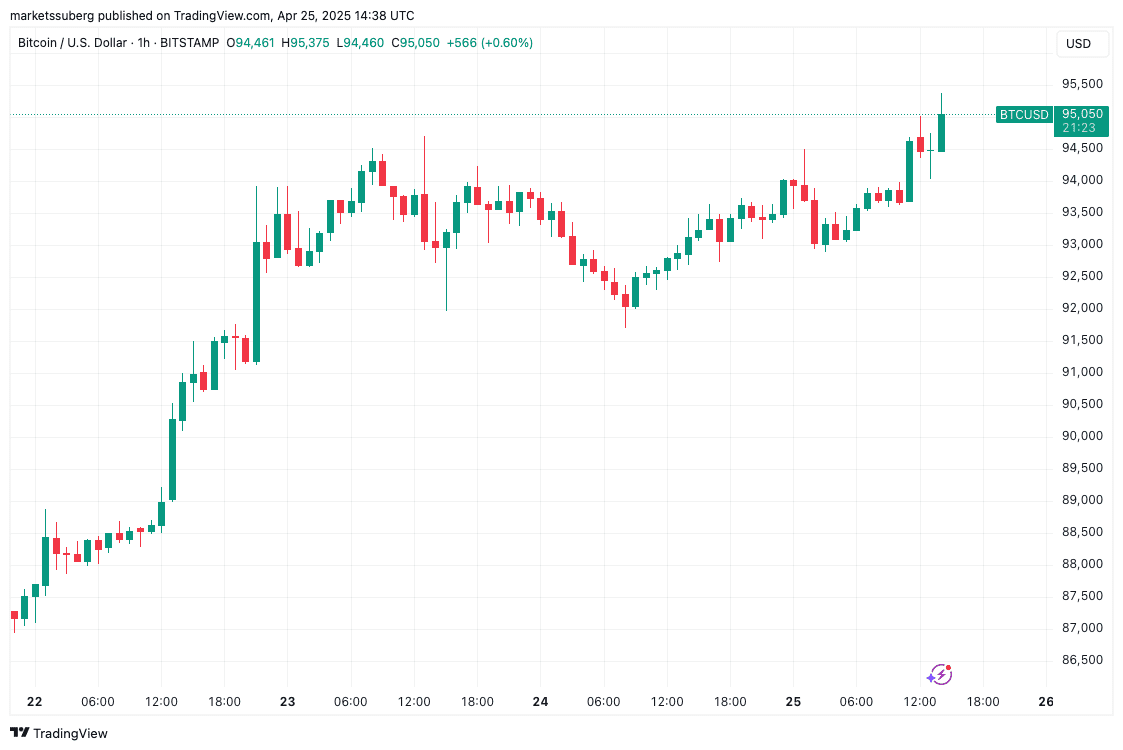

Bitcoin (BTC) has experienced a notable price surge, reaching its highest levels in seven weeks. This upward movement reflects a battle between buying and selling pressures, leaving traders uncertain about the sustainability of the breakout.

Key Takeaways:

- Price Action: Bitcoin’s rapid gains are making traders wary.

- Resistance: BTC/USD faces key resistance levels after its recent rise.

- $100K Target: Analysts suggest a $100,000 price point remains unlikely in the short term without a significant catalyst.

Buyers vs. Sellers: A Market Tug-of-War

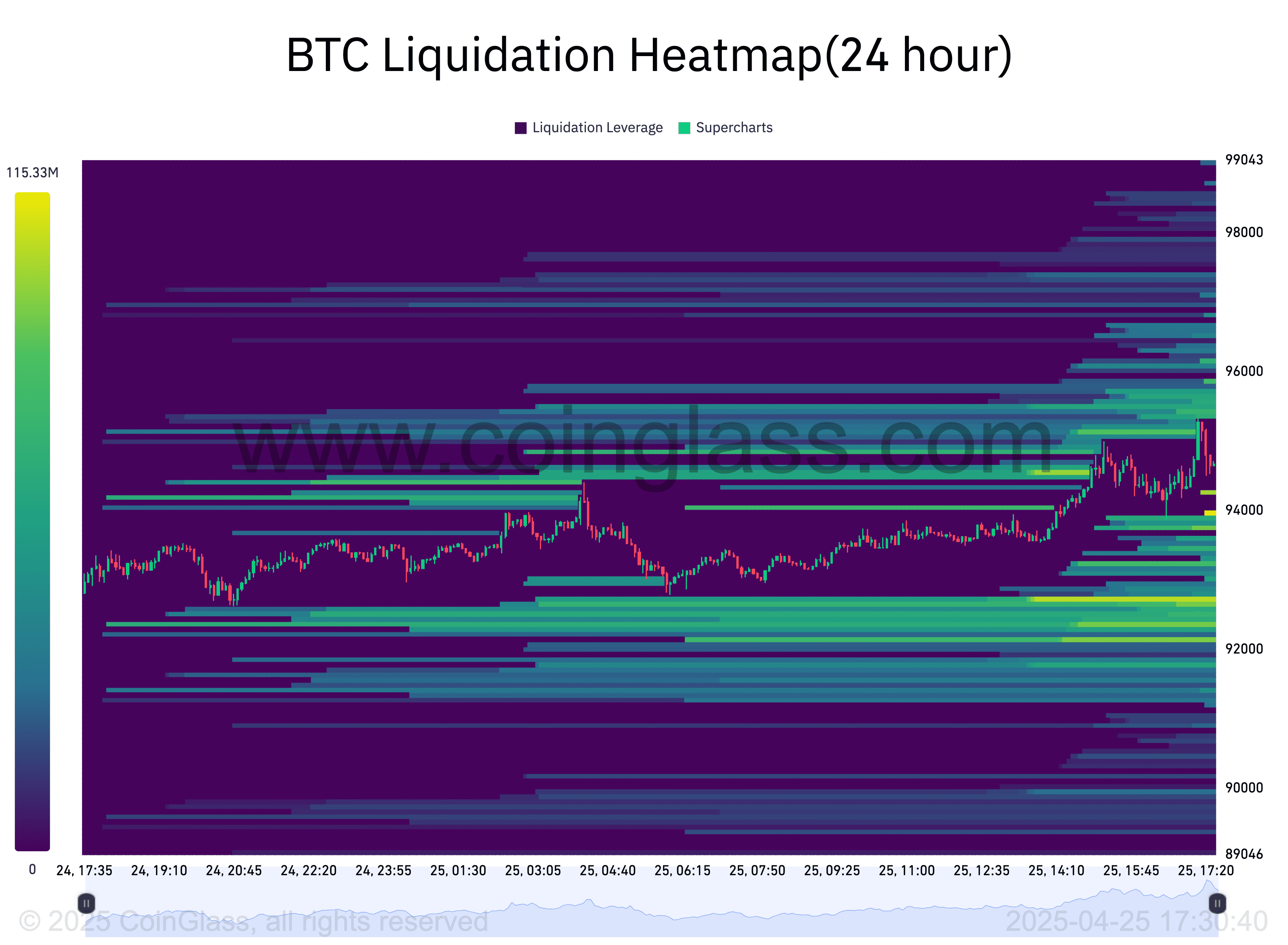

Recent data indicates a fierce competition between buyers and sellers, contributing to Bitcoin’s volatile movements. The cryptocurrency briefly surpassed $95,000, fueled by the liquidation of leveraged short positions.

Analyst Perspectives

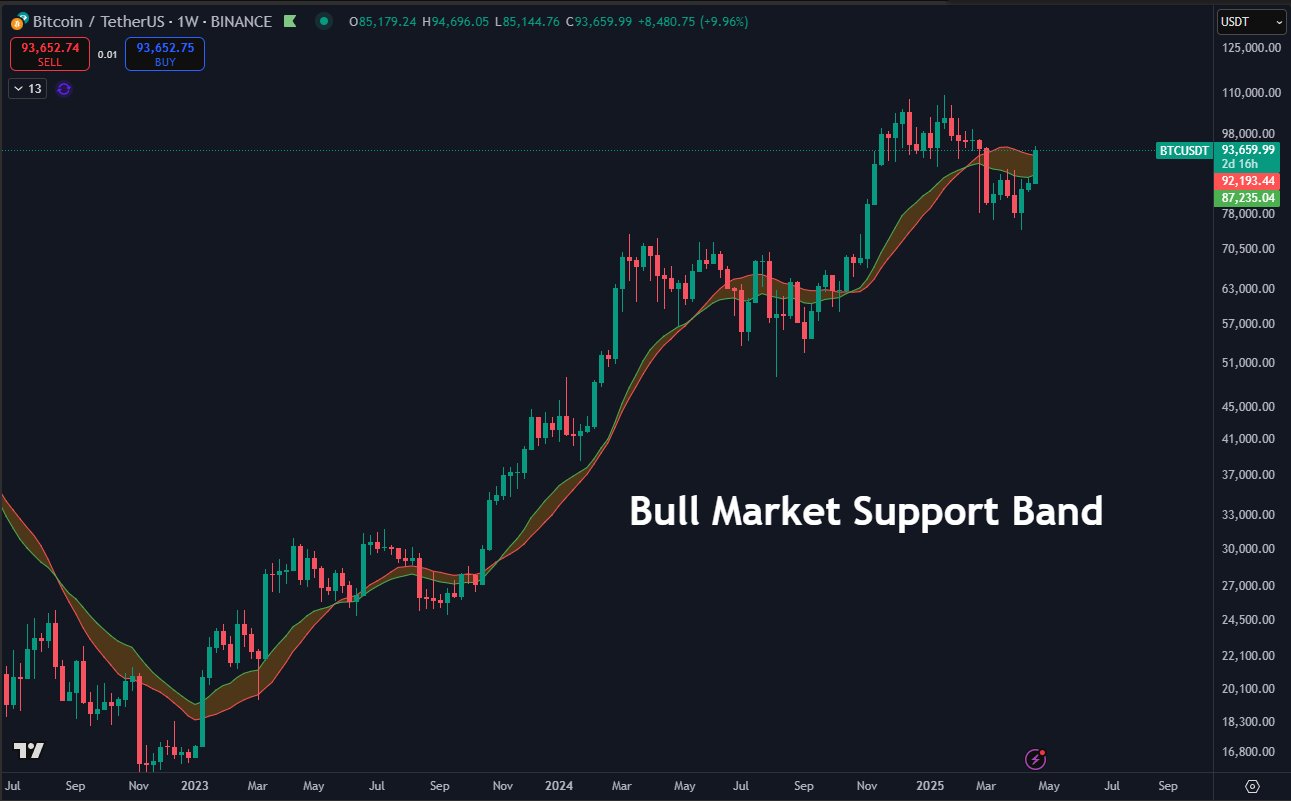

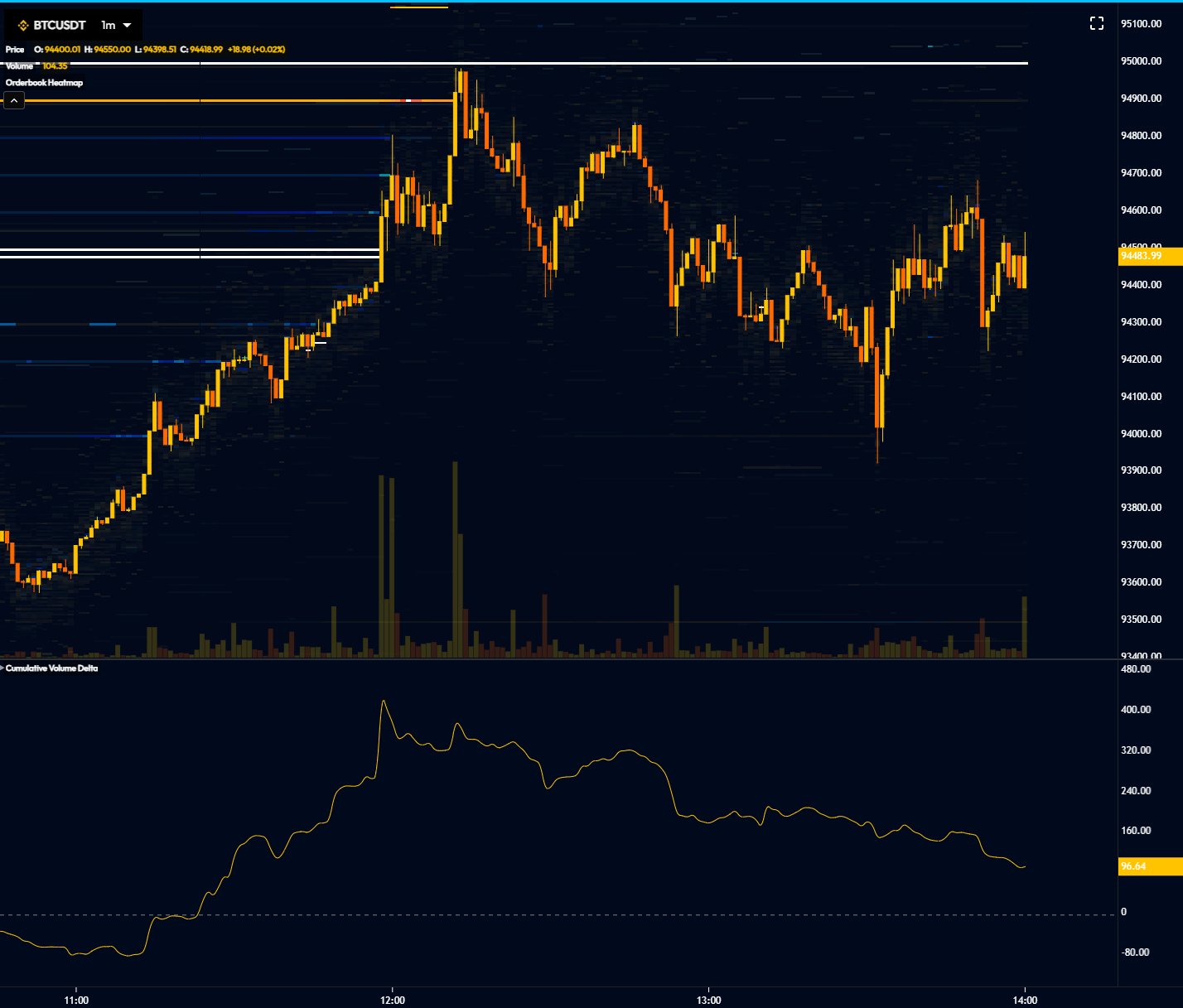

Daan Crypto Trades highlighted the importance of the current price range, noting that maintaining a position above the bull market support band could signal further gains. However, Skew cautioned about a large-volume buyer being met with significant selling pressure, suggesting potential volatility ahead.

The $100,000 Question: What’s Missing?

Keith Alan from Material Indicators expressed skepticism about Bitcoin sustaining a move above $95,000 without a substantial catalyst. He pointed to declining volume and proprietary trading signals as reasons for caution.

Macroeconomic Factors and Market Sentiment

QCP Capital suggested that Bitcoin currently lacks the necessary catalyst to reach $100,000, advising tactical caution due to crowded positioning and the potential for sharp reactions around key levels. They are closely monitoring for signs of continuation or exhaustion in the market.

Bitcoin: Factors Influencing Price Movements

Bitcoin’s price is influenced by a complex interplay of factors, spanning from technical trading dynamics to broader macroeconomic conditions. A deeper dive into these elements provides a clearer picture of what drives Bitcoin’s value and its potential trajectory.

1. Supply and Demand

- Limited Supply: Bitcoin’s design caps the total supply at 21 million coins, making it a scarce asset.

- Increasing Demand: Growing adoption by institutions and retail investors fuels demand.

- Halving Events: Every four years, the reward for mining new blocks is halved, reducing the rate at which new Bitcoins enter circulation. This can lead to price increases if demand remains constant or rises.

2. Market Sentiment

- News and Media: Bitcoin’s price is heavily influenced by news coverage, social media trends, and public perception.

- Fear of Missing Out (FOMO): Positive news and price surges can trigger FOMO, driving speculative buying and price increases.

- Fear, Uncertainty, and Doubt (FUD): Negative news, regulatory concerns, and security breaches can create FUD, leading to sell-offs and price declines.

3. Regulatory Landscape

- Government Policies: Regulations regarding Bitcoin’s use, taxation, and trading significantly impact its price.

- Central Bank Actions: Decisions on interest rates, inflation, and monetary policy can influence Bitcoin’s attractiveness as an alternative asset.

- Legal Frameworks: Clear legal frameworks that recognize Bitcoin’s legitimacy can encourage institutional investment and mainstream adoption.

4. Technological Advancements

- Protocol Upgrades: Improvements to the Bitcoin network, such as the Lightning Network for faster transactions, can enhance its functionality and appeal.

- Security Enhancements: Advances in blockchain security can reduce the risk of hacks and fraud, boosting investor confidence.

- Scalability Solutions: Efforts to increase Bitcoin’s transaction processing capacity can address concerns about its ability to handle growing transaction volumes.

5. Macroeconomic Conditions

- Inflation: Rising inflation can drive investors to Bitcoin as a hedge against currency devaluation.

- Economic Uncertainty: During times of economic instability, Bitcoin can serve as a safe-haven asset, similar to gold.

- Interest Rates: Low-interest-rate environments can make Bitcoin more attractive compared to traditional investments.

Conclusion: Navigating Bitcoin’s Volatility

Bitcoin’s price volatility is a defining characteristic, reflecting the dynamic and evolving nature of the cryptocurrency market. While the potential for substantial gains exists, investors must remain aware of the inherent risks. A comprehensive understanding of the factors driving Bitcoin’s price movements is crucial for making informed investment decisions.

Disclaimer: This article does not provide investment advice. Cryptocurrency investments are inherently risky, and you could lose money. Conduct thorough research and consult a financial advisor before making any investment decisions.