Bitcoin (BTC) is generating excitement with discussions of a potential “parabolic” price surge. On May 9th, Bitcoin bulls maintained prices above $100,000, fueling speculation about new all-time highs.

Key Takeaways:

- Bitcoin is testing a key resistance zone near its all-time high.

- Discussions about a “parabolic” BTC price increase are gaining traction.

- Signs of profit-taking are emerging as prices reach levels not seen since January.

Analysts Predict Significant Upside

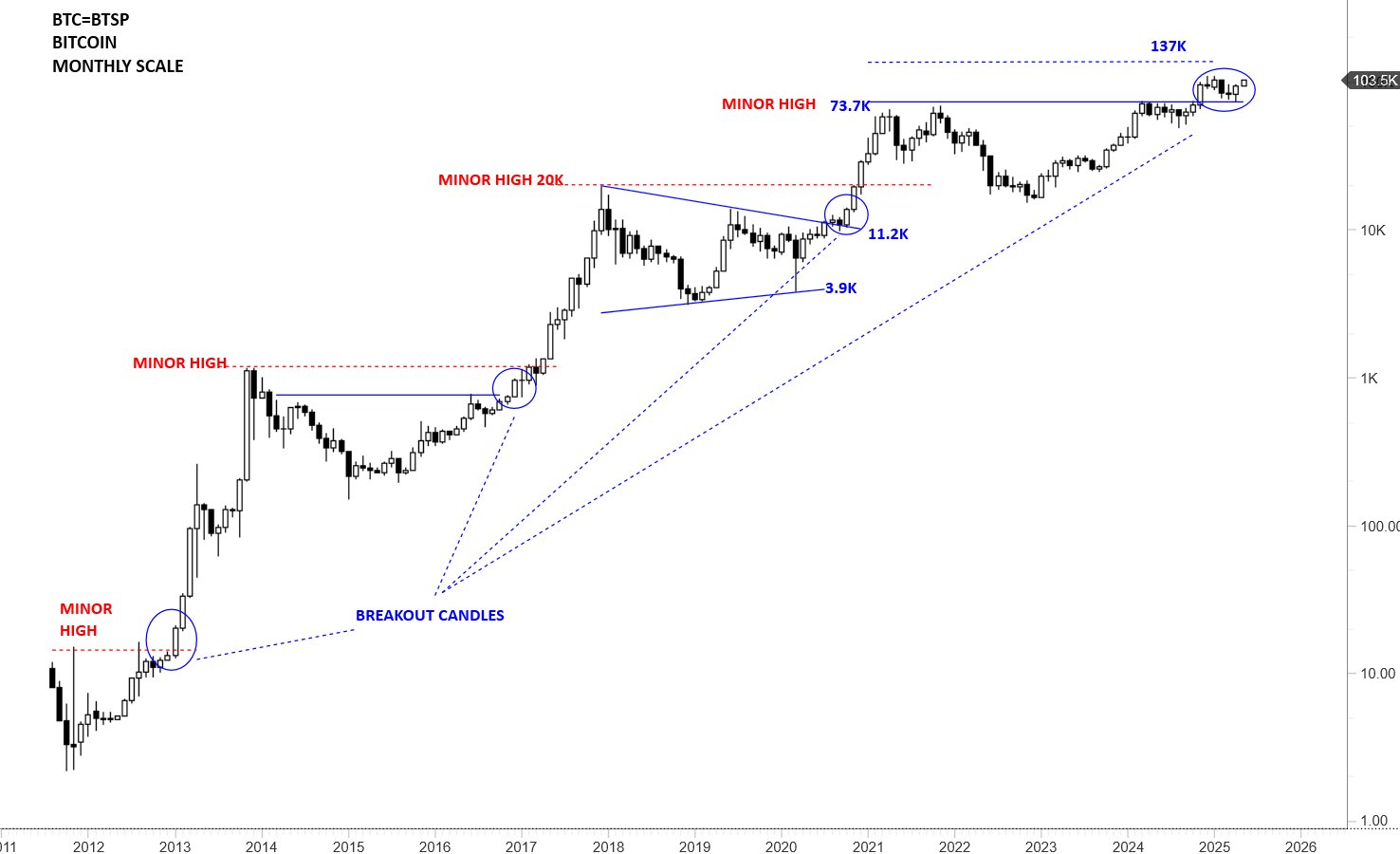

Market participants are regaining confidence in the Bitcoin bull market. Aksel Kibar, a well-known economist, highlighted November 2024 as a breakout signal on long-term charts. He reiterated his target of $137,000.

Crypto entrepreneur and investor Jason Williams noted that “Bitcoin is going exponential” as it surpassed $100,000. Matthew Hyland, a trader and analyst, also predicts new all-time highs in the second quarter of the year. He suggested that $160,000 or even higher figures could be possible if bulls maintain control and the relative strength index (RSI) supports further gains.

Factors Driving the Optimism:

- Breaking Key Resistance Levels: Bitcoin has demonstrated its ability to surpass significant resistance zones, indicating strong bullish momentum.

- Growing Institutional Interest: The increasing involvement of institutional investors is adding legitimacy and capital to the Bitcoin market.

- Positive Technical Indicators: Technical analysis, such as the RSI, suggests potential for continued upward movement.

- Increased Adoption: As more businesses and individuals adopt Bitcoin, demand is likely to rise.

Potential Roadblocks and Considerations:

- Profit-Taking: Skew, a popular trader, noted signs of profit-taking around $103,000, a key long-term resistance area.

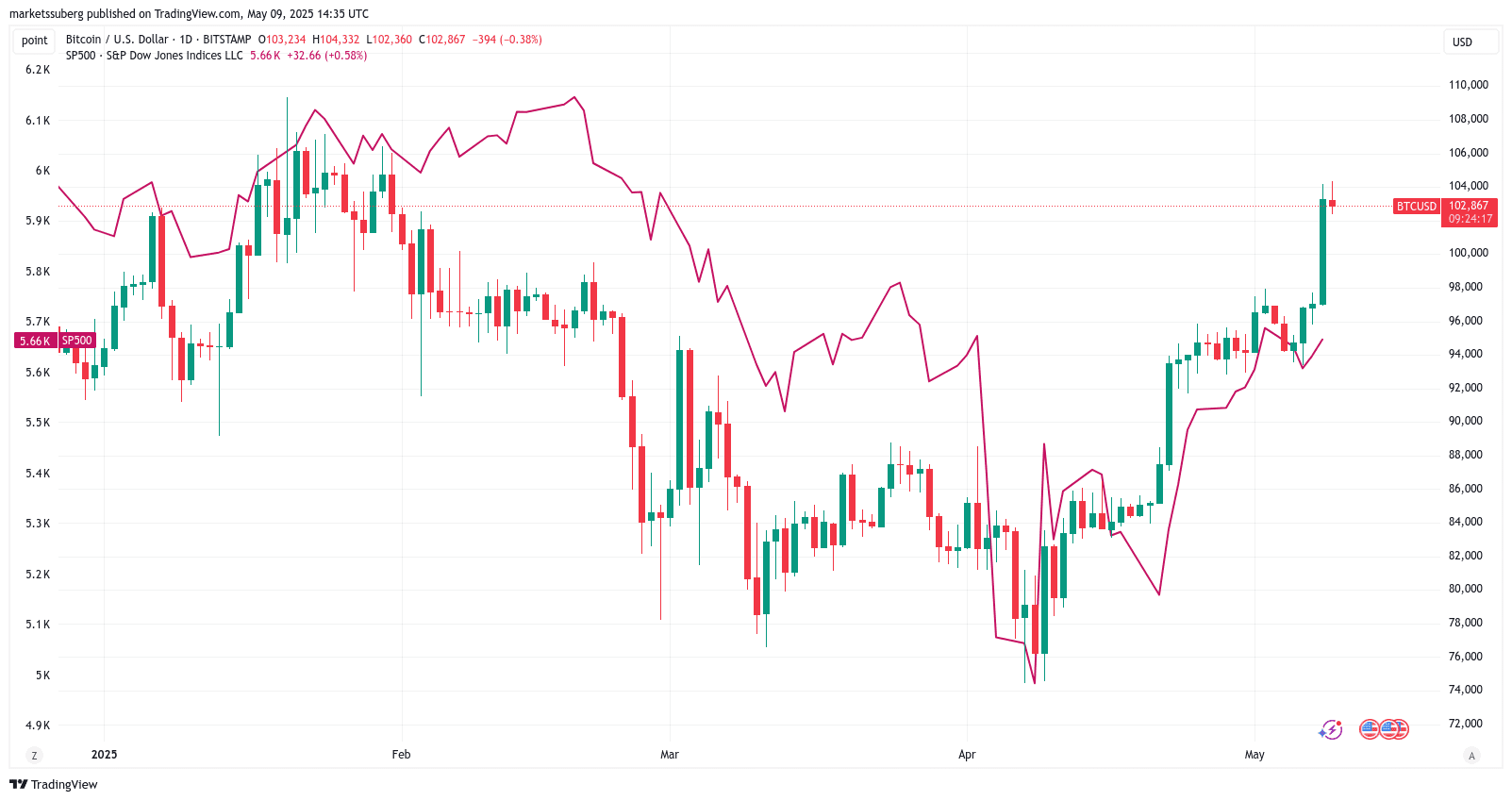

- Market Correlation: Bitcoin’s correlation with traditional financial markets (TradFi) means that its performance can be affected by broader economic trends.

- Regulatory Uncertainty: Evolving regulations surrounding cryptocurrencies could impact investor sentiment and market activity.

- Volatility: Bitcoin’s inherent volatility remains a risk factor for investors.

Bitcoin Halts Progress at Stubborn Resistance

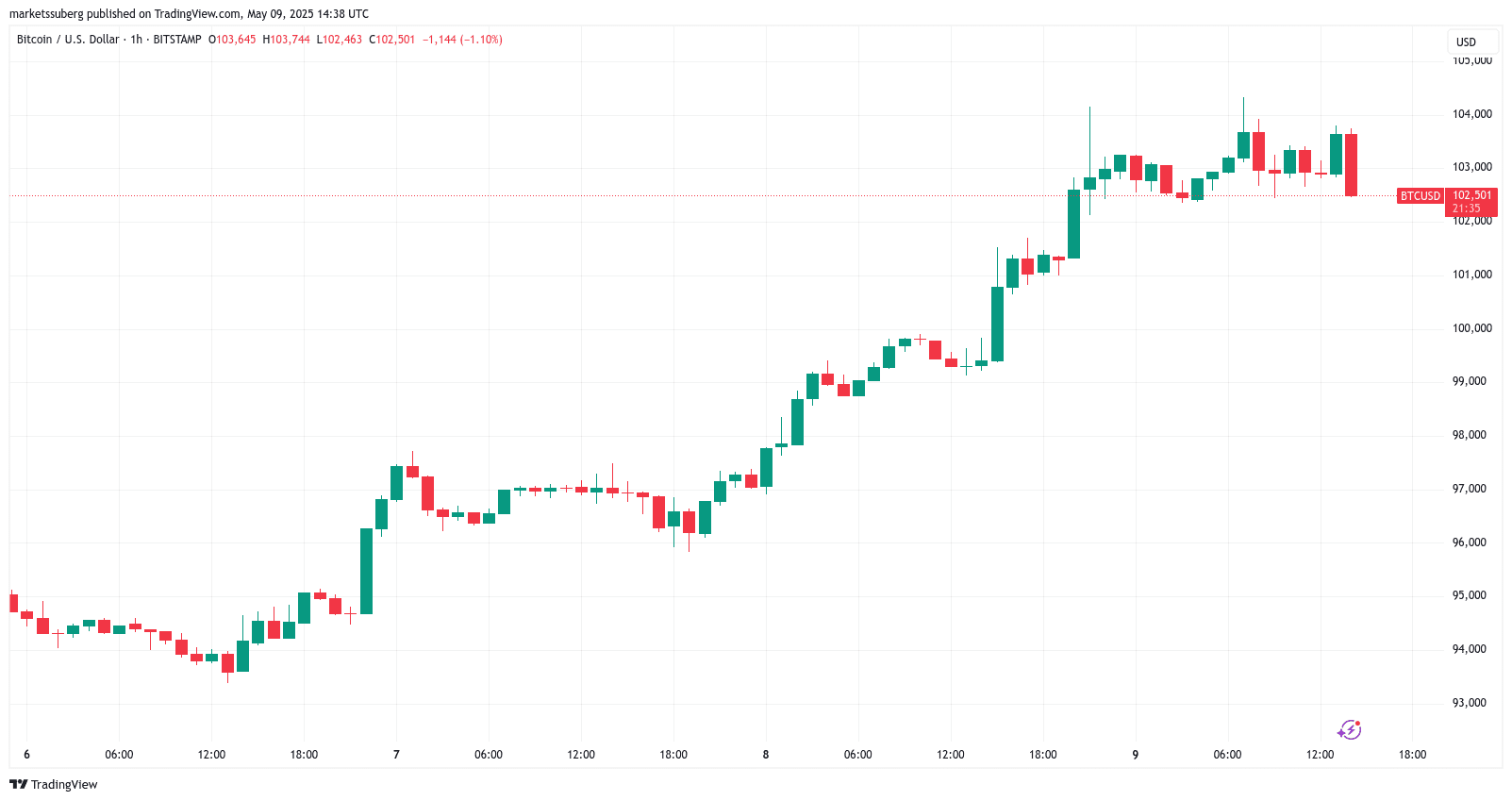

On shorter timeframes, popular trader Skew sounded the alarm over profit-taking being in full swing at $103,000, itself a key long-term resistance zone.

US stock markets were flat at the Wall Street open, with Skew suggesting their behavior may spill over into crypto.

Conclusion:

While predictions of a parabolic Bitcoin surge are gaining momentum, it’s crucial to remember the inherent risks associated with cryptocurrency investments. Factors such as profit-taking, market correlations, and regulatory developments could influence Bitcoin’s price. However, the breaking of key resistance levels, growing institutional interest, and positive technical indicators point to a potentially bullish outlook for Bitcoin in the near future. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.