Bitcoin (BTC) is currently navigating a volatile period, with traders closely monitoring the upcoming Federal Reserve (Fed) interest rate decision. Market analysts are suggesting potential price movements, including a retest of the $95,000 level.

Key Takeaways:

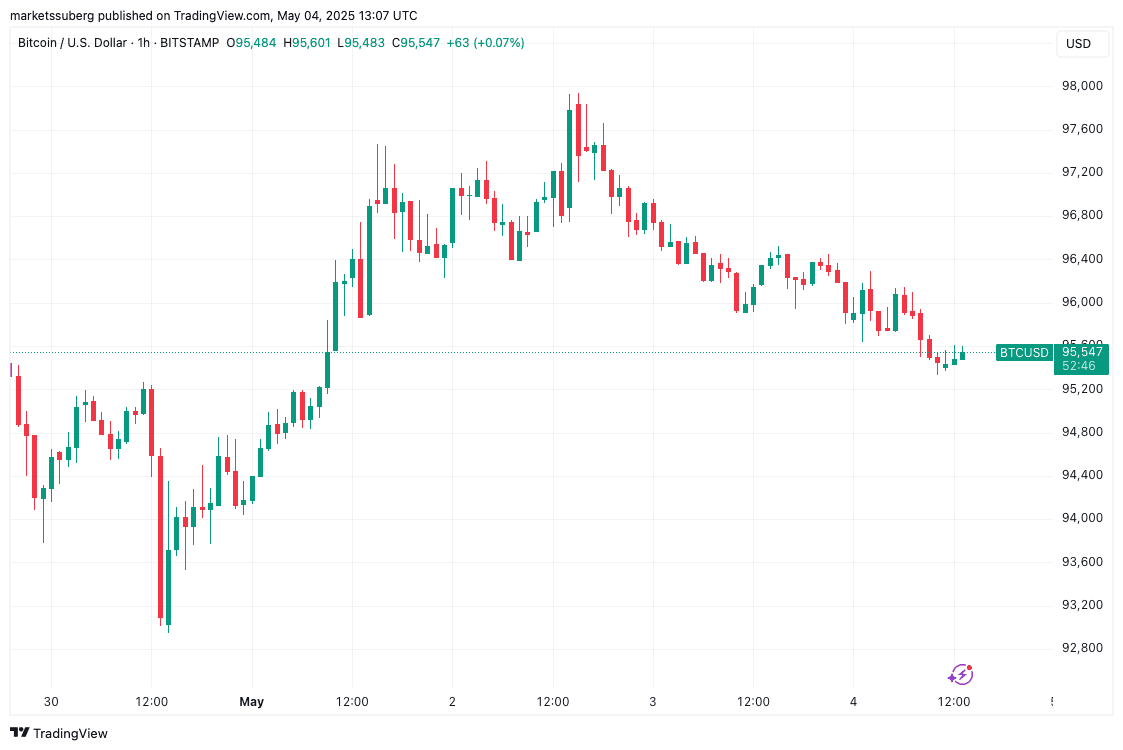

- Bitcoin is testing liquidity around its current price as the week closes.

- Analysts are eyeing key BTC price levels, with a focus on $95,000 as a potential support.

- The Fed’s interest rate decision is the primary macro event influencing market sentiment.

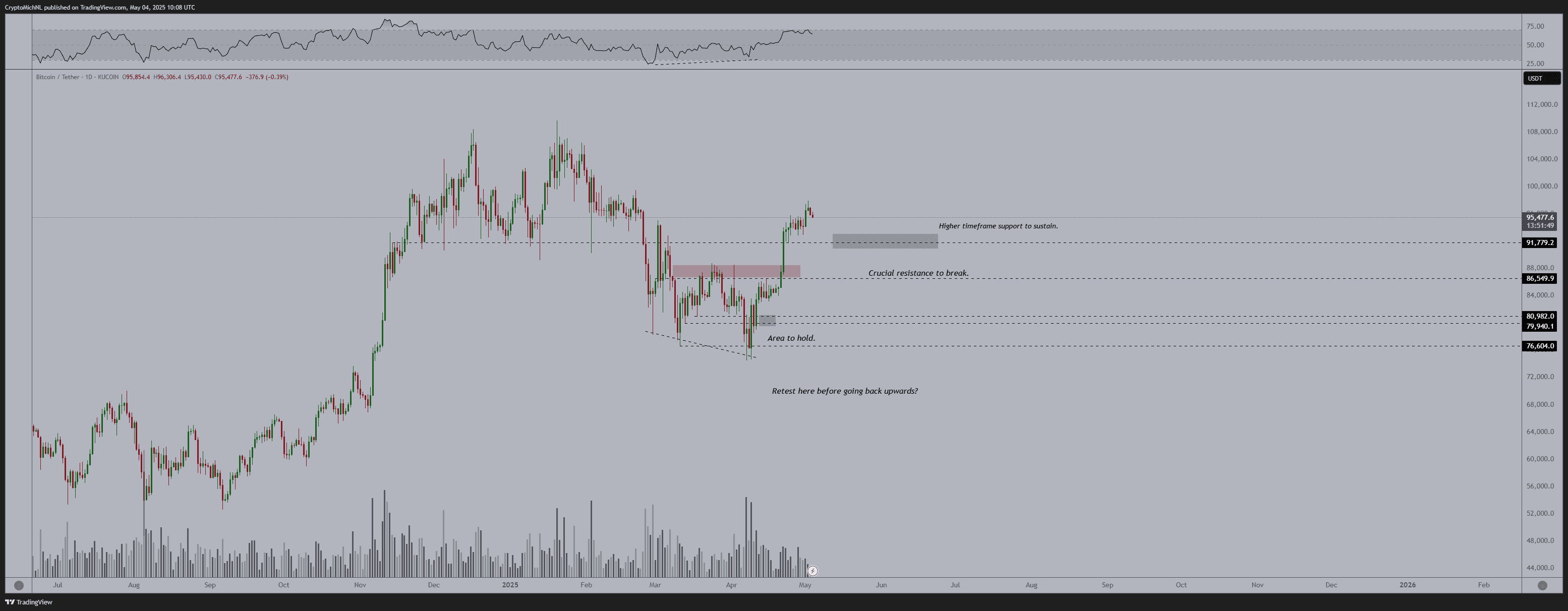

Bitcoin’s recent price action has seen it retract from multi-month highs, testing liquidity pools and creating volatility as traders assess critical support and resistance levels.

Liquidation Levels and Price Magnets

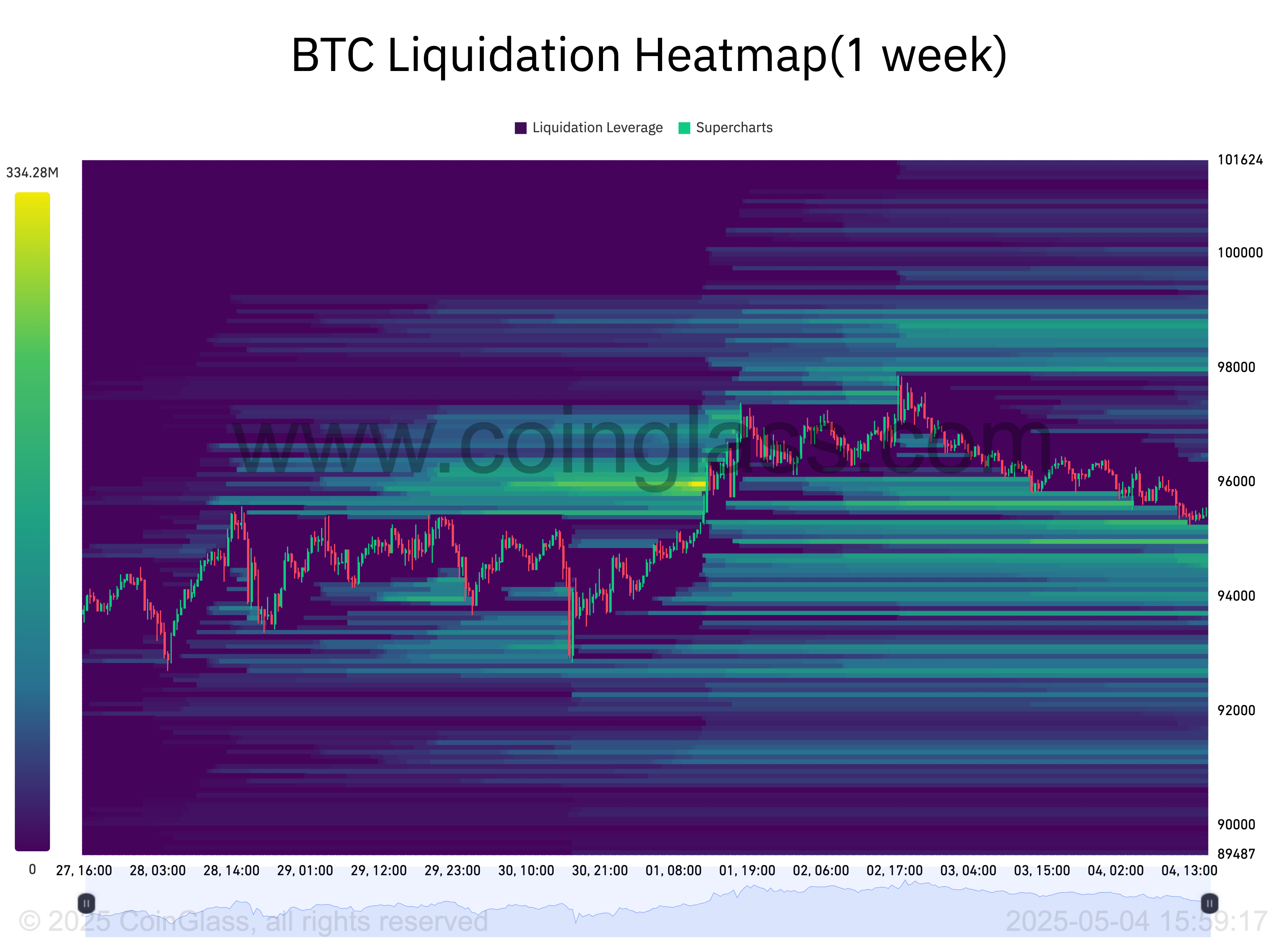

Analysis of liquidation data reveals:

- Dense long positions clustered around $95,700 – $96,000.

- Heavy short positions around $96,500 – $97,000.

These clusters act as price magnets, leading to choppy trading conditions as they are tested.

Data from CoinGlass indicates that Bitcoin’s price is currently interacting with buy liquidity, with significant sell orders positioned around $97,200.

Analyst Perspectives

Several analysts have shared their insights on the current market situation:

- TheKingfisher: Expects volatility due to the concentration of long and short positions.

- BitBull: Noted the flushing of positions between $94,000 and $97,000.

- Michaël van de Poppe: Suggests holding above $91,500 – $92,000 to validate continuation towards new all-time highs.

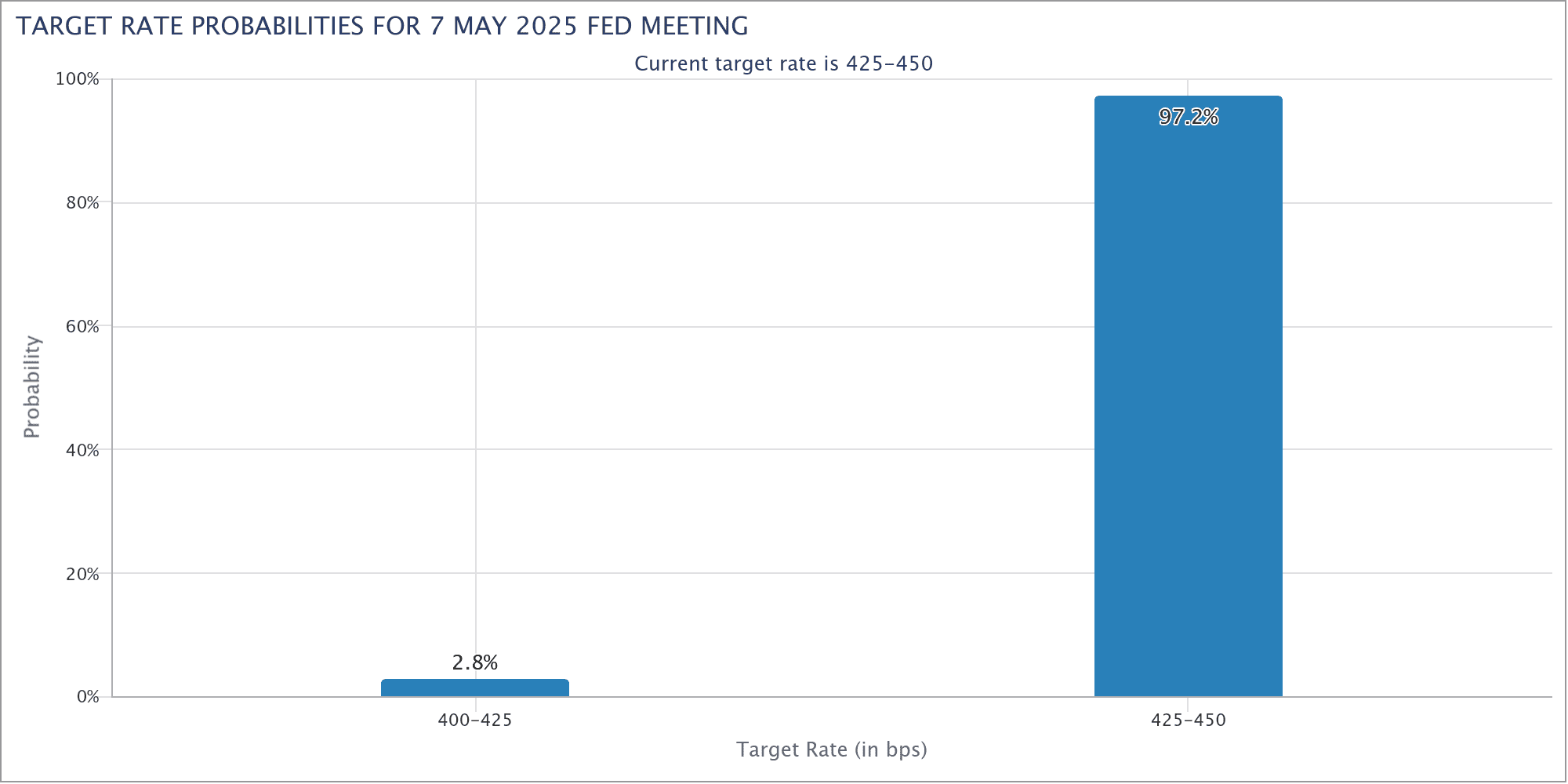

Fed Rate Cut Decision Impact

The upcoming Fed interest rate decision is expected to introduce further volatility into the market. Factors contributing to this include:

- Recession warnings

- Pressure from political figures for rate cuts

- Hawkish signals from Fed officials

The CME Group’s FedWatch Tool currently indicates minimal odds of a rate cut at the May 7 meeting.

Analyst Michaël van de Poppe advises that cryptocurrencies may experience a correction in the week leading up to the Fed meeting, with a potential rebound following the announcement.

Understanding the Federal Reserve’s Role in Cryptocurrency Markets

The Federal Reserve’s decisions on interest rates have a significant impact on the broader financial markets, including the cryptocurrency market. Here’s why:

Impact on Risk Appetite

When the Fed lowers interest rates, it generally encourages borrowing and investment. This can lead to increased risk appetite among investors, who may be more willing to allocate capital to riskier assets like Bitcoin and other cryptocurrencies.

Inflation Hedge Narrative

Bitcoin is often touted as an inflation hedge, a store of value that can protect against the erosion of purchasing power caused by inflation. In times of economic uncertainty and rising inflation, investors may turn to Bitcoin as a safe haven asset.

Dollar Strength

Changes in the Fed’s monetary policy can affect the strength of the US dollar. A weaker dollar can make Bitcoin more attractive to investors holding other currencies, as it becomes relatively cheaper to purchase.

Institutional Adoption

Lower interest rates can also encourage institutional investors to allocate more capital to the cryptocurrency market. As institutions become more involved, it can lead to increased liquidity and price stability.

Disclaimer: This article does not constitute investment advice. Cryptocurrency investments are inherently risky, and investors should conduct thorough research before making any decisions.