Key Takeaways:

- Fidelity Digital Assets indicates Bitcoin (BTC) is undervalued based on its ‘Bitcoin Yardstick’ metric.

- The US JOLTS report shows a significant drop in job openings, fueling speculation about upcoming Federal Reserve interest rate cuts.

- BlackRock’s iShares Bitcoin Trust (IBIT) ETF experienced a substantial inflow of $970.9 million, its second-largest daily inflow since launch.

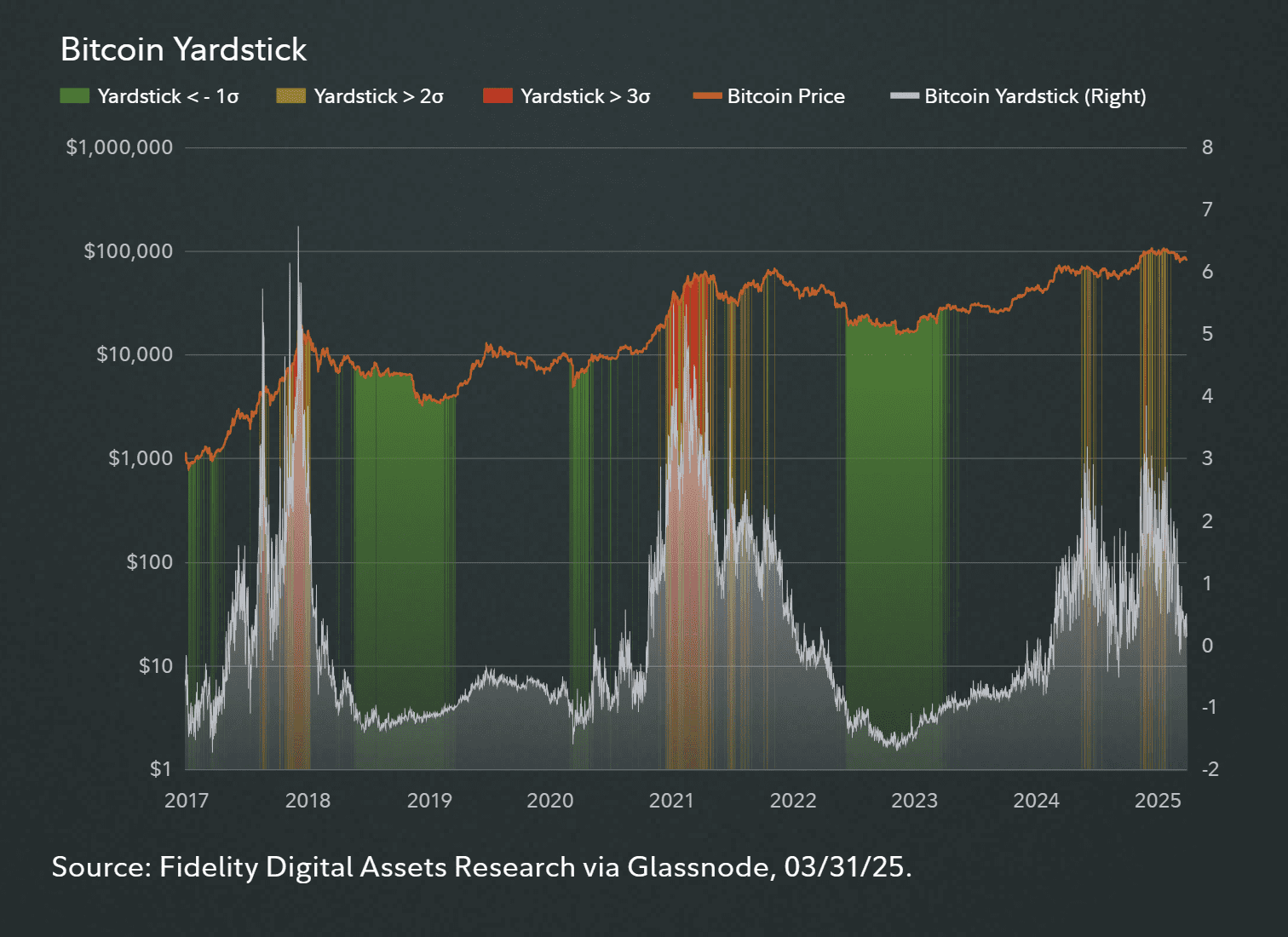

Recent analysis from Fidelity Digital Assets suggests that Bitcoin’s mid-term outlook has entered an “optimism” zone, with indicators pointing towards undervaluation. This assessment is based on the firm’s ‘Bitcoin Yardstick’ metric, which compares Bitcoin’s market capitalization to its hashrate. A lower ratio implies that Bitcoin is relatively inexpensive compared to the energy securing its network.

Understanding the Bitcoin Yardstick:

The ‘Bitcoin Yardstick’ is a metric that aims to gauge Bitcoin’s value relative to the strength of its network. It essentially divides Bitcoin’s market cap by its hashrate. Here’s a breakdown:

- Market Cap: The total value of all Bitcoins in circulation.

- Hashrate: A measure of the computational power used to secure the Bitcoin network. Higher hashrate means a more secure network.

- The Ratio: A lower ratio suggests Bitcoin is “cheaper” relative to the energy security of its network, indicating potential undervaluation.

In the first quarter of 2025, the Bitcoin Yardstick remained within -1 and 3 standard deviations, a cool-down from the overheated levels seen in Q4 2024. The number of days exceeding 2 standard deviations decreased from 22 to 15, with no days surpassing 3, which strengthens the argument that Bitcoin’s price is low compared to its underlying network strength.

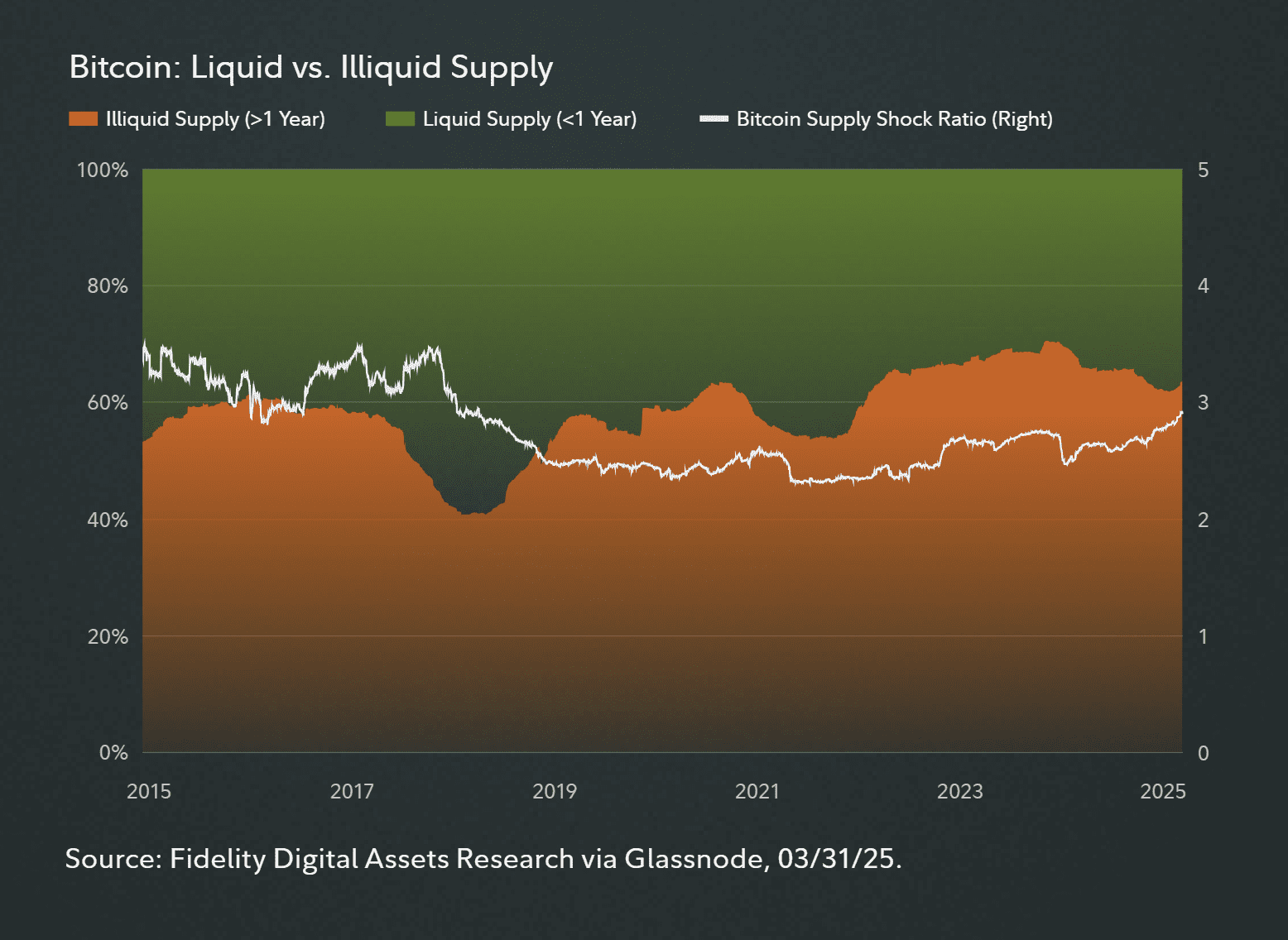

Fidelity also noted that Bitcoin is in an “acceleration phase,” where rallies to new highs are common, although a blow-off top remains a possibility. Data also reveals an increase in illiquid supply, rising from 61.50% to 63.49%, while liquid supply decreased by 4%. This indicates that holders are increasingly committed to long-term positions. The Illiquid Supply Shock Ratio remains below its 2017 peak, suggesting potential for further price appreciation.

BlackRock’s IBIT ETF Sees Massive Inflows:

Corroborating the positive sentiment, BlackRock’s iShares Bitcoin Trust (IBIT) ETF recorded a significant inflow of $970.9 million on April 28, 2025, marking its second-largest daily inflow since its launch in January 2024. Since April 22, IBIT has accumulated over $4.5 billion in net inflows, contrasting with outflows experienced by competitors like Fidelity’s FBTC and ARK’s ARKB. IBIT currently manages over $54 billion in assets, holding a 51% share of the US spot Bitcoin ETF market.

US JOLTS Data Fuels Rate Cut Hopes:

The March 2025 US Job Openings and Labor Turnover Summary (JOLTS) report revealed a plunge to 7.19 million job openings from February’s 7.57 million, falling below the forecast of 7.48 million. This lower-than-expected JOLTS number signals a cooling labor market. A cooling labor market increases expectations for Federal Reserve rate cuts, which typically weakens the dollar and boosts risk assets such as Bitcoin.

Conversely, a higher-than-expected JOLTS figure would suggest economic strength, potentially delaying rate cuts and putting downward pressure on crypto prices. With federal layoffs reaching a 2020 peak, market expectations are currently leaning dovish.

Economist and Bitcoin commentator Alex Kruger highlighted the JOLTS data as a short-term positive for Bitcoin, classifying it as a “risk/gold hybrid” that stands to benefit from tariff de-escalation following Trump’s 90-day pause (ending July 8).

Kruger also suggested that markets will be paying close attention to earnings guidance from major firms like Caterpillar and tech stocks, as well as the upcoming Federal Open Market Committee (FOMC) meeting, where Fed Chair Powell might hint at earlier rate cuts.

While Kruger cautioned about a potential Q3 economic slowdown and increased market volatility, he also argued that Bitcoin’s unique risk-reward profile would likely outperform altcoins, which he considers to be overbought.

In summary, multiple factors are currently influencing Bitcoin’s price:

- Fidelity’s Undervaluation Signal: The ‘Bitcoin Yardstick’ suggests Bitcoin is undervalued relative to its network security.

- ETF Inflows: Strong inflows into Bitcoin ETFs, particularly BlackRock’s IBIT, are adding buying pressure.

- Macroeconomic Factors: Cooling US labor market data is raising expectations for Federal Reserve rate cuts, which could weaken the dollar and benefit Bitcoin.

These factors contribute to a complex but potentially favorable outlook for Bitcoin in the near term.