Key points:

- Bitcoin is attempting a support retest, increasing optimism among traders before the weekly close.

- Liquidity analysis indicates that market conditions are ripe for a significant short squeeze, potentially causing BTC price volatility.

- Despite potential dips, the $100,000 level remains a plausible target.

Bitcoin (BTC) was trading around $105,500 on June 8, as traders hoped the recent price correction was complete.

Bitcoin Liquidation Risk Rises as Price Consolidates

Data indicates BTC/USD is solidifying its rebound following a dip to $100,500 on June 5.

Back near its weekly opening price, Bitcoin is encouraging traders to anticipate further upside and a continuation of the bull market.

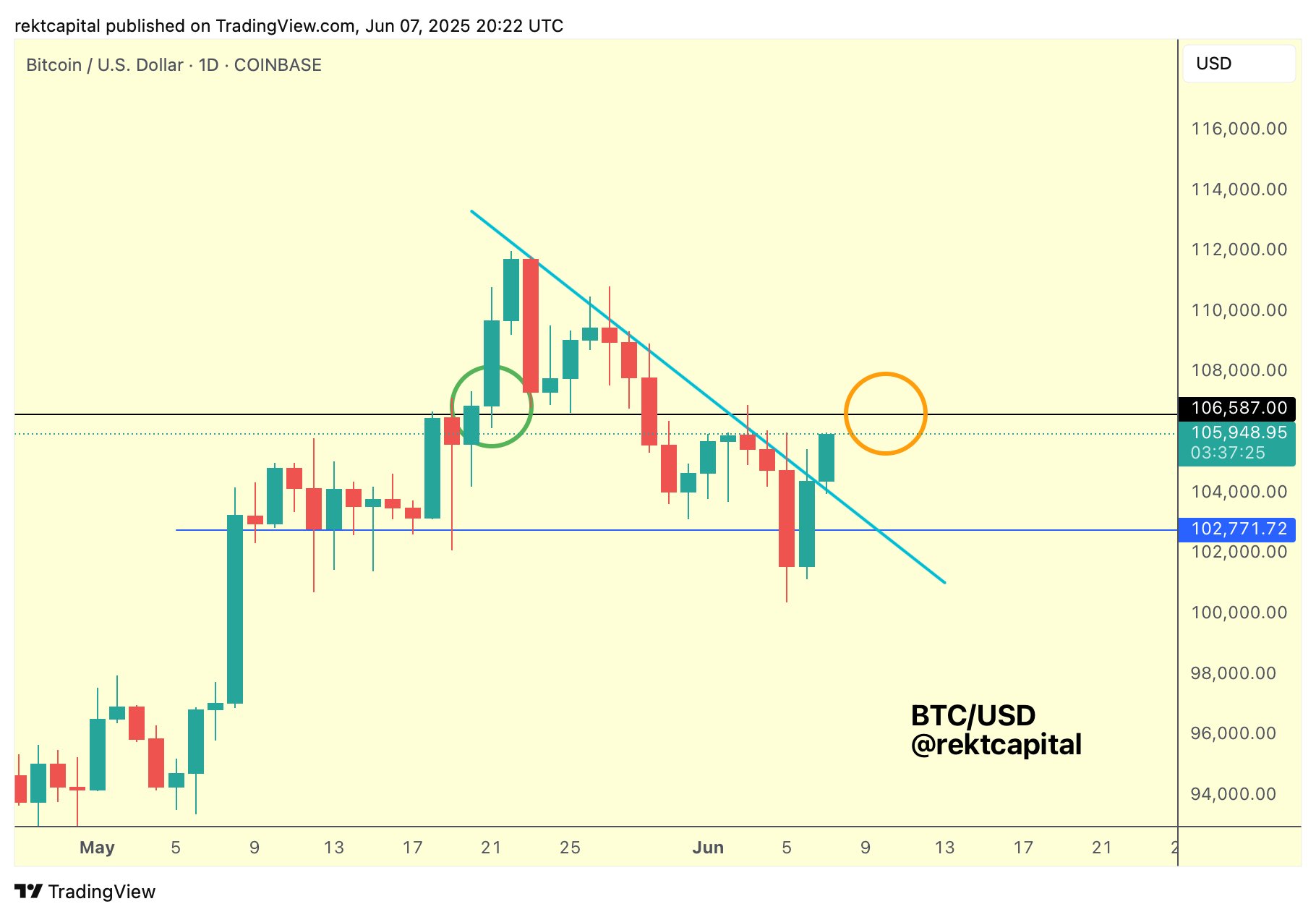

Trader and analyst Rekt Capital noted, “On the Daily timeframe, Bitcoin is showcasing signs of breaking its two-week Downtrend (light blue) while also turning it into support earlier today.”

“Daily Closing & retesting ~$106600 (black) would be even better to enable trend continuation.”

BTC price action had already closed above its 10-day simple moving average (SMA), a condition SuperBro deemed necessary to “invalidate the bear case.”

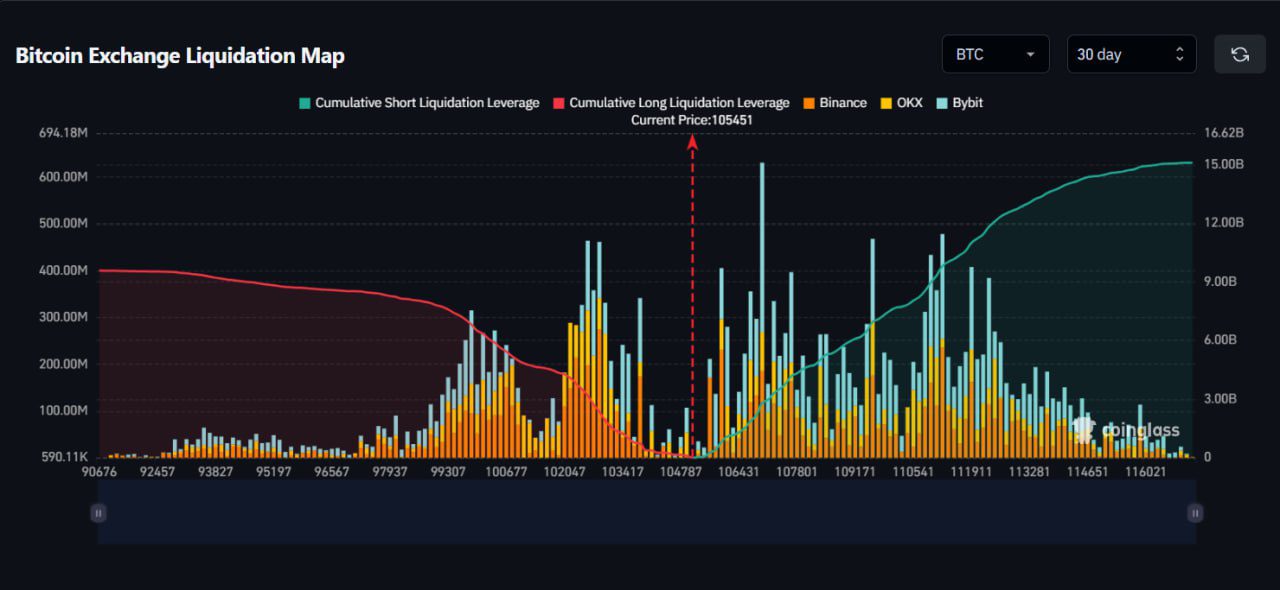

Cas Abbe examined order book liquidity to gauge potential price movements.

Liquidity was building both above and below the current price, leading Abbe to suggest a magnetic-like movement to “grab” the liquidity.

“BTC liquidation cluster is now signalling an upside move,” he summarized.

“If BTC pumps 10% from here, $15.11 billion in shorts will get liquidated. Meanwhile a 10% downside move will liquidate $9.58 billion in longs.”

Abbe also pointed out that negative funding rates indicated substantial short positions forming over the weekend.

“I think BTC big move is coming next week, possibly pushing it above $109K-$110K,” he concluded.

$104,400 Now Key Weekly Close Level

Some analysts anticipate further support retests before the next major move.

CrypNuevo stated that the logical area to establish long positions was around $100,000, calling it the “strongest psychological support.”

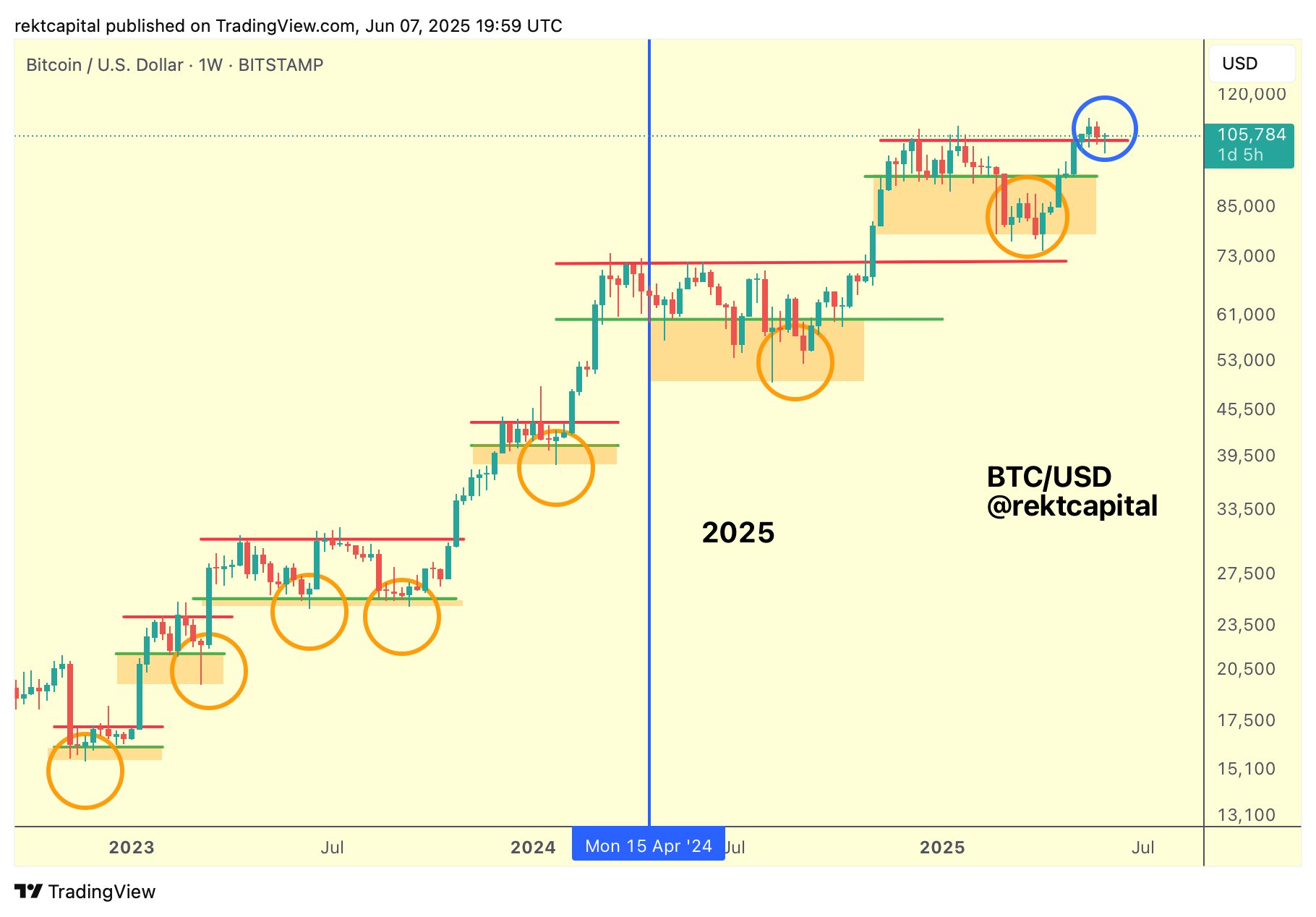

Rekt Capital described the support retest after May’s all-time highs on weekly timeframes as “successful.”

“Can Bitcoin successfully confirm this retest with a Weekly Close above $104400 for what would be a 4th week in a row?” he queried.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.