Bitcoin (BTC) experienced a volatile trading session, briefly dipping from $107,000 before recovering to $105,000. This fluctuation occurred amidst broader market concerns stemming from Moody’s downgrade of the United States’ credit rating. This article delves into the factors influencing Bitcoin’s price action and its potential role as a safe haven asset.

Key Takeaways

- Bitcoin’s recovery suggests it acts as a hedge against economic uncertainty following Moody’s US debt downgrade.

- Moody’s downgraded the US credit rating to Aa1 due to a $36 trillion debt and rising deficits, triggering market volatility.

- Despite short-term macroeconomic pressures, Bitcoin’s long-term outlook remains positive due to cautious shorting and a potentially weakening US dollar.

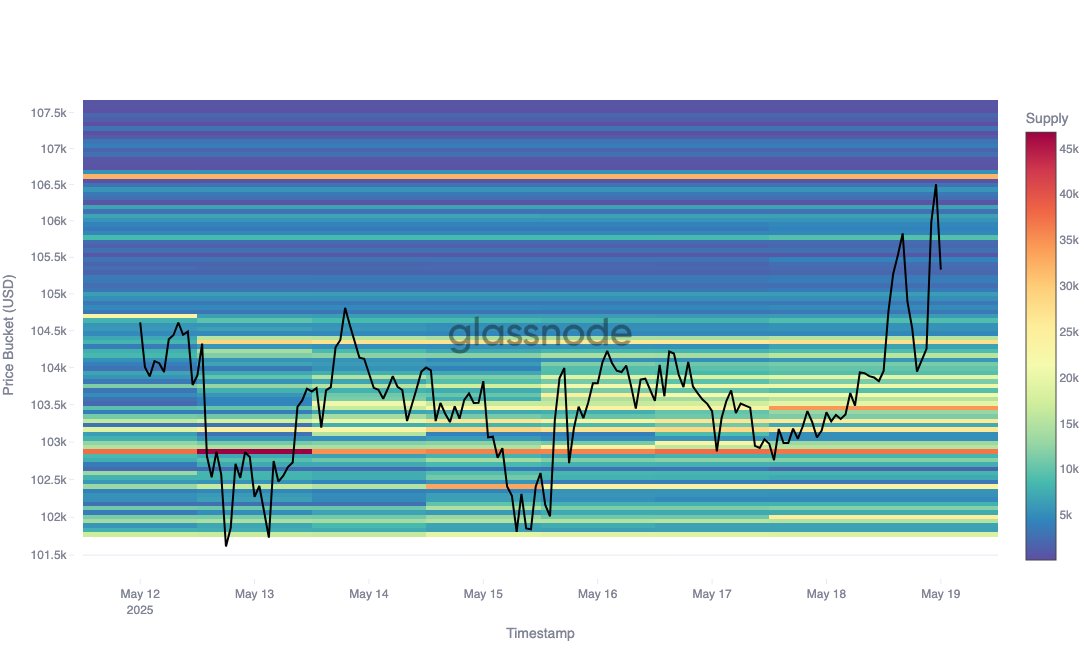

Bitcoin’s price initially faced a 4% correction, dropping from a peak near $107,000. Data indicated strong holder conviction around the $106,600 level, where a significant cluster of Bitcoin was held. This sell-off coincided with Moody’s Investors Service downgrading the US credit rating from Aaa to Aa1, citing concerns about the nation’s growing debt and fiscal deficits.

Moody’s Downgrade and Market Impact

Moody’s cited the US’s $36 trillion debt and projections of federal deficits reaching 9% of GDP by 2035 as primary reasons for the downgrade. Interest payments on this debt are expected to consume a substantial portion of federal revenue, further straining the nation’s fiscal health. This downgrade followed similar actions by S&P and Fitch in previous years, collectively highlighting concerns about the long-term sustainability of US fiscal policy.

The downgrade also contributed to a rise in US Treasury yields, with the 10-year yield opening at 5.53% and the 30-year yield reaching 4.98%. This increase reflects investor anxieties about higher borrowing costs for the US government and potential inflationary pressures.

Bitcoin’s Resilience and Long-Term Outlook

Despite the initial price drop, Bitcoin’s subsequent recovery suggests underlying strength and potential as a safe haven asset. Some analysts believe that traders have become more cautious in building short positions, indicating a generally bullish long-term outlook.

Historically, Bitcoin has acted as a hedge against economic uncertainty, particularly during periods of eroding trust in traditional financial systems. The weakening US Dollar Index (DXY), signaling a potential decline below $100, could further support Bitcoin’s price. A weaker dollar typically benefits risk assets like Bitcoin, as investors seek alternative stores of value.

Factors Influencing Bitcoin’s Price

Several factors are currently influencing Bitcoin’s price:

- Macroeconomic Conditions: Global economic uncertainty, including debt downgrades and rising interest rates, can impact investor sentiment and drive demand for safe haven assets.

- Investor Sentiment: The overall mood of the market, including the balance between bullish and bearish positions, plays a crucial role in price movements.

- US Dollar Strength: A weakening dollar can make Bitcoin more attractive to international investors.

- Regulatory Developments: Changes in regulations surrounding cryptocurrencies can significantly impact market sentiment and adoption.

- Technological Advancements: Innovations in blockchain technology and the development of new applications can increase the value and utility of Bitcoin.

Conclusion

Bitcoin’s ability to recover from a sharp sell-off amidst a US debt downgrade highlights its potential as a store of value and hedge against economic uncertainty. While short-term volatility is expected, the long-term outlook for Bitcoin remains positive, driven by factors such as cautious shorting, a weakening dollar, and increasing adoption as a digital asset. Investors should carefully consider these factors and conduct thorough research before making any investment decisions.