Bitcoin (BTC) recently surged to $97,900, driven by increasing institutional investor interest. However, futures market data suggests that traders are not fully convinced about a sustained rally to $100,000. This article delves into the factors influencing Bitcoin’s price, analyzing derivatives market sentiment, macroeconomic headwinds, and potential catalysts for future gains.

Key Factors Influencing Bitcoin’s Price

- Institutional Demand: Soaring institutional investor demand is pushing Bitcoin towards $100,000.

- Futures Market Caution: Futures pricing indicates traders are wary of a sustained rally.

- Macroeconomic Risks: Global trade tensions and potential recession fears limit bullish sentiment.

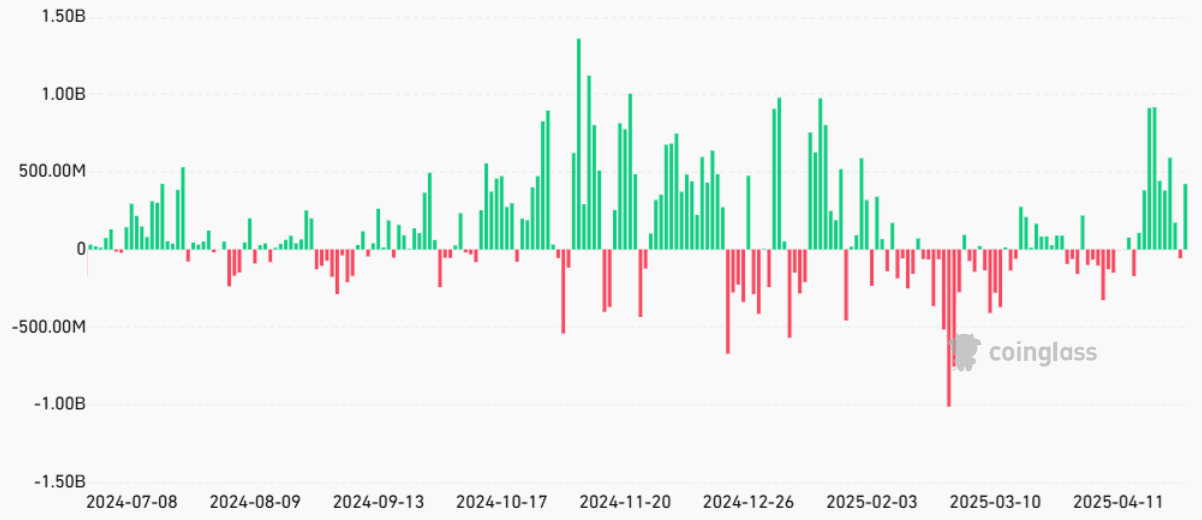

- ETF Inflows: $3.6 billion in spot BTC ETF inflows provide support but may reflect hedging strategies.

Bitcoin’s breakout above the $93,000-$95,600 range marked a ten-week high. Despite this, sentiment remains neutral, according to BTC derivatives indicators. The ongoing global tariff dispute, affecting macroeconomic data, contributes to this caution.

Traders are concerned that fears of an economic recession could limit Bitcoin’s price performance, despite growing institutional interest. This reduces the likelihood of BTC reaching $110,000 or higher in 2025. The cryptocurrency’s strong correlation with the stock market has also diminished its appeal as “digital gold” for some investors.

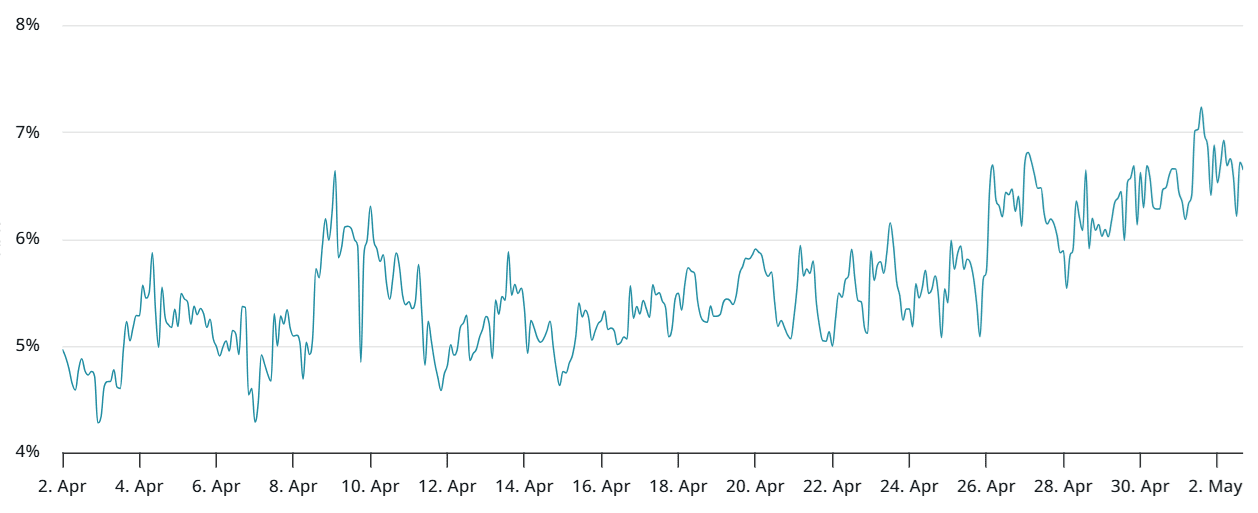

The annualized premium for Bitcoin’s two-month futures has remained in the neutral range of 6% to 7%. This contrasts with January, when Bitcoin was trading near $95,000, and the futures premium exceeded 10%, indicating stronger optimism.

Gold’s Rally Overshadows Bitcoin’s Gains

Gold’s recent 20% rally, from $2,680 to $3,220, has raised concerns among some market participants. While Bitcoin surpassed silver’s $1.8 trillion market capitalization, gold’s surge to a $21.7 trillion valuation overshadows this achievement.

The $3.6 billion in net inflows to US spot ETFs could also be driven by delta-neutral strategies, where Bitcoin holders move to listed products or use derivatives for hedging. In this scenario, the direct impact on price would be limited, explaining Bitcoin’s modest 5% gain during this period.

Options Market Shows Bullish Bias

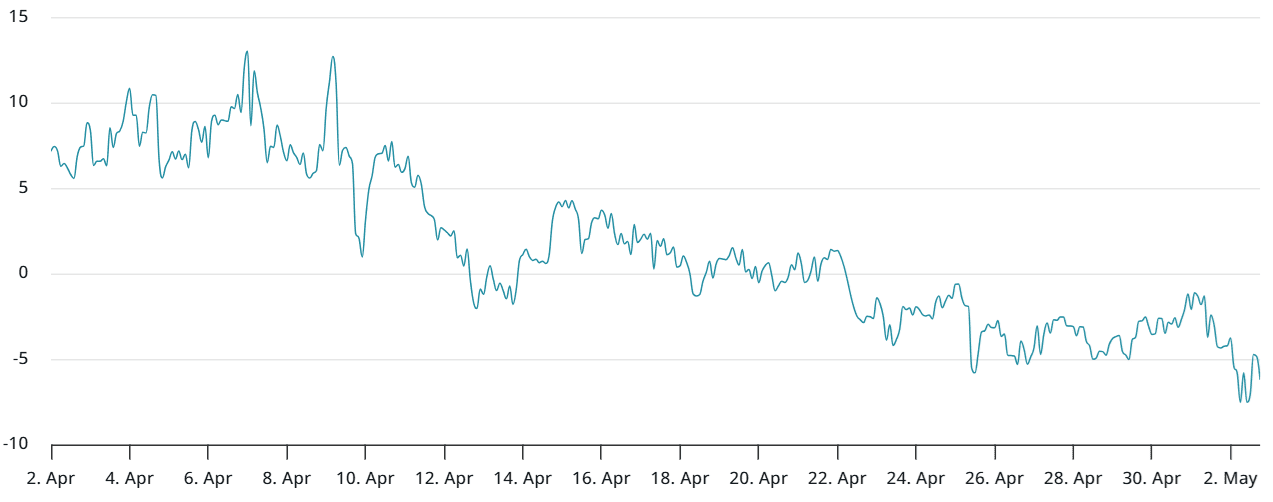

Analysis of the BTC options market reveals a shift in sentiment. The BTC options 25% delta skew metric is near its lowest level since Feb. 15, suggesting that whales and market makers assign higher odds to further upside. This represents a sharp reversal from three weeks prior, when put (sell) options traded at a premium.

Derivatives Market Indicates Moderate Optimism

Overall, Bitcoin derivatives indicate moderate optimism. Traders generally anticipate further price gains, but bulls are refraining from using leverage. This cautious approach might set the stage for a surprise rally, especially given that the retest of $74,500 on April 9 did not significantly affect BTC derivatives.

The US-China trade relationship remains a critical factor influencing Bitcoin’s performance. As long as trade tensions persist, Bitcoin is likely to continue tracking the S&P 500 movements. While this environment may hinder Bitcoin from reaching a new all-time high in the near term, BTC derivatives currently lean slightly in favor of the bulls.

Summary

While institutional demand and positive ETF inflows are driving Bitcoin’s price towards $100,000, caution prevails among futures traders due to macroeconomic risks and ongoing trade tensions. The options market shows a bullish bias, but overall, derivatives indicate moderate optimism. The US-China trade relationship remains a key determinant of Bitcoin’s future performance.