Key Takeaways:

- Bitcoin price climbed to $101,707, supported by positive regulatory developments and increasing integration into traditional finance.

- Market sentiment suggests strong support at the $100,000 level.

Bitcoin (BTC) experienced a surge, exceeding $100,000 following indications of potential trade agreements involving the US and the UK. These agreements could ease import tariffs.

The market has responded favorably to hints of multiple trade negotiations by the US administration. In addition to the UK deal, US officials are scheduled to meet with Chinese counterparts in Switzerland on May 10.

The Dow Jones Industrial Average rose by 500 points following the White House’s announcement, while the S&P 500 saw a 1.47% increase. Bitcoin was trading near $101,600 at the time of this report.

Former US President Trump noted ongoing trade deal negotiations.

The return of Bitcoin to six-figure valuation after trading below this mark since February is a noteworthy milestone for investors.

Market analyst Macroscope emphasized the importance of Bitcoin maintaining support at the $100,000 level.

While the initial breakout above $100,000 was influenced by futures market liquidations, the underlying political and investment landscape for Bitcoin has substantially improved.

Recent developments include the passing of bills in two US states legalizing the establishment of strategic Bitcoin reserves. Missouri is also considering eliminating capital gains taxes.

The US Office of the Comptroller of the Currency (OCC) has also stated that banks can responsibly engage in crypto trading on behalf of their customers and outsource crypto-related activities to trusted third parties.

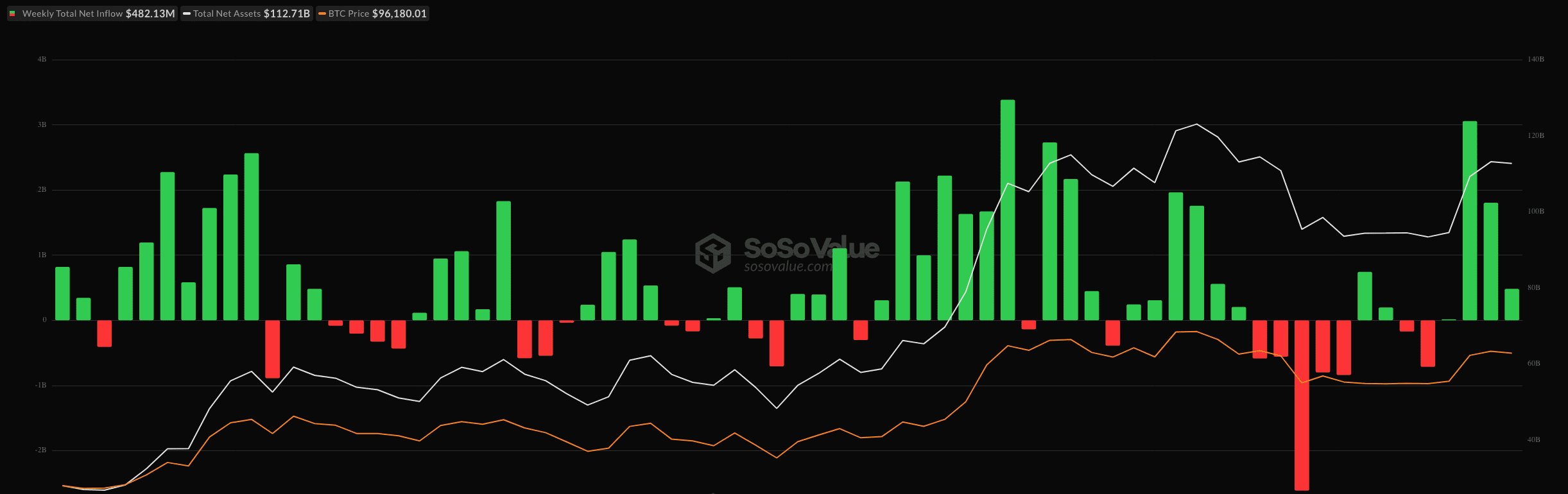

In late March, the FDIC provided guidance that allows banks to hold crypto assets and offer related services to clients. Support for Bitcoin is growing, with substantial inflows into spot Bitcoin ETFs and increasing Bitcoin treasury holdings by publicly listed companies.

Factors Driving Bitcoin’s Price Surge:

- Regulatory Approvals: Recent regulatory approvals in the US have boosted investor confidence and legitimized Bitcoin as an asset class.

- Institutional Adoption: Increased investment from institutional players, including hedge funds and corporations, has driven up demand.

- ETF Inflows: Significant inflows into spot Bitcoin ETFs indicate strong investor interest and provide a steady stream of capital into the market.

- Macroeconomic Factors: Potential trade deals and positive economic indicators have contributed to a favorable environment for risk assets like Bitcoin.

- Strategic Bitcoin Reserves: States creating Bitcoin reserves signal confidence in its future value and potential as a store of value.

Expert Analysis:

Analysts suggest that the $100,000 level now acts as a critical support level, with continued positive developments potentially pushing Bitcoin to new all-time highs. The growing regulatory clarity and increasing acceptance by traditional financial institutions suggest a maturing market for Bitcoin.

Potential Challenges and Risks:

- Market Volatility: Bitcoin remains a volatile asset, and significant price swings are possible.

- Regulatory Uncertainty: Future regulatory changes could impact the price and adoption of Bitcoin.

- Competition from Other Cryptocurrencies: The cryptocurrency market is constantly evolving, and new cryptocurrencies could challenge Bitcoin’s dominance.

- Security Risks: Bitcoin is susceptible to security breaches and hacks, which could result in the loss of funds.

Conclusion:

Bitcoin’s recent surge above $100,000 reflects a confluence of factors, including positive regulatory developments, increased institutional adoption, and growing mainstream acceptance. While challenges and risks remain, the overall outlook for Bitcoin appears increasingly positive, potentially paving the way for further price appreciation and wider adoption.