Key Takeaways:

- Bitcoin (BTC) experienced a sell-off despite positive US Consumer Price Index (CPI) data.

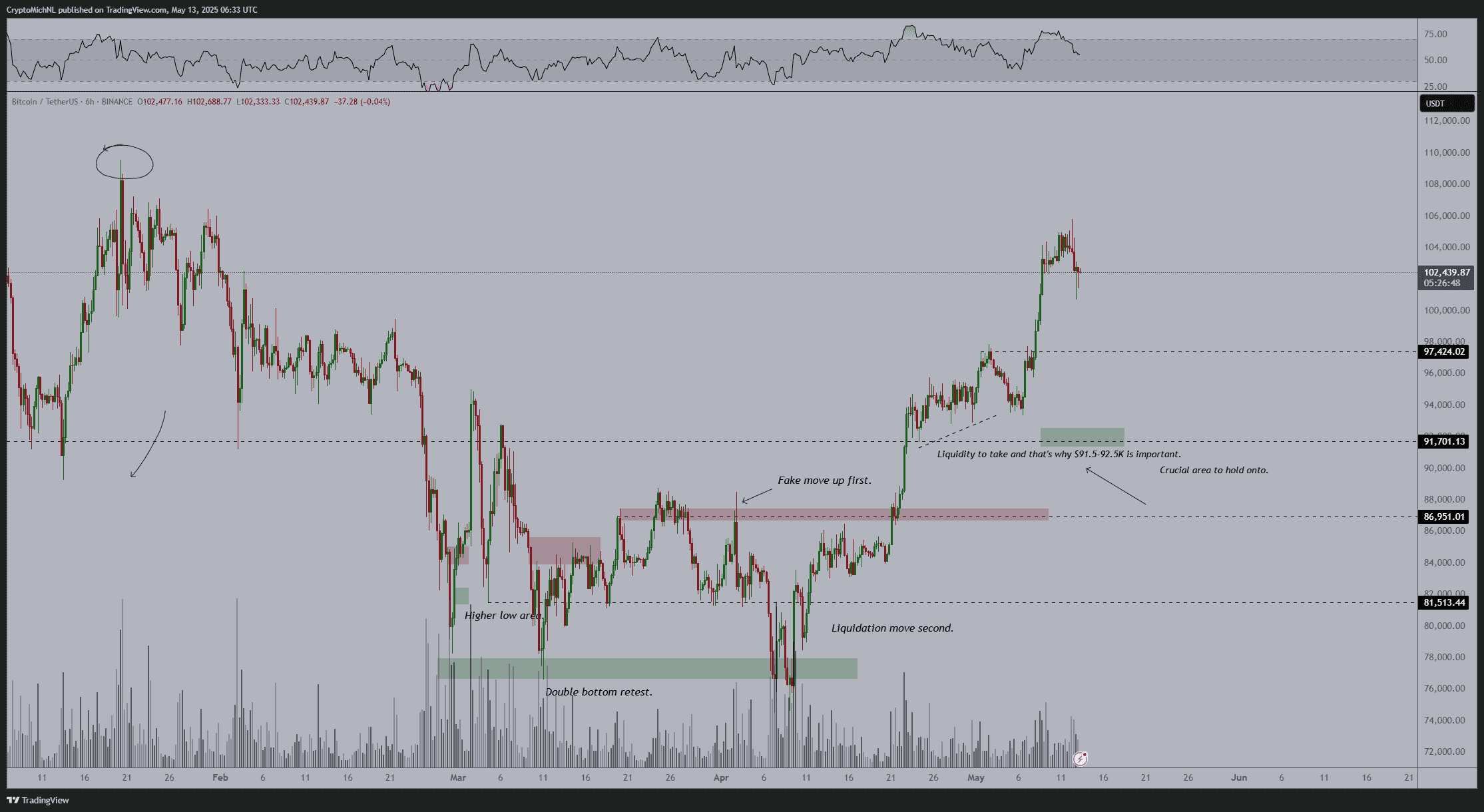

- Analysts suggest BTC/USD is consolidating before its next major move, potentially testing lower levels.

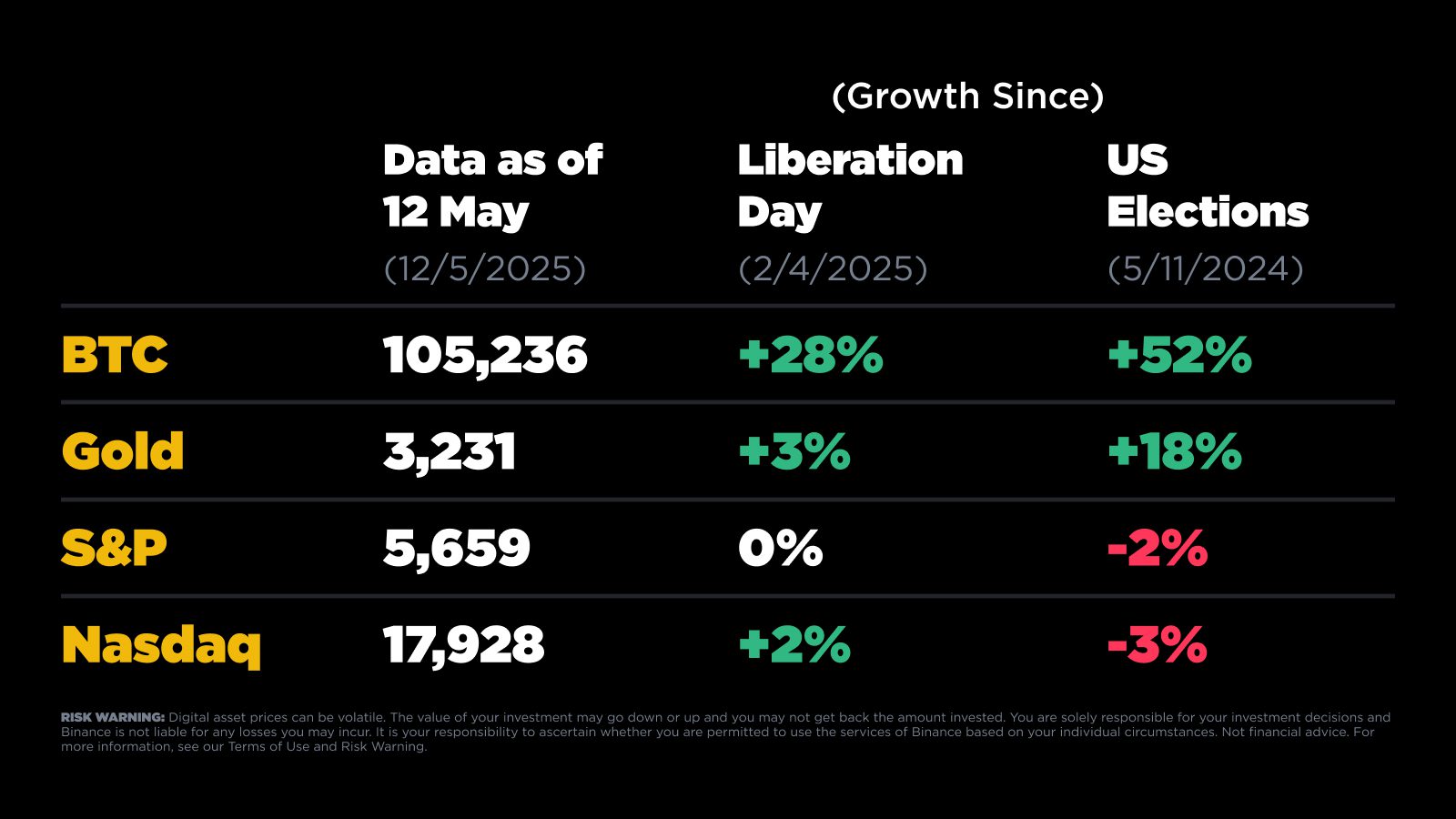

- Binance CEO Richard Teng points to Bitcoin’s strong performance relative to gold and traditional stock markets.

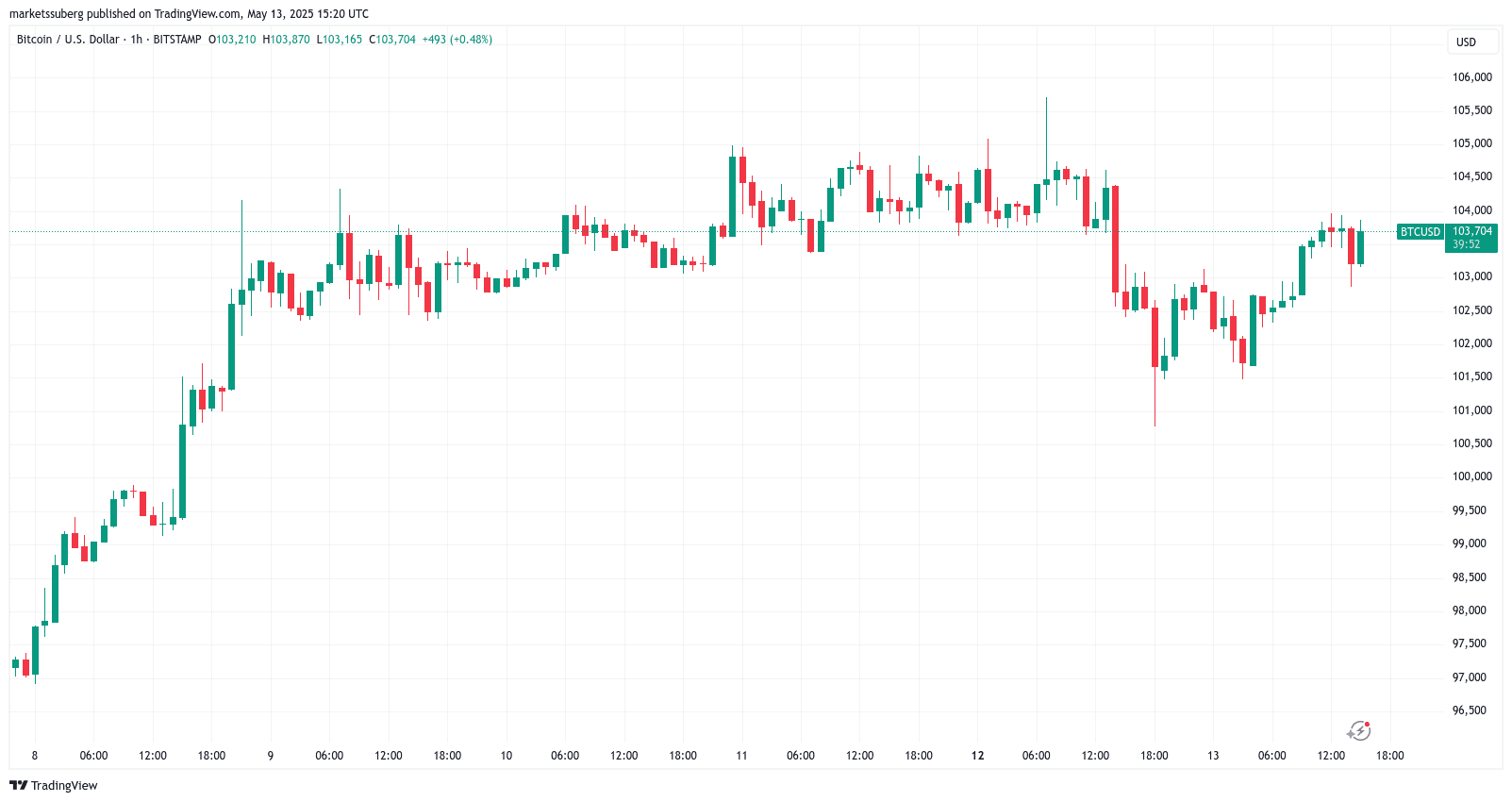

Bitcoin’s price action showed a muted response to the latest US inflation figures, with a sell-off occurring at the Wall Street open. This raised questions about Bitcoin’s immediate trajectory amid broader market dynamics.

Bitcoin’s Price Stagnation After CPI Release

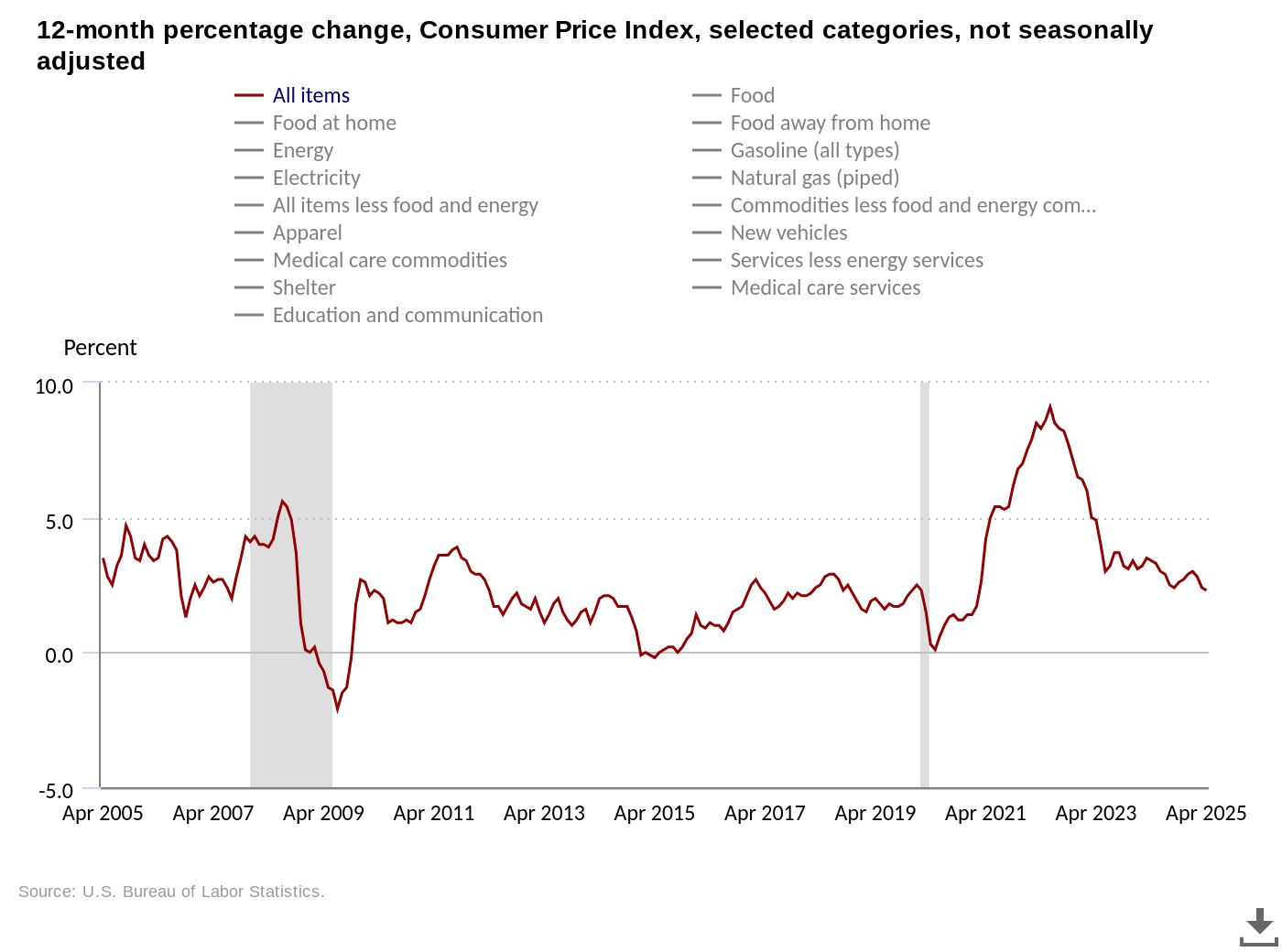

Following the release of the US Consumer Price Index (CPI) data, which indicated a cooling of inflation, Bitcoin struggled to reclaim the $104,000 level as support. The CPI’s April print came in below expectations, which would generally be seen as a positive sign for risk assets like Bitcoin.

According to the US Bureau of Labor Statistics (BLS), “The all items index rose 2.3 percent for the 12 months ending April, after rising 2.4 percent over the 12 months ending March,” marking the smallest 12-month increase since February 2021.

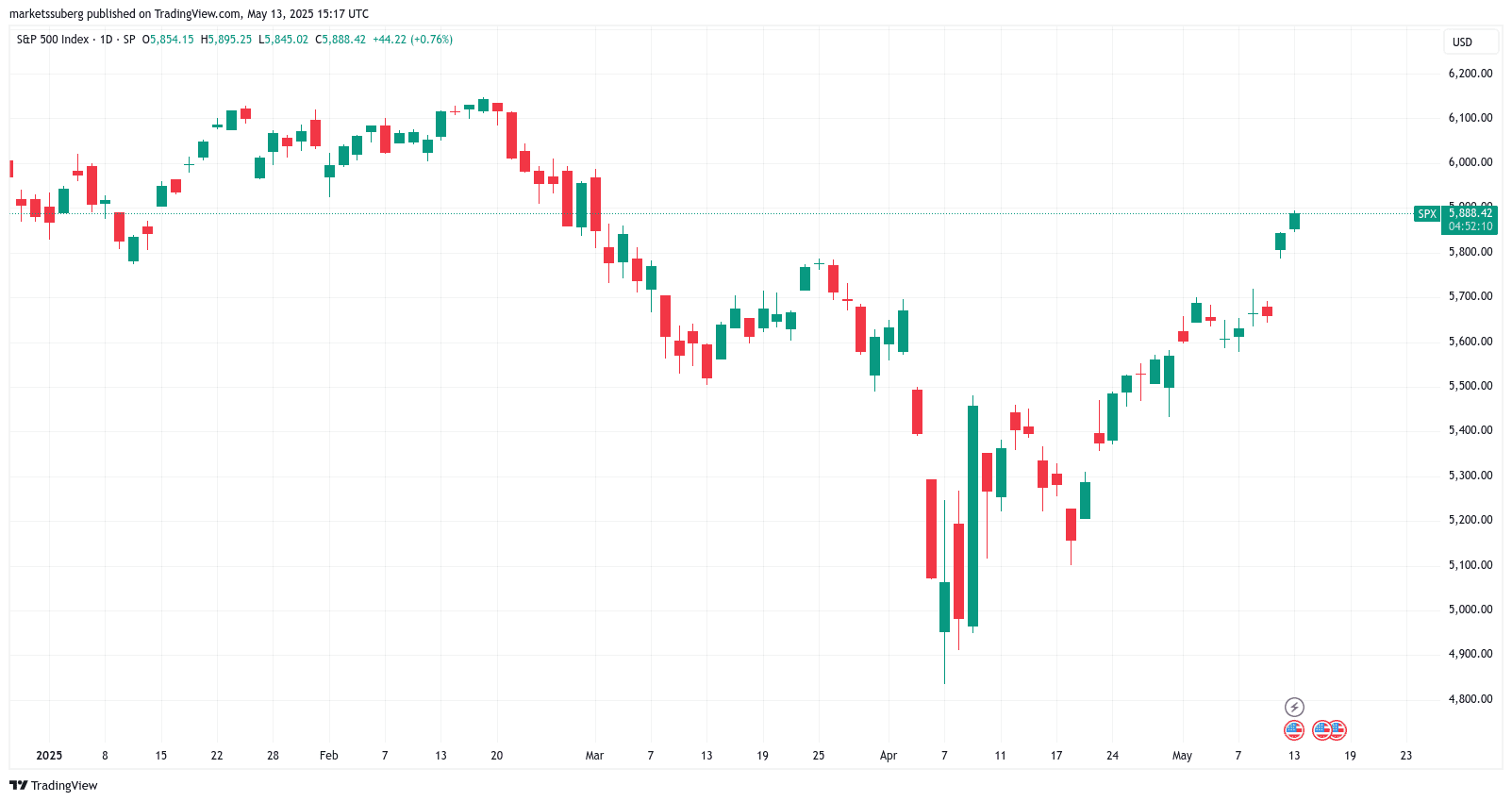

In the traditional markets, US stocks initially reacted positively, with the S&P 500 and Nasdaq Composite Index both showing gains. However, Bitcoin’s price failed to follow suit, raising concerns about its correlation with macroeconomic data.

The Kobeissi Letter noted that the S&P 500 had technically entered a new bull market, being up 20% since April. They also highlighted the historic moves in both stocks and commodities.

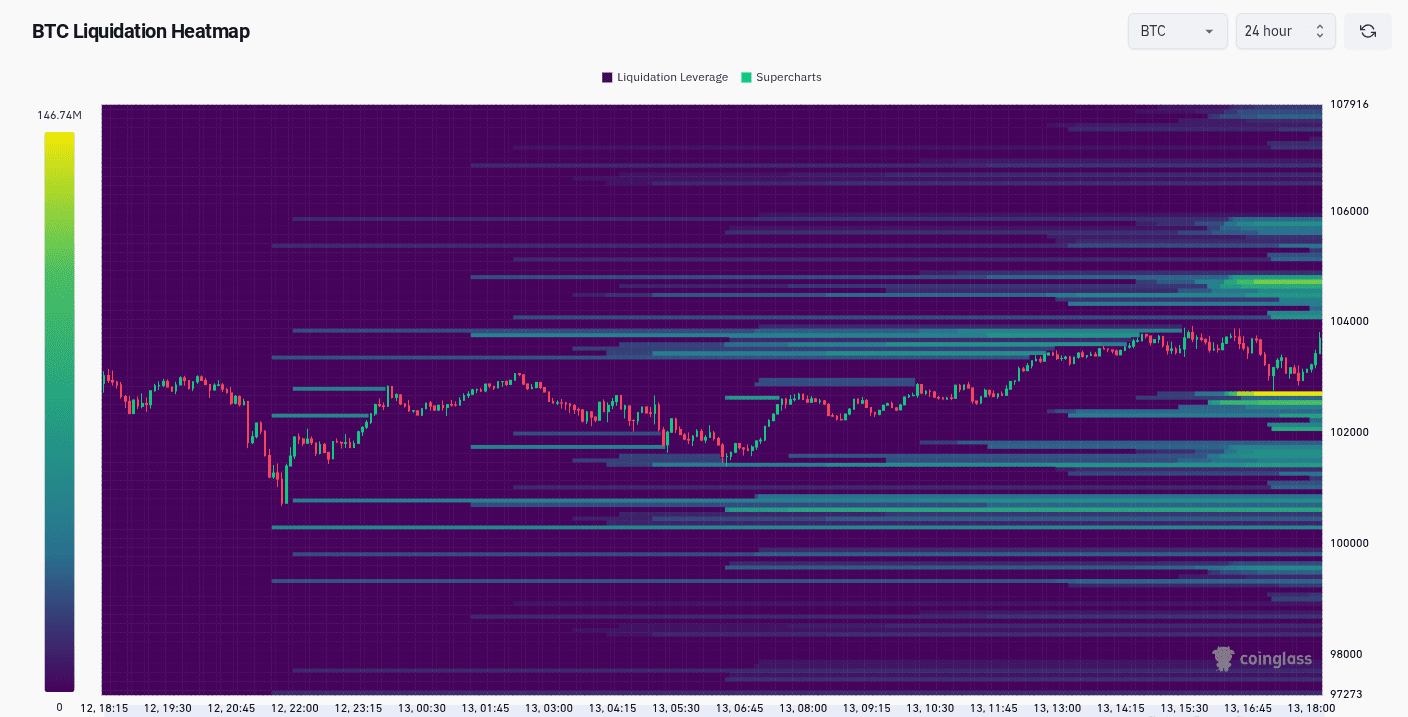

Daan Crypto Trades pointed out that significant liquidity clusters above and below the spot price had been taken out, suggesting the potential for increased volatility in the near future. He indicated the market may range for a bit to decide what it wants to do, and there were no massive liquidity levels nearby.

Previously, Daan Crypto Trades had predicted a retest of $102,000 based on liquidity clusters, which did occur.

Crypto analyst Michaël van de Poppe suggested that Bitcoin’s current consolidation was normal, and even a dip to $97.5-98K would still maintain an uptrend in preparation for new all-time highs.

Binance CEO: Bitcoin’s “Undeniable” Momentum

Richard Teng, CEO of Binance, offered a contrasting perspective, emphasizing Bitcoin’s strength compared to traditional markets. He stated that Bitcoin is “already leading the pack” in terms of returns since April 2.

Teng highlighted that Bitcoin’s double-digit gains following key global events reinforce its position as a resilient alternative asset, outperforming gold, the S&P 500, and the Nasdaq year-to-date. He emphasized that “the momentum is undeniable.”

QCP Capital suggests that Bitcoin remains caught between being seen as ‘digital gold’ and a risk-on asset, which is obscuring its directional conviction. As the macro narrative shifts from protectionism toward trade optimism, BTC could remain range-bound.

Additional Insights: Factors Influencing Bitcoin’s Price

Several factors could be contributing to Bitcoin’s recent price action:

- Macroeconomic Uncertainty: Lingering concerns about inflation, interest rate hikes, and overall economic stability can create headwinds for risk assets, including Bitcoin.

- Regulatory Developments: Changes in regulations surrounding cryptocurrencies can impact investor sentiment and market behavior.

- Market Sentiment: Overall investor confidence in the cryptocurrency market plays a crucial role in price movements.

- Geopolitical Events: Global events can create volatility in financial markets, affecting Bitcoin’s price.

Conclusion: Bitcoin’s Position in a Dynamic Market

Bitcoin’s subdued reaction to positive CPI data highlights the complexities of its role in the financial landscape. While some analysts see it as consolidating before a potential downturn, others, like Binance CEO Richard Teng, emphasize its strength relative to traditional assets. Understanding these different perspectives, along with macroeconomic factors, is essential for navigating the cryptocurrency market.