Bitcoin (BTC) has demonstrated resilience, surging above $93,000 on April 24th and signaling a potential end to a 52-day bear market. This recovery has caught bearish traders off guard, fueled by significant spot market activity.

Key Factors Driving Bitcoin’s Rebound

- Strong Spot Volumes: The primary driver of the recent Bitcoin price rally appears to be robust activity in the spot market, indicating genuine buying interest.

- Short Squeeze Potential: A significant number of leveraged short positions remain open, creating the possibility of a short squeeze if Bitcoin’s price continues to rise.

- ETF Inflows: Spot Bitcoin exchange-traded funds (ETFs) have experienced substantial inflows, adding further buying pressure to the market.

- Economic Factors: A weakening US dollar and adjustments in S&P 500 targets by Deutsche Bank are contributing to a favorable environment for Bitcoin.

Analysis of Market Sentiment

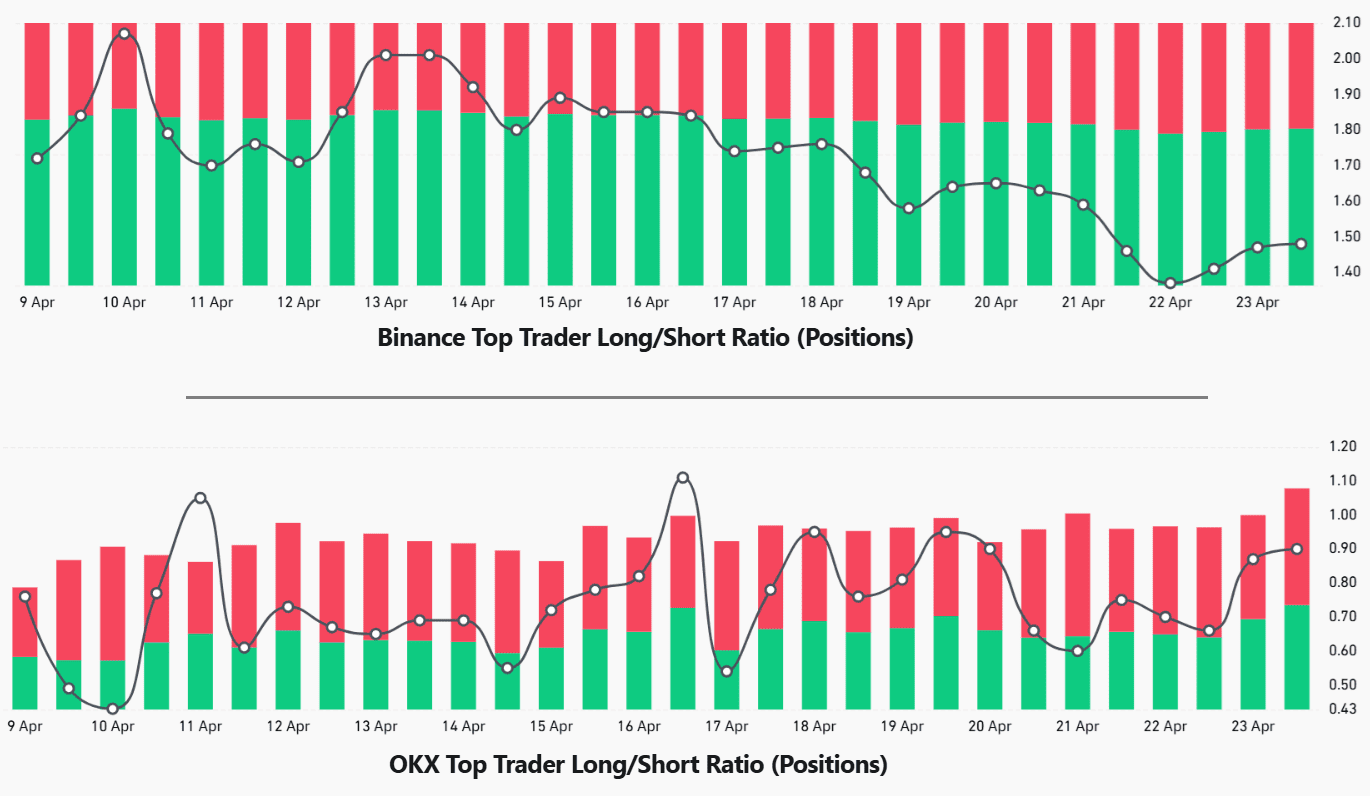

While Bitcoin shows signs of decoupling from traditional markets like the stock market, professional traders’ strategies haven’t drastically shifted. The long-to-short ratio on major exchanges like Binance and OKX provides insights into market sentiment. A higher ratio reflects bullish sentiment, while a lower ratio indicates bearishness. Currently, the top traders’ long-to-short ratio on Binance stands at 1.5x, down from 2x ten days prior. At OKX, the ratio peaked near 1.1x on April 17th but has since declined to 0.9x.

Bitcoin’s Rise Amidst Economic Uncertainty

Bitcoin’s recent 10% rally coincided with remarks by US President Donald Trump regarding import tariffs and criticism of Federal Reserve Chair Jerome Powell. Deutsche Bank strategists have also reduced their year-end S&P 500 target by 12% to 6,150, reflecting broader economic uncertainty. This has contributed to the US dollar weakening, pushing the DXY index below 99.

Despite modest gains, Bitcoin has performed well enough to secure its position among the world’s top tradable assets, boasting a market capitalization of $1.84 trillion.

Potential Short Squeeze Scenario

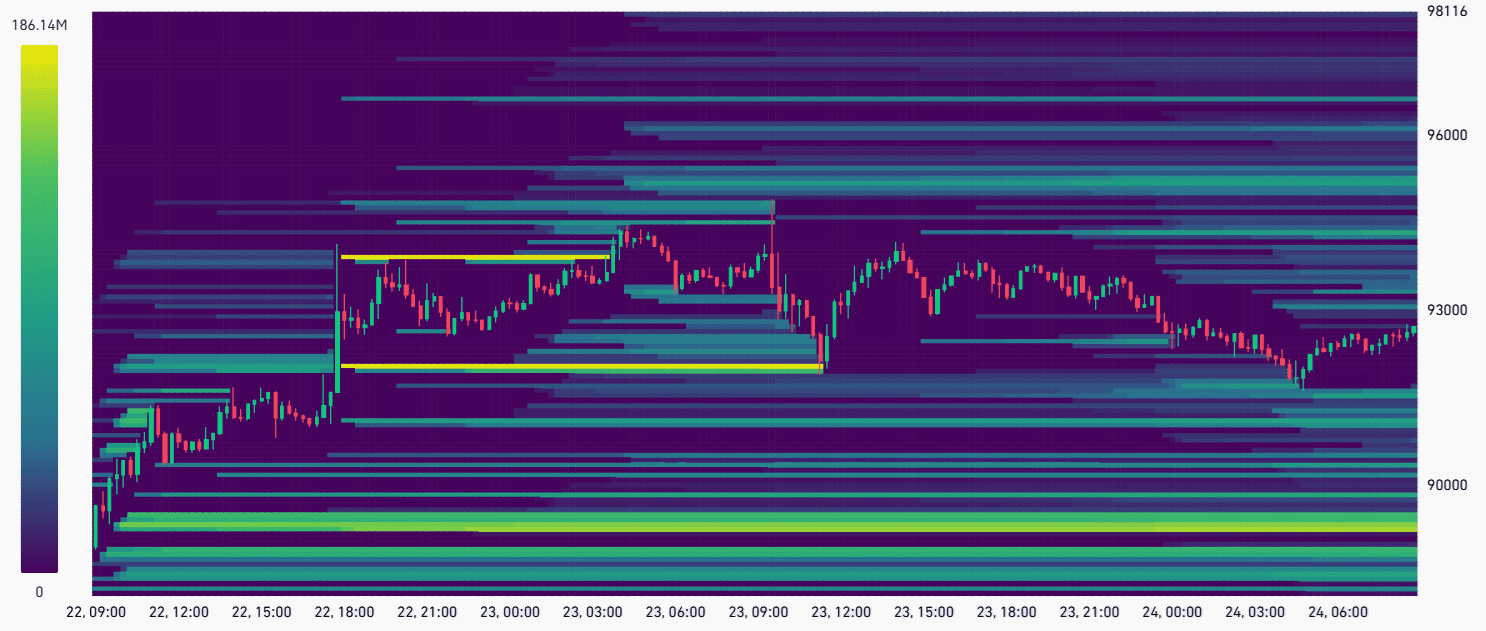

The rapid price increase caught many Bitcoin bears off guard, leading to over $390 million in leveraged short futures liquidations between April 21st and April 22nd. Aggregate open interest in BTC futures remains only 5% below its all-time high, indicating that many bearish traders have yet to exit their positions.

If Bitcoin surpasses $95,000, an additional $700 million in short futures positions could be liquidated. This short squeeze could be exacerbated by robust inflows into spot Bitcoin ETFs, which totaled over $2.2 billion between April 21st and April 23rd.

New Players Entering the Bitcoin Space

A newly announced joint venture involving SoftBank, Cantor Fitzgerald, and Tether, named Twenty One Capital, aims to accumulate Bitcoin through convertible bonds and equity financing. Led by Strike founder Jack Mallers, the company plans to launch with 42,000 BTC, further strengthening the bullish outlook.

Spot Market Dominance

The muted response from top traders in BTC margin and futures markets suggests that the recent buying pressure has primarily originated from spot markets, a positive indicator for a sustainable bull run.

Path to $100,000

The longer Bitcoin consolidates above $90,000, the more pressure mounts on bears to cover their short positions. This level reinforces the narrative that Bitcoin is decoupling from the stock market, potentially providing the confidence needed to test the $100,000 psychological threshold.

Conclusion

Bitcoin’s recent rebound is supported by multiple factors, including strong spot market demand, the potential for a short squeeze, and the entry of new institutional players. While challenges remain, the cryptocurrency’s resilience suggests that a retest of the $100,000 level is a distinct possibility.