Key Takeaways:

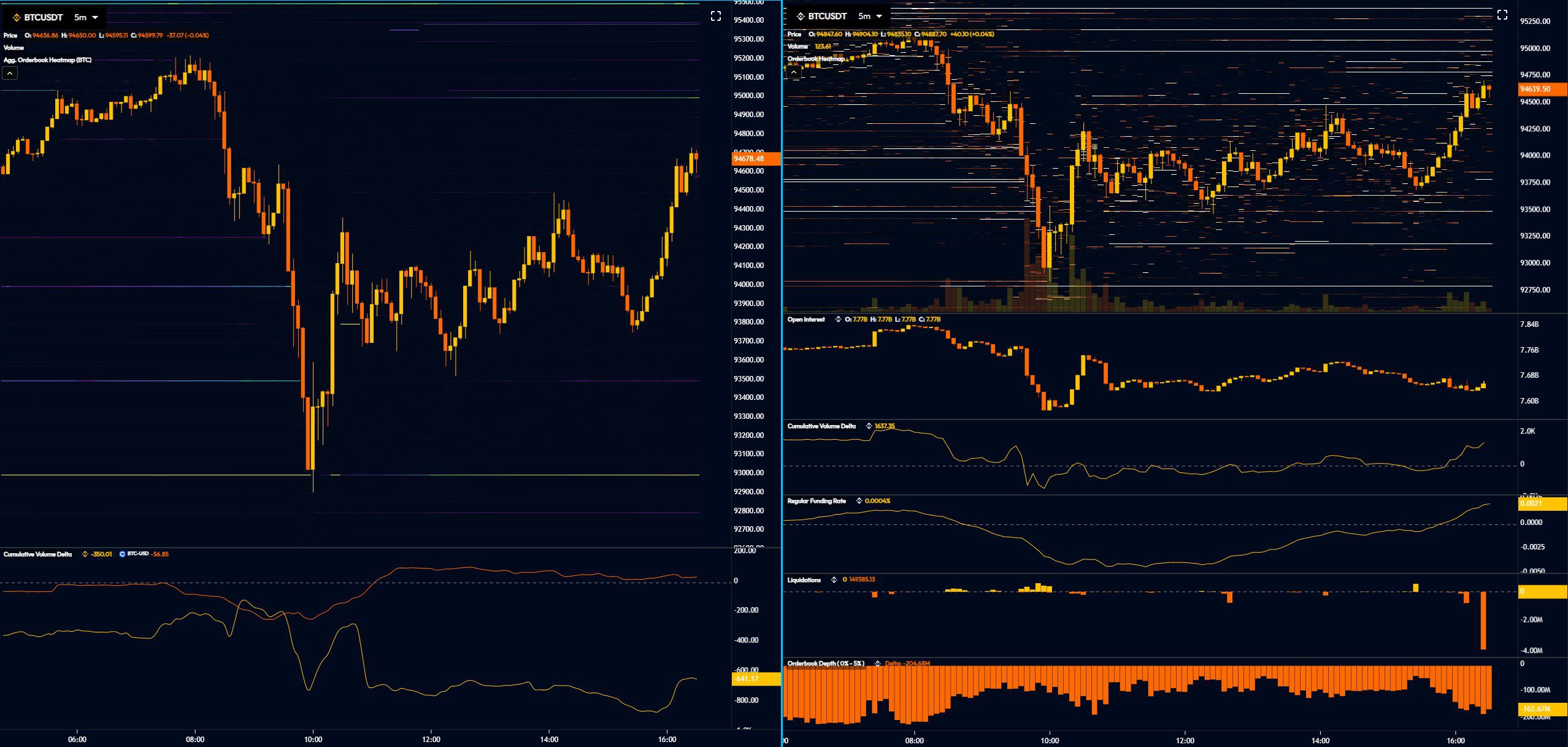

- Bitcoin price is testing the $95,000 resistance level following a brief dip triggered by weaker-than-expected US GDP data.

- Market sentiment suggests traders anticipate a potential shift in Federal Reserve policy towards easing and rate cuts, boosting Bitcoin’s appeal.

- Positive revenue reports from major US companies are bolstering risk appetite and contributing to the Bitcoin recovery.

Bitcoin (BTC) is showing resilience, rebounding strongly after an initial dip to $92,910 following the release of concerning US GDP data indicating economic contraction in Q1 2025. This recovery mirrors similar trends observed in the DOW and S&P 500, signaling a broader market rebound. The quick turnaround highlights strong buying interest and suggests the GDP data might be a temporary setback, possibly influenced by businesses front-loading imports ahead of anticipated tariffs.

Factors Driving Bitcoin’s Rebound:

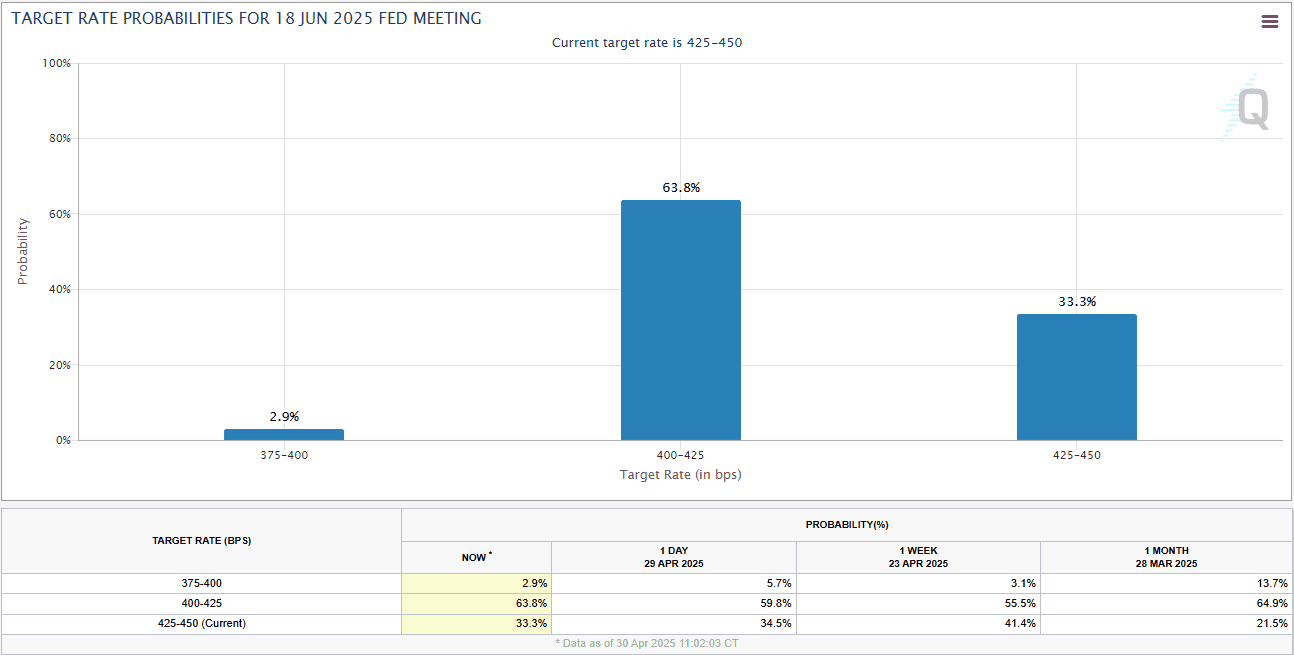

- Anticipation of Federal Reserve Easing: Despite economic concerns, crypto traders believe a US recession could prompt the Federal Reserve to lower interest rates and increase the money supply, historically benefiting Bitcoin. Current probabilities favor a Fed rate cut, increasing from 59.8% on April 29 to 63.8% on April 30.

- Positive Corporate Earnings: Strong revenue beats from large US companies are instilling confidence in the market, reducing risk aversion, and supporting Bitcoin’s recovery.

- Passive Buying Pressure: Market analysis suggests passive buyers are driving spot flow, with price increases supported by strong bidding and normalization of funding rates.

Impact of US GDP Data:

The US GDP data, showing a contraction in the economy, initially triggered a sell-off in both traditional financial markets and the cryptocurrency market. However, the swift recovery suggests investors are looking beyond the immediate data, focusing on potential future policy changes and the long-term prospects of Bitcoin.

Potential Fed Response:

The prospect of a weakening economy raises the likelihood of the Federal Reserve intervening to stimulate growth. This could involve lowering interest rates or implementing quantitative easing (QE), both of which tend to devalue the US dollar and increase the attractiveness of alternative assets like Bitcoin.

Trader Sentiment and Market Analysis:

According to market analysts, a sustained break above the $95,500 resistance level could pave the way for a rapid ascent towards $100,000. The May 2 jobs report, revealing April’s job creation figures, could further influence market sentiment and cryptocurrency prices.

Bitcoin’s Long-Term Outlook:

Bitcoin’s long-term outlook remains positive, driven by its scarcity, decentralization, and increasing adoption as a store of value and hedge against inflation. While short-term price fluctuations are inevitable, the underlying fundamentals supporting Bitcoin continue to strengthen.

The Role of Institutional Investors:

Increased institutional adoption of Bitcoin is playing a significant role in its price stability and long-term growth. As more institutions allocate capital to Bitcoin, its liquidity and legitimacy increase, further solidifying its position as a mainstream asset.

Conclusion:

Bitcoin’s resilience in the face of negative economic data underscores its unique appeal as an alternative asset. The anticipation of potential Federal Reserve easing, coupled with positive corporate earnings and strong buying pressure, is fueling the current rebound. While the market remains susceptible to volatility, Bitcoin’s long-term prospects remain promising.