Bitcoin Shows Resilience Amid Coinbase Security Breach and Positive DeFi Developments

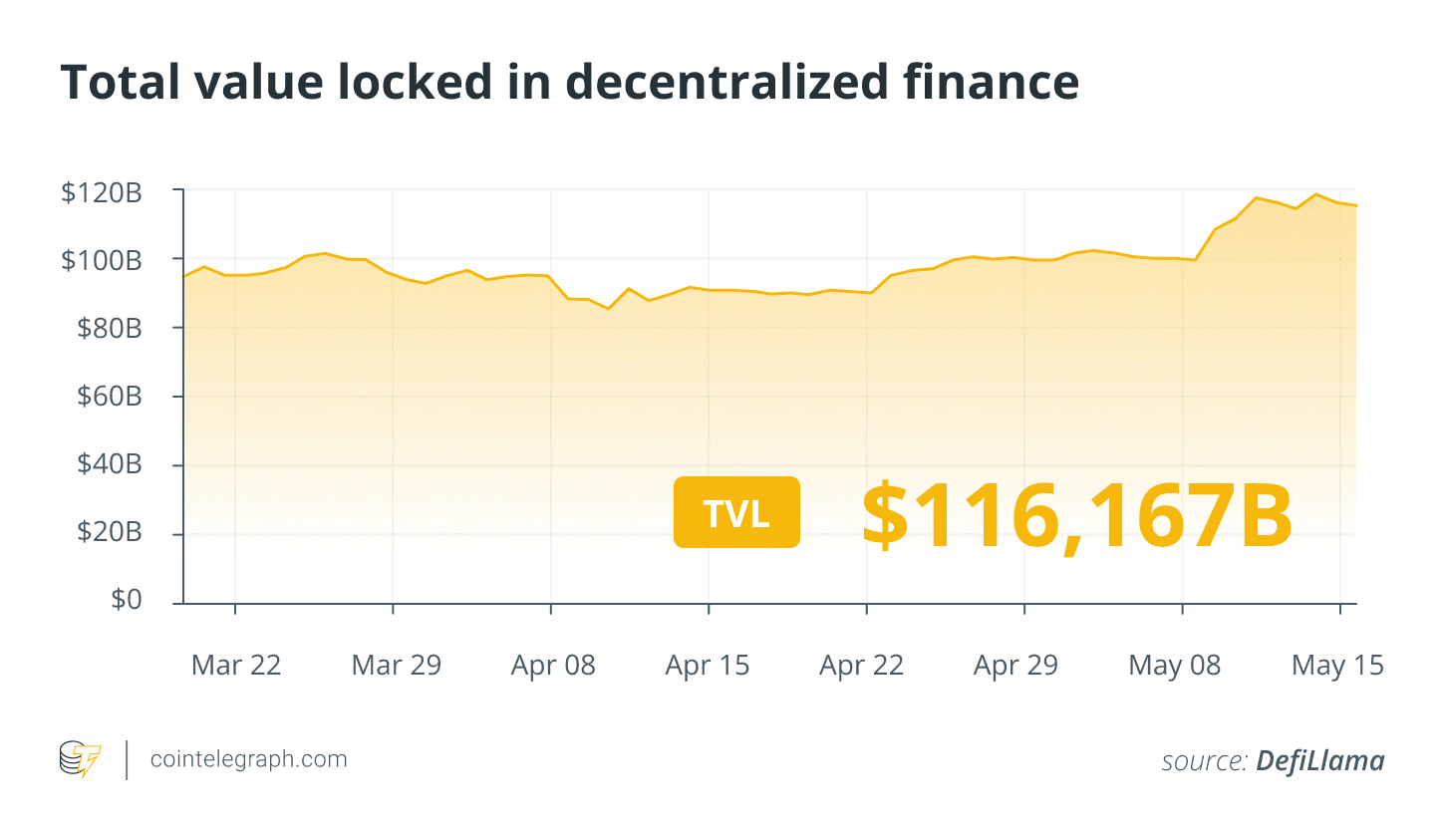

This week in cryptocurrency and decentralized finance (DeFi) saw a mix of challenges and positive momentum. A major security breach at Coinbase, the world’s third-largest crypto exchange, was offset by strong Bitcoin outflows and record-breaking total value locked (TVL) for DeFi protocols like Aave.

Coinbase Faces $400 Million Bill After Phishing Attack

Coinbase was targeted by cybercriminals who managed to steal user data through bribed overseas support agents. This led to a $20 million extortion attempt, which Coinbase refused. The company estimates remediation and reimbursement expenses could range from $180 million to $400 million, pledging to repay victims of the phishing attack.

According to Coinbase, less than 1% of their active monthly users were affected, and no passwords, private keys, funds, or Coinbase Prime accounts were compromised.

Key Takeaways from the Coinbase Hack:

- Breach Details: Cybercriminals compromised user data through bribed support agents.

- Financial Impact: Remediation and reimbursement costs estimated between $180 million and $400 million.

- User Impact: Less than 1% of monthly users affected; no critical account data compromised.

- Coinbase Response: Offered a $20 million reward for information leading to the arrest of those responsible.

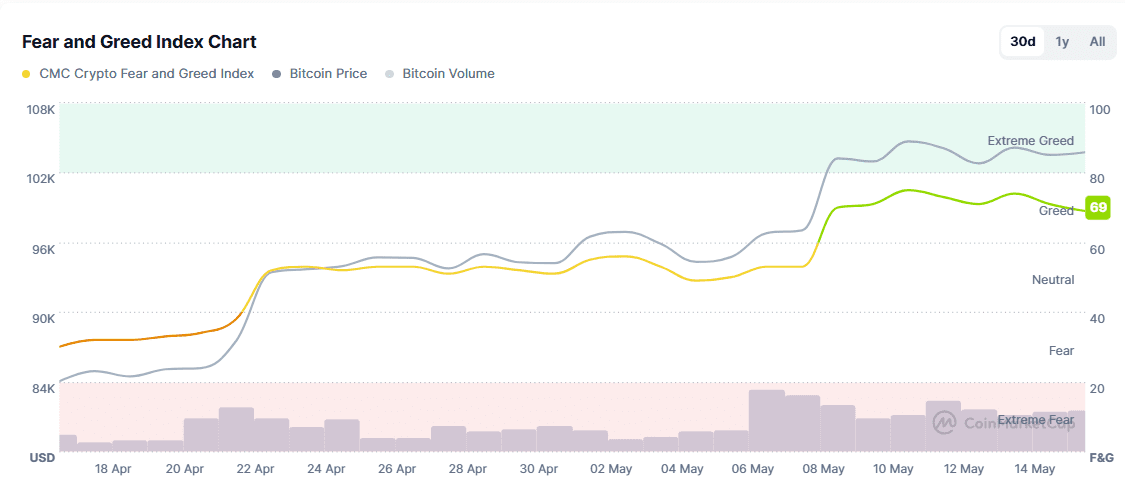

$1 Billion Bitcoin Exits Coinbase, Signaling Institutional Demand

Despite the security concerns, investor sentiment remained positive. Coinbase recorded its highest daily Bitcoin outflows of 2025 on May 9, with over $1 billion worth of Bitcoin withdrawn. This outflow suggests growing institutional demand for Bitcoin and analysts predict a potential supply shock driven Bitcoin rally.

André Dragosch, Head of European Research at Bitwise, noted the accelerating institutional appetite for Bitcoin in a recent post.

Drivers Behind Bitcoin Outflows:

- Growing Institutional Demand: Significant Bitcoin withdrawals from Coinbase indicate strong institutional interest.

- Market Optimism: Bitcoin traded above $103,600 during the outflow.

- US-China Tariff Reduction: A 90-day suspension of reciprocal tariffs between the US and China eased market concerns.

Aave Reaches $40 Billion in Total Value Locked (TVL)

Aave, a decentralized finance (DeFi) lending protocol, reached a new record with over $40 billion in total value locked (TVL) onchain. Aave v3, the latest version of the protocol, accounts for most of this TVL.

Aave allows users to borrow cryptocurrency by depositing other cryptocurrencies as collateral, while lenders earn yield from borrowers.

Key Highlights of Aave’s Growth:

- Record TVL: Aave reached $40.3 billion in TVL.

- Lending Protocol: Users can borrow cryptocurrency by depositing collateral.

- Yield for Lenders: Lenders earn yield from borrowers.

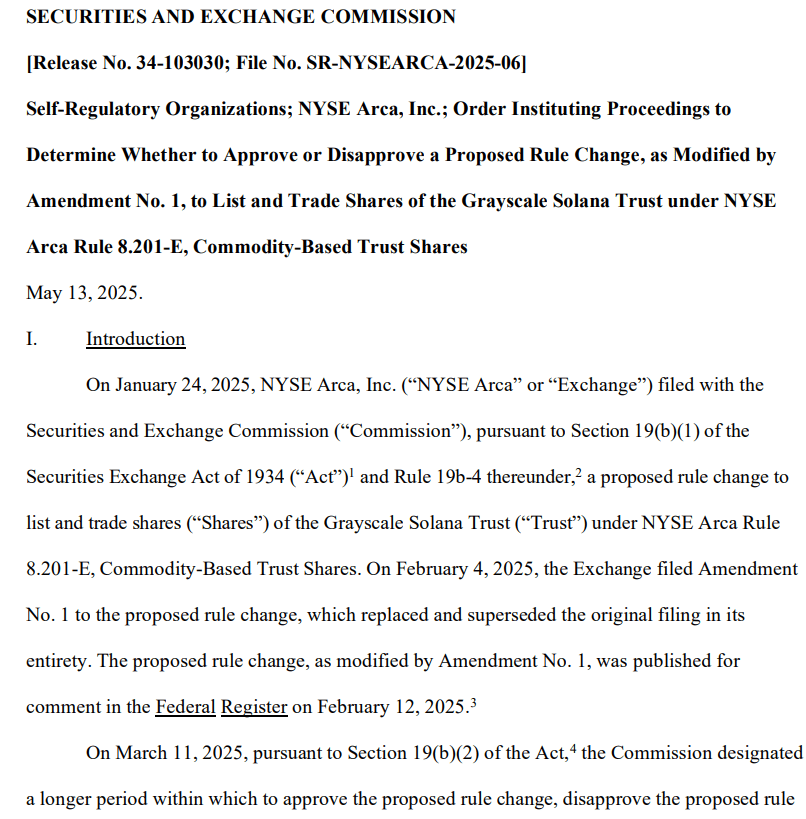

SEC Delays Solana ETF Decision

The US Securities and Exchange Commission (SEC) delayed its decision on Grayscale’s proposed spot Solana exchange-traded fund (ETF) to October 2025. The industry is now awaiting decisions on Polkadot and XRP-based ETFs in June.

This delay follows a similar postponement for Canary Capital’s Litecoin (LTC) ETF. Spot ETFs are seen as key drivers of liquidity and institutional adoption for digital assets.

Key Points on ETF Delays:

- Solana ETF Delay: SEC pushed back decision on Grayscale’s Solana ETF to October 2025.

- Impact of Spot ETFs: Spot ETFs are key drivers of liquidity and institutional adoption.

- Bitcoin ETF Success: US spot Bitcoin ETFs accounted for approximately 75% of new investment after launch.

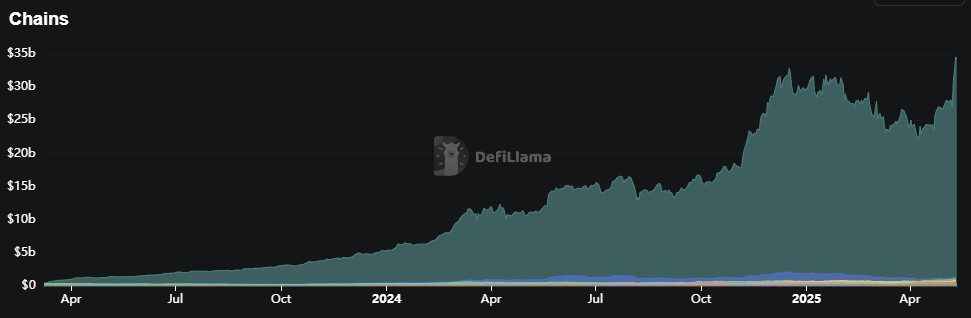

Starknet Achieves “Stage 1” Decentralization

Ethereum layer-2 scaling platform Starknet has reached “Stage 1” decentralization, according to a framework by Ethereum co-founder Vitalik Buterin. It is now the largest zero-knowledge rollup-based network by total value locked (TVL).

The network operates with limited oversight and has implemented a fully functional validity proof system governed by smart contracts.

Starknet Decentralization Milestones:

- Stage 1 Decentralization: Reached according to Vitalik Buterin’s framework.

- Largest ZK-Rollup: Starknet leads with a TVL of $629 million.

- Functional Validity Proof System: Governed by smart contracts.

DeFi Market Overview

Most of the top 100 cryptocurrencies by market capitalization ended the week positively. Solana-based memecoin Dogwifhat (WIF) rose over 43%, and decentralized exchange Raydium’s (RAY) token increased by nearly 19%.