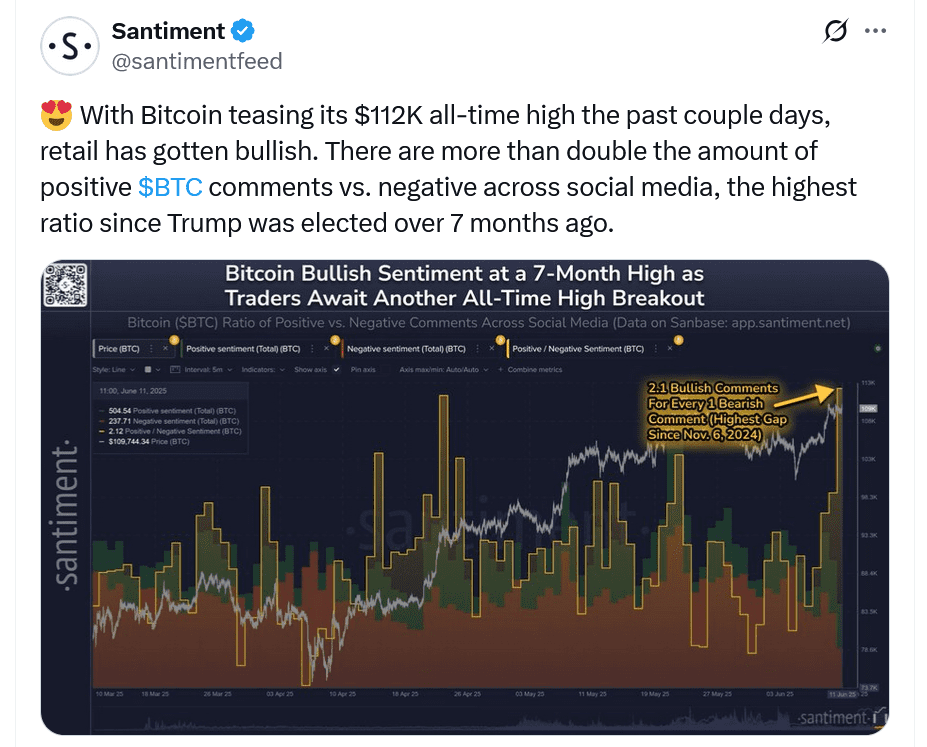

Bitcoin’s recent attempts to break above $110,000 have ignited bullish sentiment, reaching levels not seen since the aftermath of the US Presidential election. But can social media buzz translate to sustained price gains?

As of June 11, positive Bitcoin comments on social media outnumbered negative ones by a ratio of 2.12, according to crypto analytics platform Santiment.

This marks the most positive ratio since November 6th, when Bitcoin surpassed $70,000 for the first time following Donald Trump’s election victory.

While institutional and nation-state adoption have been driving Bitcoin’s price gains, a resurgence in retail interest could further amplify the upward trend.

Santiment’s data, gathered from platforms like X, Reddit, Telegram, 4Chan, Bitcoin Talk, and Farcaster, revealed 504.54 positive comments against 237.71 negative ones on June 11.

Bitcoin is currently trading around $108,635, approximately 3% below its all-time high of $112,000 reached on May 22nd.

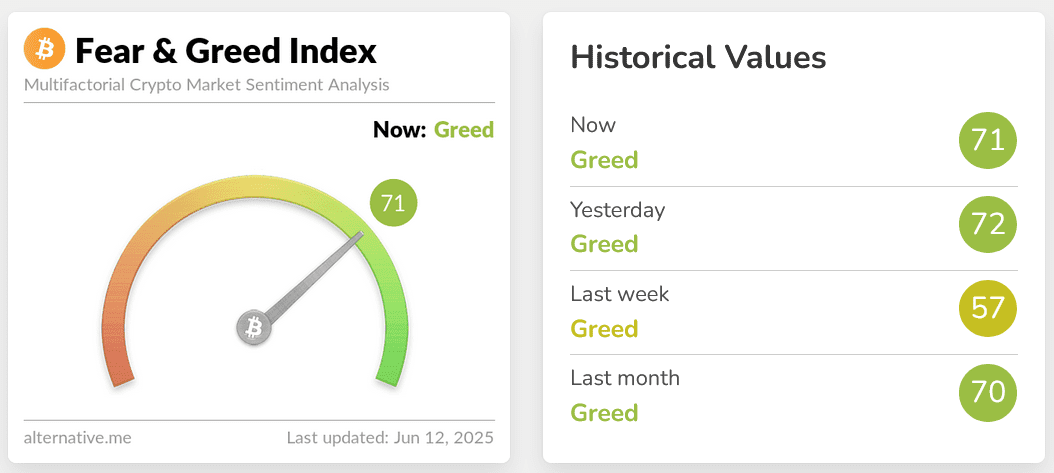

Bitcoin Market Sentiment in “Greed” Zone

The Crypto Fear & Greed Index currently stands at 71 out of 100, indicating a state of “greed” in the market.

However, this is still below the 94 out of 100 recorded on November 22nd, when Bitcoin surged from $67,700 to $99,250.

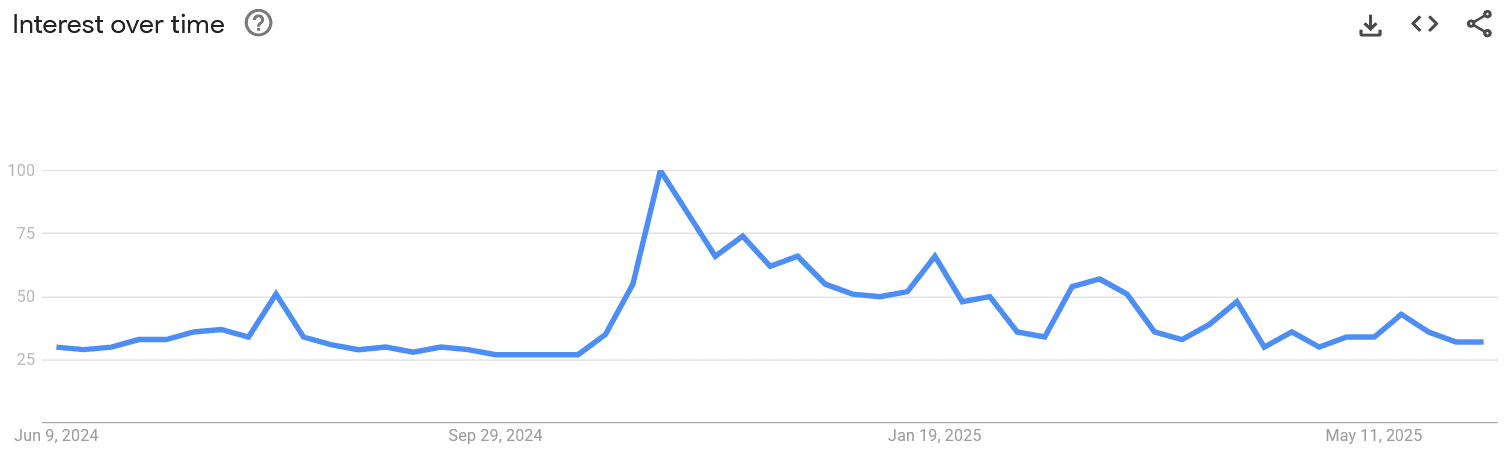

Google Trends Data Paints a Different Picture

Interestingly, Google search interest for “Bitcoin” hasn’t reflected this renewed optimism, suggesting retail participation remains subdued.

The search interest score is currently 32 out of 100, compared to its peak during the week of November 10-16, when Bitcoin jumped 18.6%.

Compared to the all-time high search interest in late 2017, the current score is even lower, at 19 out of 100.

Why It Matters

- **Bullish Sentiment Indicator:** Increased positive sentiment can fuel further price appreciation, attracting more investors.

- **Retail vs. Institutional:** Discrepancy between social media sentiment and Google Trends data suggests institutional investors are still the primary drivers.

- **Potential Overheating:** Extreme greed can lead to market corrections.

Market Impact

Here’s a quick look at key indicators:

| Indicator | Current Value | Previous High (Nov 2024) |

|---|---|---|

| Bitcoin Price | ~$108,635 | ~$112,000 |

| Santiment Sentiment Ratio | 2.12 | N/A |

| Fear & Greed Index | 71 | 94 |

| Google Trends (“Bitcoin”) | 32 | 100 |

Expert Take

While the social media buzz is encouraging, the lack of corresponding Google search interest suggests this rally is primarily driven by institutional money. This makes it more sustainable in the short term but also potentially more vulnerable to corrections if institutional sentiment shifts.

Actionable Insight

Traders should watch for confirmation from retail interest. A sustained increase in Google searches for “Bitcoin” alongside positive social media sentiment would signal broader market participation and a stronger foundation for further price gains. Be cautious of overleveraging in the current “greed” environment.

Conclusion

Bitcoin’s price action and market sentiment present a mixed picture. While social media is buzzing with optimism, the lack of widespread retail interest suggests a cautious approach is warranted. Keep an eye on key indicators and be prepared for potential volatility as the market seeks its next direction.