On Bitcoin Pizza Day, a symbolic date commemorating the first real-world transaction using Bitcoin, the cryptocurrency achieved a remarkable milestone: surpassing the market capitalization of e-commerce giant Amazon.

Bitcoin’s Market Cap Milestone

Bitcoin’s market cap reached $2.205 trillion, exceeding Amazon’s $2.135 trillion valuation. This event has captured the attention of both crypto enthusiasts and mainstream investors, signaling a potential shift in how Bitcoin is perceived and valued.

Key Takeaways:

- Bitcoin’s market cap surpassed Amazon’s on Bitcoin Pizza Day.

- Institutional interest and ETF inflows are driving Bitcoin’s growth.

- Analysts predict further price increases, with targets ranging from $150,000 to $200,000.

Factors Driving Bitcoin’s Surge

Several factors have contributed to Bitcoin’s recent surge in value:

- Institutional Adoption: Major financial institutions are increasingly embracing Bitcoin, with significant inflows into Bitcoin ETFs. BlackRock, for example, has become a major Bitcoin holder.

- ETF Inflows: Bitcoin ETFs have experienced substantial net inflows, indicating growing investor confidence and demand.

- Bitcoin Pizza Day Significance: The symbolic nature of Bitcoin Pizza Day highlights Bitcoin’s journey from a niche technology to a mainstream asset.

- Increased Investor Confidence: Surpassing Amazon’s market cap boosts confidence, attracting more investors and solidifying Bitcoin’s position in the financial landscape.

According to Alex Obchakevich, founder of Obchakevich Research, this surge is expected to “strengthen confidence in Bitcoin and lead to new injections into the crypto market.”

Expert Opinions and Predictions

Industry experts offer insights into Bitcoin’s trajectory:

- Hassan Khan (CEO, Ordeez): Believes Bitcoin is transitioning into a benchmark currency, no longer just a hedge.

- Alex Obchakevich (Founder, Obchakevich Research): Predicts a gradual move towards $200,000, with potential adjustments, and expects to see Bitcoin at $150,000 and $90,000 this year.

- Ulli Spankowski (Chief Digital Officer, Boerse Stuttgart Group): Highlights Bitcoin’s evolution into a serious asset class with a market capitalization ranking it among the world’s largest assets.

Khan notes that large ETF inflows and increasing open interest reflect growing institutional confidence. However, he also cautions about short-term profit-taking and macro rate uncertainty potentially tempering momentum.

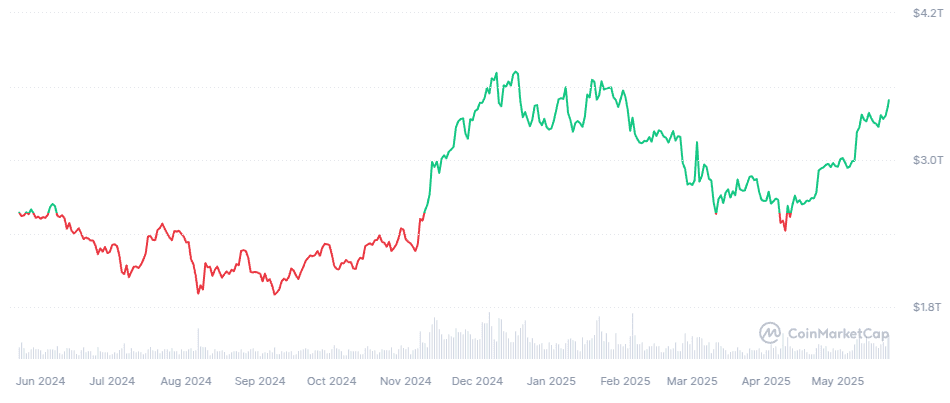

The Crypto Market Landscape

The overall cryptocurrency market cap is currently around $3.49 trillion, which is slightly lower than the all-time high of $3.71 trillion seen at the end of 2024. Bitcoin’s performance significantly influences the entire crypto market. It is important to consider the current state of the market when making assumptions about Bitcoin’s future value.

CoinMarketCap data indicates that Bitcoin ETFs experienced significant net inflows. The open interest in crypto derivatives is substantial, reflecting active trading and speculation in the market.

Bitcoin Pizza Day: A Historical Perspective

Bitcoin Pizza Day commemorates Laszlo Hanyecz’s purchase of two Papa John’s pizzas for 10,000 BTC in 2010. This event is a reminder of Bitcoin’s early days and its subsequent evolution into a major asset.

At today’s prices, those 10,000 BTC would be worth an astronomical amount, highlighting the incredible growth in Bitcoin’s value over the years.

Conclusion

Bitcoin’s achievement in surpassing Amazon’s market capitalization on Bitcoin Pizza Day is a significant milestone. Driven by institutional adoption, ETF inflows, and growing investor confidence, Bitcoin continues to solidify its position as a major player in the global financial landscape. While short-term volatility may exist, long-term predictions remain optimistic, with analysts anticipating further price increases and mainstream acceptance.