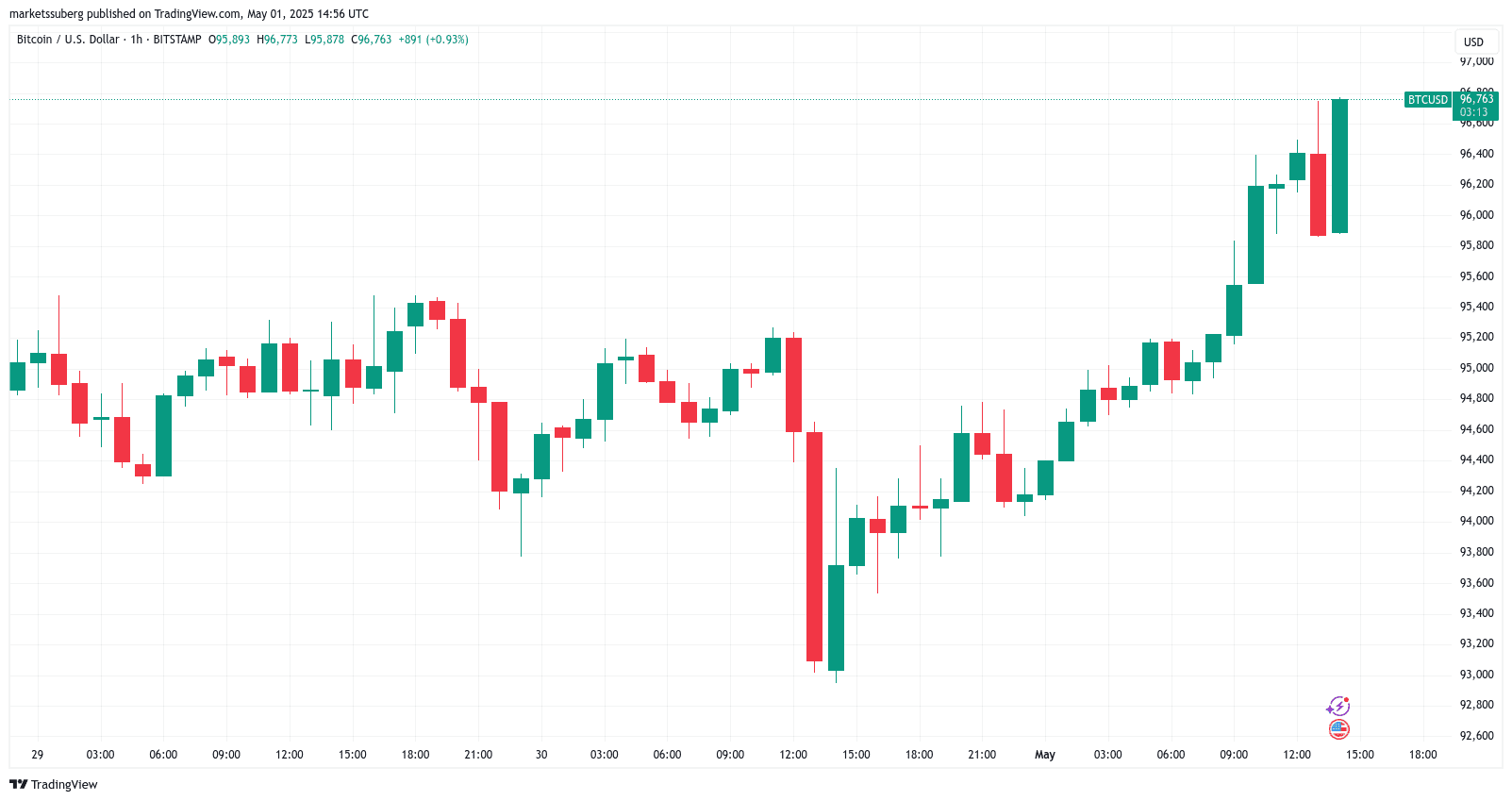

Bitcoin (BTC) experienced a 3% gain on May 1st, signaling a potential shift in market dynamics as shorts face increasing pressure. This upward movement brings Bitcoin closer to the $97,000 resistance level, prompting discussions about its ability to sustain this momentum.

Bitcoin’s Push Towards $97K: Key Factors

Bitcoin’s recent performance can be attributed to several key factors:

- Correlation with US Stocks: Bitcoin’s rise coincides with gains in US stocks, particularly Microsoft’s impressive 10% surge. This correlation suggests that broader market sentiment and investor confidence are influencing Bitcoin’s price action.

- Technical Analysis: Traders are closely monitoring key technical indicators, such as Fibonacci retracement levels, to gauge the potential for sustained bullish momentum. A break above the 0.618 Fibonacci retracement level could signal a bottoming out of the market and further upward movement.

- Exchange Order Book Liquidity: Monitoring exchange order book liquidity provides insights into potential short-term price movements. Increased ask liquidity around the $97,000 level suggests that sellers are positioning themselves to potentially cap Bitcoin’s advance.

Macroeconomic Influences and Gold’s Dip

The macroeconomic outlook remains a significant factor influencing Bitcoin’s trajectory. While recent US GDP data has fueled recession fears, it has also increased pressure on the Federal Reserve to cut interest rates. This potential shift in monetary policy could have both positive and negative implications for Bitcoin and other assets.

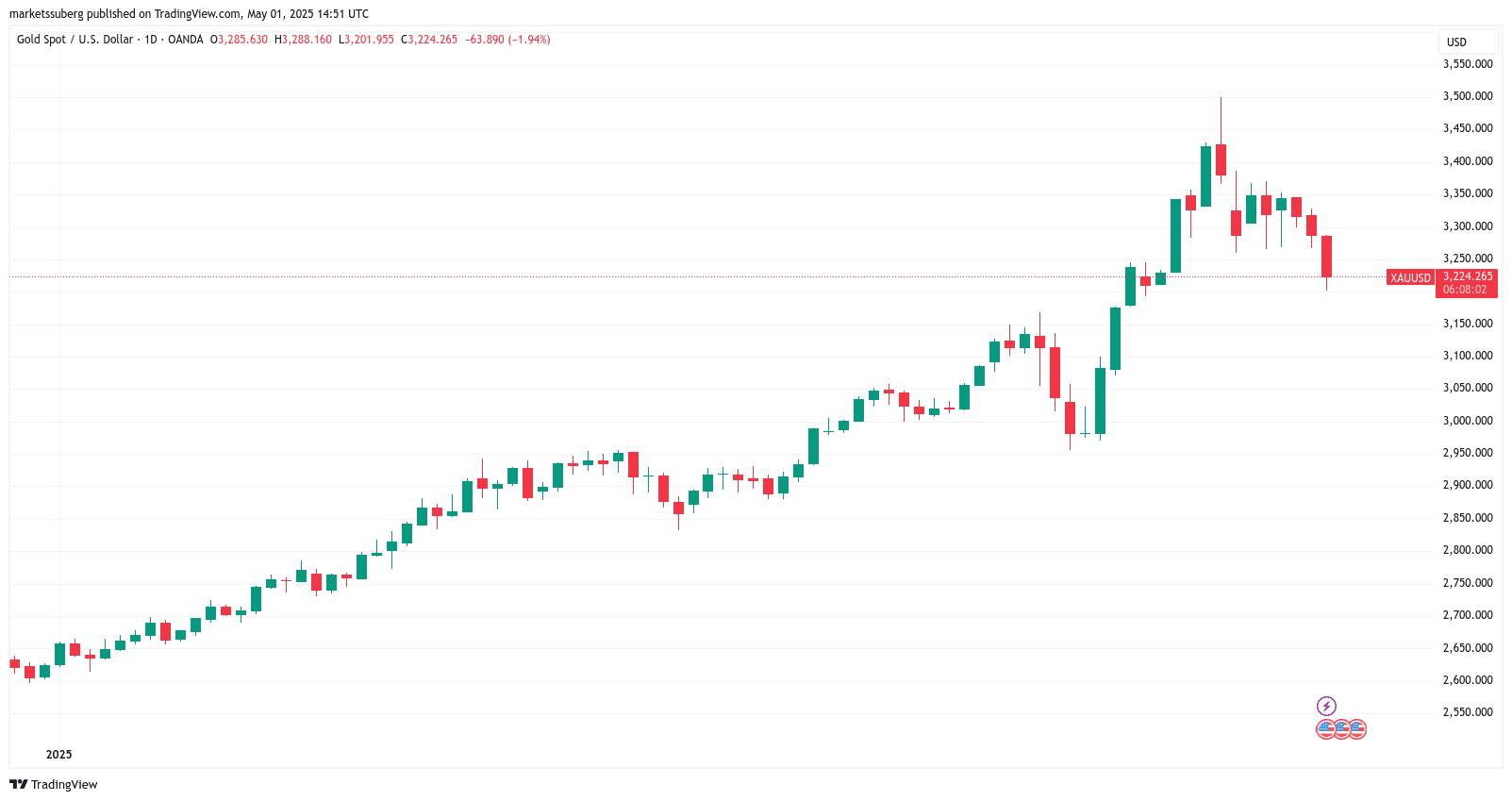

Notably, gold (XAU/USD) has experienced a decline of over 8% from its recent all-time highs. This dip, coupled with Bitcoin’s relative strength, has led some analysts to suggest that Bitcoin is emerging as a more attractive asset in the current market environment.

Analyst Perspectives

Several market analysts have weighed in on Bitcoin’s recent performance and its potential future trajectory:

- Daan Crypto Trades: Suggests that stocks may be on the cusp of a return to sustained bullish trajectory, potentially benefiting Bitcoin and the broader crypto market.

- Skew: Monitors exchange order book liquidity to anticipate short-term price movements.

- Michaël van de Poppe: Believes that bad macroeconomic data could pressure the Federal Reserve to ease monetary policy, which could ultimately be beneficial for risk-on assets like Bitcoin, but potentially negative for gold in the short term.

Bitcoin vs. Gold: A Shifting Landscape

The debate over Bitcoin’s role as a store of value and its potential to replace gold has intensified in recent years. Bitcoin’s proponents argue that its decentralized nature, limited supply, and increasing adoption make it a superior alternative to gold. They point to Bitcoin’s historical performance, particularly during periods of economic uncertainty, as evidence of its resilience and potential for long-term growth.

However, critics argue that Bitcoin’s volatility and regulatory uncertainty pose significant risks. They maintain that gold remains a more established and reliable store of value, particularly in times of crisis.

Looking Ahead

Bitcoin’s ability to break through the $97,000 resistance level will be a key test of its current momentum. Several factors could influence its future performance, including:

- Macroeconomic data and Federal Reserve policy: Changes in macroeconomic conditions and the Federal Reserve’s response could significantly impact Bitcoin’s price.

- Regulatory developments: Clarity on regulatory frameworks could boost investor confidence and drive further adoption.

- Institutional adoption: Increased institutional investment in Bitcoin could provide further validation and support its long-term growth.

- Technological advancements: Continued innovation in the Bitcoin ecosystem could enhance its functionality and attract new users.

As Bitcoin continues to evolve and mature, its role in the global financial landscape will likely become increasingly significant. Whether it ultimately replaces gold as the preeminent store of value remains to be seen, but its recent performance suggests that it is a force to be reckoned with.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.