The debate between Bitcoin and gold as a store of value is heating up, especially with Bitcoin recently trading above $100,000. Fidelity’s Director of Global Macro, Jurrien Timmer, suggests that Bitcoin (BTC) is increasingly positioned to rival gold’s dominance in this arena. This article delves into the factors driving this potential shift, including a comparison of their Sharpe ratios, ETF flows, and future price predictions.

Sharpe Ratio Convergence: Bitcoin Catching Up to Gold

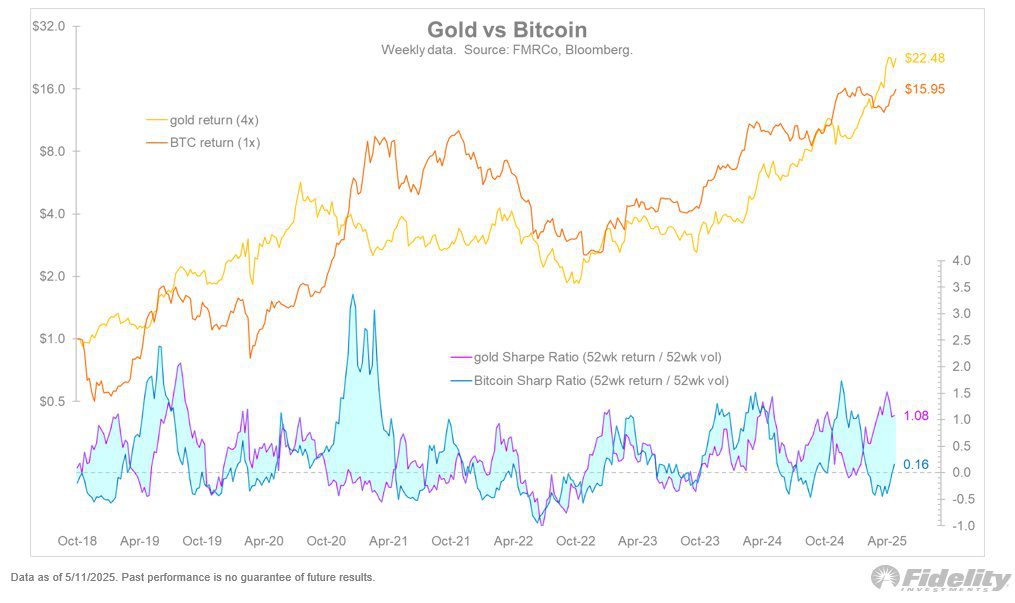

Timmer’s analysis highlights a key indicator: the convergence of Sharpe ratios between Bitcoin and gold. The Sharpe ratio measures risk-adjusted returns, comparing an investment’s performance to a risk-free benchmark relative to its volatility. A higher Sharpe ratio indicates better returns for the level of risk taken.

Data from 2018 to May 2025 shows Bitcoin’s returns gradually approaching gold’s. This suggests that Bitcoin is becoming a more mature asset with a more predictable risk profile, making it a more attractive option for investors seeking a store of value.

Timmer recommends a 4:1 gold-to-Bitcoin ratio for a store-of-value hedge, emphasizing the negative correlation between the two assets. This means that when gold performs poorly, Bitcoin tends to perform well, and vice versa. This diversification can help mitigate risk in an investment portfolio.

Q1 2025: Gold’s Temporary Lead

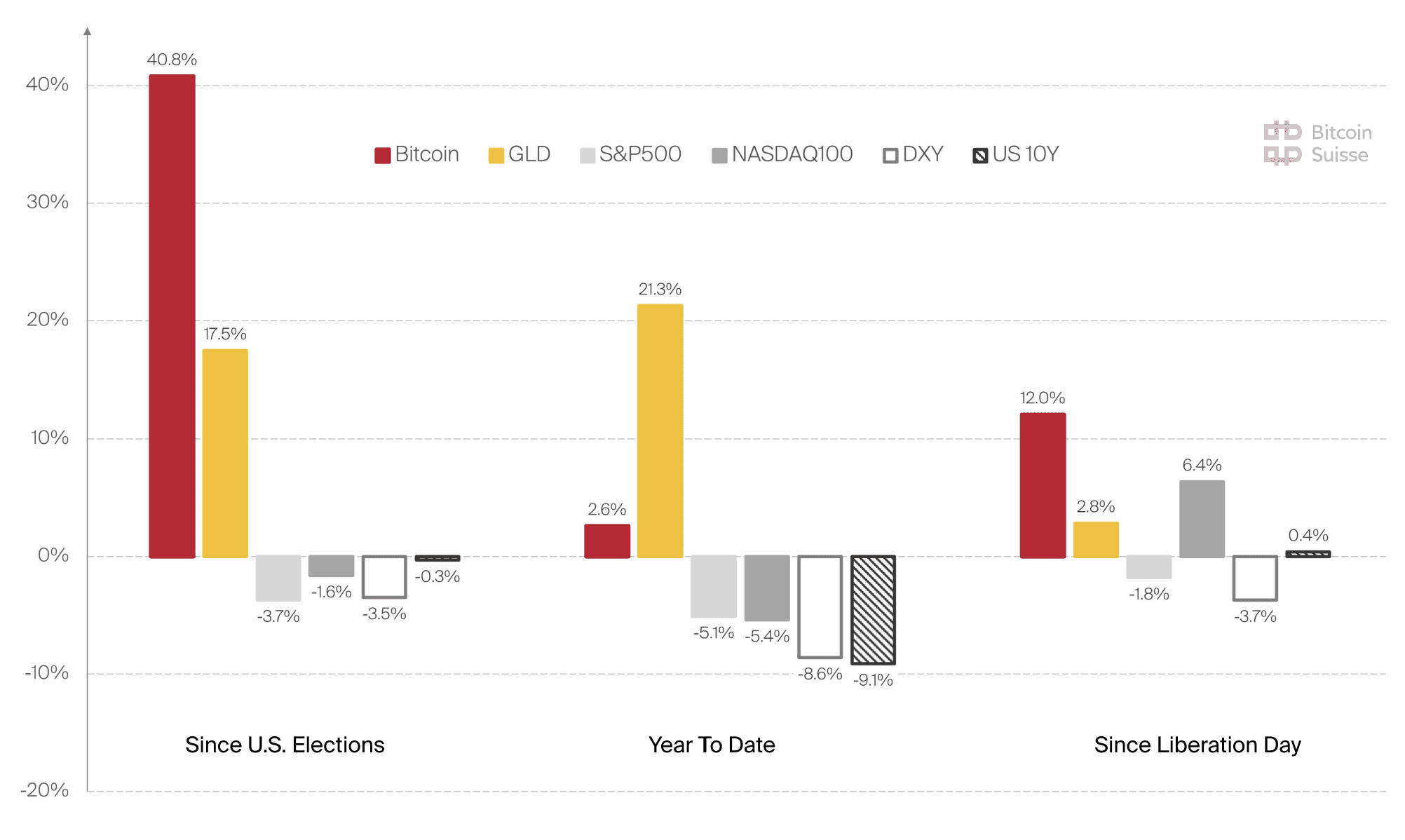

Despite Bitcoin’s long-term potential, Q1 2025 saw gold outperform BTC. Economic uncertainty surrounding Federal Reserve policy, trade policy, and the US economy drove capital towards gold, traditionally seen as a safe haven asset. Gold experienced a 30.33% price increase, while Bitcoin saw a more modest 3.84% gain.

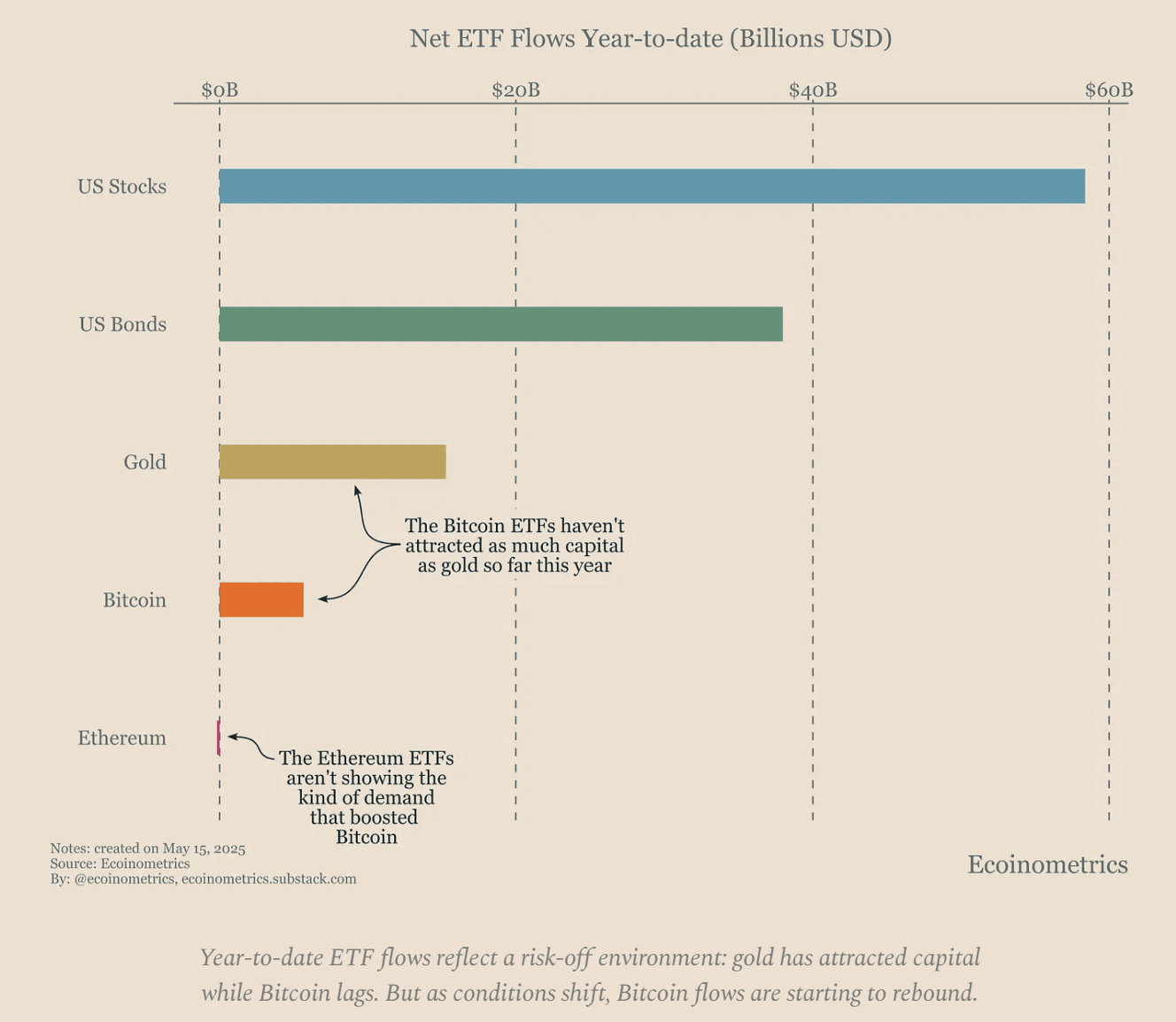

Bitcoin spot exchange-traded funds (ETFs) experienced a significant drop in inflows compared to 2024, while gold ETFs attracted more capital. This indicates that investors were temporarily prioritizing stability over potential growth.

Bitcoin’s Rebound and Future Potential

Recent developments, including clearer US trade policy, a softer Federal Reserve stance, and easing financial conditions, have spurred renewed inflows into Bitcoin ETFs. This suggests that investors are regaining confidence in Bitcoin’s growth potential.

Price Predictions for 2025: Sky High?

Several analysts are optimistic about Bitcoin’s future price. Bitcoin Suisse suggests that BTC’s high Sharpe ratio increases the probability of reaching new all-time highs above $110,000 in May. Cointelegraph reported that Bitcoin has a “decent chance” of reaching $250,000 or more in 2025, driven by its interplay with gold.

A gold-based forecast suggests that if Bitcoin’s network value, measured in gold, follows a power curve, it could potentially hit $444,000 in 2025. However, a more conservative estimate points to a “reasonable” target of $220,000 for the year.

Key Takeaways:

- Sharpe Ratio: Bitcoin’s Sharpe ratio is converging with gold’s, indicating similar risk-adjusted returns and strengthening its case as a store of value.

- Q1 2025 Performance: Gold outperformed Bitcoin in Q1 2025 due to economic uncertainty.

- ETF Flows: Bitcoin ETF inflows are recovering, suggesting renewed investor confidence.

- Price Predictions: Analysts predict BTC could reach $110,000–$444,000 in 2025.

Conclusion

The debate between Bitcoin and gold as a store of value is complex and evolving. While gold has historically been the dominant player, Bitcoin’s increasing maturity, converging Sharpe ratio, and potential for significant price appreciation are making it a compelling alternative. Whether Bitcoin can fully replace gold remains to be seen, but its potential to disrupt the store-of-value landscape is undeniable.