Key Takeaways:

- Bitcoin faces resistance around $105,000 due to US macroeconomic conditions.

- Strong institutional inflows and $100,000 support level indicate growing confidence in Bitcoin.

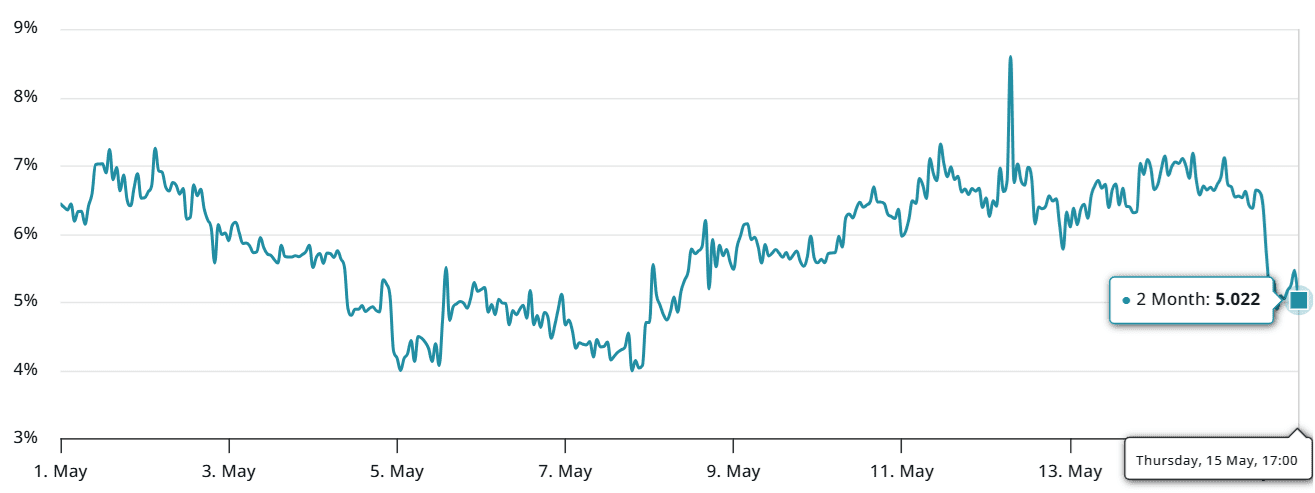

Bitcoin (BTC) has encountered challenges in surpassing the $105,000 mark since May 10th, leading to questions about the strength of its bullish momentum. Although it momentarily regained the $104,000 level, demand for leveraged long positions has diminished, as reflected by the decrease in the Bitcoin futures premium.

On May 14, the annualized Bitcoin futures premium reached a peak of 7% before declining to 5%, nearing the neutral-to-bearish threshold. This level mirrors that of four weeks prior when BTC was trading around $84,500.

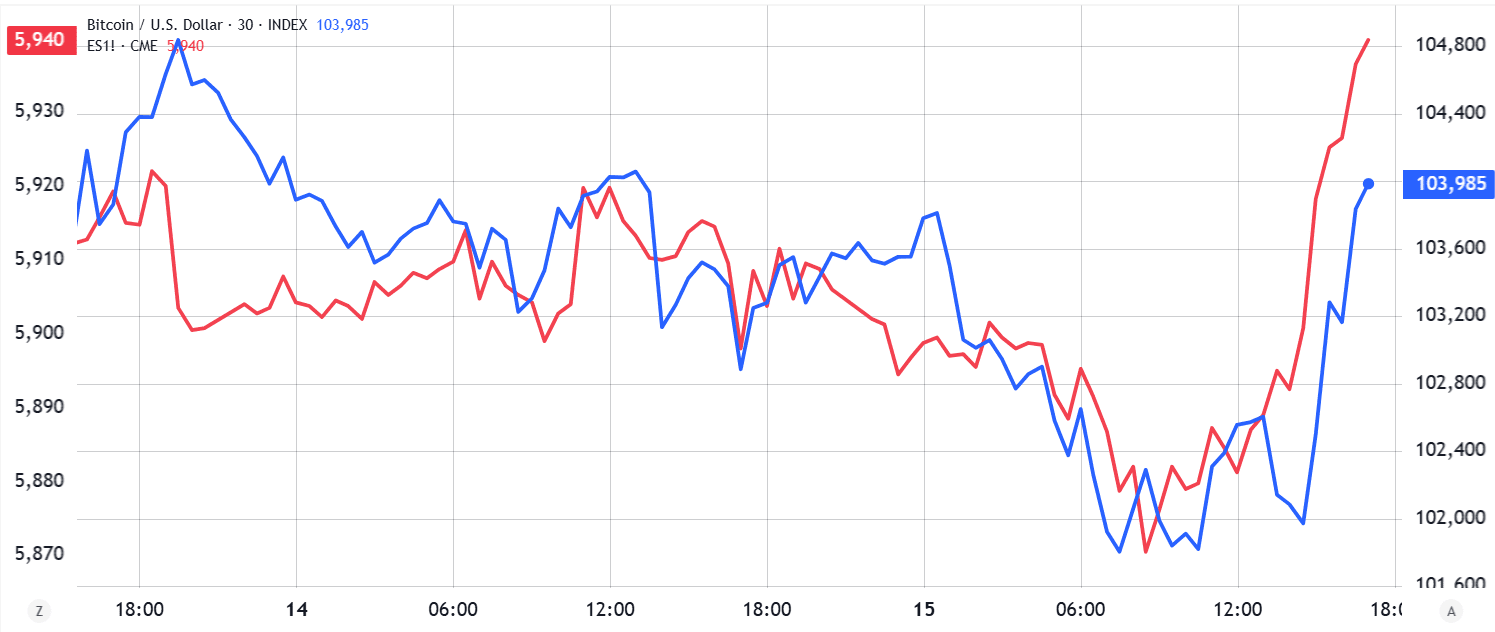

This reduction in demand for leveraged bullish positions appears connected to broader macroeconomic uncertainties, as Bitcoin’s price has been closely tracking movements in the stock market. Factors affecting Bitcoin’s price include:

- Macroeconomic Headwinds: Concerns about inflation, interest rates, and potential recession impact investor sentiment.

- Stock Market Correlation: Bitcoin’s price often mirrors the performance of the S&P 500, making it susceptible to stock market volatility.

- Federal Reserve Policy: Decisions regarding interest rates and liquidity injections influence investor risk appetite.

The S&P 500 futures experienced a reversal on May 15, coinciding with Bitcoin’s rebound from $101,800 to $104,000. Investors seem increasingly confident that the US Treasury will be compelled to inject liquidity following Federal Reserve Chair Jerome Powell’s warning about potential “supply shocks” that could sustain higher interest rates for an extended period.

Signs of economic weakening have also emerged. The US Bureau of Labor Statistics reported a 0.5% decline in April’s Producer Price Index from the previous month, contrary to economists’ expectations of a 0.2% rise.

According to Reuters, limited risk appetite among investors is also influenced by ongoing global trade tensions, particularly the US–China tariff agreement, which remains a temporary solution.

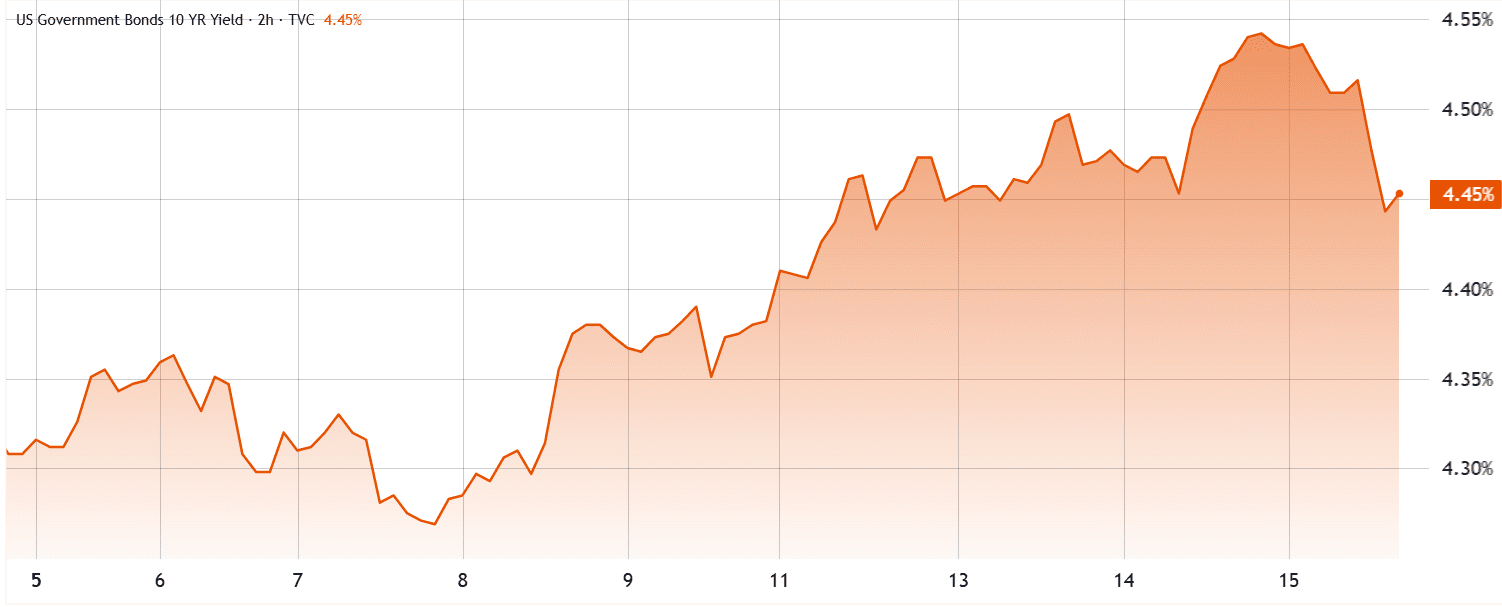

Demand for fixed income has risen, with the yield on the 10-year US Treasury decreasing to 4.45% after reaching 4.55% on May 14, reversing the previous week’s trend. Historically, Bitcoin tends to perform better when government bond yields increase, indicating reduced confidence in the Treasury’s ability to manage its debt.

Bitcoin’s Rally to $105,000: Macroeconomic Factors

The possibility of Bitcoin breaking above $105,000 is contingent on macroeconomic developments, including trends in the US Federal Reserve’s balance sheet and recession risks. It’s worth noting that Bitcoin’s high correlation with the S&P 500 has historically not lasted for extended periods of more than two months.

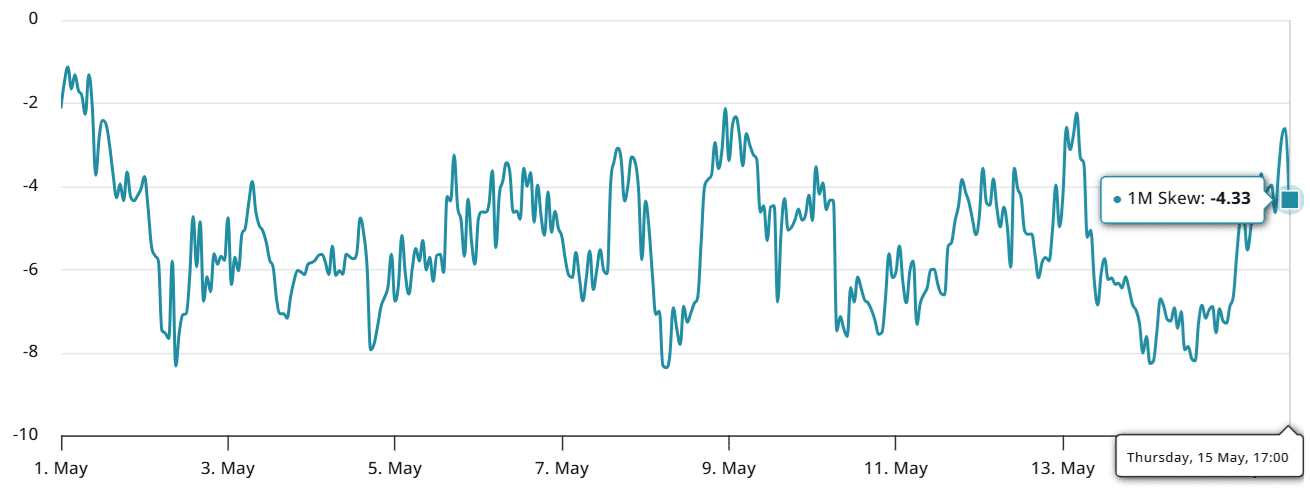

To understand if traders are avoiding leverage or actively betting against price increases it is important to analyze Bitcoin options demand. Periods of bearish sentiment often push the BTC delta skew indicator above the neutral 6% threshold.

Bitcoin put (sell) options have been trading at a discount compared to call (buy) options, indicating strong confidence in the $100,000 support level. However, the optimism observed on May 14 has diminished, with the indicator now at a neutral -4%.

Institutional Investment and Bitcoin’s Evolving Role

Net inflows of $320 million into US Bitcoin exchange-traded funds (ETFs) on May 14 underscore ongoing institutional demand. This implies that investors are progressively viewing Bitcoin as a non-correlated instrument rather than solely as a risk-on asset. This shift may mitigate the likelihood of sharp price corrections, even in the absence of strong leveraged bullish positions.

Factors Supporting Bitcoin’s Price:

- Institutional Adoption: Growing interest from institutional investors provides consistent buying pressure.

- ETF Inflows: Continued inflows into Bitcoin ETFs demonstrate investor confidence and demand.

- $100,000 Support: Strong support at the $100,000 level suggests a floor for price declines.

Bitcoin’s evolving role in portfolios: As Bitcoin matures, it is increasingly being viewed not just as a speculative asset, but as a store of value and a potential hedge against inflation. Its limited supply and decentralized nature are attractive qualities to investors seeking diversification and protection against traditional financial risks. The increased acceptance by institutional investors further validates this evolving perception, driving demand and providing stability to the market.