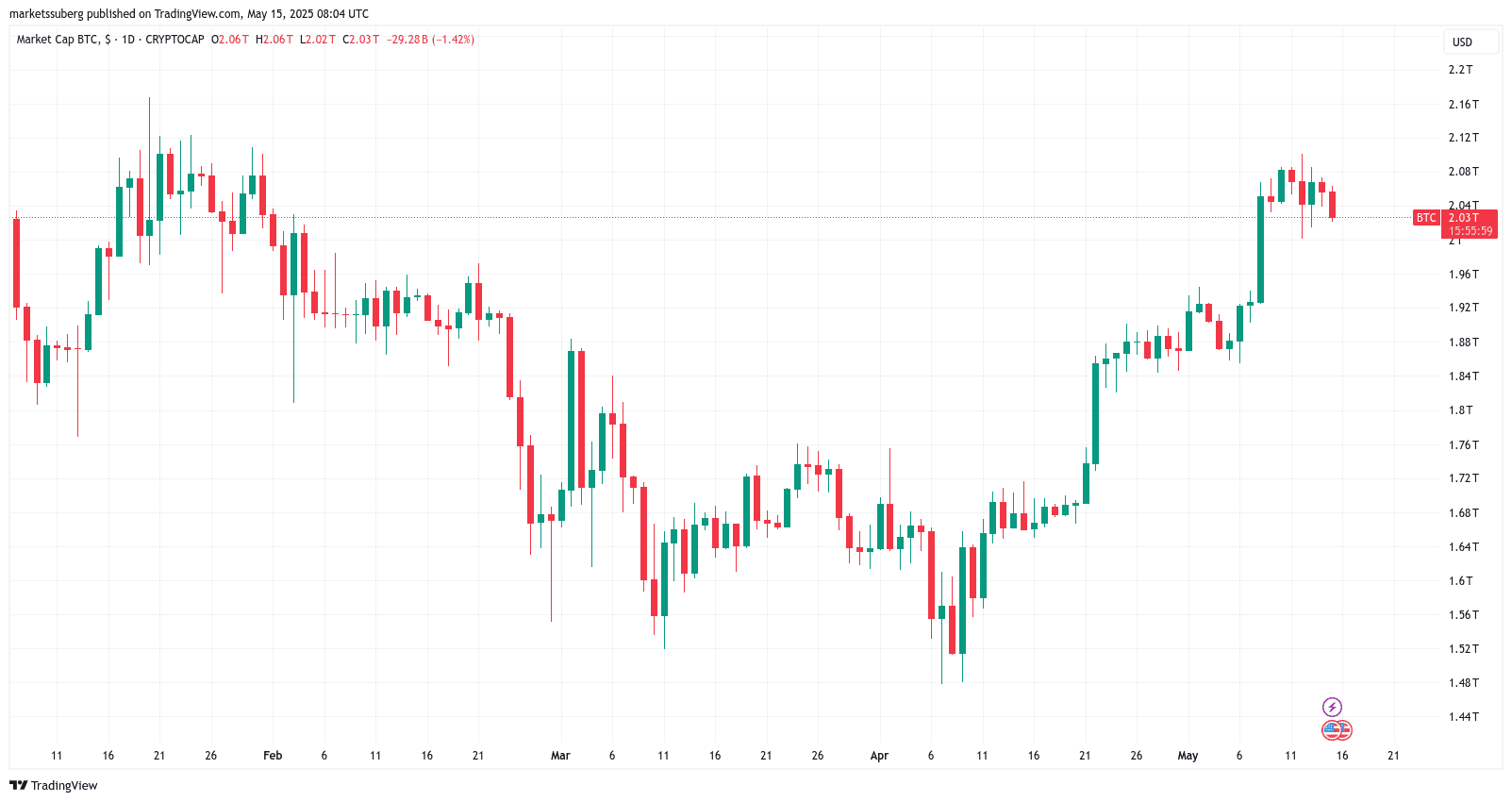

Bitcoin (BTC) faces a pivotal moment as it attempts to solidify its position above $100,000 and reclaim a $2 trillion market capitalization. Analyst filbfilb highlights the significance of this battle, noting the underlying bullish momentum despite potential volatility.

Key Takeaways:

- $100,000 and $2 Trillion Market Cap: Bitcoin is currently contending with resistance at the $2 trillion market cap level while attempting to maintain its price above $100,000.

- Analyst Perspective: filbfilb suggests that although dips below $100,000 are possible, the overall outlook remains strongly bullish.

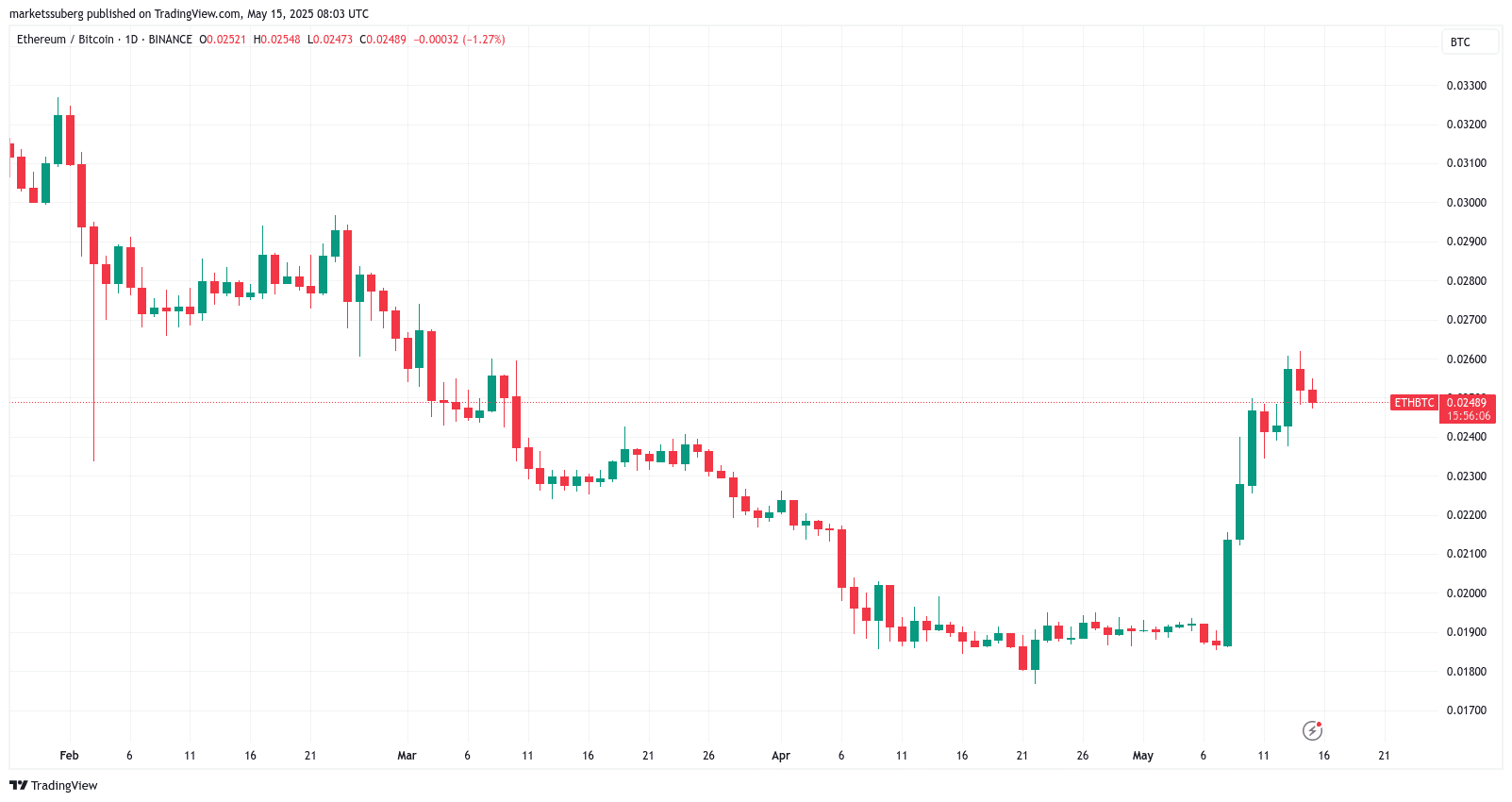

- Altcoin Watch: The ETH/BTC ratio needs to reclaim 0.03 to signal a potential altcoin resurgence.

Bitcoin’s Bullish Stance

Bitcoin’s recent gains have positioned it for further expansion, with market analysts observing a distinctly bullish trend. After a period of rapid growth, Bitcoin is now consolidating near the $100,000 mark.

filbfilb points out that reclaiming the $2 trillion market cap is just as crucial as surpassing $100,000. This level, which Bitcoin lost in early February, is now a key area of contention.

Altcoin Season on the Horizon?

As Bitcoin’s dominance in the crypto market wanes, attention is shifting toward altcoins. filbfilb suggests that the ETH/BTC ratio reaching 0.03 could trigger a renewed altcoin season.

The Psychological Significance of $100,000

filbfilb emphasizes the psychological importance of round-number price points like $100,000, noting how they often act as significant barriers for assets. Historically, assets tend to consolidate around such levels before experiencing further expansion.

“Burn the round number after ages of resistance to liquidate shorts, come back to the 80s, then find expansion later. I believe this is no different.”

Previous Market Behavior

In April, Bitcoin found support around $75,000. On-chain indicators, such as the Hash Ribbons, provided buy signals, suggesting a potential reversal.

Bullish Outlook Remains

Despite short-term pullbacks, analysts maintain a bullish outlook on Bitcoin, anticipating a retest of all-time highs near $110,000. Some targets include $120,000 in the near term and potentially $150,000 or higher in June.

filbfilb summarizes the sentiment by stating, “As for Bitcoin… Honestly.. Ridiculous, the more you zoom out, the more insane it looks. Short-term pullbacks below 100k are easily possible, however, I haven’t seen such a bullish-looking thing in a long time.”

Factors Influencing Bitcoin’s Price

Several factors could influence Bitcoin’s price trajectory in the coming weeks:

- Market Sentiment: Overall investor sentiment plays a significant role in driving Bitcoin’s price. Positive news and increasing adoption can lead to upward momentum.

- Macroeconomic Conditions: Factors such as inflation, interest rates, and global economic stability can impact Bitcoin’s attractiveness as an investment.

- Regulatory Developments: Changes in regulations surrounding cryptocurrencies can significantly affect market sentiment and adoption.

- Technological Advancements: Developments in Bitcoin’s underlying technology, such as the Lightning Network, can improve its scalability and usability, potentially driving adoption.

In conclusion:

Bitcoin’s current battle for $100,000 and a $2 trillion market cap represents a crucial juncture. While short-term volatility is possible, the overall outlook remains bullish, supported by positive market sentiment and ongoing adoption. Keeping a close eye on key levels, altcoin performance, and macroeconomic factors will be essential for navigating the market in the coming weeks. Remember, all investment decisions should be based on thorough research and an understanding of the inherent risks involved.