Bitcoin is showing signs of a potential bullish surge, driven by on-chain data and macro indicators. This analysis explores the factors suggesting a positive trajectory for Bitcoin’s price.

Key Indicators and Their Implications

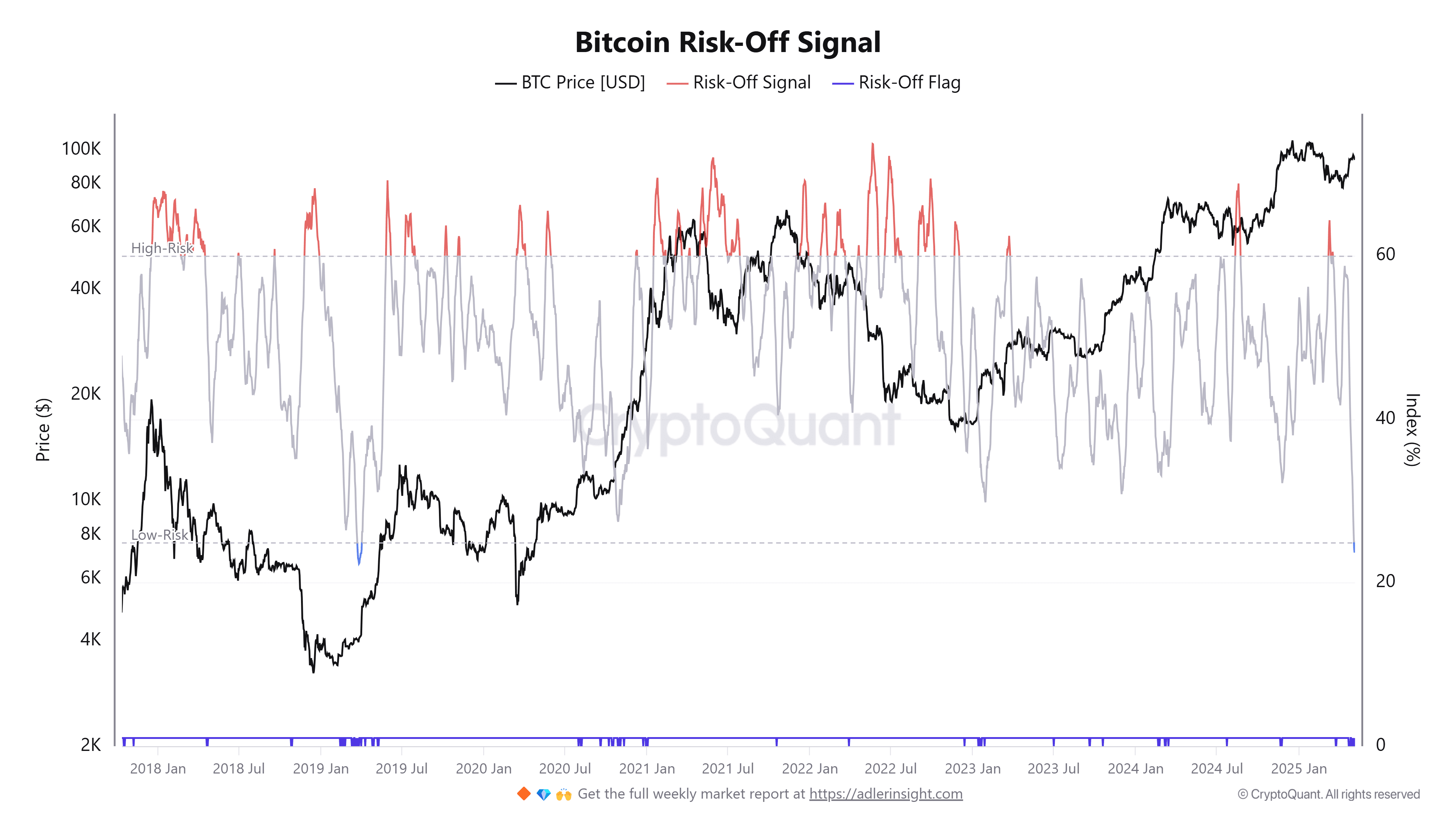

- Bitcoin Risk-Off Signal: This indicator, assessing correction risk based on on-chain and exchange data, recently dropped to 23.7, the lowest since March 2019. Historically, a low signal suggests reduced correction risk and a higher likelihood of a bullish trend. When the signal rises above 60, it typically signifies a higher risk of a bearish downturn.

- Macro Chain Index (MCI): The MCI, a composite of on-chain and macroeconomic metrics, has flashed a ‘buy’ signal for the first time since 2022. Historically, MCI crossovers have been followed by substantial rallies.

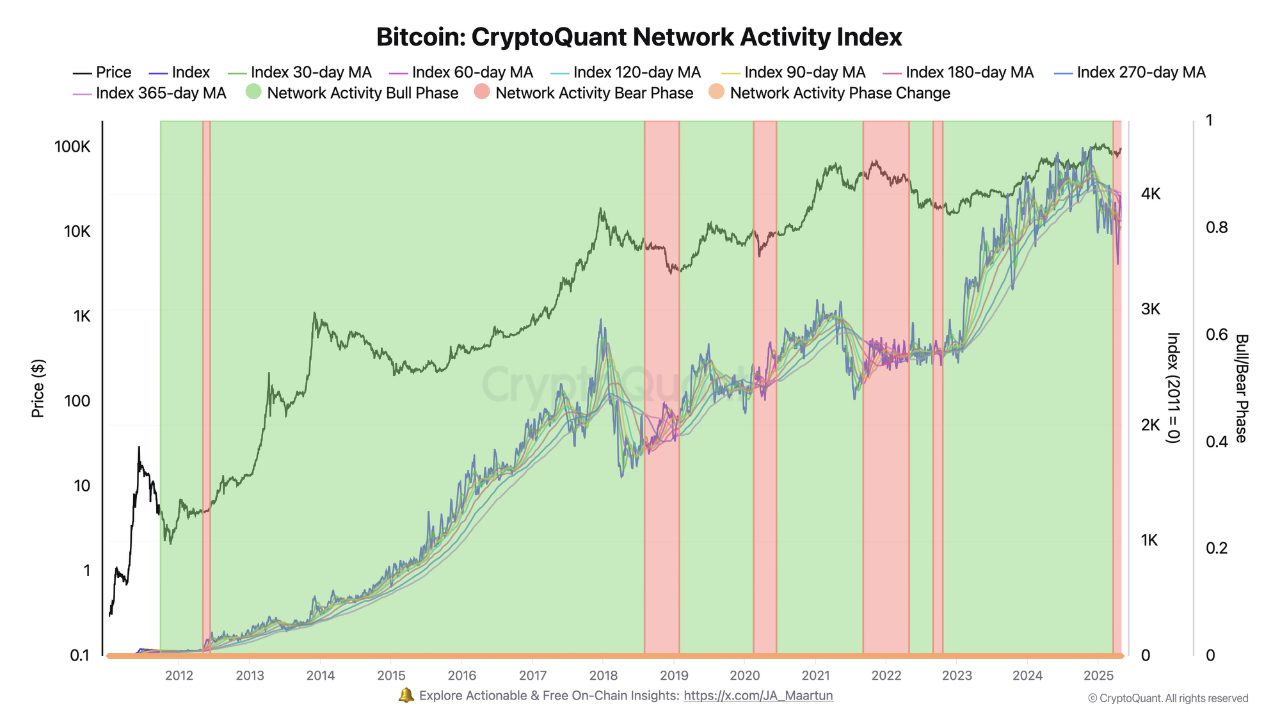

- Network Activity: While network activity has declined, indicating reduced transaction volume, analysts suggest this could be a strategic entry point for long-term investors, rather than a sign of an impending bear market.

Historical Context: The 2019 Precedent

In 2019, a similar Risk-Off signal preceded a significant rally, resulting in Bitcoin soaring to over $68,000 by 2021. This historical precedent fuels speculation about a potential repeat.

Factors Contributing to a Higher Bitcoin Price

Several factors differentiate the current market from 2019, potentially setting a higher price floor for Bitcoin:

- Spot Bitcoin ETFs: The introduction of spot Bitcoin ETFs in the US has opened the doors to institutional capital, boosting demand and stabilizing prices. ETFs and public companies now hold a significant portion (9%) of the Bitcoin supply.

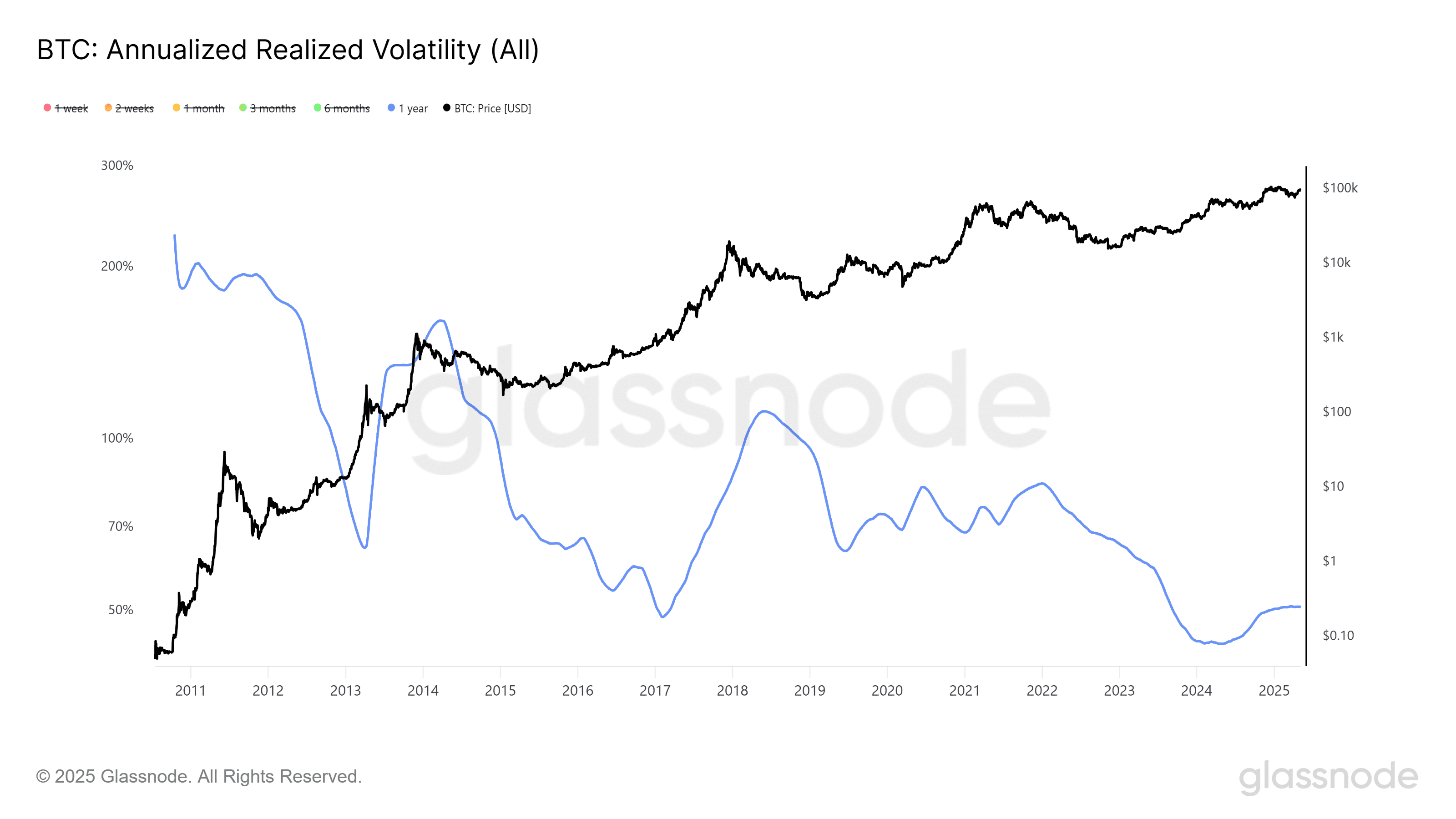

- Decreased Volatility: Bitcoin’s volatility has decreased significantly, now three to four times lower than that of equity indexes. This increased stability makes it more attractive to institutional investors.

- Growing Adoption: Mainstream adoption, regulatory clarity, and Bitcoin’s increasing role as a hedge against inflation contribute to its sustained value.

Expert Perspectives

Crypto analysts are closely monitoring these indicators. The consensus is cautiously optimistic, acknowledging the potential for a significant rally, possibly exceeding $100,000, based on the convergence of positive on-chain and macro factors.

Potential Challenges and Considerations

While the outlook is bullish, it’s important to acknowledge potential challenges:

- Network Activity Dip: The decline in network activity, while potentially a buying opportunity, could also signal underlying weakness in demand.

- Market Volatility: The cryptocurrency market is inherently volatile, and unexpected events can significantly impact prices.

Conclusion

Bitcoin’s on-chain indicators suggest a potential for a substantial rally. While risks remain, the convergence of favorable factors, including increased institutional adoption and decreased volatility, paints a promising picture for the future of Bitcoin. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.