Key Takeaways:

- Bitcoin achieved a triple breakout, surpassing multiple resistance levels in a single week.

- The $93,500 level, representing the 2025 yearly open, is a critical support level.

- Analysts are closely watching Bitcoin’s ability to maintain this support amid concerns of potential downside volatility.

Bitcoin (BTC) has experienced significant volatility, marked by a recent surge through multiple resistance levels followed by a period of consolidation. This article delves into the critical factors influencing Bitcoin’s price action, focusing on the significance of the $93,500 support level and the potential for further price movements.

Bitcoin’s Triple Breakout: A Bullish Signal?

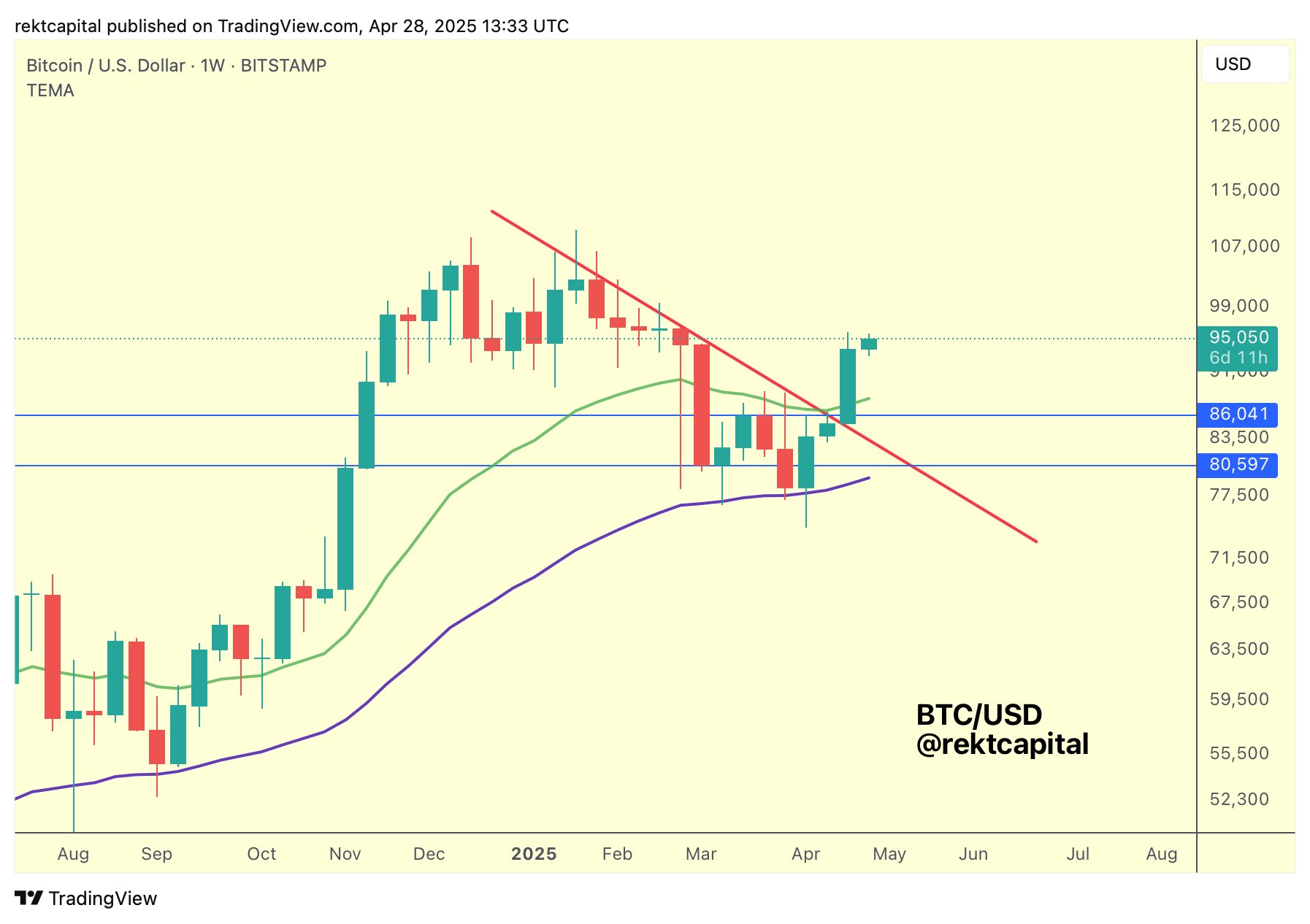

In a notable display of strength, Bitcoin broke through three key resistance levels within a single week. This “triple breakout,” as highlighted by analysts, included:

- Horizontal weekly resistance

- A multi-month downtrend

- The 21-week exponential moving average (EMA)

This breakout initially signaled strong bullish momentum, suggesting a potential continuation of the upward trend. The ability to overcome these resistance levels demonstrated significant buying pressure and investor confidence.

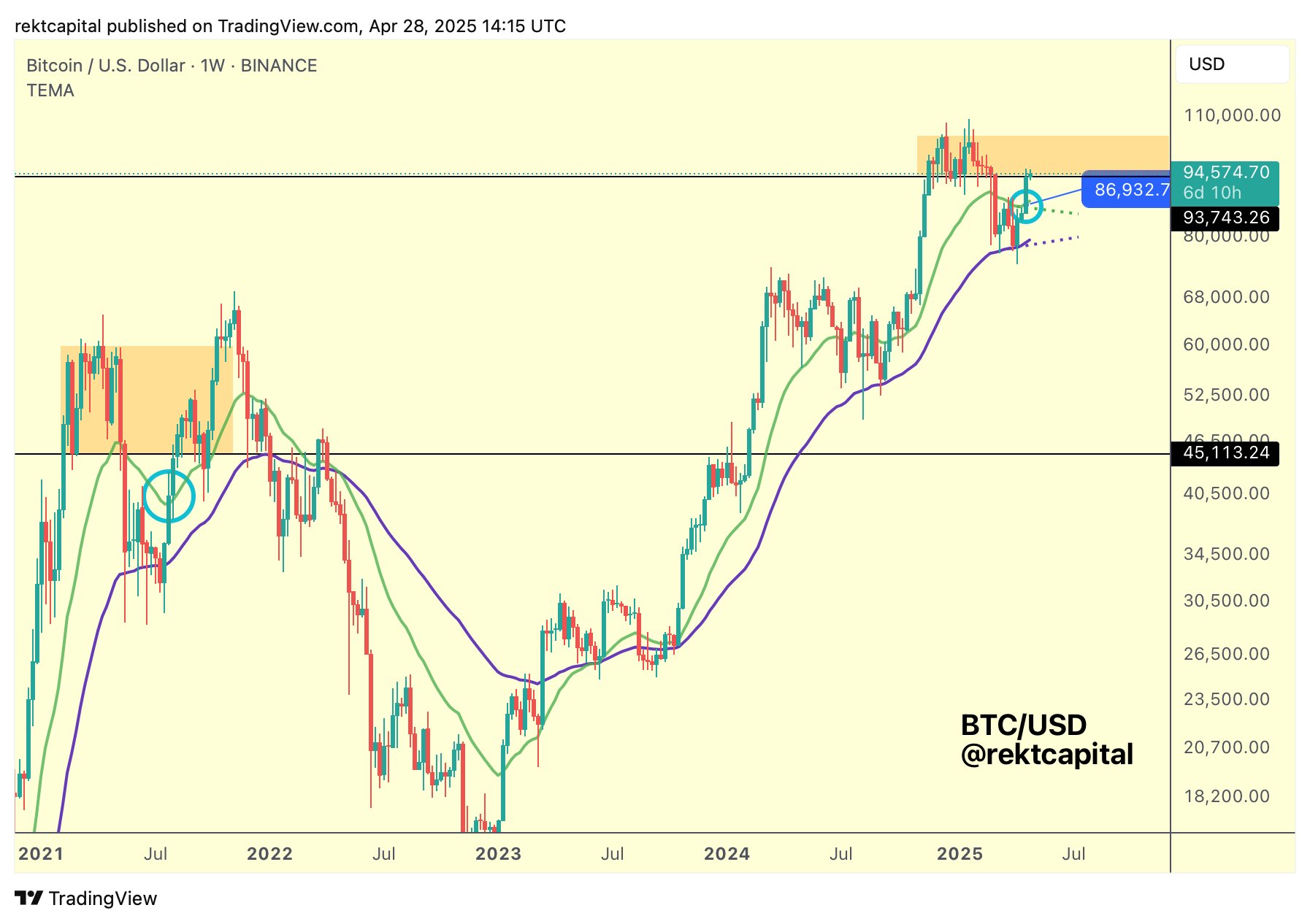

Furthermore, Bitcoin moved beyond both the 21-week and 50-week EMAs, levels traditionally considered to offer support during bull markets. This development mirrored price action observed in mid-2021, reinforcing the bullish outlook.

The $93.5K Support Level: A Critical Test

Despite the bullish breakout, concerns remain regarding Bitcoin’s ability to sustain its upward momentum. A key level to watch is the $93,500 mark, which represents the 2025 yearly open. A dip below this level has raised concerns among analysts, suggesting the potential for increased downside volatility.

The 21-week simple moving average (SMA) is another important indicator to monitor. Its ability to hold as support could be crucial in preventing further price declines.

Factors Influencing Bitcoin’s Price Action

Several factors could influence Bitcoin’s price action in the coming days and weeks:

- Market Sentiment: Overall market sentiment towards cryptocurrencies plays a significant role in Bitcoin’s price movements. Positive news and developments can drive prices higher, while negative news can trigger sell-offs.

- Macroeconomic Factors: Economic indicators such as inflation, interest rates, and unemployment can influence investor risk appetite and impact Bitcoin’s price.

- Regulatory Developments: Regulatory clarity and acceptance of cryptocurrencies by governments can boost investor confidence and drive adoption. Conversely, restrictive regulations can negatively impact the market.

- Whale Activity: Large Bitcoin holders, known as whales, can significantly influence price movements through their buying and selling activity.

- Technical Analysis: Traders and analysts use technical indicators and chart patterns to identify potential buying and selling opportunities.

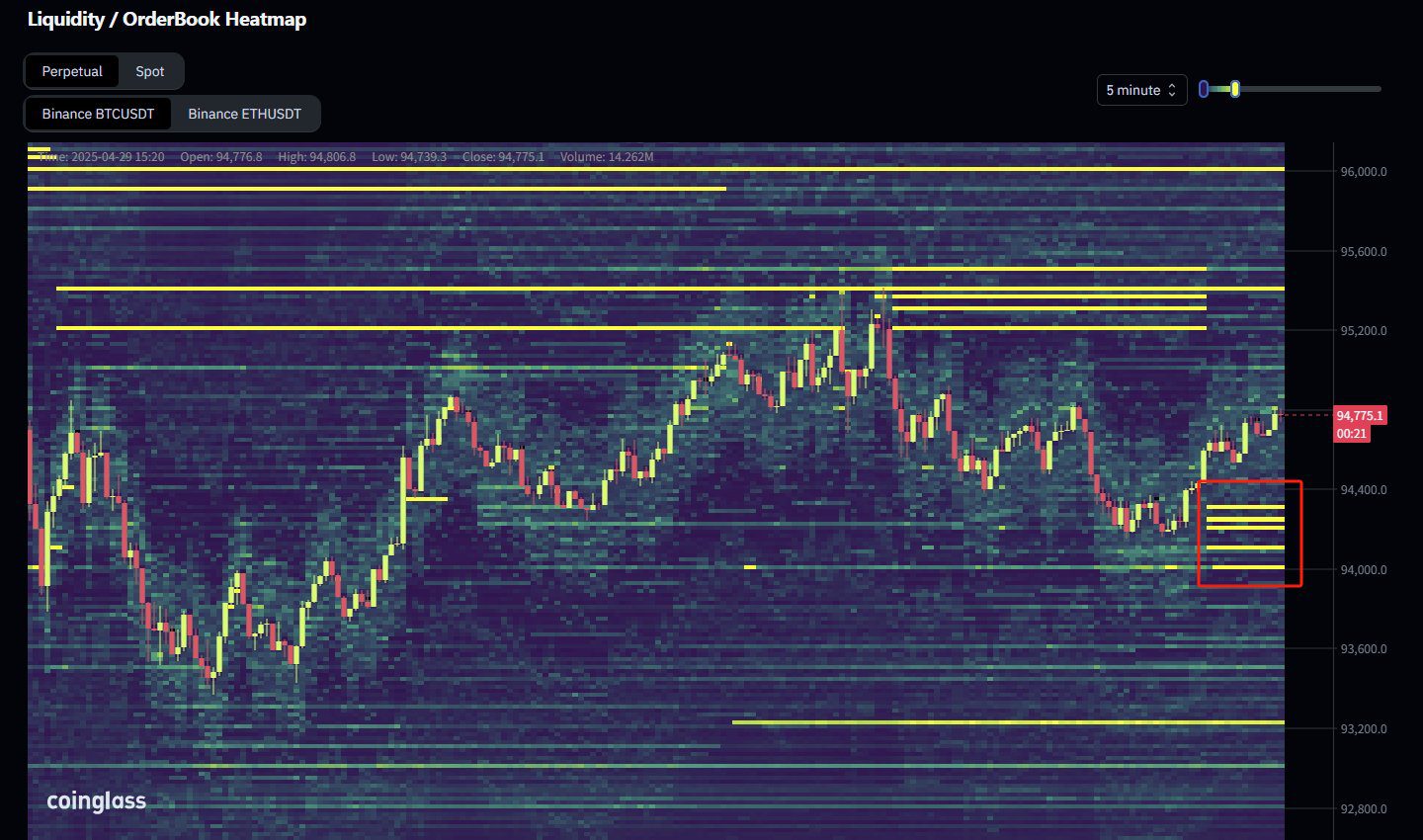

Short-Term Price Magnets

Short-term price magnets, such as the $94,000 level, are also worth noting. A significant buy wall on Binance futures order book indicates strong buying interest around this price point.

Conclusion: Navigating the Critical Zone

Bitcoin finds itself in a critical zone, facing a crucial test of support around the $93,500 level. While the recent triple breakout signaled bullish momentum, concerns remain regarding the sustainability of this upward trend. Investors should closely monitor the key support levels, market sentiment, and other influencing factors to make informed decisions. Understanding these elements is essential for navigating the volatile cryptocurrency market and making informed investment choices. Whether Bitcoin can hold the $93,500 mark or if further downside volatility is imminent remains to be seen, but diligent observation and analysis will be key for market participants.