The Shifting Sands of Global Finance: De-Dollarization and Its Impact

The decline of the US dollar (DXY) has become a notable trend, sparking discussions about a broader shift in the global financial system. Independent market analyst Lyn Alden suggests this isn’t merely a temporary dip but a necessary step in stabilizing the US economy. As the dollar’s dominance wanes, alternative assets like Bitcoin (BTC) and gold are gaining traction.

Key Takeaways:

- A weaker dollar may be essential for the US to stabilize its financial system.

- Bitcoin and gold are well-positioned to benefit from de-dollarization.

- Sovereign wealth funds and nations are increasing Bitcoin exposure.

Why is the US Dollar Weakening?

The US financial system relies heavily on fractional reserve banking, which creates money through lending. This system requires continuous credit expansion to remain solvent. With over $102 trillion in public and private dollar-denominated debt within the US and another $18 trillion owed by borrowers outside the US, the system is under immense pressure.

Alden illustrates this with a compelling analogy: it’s like a game of musical chairs with too few chairs for the number of players. The US imports more than it exports, relying on surplus countries to reinvest their dollar earnings. However, when dollar liquidity tightens, foreign holders sell US assets to service debts, threatening US financial stability.

The Federal Reserve’s intervention during the COVID-19 pandemic, while solving immediate liquidity issues, led to inflation, impacting lower-income Americans the most. This situation, combined with industrial decline and social gaps, created the impetus for protectionist policies.

The current system necessitates structural trade deficits to provide enough dollars globally. Rebalancing trade flows requires a weaker dollar and a move away from monetary hegemony.

Bitcoin and the DXY: An Inverse Relationship

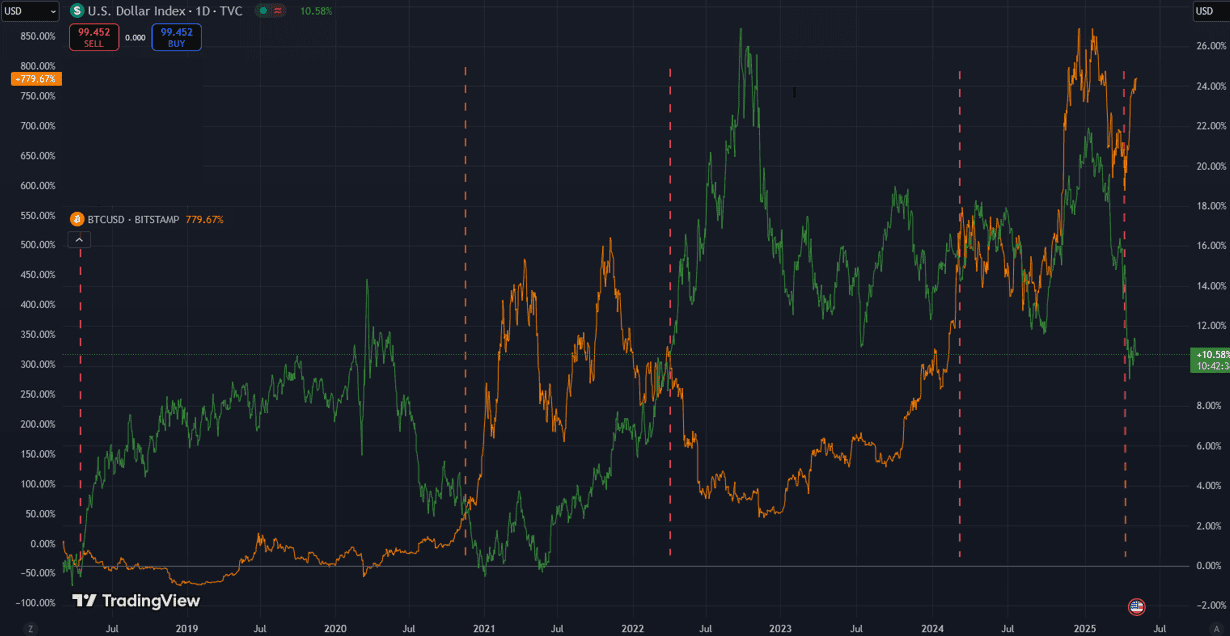

Bitcoin and the DXY often exhibit an inverse correlation. A stronger dollar typically diminishes the appeal of risk-on assets like Bitcoin, while a weaker dollar enhances Bitcoin’s attractiveness as an alternative currency. Bitcoin’s fixed supply and monetary neutrality offer a hedge against fiat currency devaluation.

Historical data reveals that divergences between BTC and DXY charts often coincide with Bitcoin trend reversals. For example, divergences in April 2018 and March 2022 signaled bear markets, while November 2020 marked the beginning of a bullish rally.

In early 2025, a clear divergence emerged as the DXY fell below 100, potentially signaling the start of a new Bitcoin rally. A long-term strategic weakening of the dollar could have a lasting impact on Bitcoin’s price action.

Investing in a Post-Dollar World

Navigating periods of monetary upheaval requires a focus on neutral, high-quality reserve assets that benefit from de-dollarization. Gold and Bitcoin are prime examples.

Several sovereign entities are already accumulating Bitcoin. El Salvador and Bhutan are directly buying and mining BTC. Investment firms and pension funds are gaining exposure through spot BTC ETFs.

Furthermore, numerous companies and institutions hold equity in Bitcoin-related entities. Even Norway’s sovereign wealth fund has Bitcoin exposure through its holdings in various companies.

As the dollar retreats, opportunities arise for other currencies. International trade deals are increasingly settled in yuan, dirham, and other national currencies. Cross-border yuan payments have surged, and the euro is gaining strength against the dollar.

The concept of “de-dollarization” is becoming a reality, with countries and companies exploring alternatives for trade settlement and value storage. Bitcoin’s borderless and politically independent nature makes it an appealing option.

Implications for Investors

The shift away from dollar dominance presents both challenges and opportunities for investors. Diversifying into assets like Bitcoin and gold, which are less correlated with traditional financial systems, may provide a hedge against economic uncertainty. Keeping abreast of geopolitical developments and the evolving landscape of international trade will be crucial for making informed investment decisions.

Potential Investment Strategies:

- Allocating a portion of your portfolio to Bitcoin and other cryptocurrencies.

- Investing in gold as a store of value.

- Monitoring the progress of de-dollarization and its impact on various markets.

By understanding the forces driving de-dollarization and the potential benefits of alternative assets, investors can position themselves to thrive in a changing global financial environment.