Bitcoin (BTC) is currently being debated for its true value, with some analysts suggesting it trades at a significant discount. Recent market activity, including substantial spot Bitcoin ETF inflows and large exchange outflows, points to potential bullish momentum. This article explores the factors contributing to this perceived undervaluation and examines whether Bitcoin could reach $100,000.

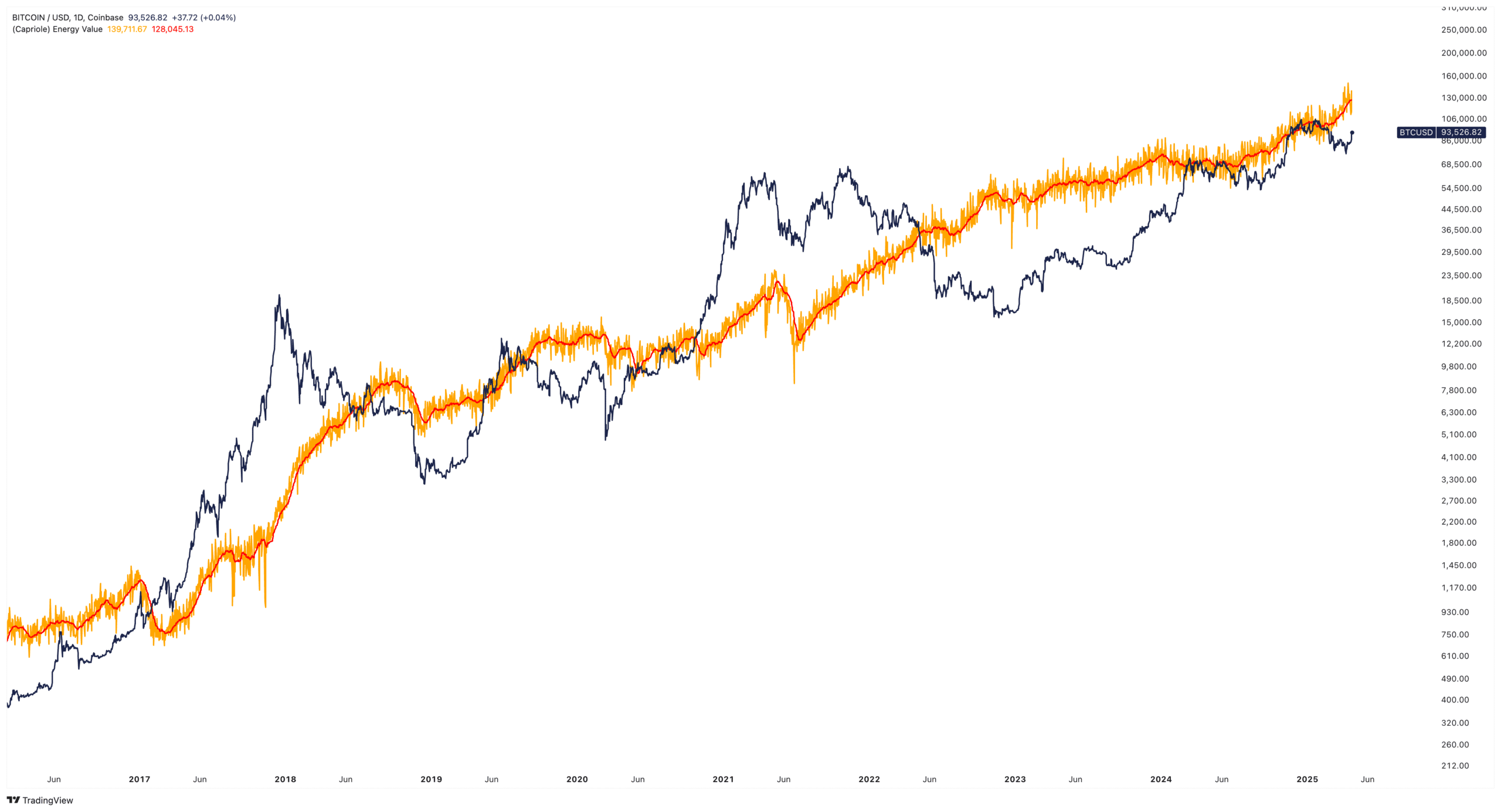

Is Bitcoin Trading at a 40% Discount?

Capriole Investments founder Charles Edwards suggests Bitcoin is trading at a 40% discount to its intrinsic value. He estimates Bitcoin’s energy value, based on mining costs and energy consumption, at $130,000 following the April 2024 halving.

Key Factors Suggesting Potential Undervaluation:

- Energy Value: Edwards’ calculation based on post-halving mining costs estimates a higher intrinsic value.

- Spot Bitcoin ETF Inflows: Strong inflows indicate institutional demand.

- Exchange Outflows: Significant Bitcoin withdrawals from exchanges like Coinbase and Binance may signal accumulation.

Spot Bitcoin ETF Inflows Reach $3 Billion

Institutions have poured approximately $3 billion into spot Bitcoin ETFs recently. This substantial inflow suggests growing institutional interest and demand for Bitcoin exposure.

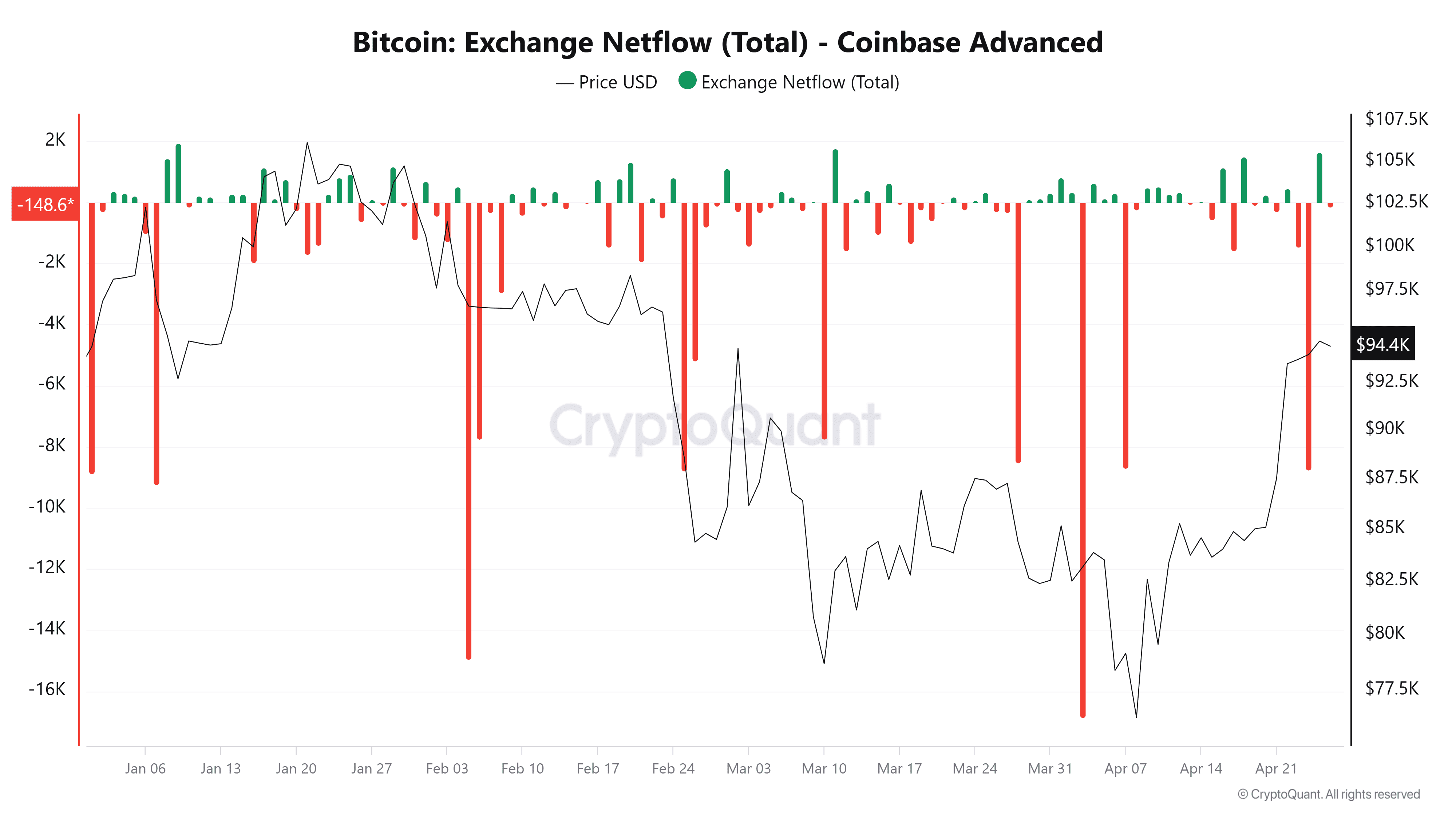

Significant Exchange Outflows: A Bullish Signal?

Data from CryptoQuant reveals significant Bitcoin outflows from major exchanges:

- Coinbase: Over 8,756 BTC ($830 million) withdrawn on April 24, potentially reflecting institutional buying or ETF-related purchases.

- Binance: 27,750 BTC outflow on April 25, the third largest in the exchange’s history.

Large outflows, especially when coupled with positive price action, often indicate bullish sentiment. However, analysts caution against assuming a guaranteed continued rally. Historical data shows that large outflows don’t always prevent price corrections.

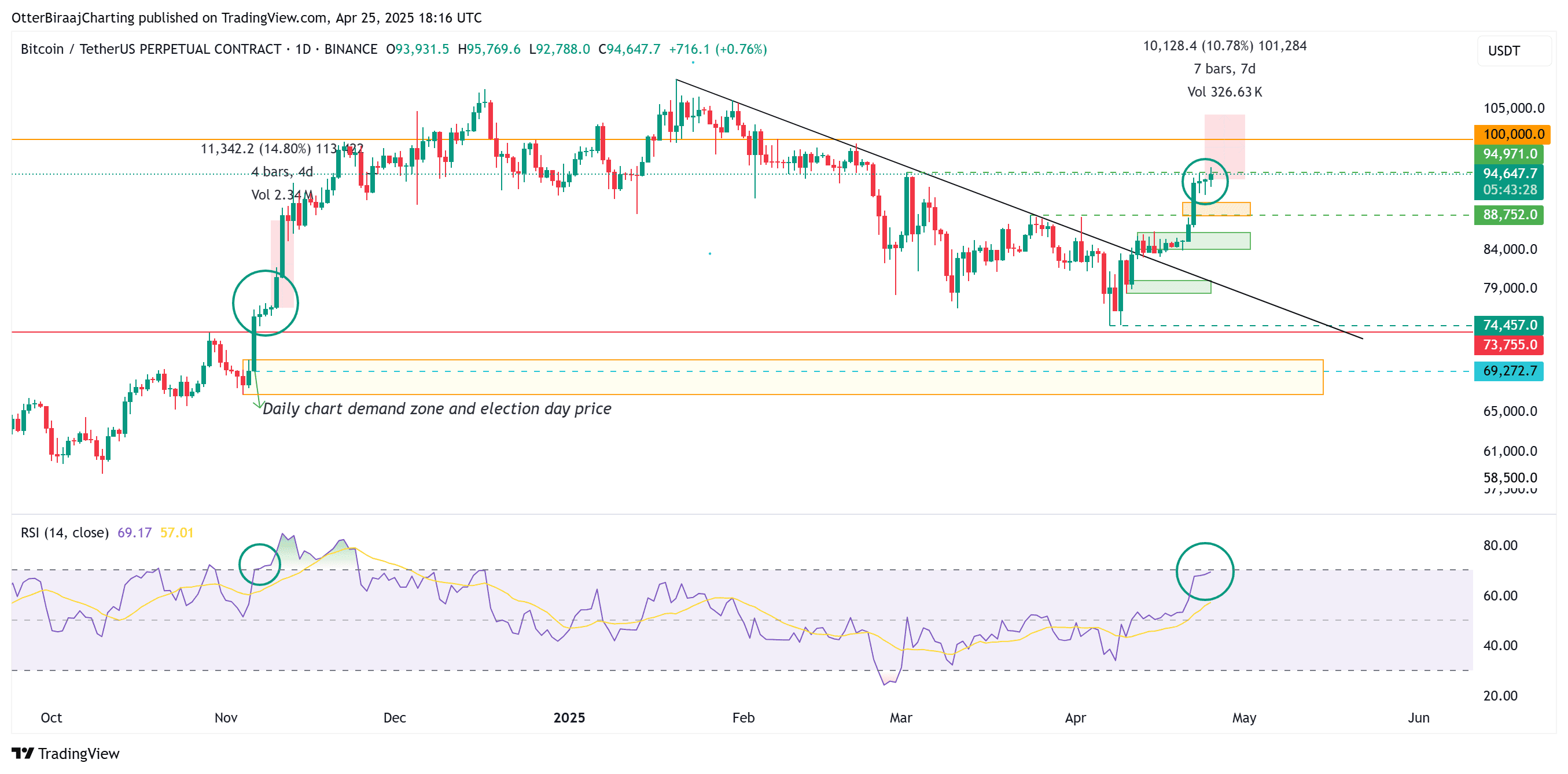

Bitcoin’s Fractal Pattern: Can It Reach $100,000 in April?

Bitcoin’s recent weekly performance has been strong, mirroring price action observed in Q4 2024. This pattern suggests a potential for further price increases.

Similarities to Q4 2024:

- Comparable returns.

- Consolidation at a higher range after a breakout.

- Weekend breakout.

If the fractal pattern continues, Bitcoin could experience a significant price jump, potentially pushing it above $100,000. However, current overhead resistance at $96,100 might impede this breakout, unlike the unresisted rally during Q4.

Potential Risks and Considerations

- Overhead Resistance: The $96,100 level presents a potential obstacle to further price increases.

- Market Volatility: The cryptocurrency market is inherently volatile, and past performance does not guarantee future results.

- External Factors: Regulatory changes, macroeconomic conditions, and unforeseen events can impact Bitcoin’s price.

In conclusion, While Bitcoin may be trading at a discount based on certain metrics, various factors could influence its future price. The surge in spot Bitcoin ETF inflows and significant exchange outflows suggest a bullish trend. However, investors should exercise caution and conduct thorough research before making any investment decisions.