Key Takeaways:

- Bitcoin’s price and overall crypto market sentiment are closely tied to US economic policy and Federal Reserve decisions.

- Growing concerns about a US recession in 2025, driven by rising unemployment and persistent inflation, could influence the Fed’s actions.

- Potential recession could lead the FED to loosen up the policy, adding liquidity to the markets, and risk-on to thrive.

Bitcoin (BTC) is drawing attention as discussions surrounding a potential US recession intensify. Several factors are contributing to this outlook, including recent macroeconomic data that presents challenges for the Federal Reserve. This article delves into the interplay between the US economy, Federal Reserve policy, and Bitcoin’s potential performance in the face of a possible economic downturn.

The US Economic Landscape: Navigating a “Worst Nightmare” Scenario

Recent data indicates a potential slowdown in the US economy, fueled by trade tariffs and ongoing inflationary pressures. Analyses, like those from The Kobeissi Letter, highlight the difficult position the Federal Reserve faces.

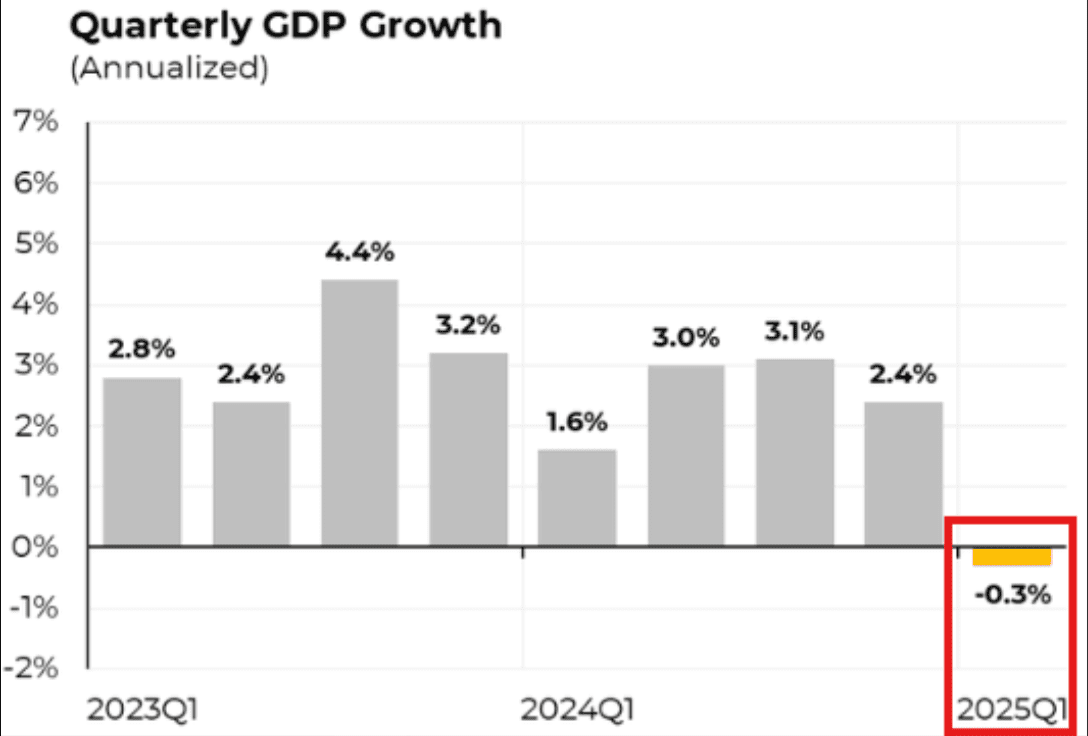

Q1 GDP figures came in below expectations, signaling a potential contraction. This, coupled with persistent inflation, puts pressure on the Fed to make difficult choices regarding interest rate policy.

The core issue revolves around interest rate adjustments. Lowering rates could stimulate the economy but risk exacerbating inflation. Conversely, maintaining or raising rates could further weaken GDP and increase unemployment.

This creates a challenging scenario for the Fed, potentially leading to stagflation (rising inflation and unemployment) or a full-blown recession. The increasing probability of a recession has led some analysts to consider it a “base case scenario” for 2025.

Bitcoin’s Potential as a Recession Hedge

Historically, Bitcoin and other cryptocurrencies have been viewed as potential hedges against economic uncertainty. During times of recession or economic instability, investors may seek alternative assets like Bitcoin to preserve capital.

The expectation is that a recession could prompt the Fed to loosen its monetary policy, potentially leading to increased liquidity in the markets. This could, in turn, benefit risk assets like Bitcoin.

However, it’s important to note that Bitcoin’s performance during a recession is not guaranteed. The cryptocurrency market is still relatively young and can be influenced by various factors, including regulatory developments and investor sentiment.

Market Expectations and Federal Reserve Policy

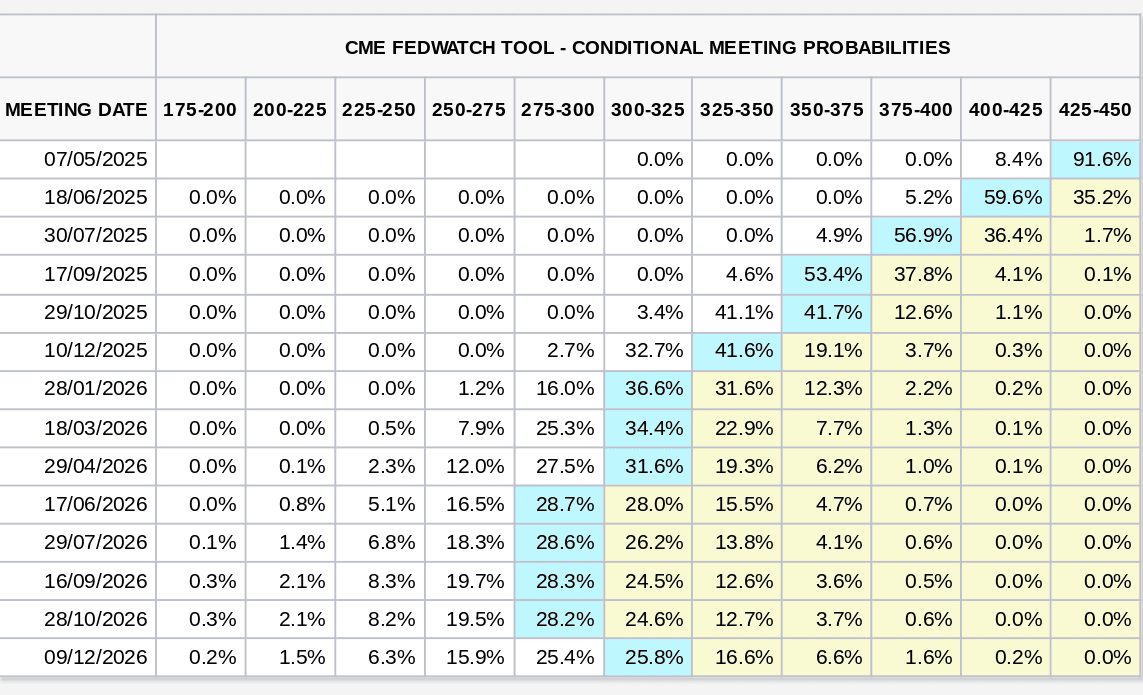

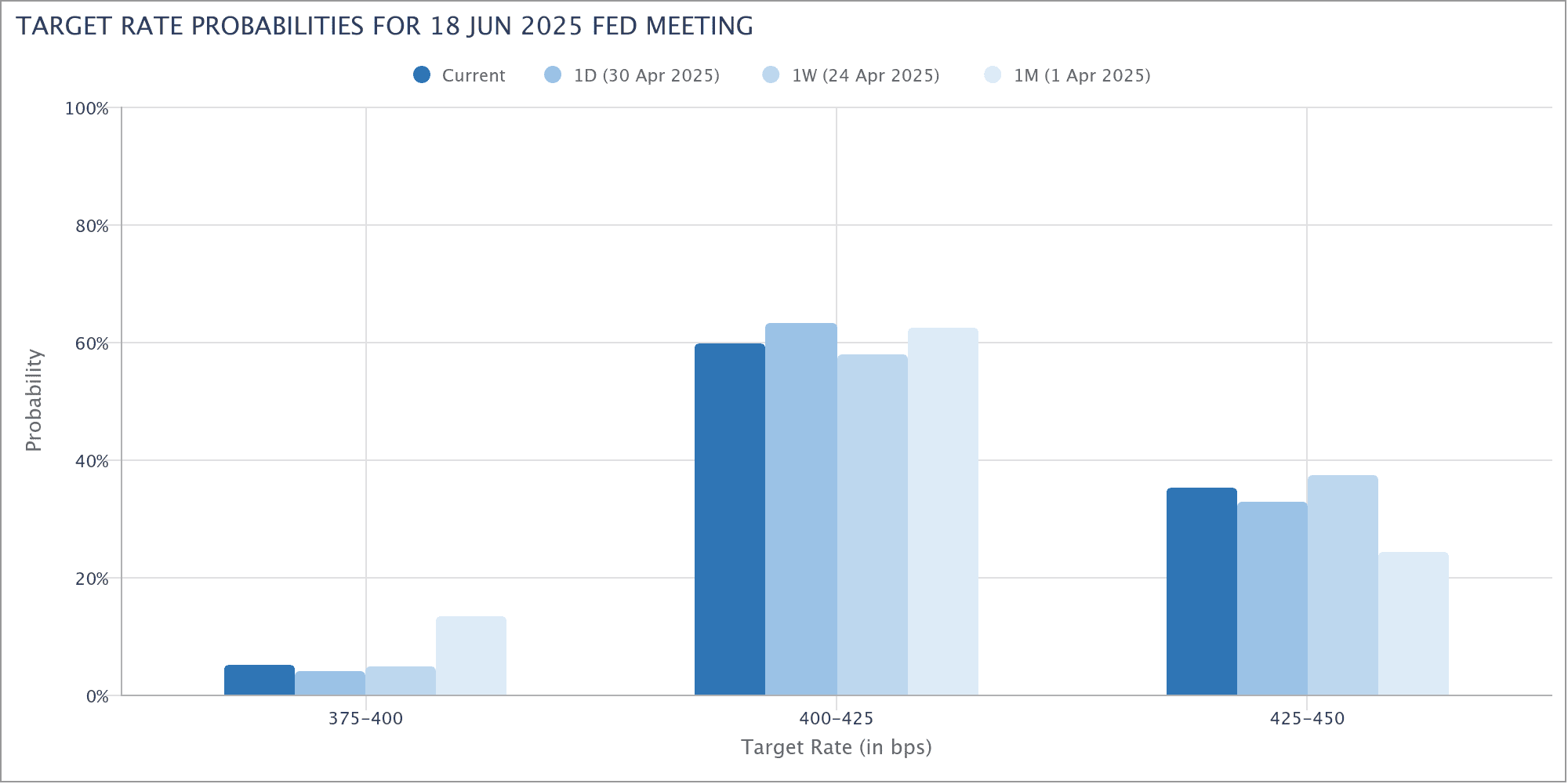

Market participants are closely monitoring the Federal Reserve’s actions. The CME Group’s FedWatch Tool provides insights into market expectations for future Fed policy decisions.

As of now, the market anticipates a potential interest rate cut at the June meeting of the Federal Open Market Committee (FOMC). However, these expectations can shift based on incoming economic data and Fed communications.

Crypto traders and analysts are actively assessing the Fed’s potential course of action, recognizing its potential impact on the cryptocurrency market.

Analyst Perspectives

Several analysts have weighed in on the potential impact of a US recession on Bitcoin. Some believe that a recession could force the Fed to ease its monetary policy, which could benefit Bitcoin and other risk assets.

However, other analysts caution that Bitcoin’s performance during a recession is uncertain and that the cryptocurrency market could be affected by other factors.

Additional Factors to Consider

Several other factors could influence Bitcoin’s performance in the coming months:

- Regulatory Developments: Changes in cryptocurrency regulations could significantly impact the market.

- Institutional Adoption: Increased adoption of Bitcoin by institutional investors could provide further price support.

- Technological Advancements: Developments in blockchain technology could enhance Bitcoin’s utility and value.

Conclusion

The possibility of a US recession in 2025 presents both challenges and opportunities for Bitcoin. While a recession could trigger a loosening of monetary policy that benefits Bitcoin, the cryptocurrency’s performance is not guaranteed. Investors should carefully consider the various factors at play and conduct thorough research before making any investment decisions.