Bitcoin’s Price Consolidation: Is $150K Still on the Horizon?

Bitcoin (BTC) has recently reached new all-time highs, but signs suggest that its upward momentum may be slowing. This article examines the factors contributing to this consolidation and explores analysts’ perspectives on whether Bitcoin can still reach the ambitious $150,000 target.

Key Takeaways:

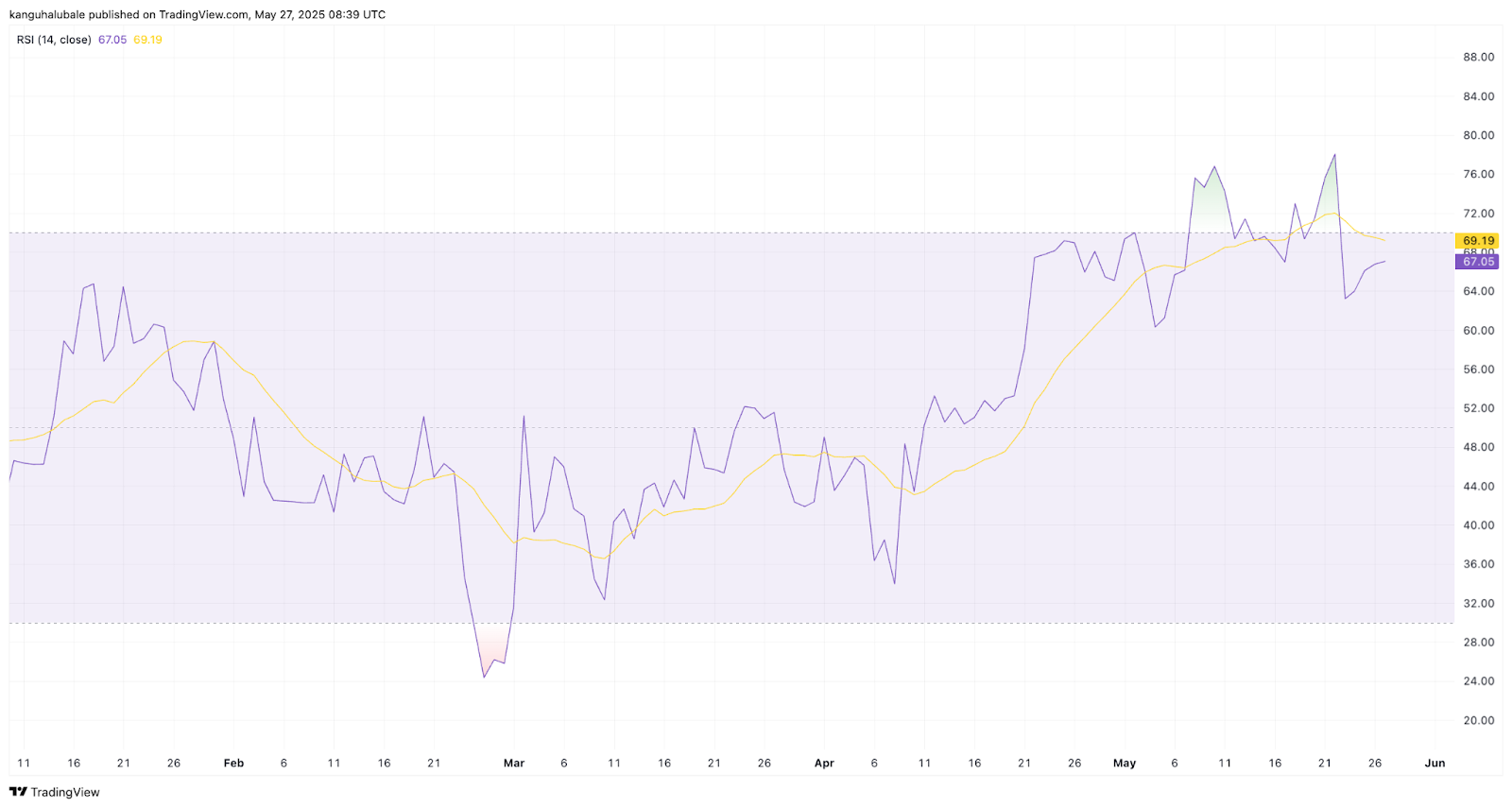

- Bitcoin’s Relative Strength Index (RSI) has decreased, indicating reduced buying pressure.

- Bitcoin futures are showing bearish trends, with a decline in perpetual CVD.

- Despite these signs, some analysts maintain a bullish outlook, predicting a potential rise to $150,000 if key support levels hold.

Analyzing Bitcoin’s Current Market Position

After surging to nearly $112,000, Bitcoin’s price is now consolidating. The daily Relative Strength Index (RSI) had entered overbought territory but has since declined, signaling a potential cooling of buyer enthusiasm.

According to Glassnode, this decline in RSI could indicate a pause or reversal in the recent bullish trend. This suggests that the rapid price appreciation may not be sustainable in the short term.

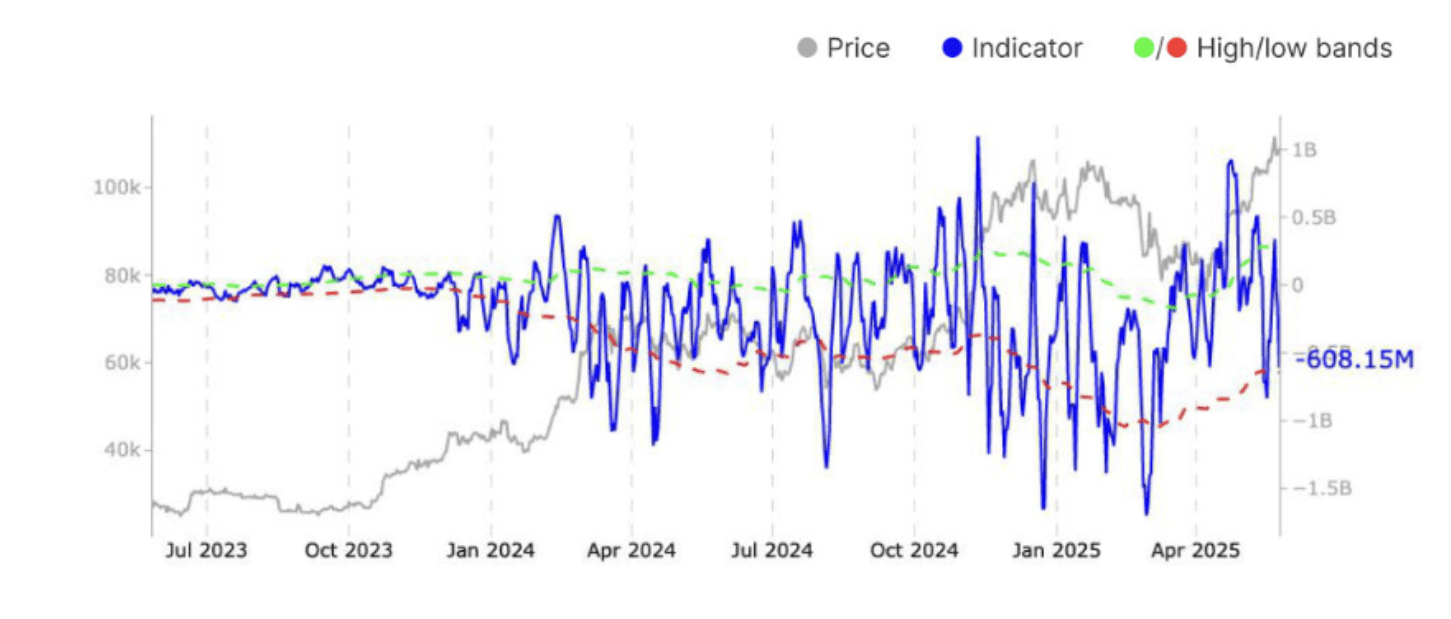

Furthermore, data from Glassnode reveals that while Bitcoin futures open interest rose, the perpetual CVD trended lower. This divergence suggests stronger sell-side flows and a more cautious approach among traders, indicating a potential shift in market sentiment.

Bearish Signals in Bitcoin Futures

The perpetual CVD (Cumulative Volume Delta) for Bitcoin has dropped significantly, reflecting bearish sentiment. This decline highlights dominant sell-side pressure in the Bitcoin futures market, indicating that more traders are betting against Bitcoin’s price rising.

The shift in futures market sentiment is crucial as it can impact spot market prices. If bearish pressure continues, it could lead to further price corrections for Bitcoin.

Analysts’ Predictions: The $150,000 Target

Despite the signs of easing momentum, some analysts remain optimistic about Bitcoin’s future price potential. They point to technical analysis and historical patterns to support their bullish predictions.

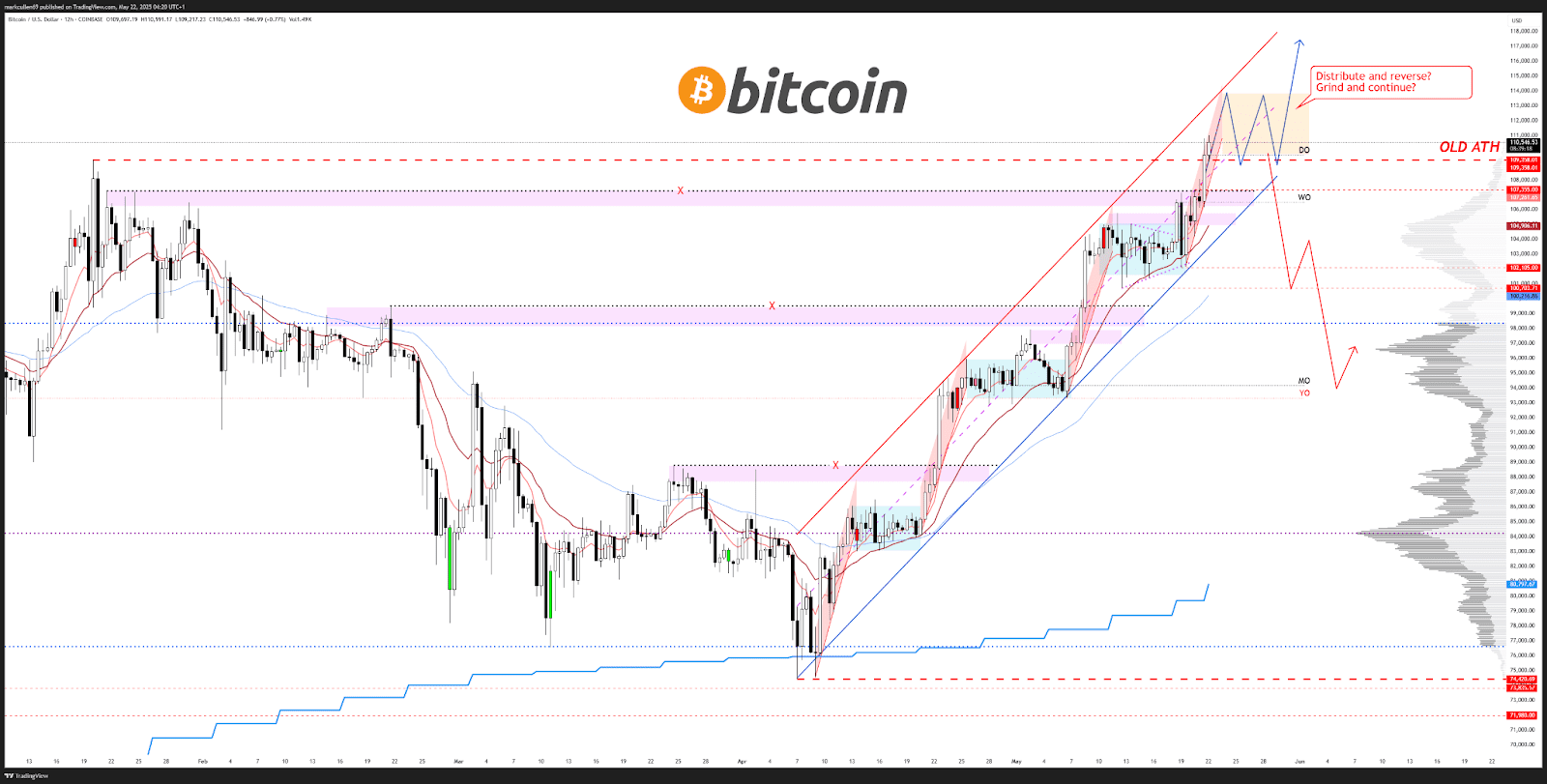

Analyst AlphaBTC noted that Bitcoin is still holding above the $106,000 level, reinforcing its importance to buyers. They suggested that Bitcoin is trading in an ascending channel in the 12-hour timeframe, with a potential price target above $120,000.

MN Capital founder Michael van de Poppe believes Bitcoin is looking to attack all-time highs. He suggested a possible retest of the $102,000 level before a rally towards $115,000 and beyond. His outlook remains bullish.

Titan of Crypto predicted a cycle top of $135,000 for BTC if it repeats a 2024 pattern in the weekly timeframe. Using Fibonacci retracement levels, they identified this as a potential target.

Historical Patterns and Future Projections

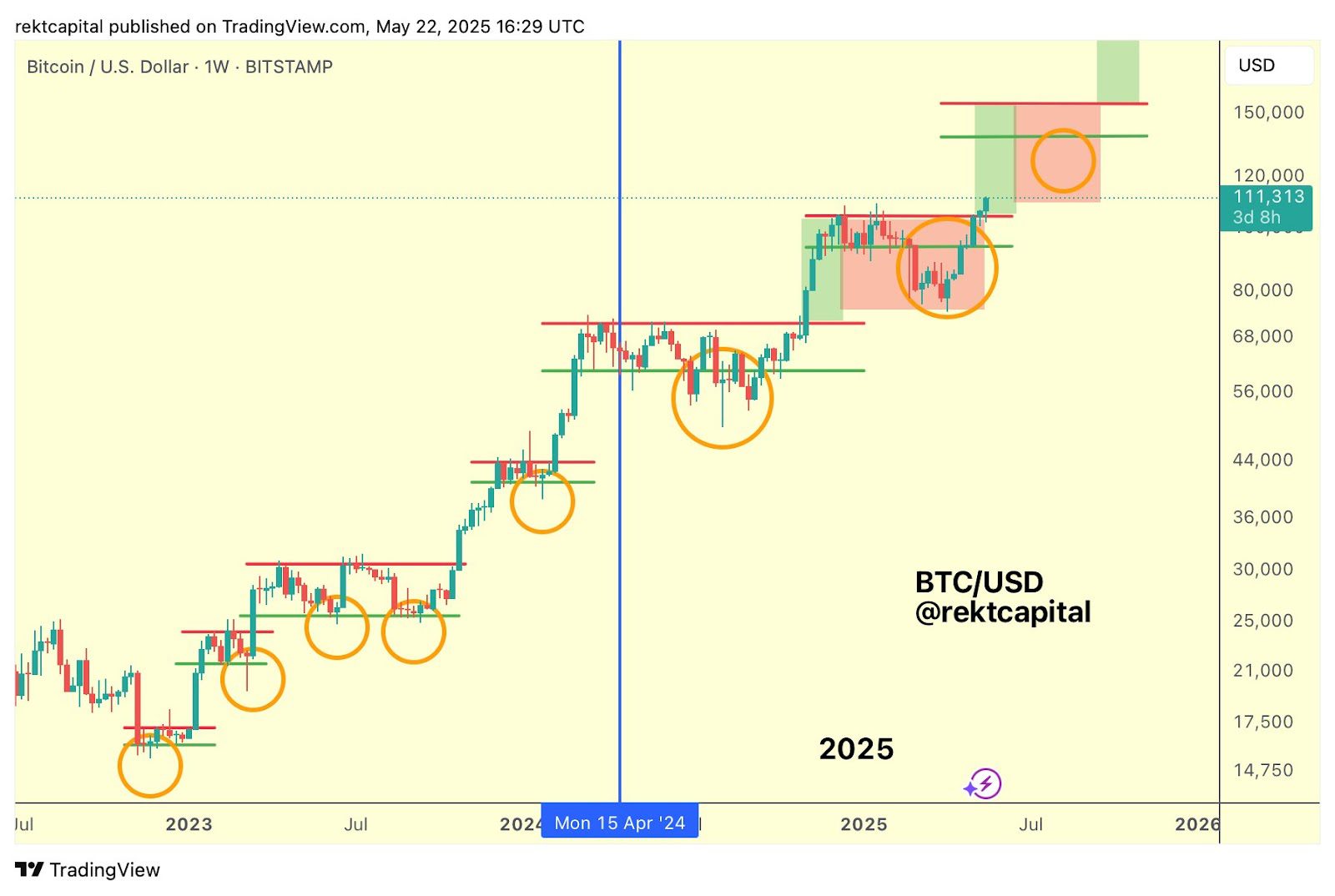

Rekt Capital highlighted Bitcoin’s price discovery roadmap, indicating that BTC was transitioning into a price discovery uptrend. This is similar to the price action seen between January and March 2024, when BTC rallied significantly.

According to Rekt Capital’s analysis, if the same scenario plays out, Bitcoin could reach a peak of around $150,000. This projection is based on the replication of historical price patterns.

Conclusion: Navigating Bitcoin’s Price Movements

Bitcoin is currently experiencing a period of consolidation after a significant rally. While some indicators suggest easing momentum and potential price corrections, analysts remain divided on whether the $150,000 target is still achievable.

The outlook for Bitcoin remains cautiously optimistic, but monitoring key support levels and shifts in market sentiment is essential. While upward predictions are still in place, traders must be ready for considerable volatility and market corrections.