Bitcoin (BTC) is facing renewed headwinds as its price struggles to mirror gold’s recent surge. This divergence raises questions about Bitcoin’s correlation with gold and its potential to maintain support levels.

Key Takeaways:

- Bitcoin’s Stagnation: While gold has gained nearly 5% this week, Bitcoin’s price momentum has stalled, leading to concerns about a potential retest of lower support levels.

- Gold Correlation Under Scrutiny: The historical correlation between Bitcoin and gold is being challenged as macroeconomic shifts influence investor behavior.

- Short-Term Slump Anticipated: Some analysts predict a short-term price slump for Bitcoin before a potential rebound.

Bitcoin vs. Gold: A Tale of Two Assets

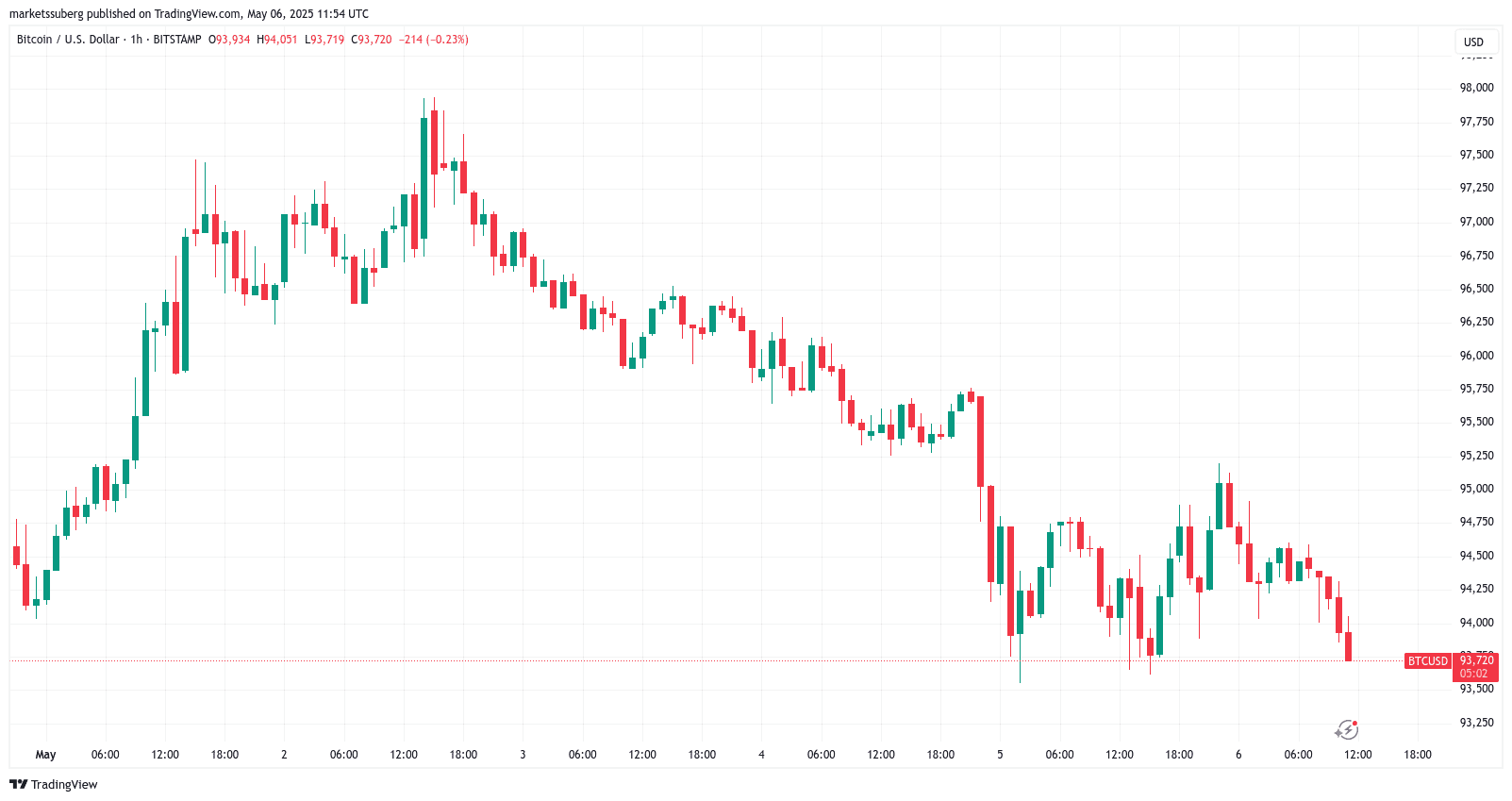

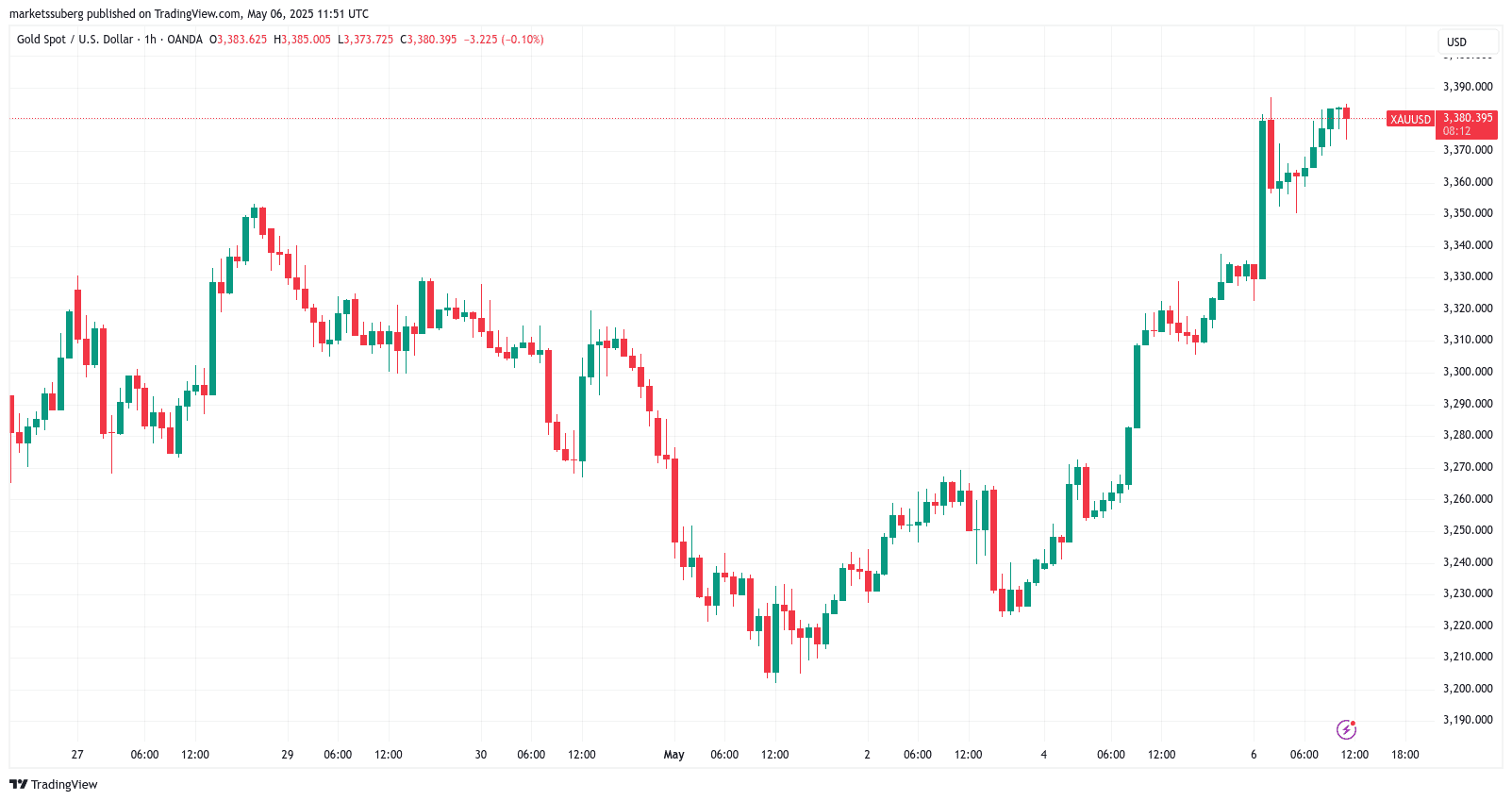

As of May 6th, Bitcoin’s price was hovering around $95,000, struggling to maintain upward momentum. This contrasts sharply with gold (XAU/USD), which has experienced a significant rally, gaining 1.5% on the day and 4.4% week-to-date.

According to trading firm QCP Capital, crypto implied volatilities remain suppressed, and the market appears directionless. This is happening amid a backdrop of a weaker dollar and surging emerging market currencies, particularly the Taiwanese dollar. The firm also noted that gold’s recent surge is driven by investors seeking a safe haven amid geopolitical risks and anticipating potential shifts in US trade diplomacy.

The central question is whether Bitcoin will follow gold’s lead as a safe haven asset or decouple and align itself with broader risk proxies. Some argue that Bitcoin’s decentralized nature and potential as an inflation hedge should drive its price upward, similar to gold. However, others believe that Bitcoin’s volatility and regulatory uncertainties make it a riskier asset compared to gold.

Technical Analysis: Warning Signs for Bitcoin?

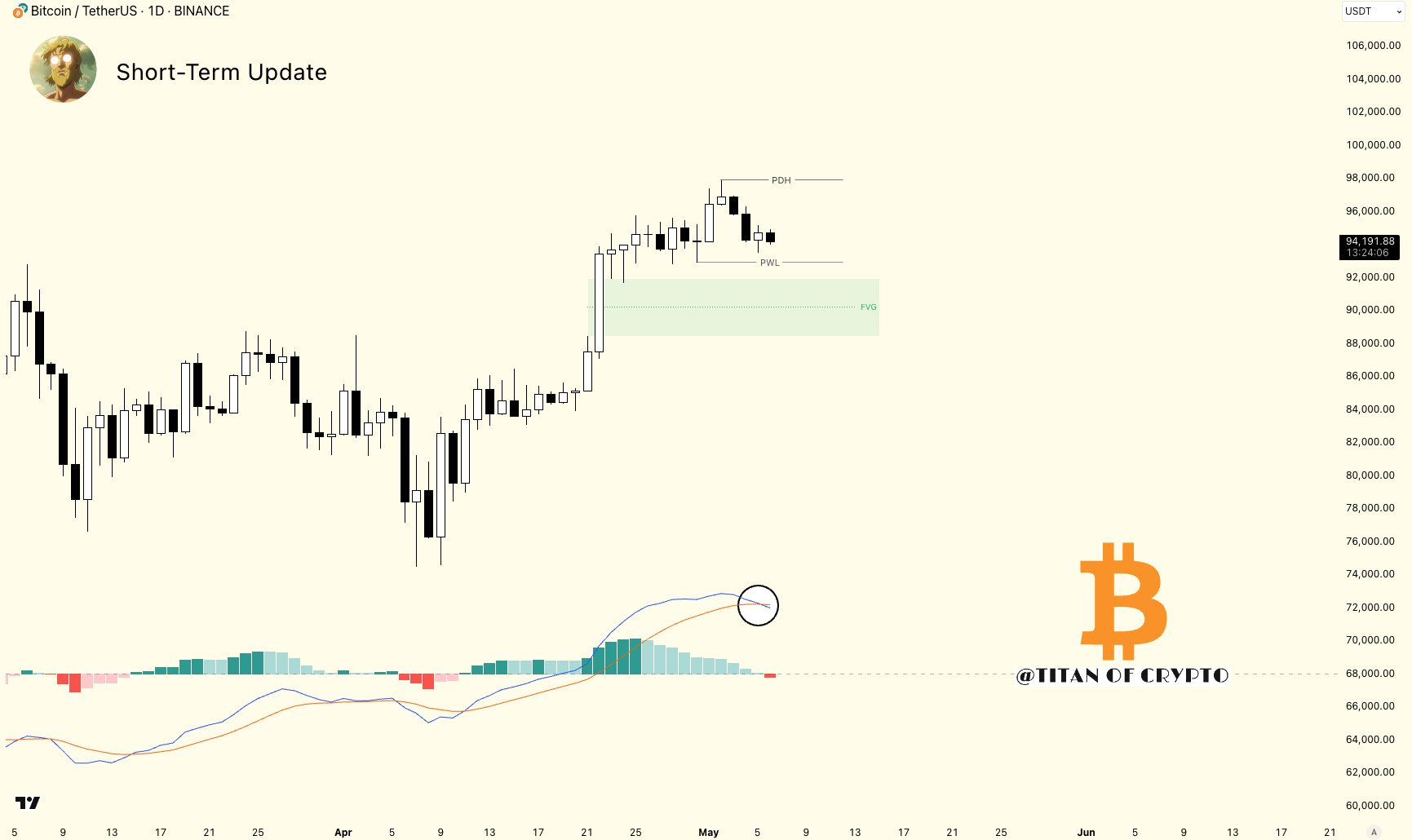

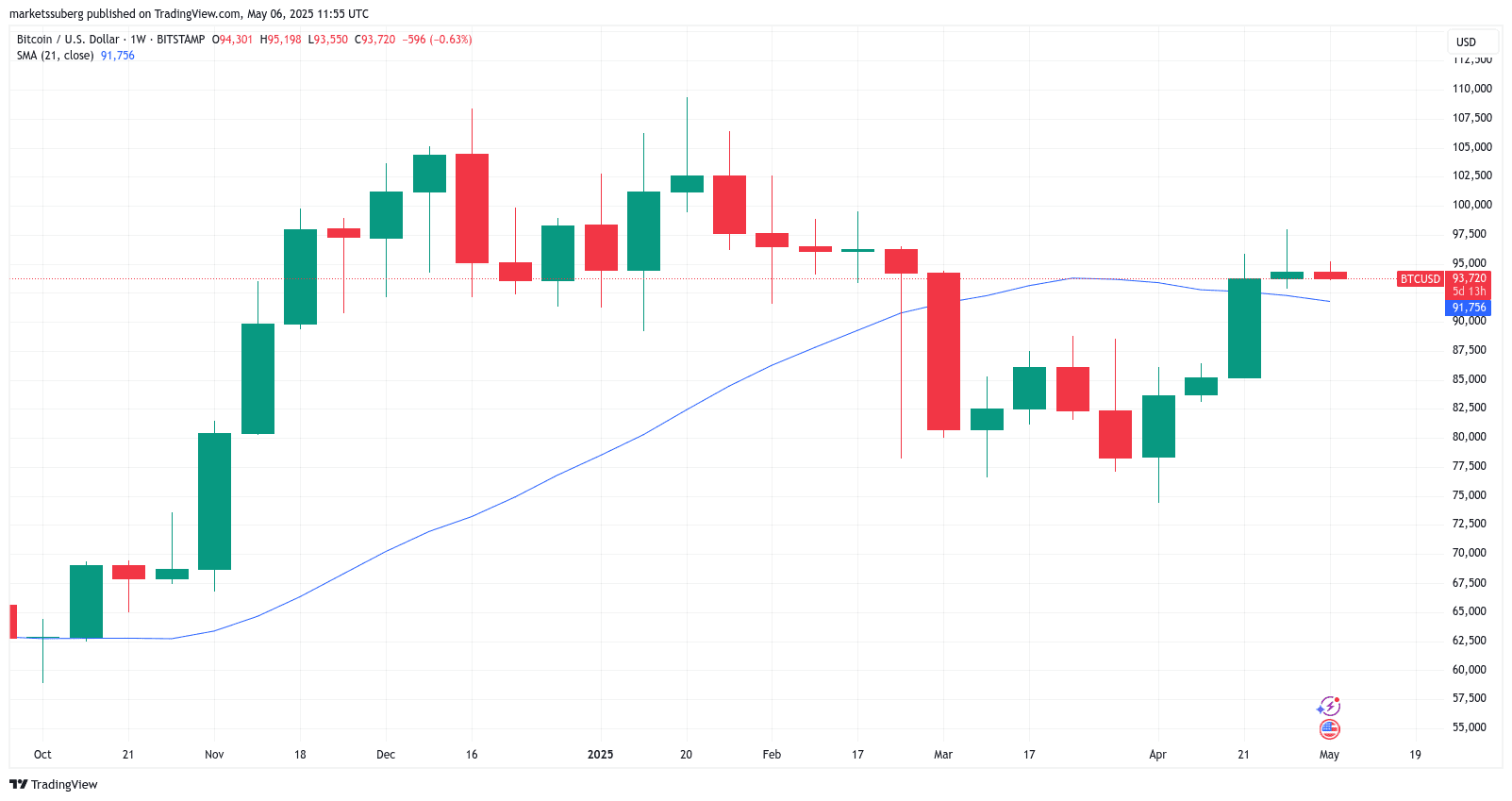

Technical indicators paint a mixed picture for Bitcoin’s short-term prospects. The Moving Average Convergence Divergence (MACD) indicator, a measure of trend strength, shows conflicting signals on different timeframes.

While the weekly MACD suggests a bullish trend, the daily MACD indicates a bearish crossing below the zero line, signaling slowing momentum. This suggests that Bitcoin may be consolidating before its next major move.

#btc weekly MACD about to cross bullishly from a position of strength… pic.twitter.com/x2JjK9rHNW

— dave the wave🌊 (@davthewave) May 6, 2025

The upcoming Federal Reserve meeting on May 7th, where interest rate changes will be discussed, could also play a significant role in Bitcoin’s price action. Any hawkish signals from the Fed could put downward pressure on Bitcoin, while dovish signals could provide a boost.

Potential Scenarios for Bitcoin’s Price

Several factors could influence Bitcoin’s price in the coming days and weeks:

- Continued Correlation with Gold: If Bitcoin maintains its correlation with gold, its price could rise alongside gold as investors seek safe-haven assets.

- Decoupling and Risk-On Sentiment: If Bitcoin decouples from gold and aligns with riskier assets, its price could be more volatile and susceptible to market corrections.

- Macroeconomic Factors: Interest rate decisions, inflation data, and geopolitical events could all significantly impact Bitcoin’s price.

A key level to watch is the yearly open support at $93,500. Breaking below this level could lead to a further decline towards the $92,000 range or even lower. On the upside, breaking above the $95,000 resistance could signal a renewed bullish trend.

Ultimately, Bitcoin’s price trajectory will depend on a complex interplay of technical, fundamental, and macroeconomic factors. Investors should carefully monitor these factors and conduct their own research before making any investment decisions.