Bitcoin’s Bullish Momentum Faces Potential Hurdles

Bitcoin (BTC) has experienced a significant rally, surging 39% in a single month and briefly exceeding $105,000. This surge has fueled optimism among traders who believe new all-time highs are within reach. However, signs of an overheated market and potential headwinds suggest a need for caution.

Key Takeaways:

- Bullish Momentum: Bitcoin is nearing new highs after a strong rally.

- Overheating Concerns: Sentiment indicators suggest the market may be overheating.

- Profit-Taking: Investors are taking profits, with Bitcoin’s realized cap reaching a record $889 billion.

- Potential Correction: Analysts warn of a possible short-term correction, influenced by factors like gold’s performance and seasonal trends.

Renewed Market Strength and Profit-Taking

Glassnode analysts indicate renewed market strength, with trading occurring within a profit-dominated regime. However, profit-taking is on the rise, with significant activity expected at the $106,000 level. Historically, euphoric market sentiment has often led to periods of consolidation or corrections.

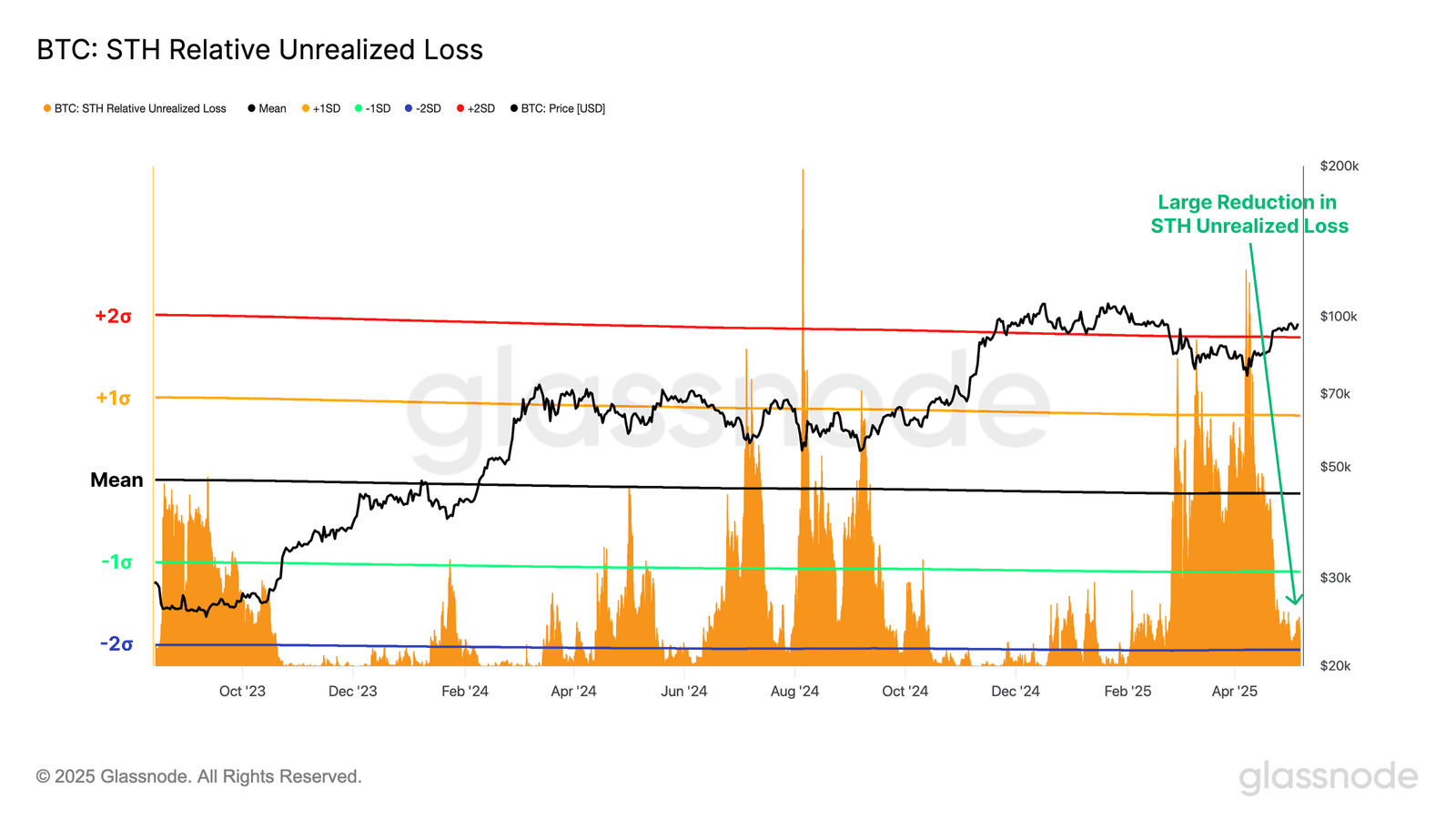

The recent rally has returned over 3 million BTC to a profitable state, reigniting capital inflows exceeding $1 billion per day. Short-term holders, previously underwater since December 2024, have also seen their portfolios turn profitable.

This financial and psychological relief is translating into increased spending. The net difference between short-term holders’ transfer volume in profit versus at a loss has swung sharply, indicating a significant reversal from previous capitulation phases.

Institutional investor confidence is also rebounding, with over $5.7 billion flowing into Bitcoin ETFs in the past three weeks. Total assets under management within US spot ETFs have climbed to over 1.26 million BTC, reaching a new all-time high.

Euphoria and Market Overheating

While the momentum is strong, caution is advised. Bitcoin’s open interest has climbed to $68 billion, nearing all-time highs and indicating a heavily positioned market. Such conditions can lead to outsized price movements triggered by even small catalysts.

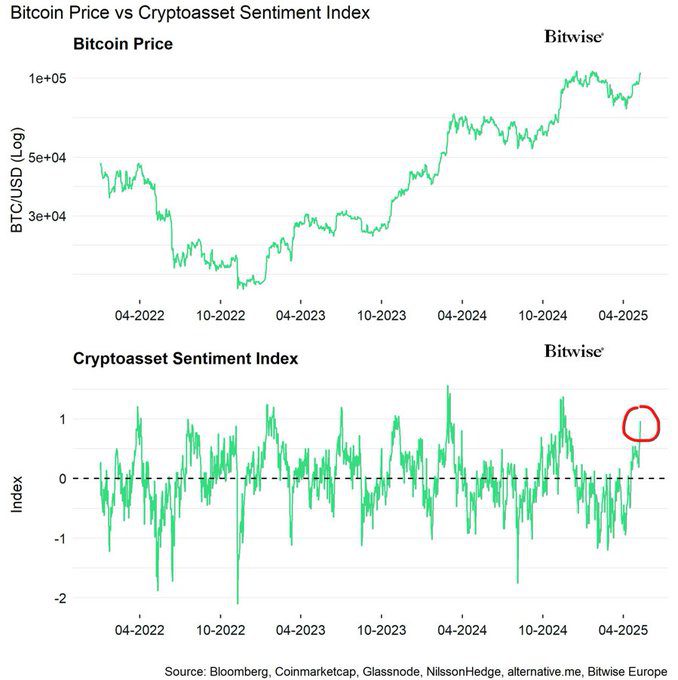

André Dragosch, head of research at Bitwise Asset Management, suggests that Bitcoin might be getting ahead of itself. Bitwise’s Cryptoasset Sentiment Index has reached its highest level since November 2024, indicating an overheated market.

Dragosch notes that the overheated market sentiment and one-sided long positioning increase the risk of a temporary pullback in Bitcoin’s price. Despite this, he remains structurally constructive until the end of 2025, citing continued BTC accumulation by corporations and ETPs, which depletes Bitcoin on-exchange balances.

Potential Market Headwinds

Several risks could challenge Bitcoin in the short term:

- Regulatory Uncertainty: Renewed regulatory uncertainty, particularly after the Senate stalled stablecoin legislation, poses a concern.

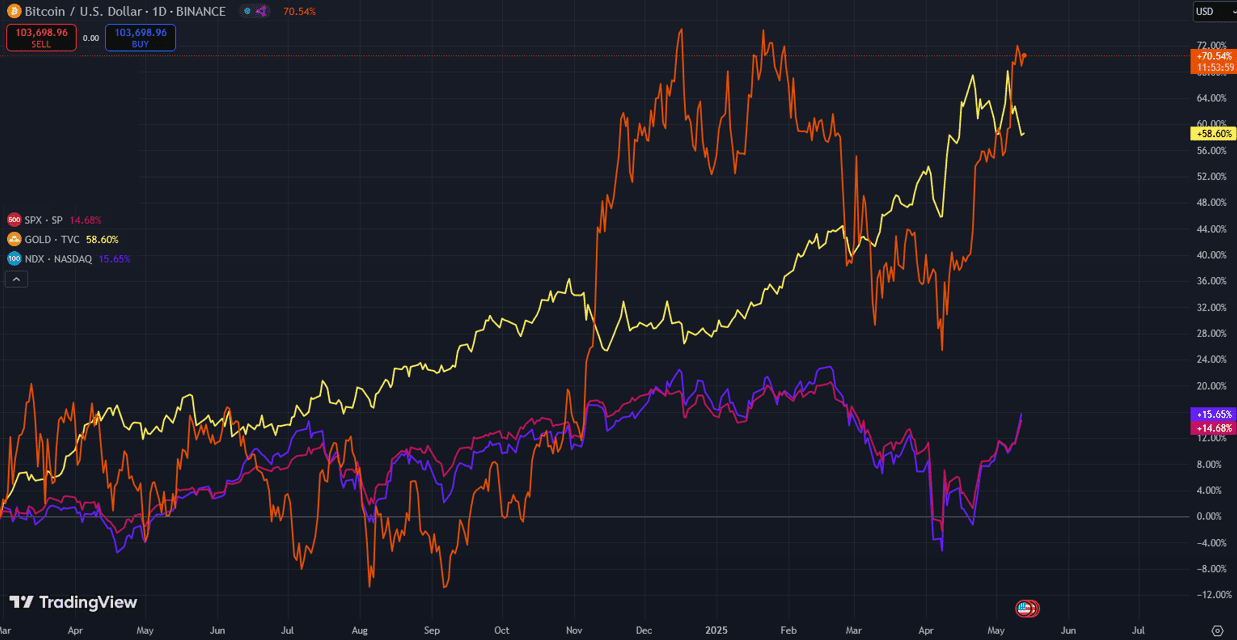

- Correlation with Gold: Bitcoin has shown a stronger correlation with gold than with equities since March 2025. Gold’s potential correction could impact Bitcoin.

Since March 2025, Bitcoin has mirrored gold’s performance, with both rising significantly. However, gold has started showing signs of fatigue, potentially signaling a downtrend. If gold enters a corrective phase, Bitcoin might follow.

Seasonality may also play a role. Historically, June and September have been the worst-performing months for Bitcoin. While seasonality should not be the sole basis for decisions, it is a factor many investors consider.

Conclusion

Bitcoin’s current rally faces potential headwinds, including overheated market sentiment, profit-taking, regulatory uncertainty, and correlation with gold. While the long-term outlook remains positive, investors should be aware of the risks and potential for a short-term correction. Monitoring market trends, regulatory developments, and macroeconomic factors is crucial for making informed investment decisions.