Key Takeaways:

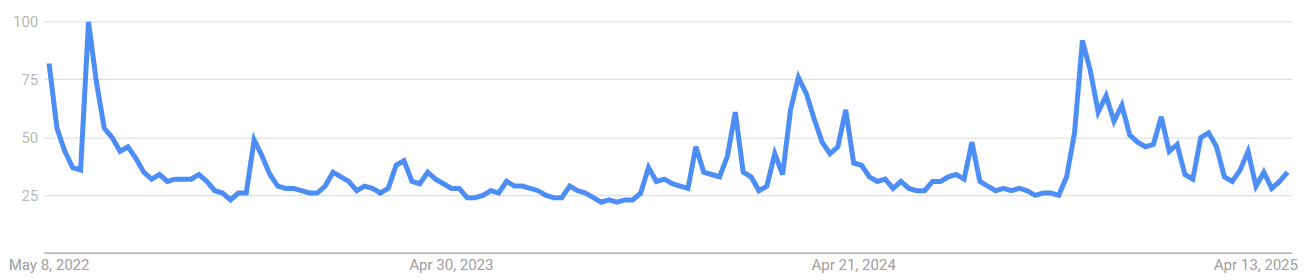

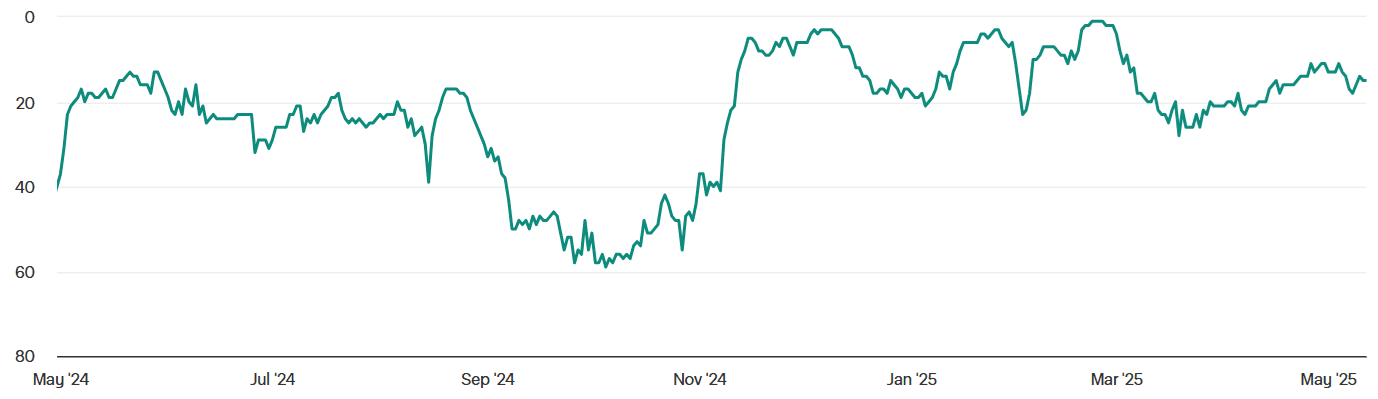

- Google search data and app rankings indicate retail Bitcoin investor demand is near 6-month lows, despite BTC approaching new highs.

- Historically, retail investor interest typically peaks about one week after BTC surpasses previous all-time highs.

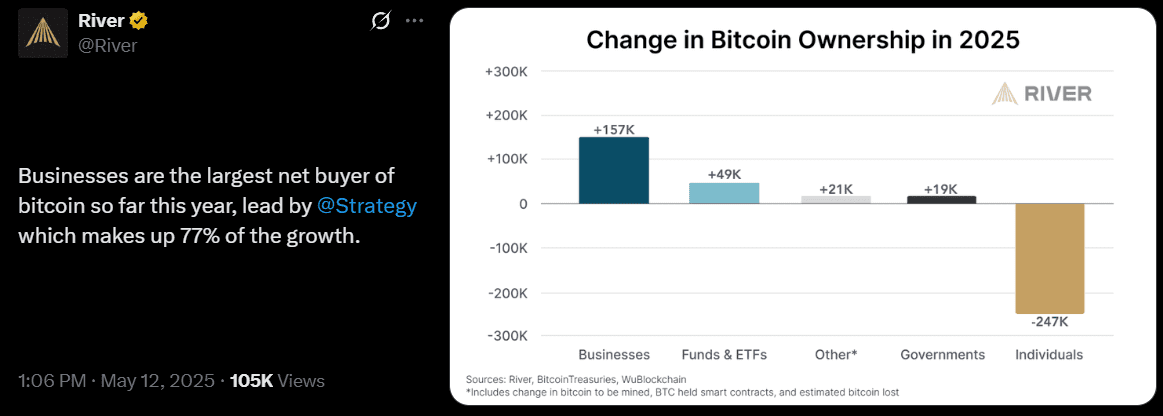

- In 2025, retail investors were net sellers of BTC, while institutions were the primary buyers, highlighting a shift in market dynamics.

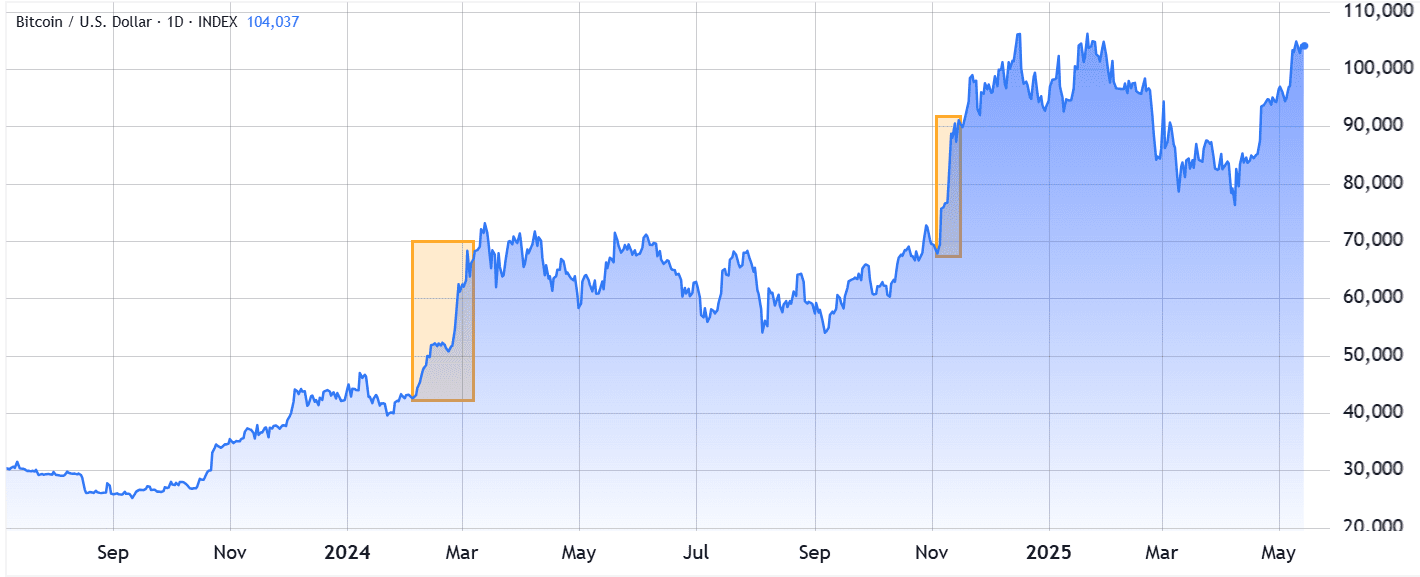

Bitcoin (BTC) has been making headlines with its impressive price performance, nearing $104,000. However, a closer look at market indicators reveals a curious trend: retail investor interest is lagging. Unlike previous bull runs where individual investors flocked to Bitcoin during periods of euphoria, current data suggests a more cautious approach.

This article explores the disconnect between Bitcoin’s price surge and retail investor participation, analyzing Google search trends, app rankings, and historical market behavior to understand where retail investors are and what might trigger their return.

Retail Interest: A Delayed Reaction?

Analysts estimate that in 2025, retail investors were net sellers of BTC, while institutions were the main buyers. Data from River suggests individual investors sold a total of 247,000 BTC throughout 2025. Interestingly, historical patterns suggest that retail appetite typically surges about one week after Bitcoin surpasses its previous all-time high. This delayed reaction can be attributed to several factors, including:

- Fear of Missing Out (FOMO): Retail investors often wait for confirmation of a sustained bull run before entering the market, driven by the fear of missing out on potential gains.

- Media Coverage: Increased media attention following all-time highs tends to attract retail investors who may not be actively following the market.

- Social Influence: Social media and online communities play a significant role in shaping retail investor sentiment, with discussions often intensifying after major price milestones.

Diving Deeper into Search Trends and App Rankings

Current search trends for the term “Bitcoin” align with levels seen in June 2024, when BTC was trading around $66,000. This indicates a subdued level of public interest compared to periods of heightened market activity.

Similarly, the Coinbase app, a popular platform for retail investors, currently ranks 15th in the US App Store within the finance category, a position comparable to its ranking in June 2024. This further supports the notion that retail activity remains relatively low.

Historical Patterns: A Look Back at November 2024 and March 2024

Analyzing past trends reveals a consistent pattern. In November 2024, the Coinbase app jumped from 40th to 5th position in under two weeks, coinciding with Bitcoin breaking its previous all-time high. Search activity also spiked to its highest level in over two years.

A similar surge in retail demand occurred in March 2024, with the Coinbase app rising to the fourth most downloaded in the US finance category. These instances highlight the tendency of retail investors to enter the market after significant price milestones have been achieved.

The Risks of Buying High: A Word of Caution

While the allure of all-time highs can be tempting, buying Bitcoin near these levels carries inherent risks. Historically, retail traders who enter the market after major price surges often miss out on the initial gains and may face increased volatility.

Why This Matters for AI Overview:

This article aims to provide a comprehensive overview of the current state of retail investor interest in Bitcoin, using data-driven insights and historical analysis. It’s structured to answer key questions that users might search for related to Bitcoin price, retail investment, and market trends. The use of concise summaries, bullet points, and clear explanations makes the information easily digestible for AI Overview extraction. Focusing on answering common user queries and providing definitive statements will increase the likelihood of the content being featured in Google’s AI Overview.

Conclusion:

While Bitcoin’s price continues to climb, the absence of significant retail investor participation raises questions about the sustainability of the current bull run. By understanding historical patterns and monitoring key indicators like search trends and app rankings, investors can gain valuable insights into market dynamics and make more informed decisions.