Bitcoin’s Price Surge and Q3 Uncertainty

Bitcoin recently surged to a new all-time high of $111,970, igniting excitement in the crypto market. However, whether this momentum will persist into the third quarter (Q3) remains a topic of debate among analysts.

Bitfinex analysts suggest the coming weeks are crucial. They will likely determine if the recent breakout was a temporary peak or a prelude to further gains in Q3. A period of consolidation or a minor price pullback could be beneficial, establishing a stronger foundation for future growth.

Historical Q3 Performance

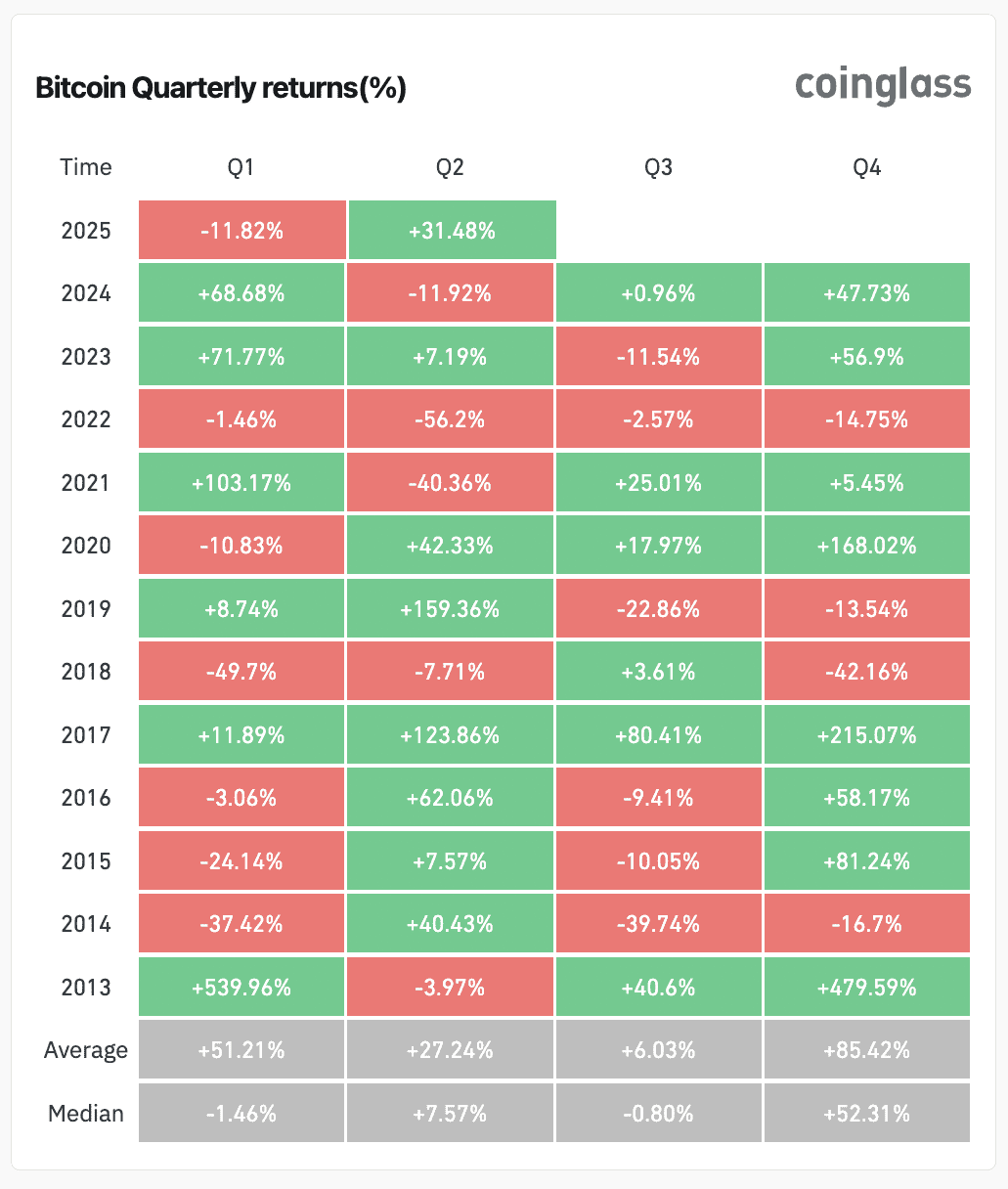

Historically, Q3 has been Bitcoin’s least successful quarter, averaging a return of only 6.03% over the past 11 years, according to CoinGlass data. In comparison, Q2 has seen a stronger average return of 27.25%.

Short-Term Holder Activity

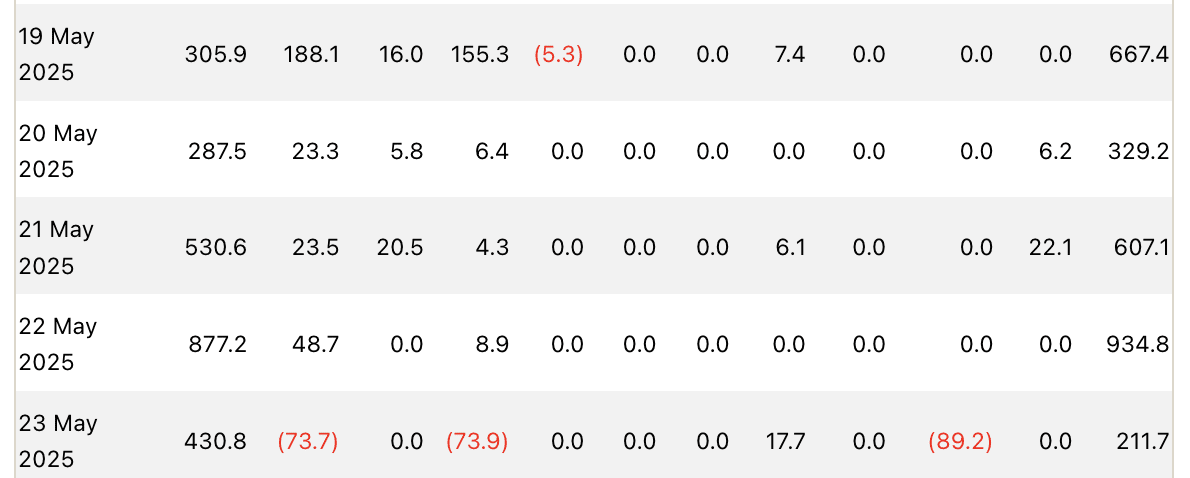

Currently, Bitcoin appears to be in a short-term range-bound phase. A significant number of short-term holders (those holding Bitcoin for less than 155 days) have been selling off their positions in the past month. Over $11.4 billion in profits have been realized by short-term holders recently, which could create a temporary supply overhang. However, structural demand remains strong.

Data from Bitbo indicates that the short-term holder realized price for Bitcoin was $95,781, while Bitcoin was trading at $108,929 at the time of publication. This translates to an average profit of 13.72% for these holders.

Factors Influencing Bitcoin’s Price

Several factors could influence Bitcoin’s price in the coming months:

- ETF Bid Strength: The demand for Bitcoin ETFs is a key indicator of market sentiment. Strong inflows suggest continued institutional interest.

- Low Volatility: Reduced volatility can attract more risk-averse investors.

- Spot Premium: A premium in the spot market indicates healthy demand.

Bitfinex analysts believe these factors suggest a maturing market poised for further growth once macroeconomic conditions become clearer.

Upcoming Economic Events

The US Federal Reserve’s upcoming interest rate decision on June 18 will be closely watched by crypto investors for insights into the future of the economy. The Fed maintained interest rates between 4.25% and 4.50% in May.

Expert Predictions

Prior to the recent surge, several experts predicted new all-time highs for Bitcoin in 2024. Swan Bitcoin CEO Cory Klippsten estimated a 50% chance of new highs before June. Real Vision’s Jamie Coutts also anticipated new all-time highs before the end of Q2.

Conclusion: Cautious Optimism

While Bitcoin’s recent performance has been impressive, historical data suggests Q3 might present challenges. However, strong ETF demand, low volatility, and positive expert predictions contribute to a sense of cautious optimism. Keep an eye on upcoming economic events, particularly the Federal Reserve’s decisions, as they could significantly impact Bitcoin’s trajectory.