Key Takeaways:

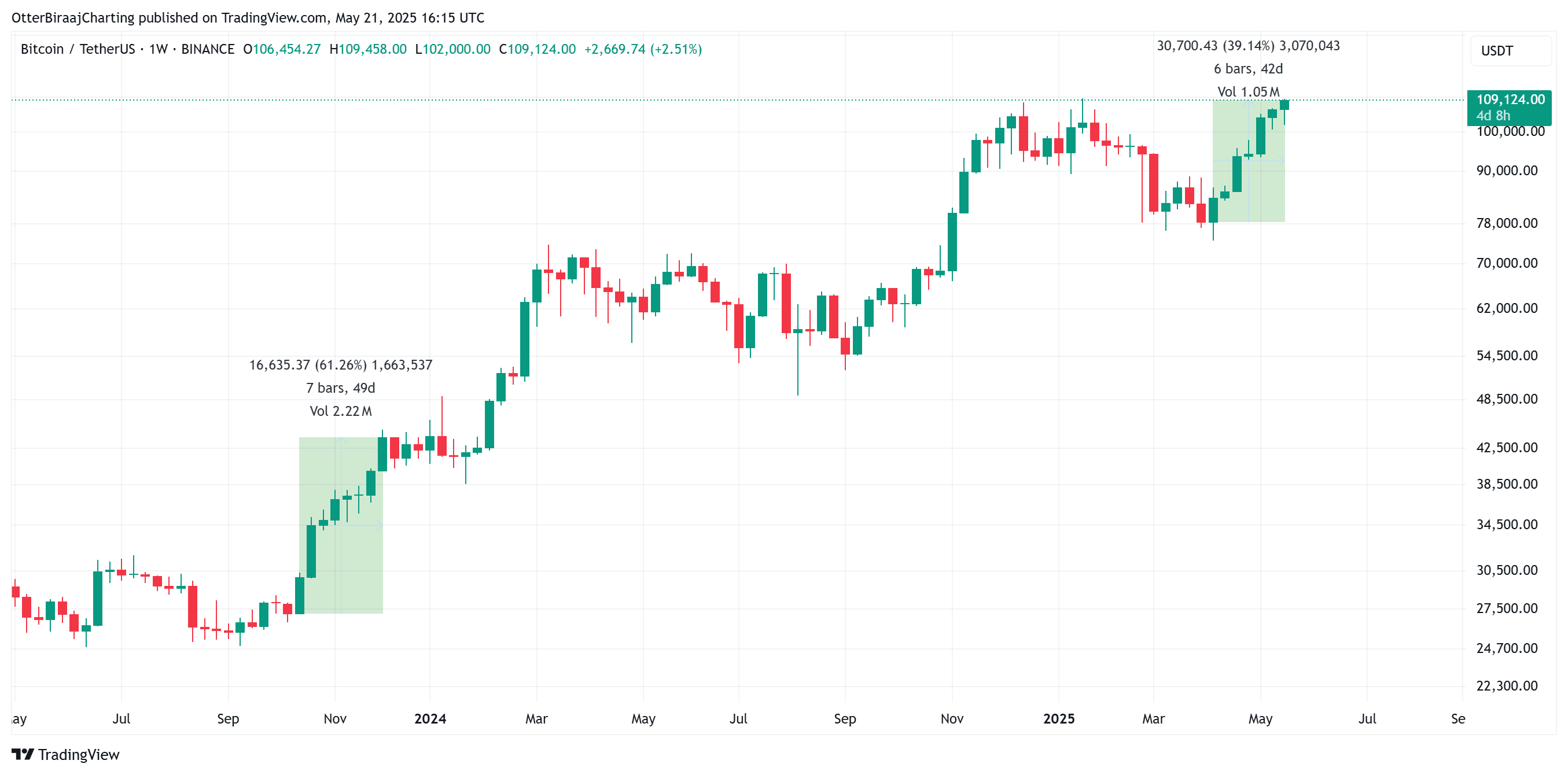

- Bitcoin hit a new all-time high of $109,458 on Binance, marking seven consecutive weeks of gains.

- Analysts’ price targets for Bitcoin in 2025 range from $135,000 to $320,000.

- Market analysis suggests potential volatility due to high-leverage zones, emphasizing the importance of risk management.

Bitcoin (BTC) has experienced a significant surge, reaching a record high and fueling optimism among investors and analysts. This article delves into the factors contributing to this bullish trend and explores potential future price trajectories.

Current Market Momentum

Bitcoin’s recent performance is characterized by a strong uptrend. The surge to a new all-time high is supported by several factors, including increased institutional adoption, growing mainstream awareness, and positive market sentiment. Bitcoin’s market capitalization and realized capitalization have also reached new peaks, underscoring the asset’s growing prominence in the financial landscape.

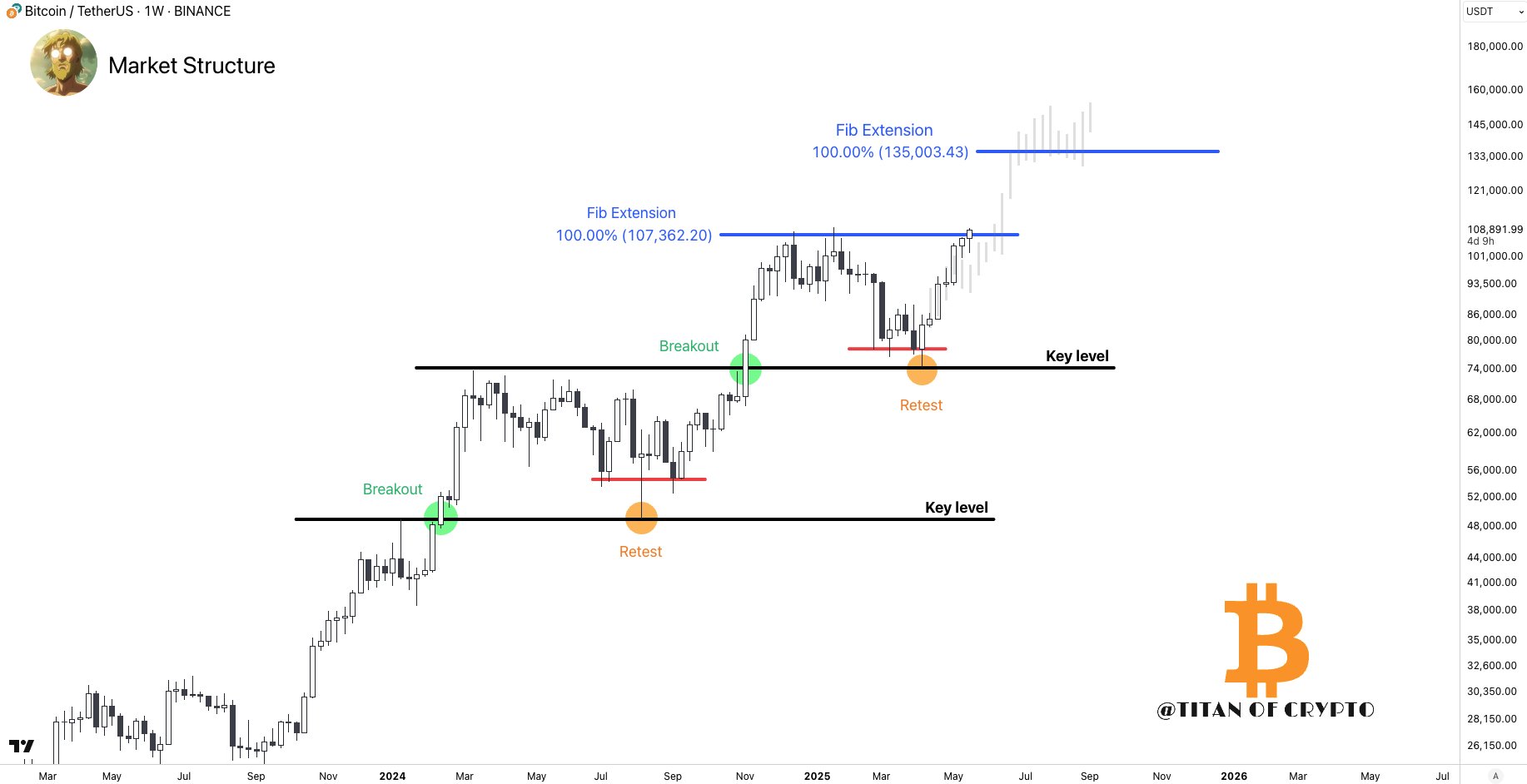

Analyst Projections and Price Targets

Several analysts have weighed in on Bitcoin’s potential future price. Their projections, based on various technical indicators and market trends, paint a picture of continued growth.

- Titan of Crypto: Projects a price target of $135,000 for 2025, based on Fibonacci extension levels.

- Peter Brandt: Suggests a potential top between $125,000 and $150,000 by the end of August.

- Gert van Lagen: Foresees a more ambitious target between $300,000 and $320,000, citing Bitcoin’s breakout from a bullish Megaphone Pattern and Elliott Wave Theory.

Analyzing the Bullish Megaphone Pattern

Gert van Lagen’s analysis highlights the significance of the bullish Megaphone Pattern. This pattern, characterized by diverging trendlines with higher highs and lower lows, suggests a potential for a sharp uptrend after breaking the upper resistance. This pattern, combined with Elliott Wave Theory, supports the analyst’s high price target.

Risk Management and Market Volatility

While the overall outlook for Bitcoin appears positive, analysts advise caution and emphasize the importance of risk management. Market dynamics, such as high-leverage zones, suggest the potential for volatility and liquidations. Investors should remain vigilant and implement appropriate risk mitigation strategies.

Factors Driving Bitcoin’s Price Increase: A Detailed Look

Several key factors have contributed to Bitcoin’s recent price surge:

- Institutional Adoption: Major corporations and financial institutions are increasingly investing in Bitcoin, lending credibility and stability to the market. Examples include MicroStrategy, Tesla, and various hedge funds and investment firms.

- Increased Mainstream Awareness: As Bitcoin gains more media coverage and public attention, more individuals are becoming aware of its potential as an investment asset. This increased awareness leads to greater demand and upward price pressure.

- Halving Events: Bitcoin’s halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are created. This scarcity effect can lead to price increases as demand remains constant or increases.

- Inflation Hedge: Some investors view Bitcoin as a hedge against inflation, particularly in times of economic uncertainty. As governments print more money and traditional currencies devalue, Bitcoin’s fixed supply makes it an attractive store of value.

- Technological Advancements: Ongoing developments in Bitcoin’s underlying technology, such as the Lightning Network, improve its scalability and usability, further enhancing its appeal.

- Geopolitical Factors: Economic instability or political turmoil in certain regions can drive investors towards Bitcoin as a safe haven asset, increasing demand and driving up the price.

Conclusion

Bitcoin’s recent surge to a new all-time high reflects the increasing maturity and acceptance of cryptocurrency as an asset class. While price predictions vary, the overall sentiment remains bullish, with analysts projecting further gains in the coming months and years. However, investors should remain cautious and prioritize risk management in light of potential market volatility.