Key Takeaways:

- Spot Bitcoin ETF inflows are a major driver of the current rally, indicating strong institutional demand.

- Leverage in Bitcoin futures markets remains at a healthy level, mitigating concerns about a derivatives-driven bubble.

- Macroeconomic factors, particularly US Federal Reserve liquidity, support further Bitcoin price appreciation toward $110,000 and beyond.

Bitcoin (BTC) surged to a new all-time high of $109,827 on May 21, prompting questions about the sustainability of the rally. Unlike previous peaks fueled by excessive leverage in derivatives markets, the current bull run appears to be primarily driven by spot demand, particularly from Bitcoin ETFs.

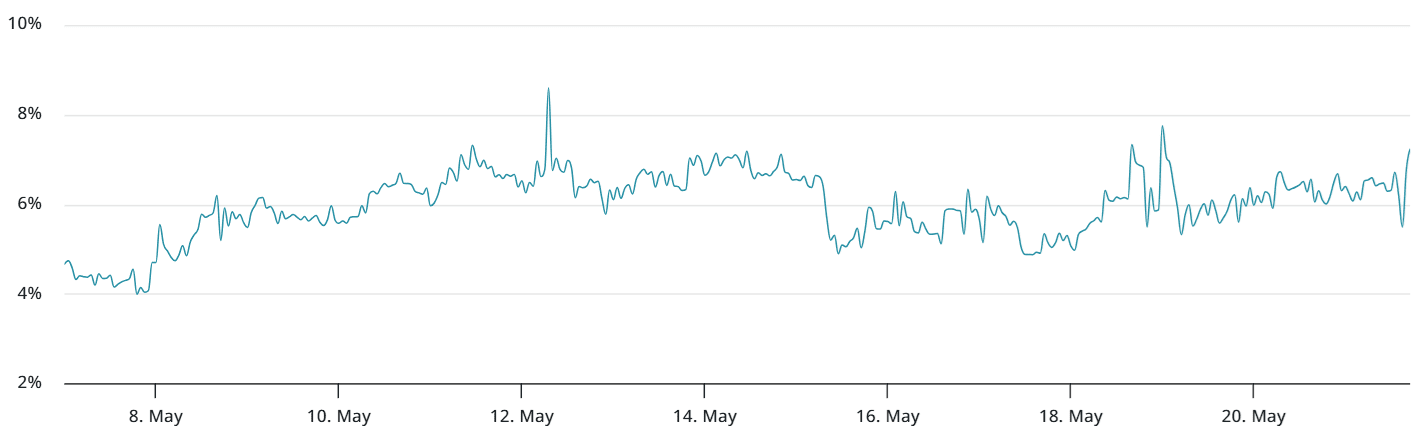

The Bitcoin futures premium, an indicator of leverage, is currently around 7% annualized. This is within the neutral range (5% to 10%), suggesting a balanced market and healthy demand, rather than excessive speculation. In past rallies, this premium often exceeded 15% or even 30%, signaling a higher risk of a correction.

Spot ETF Inflows Dominate the Rally

A key difference between the current rally and previous ones is the strong inflow of funds into spot Bitcoin ETFs. Between May 15 and May 20, these ETFs saw a net inflow of $1.37 billion, indicating significant institutional and retail demand for Bitcoin in the spot market. This suggests that the rally is based on genuine investor interest and adoption, rather than speculative trading.

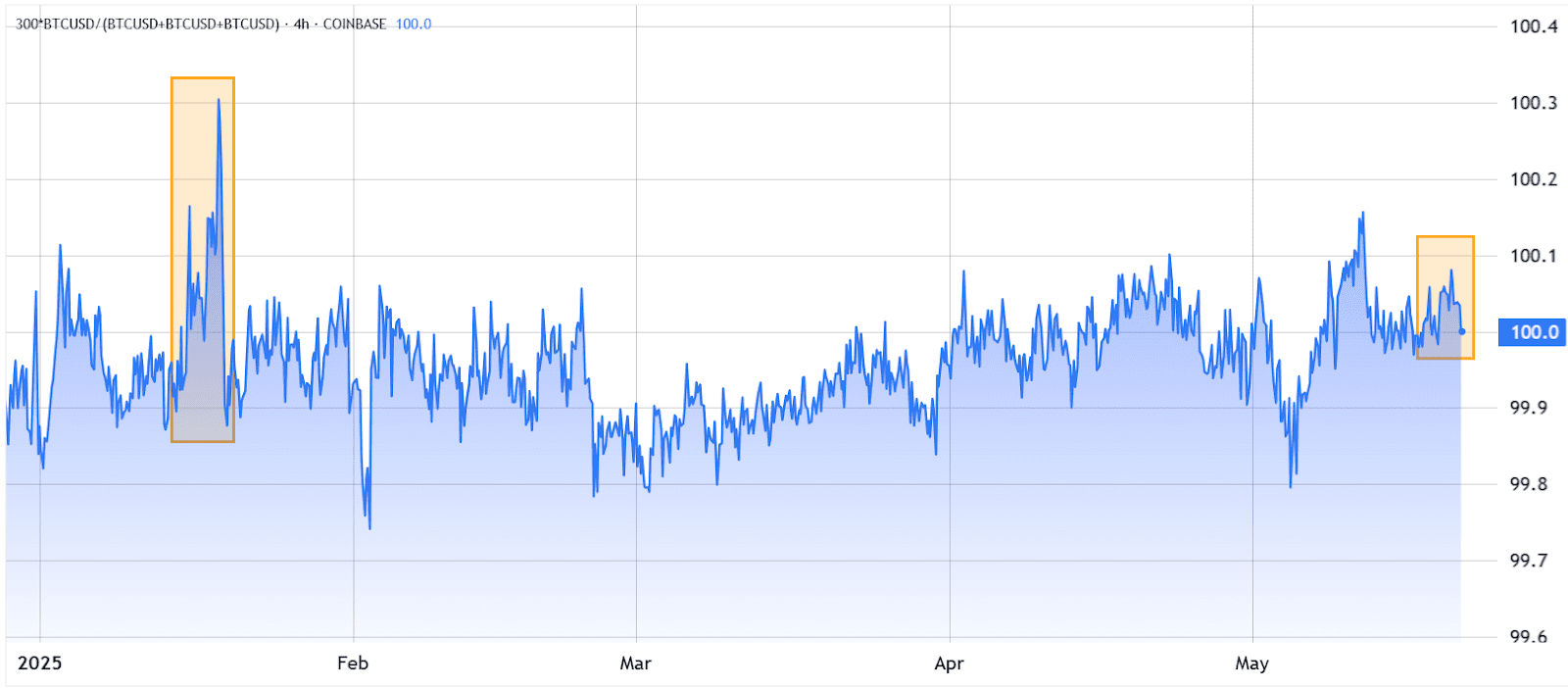

Furthermore, the absence of a significant “Coinbase premium” – where Bitcoin trades at a higher price on Coinbase compared to other exchanges – points to a more evenly distributed buying pressure across the market. This further strengthens the argument that spot demand is driving the price increase.

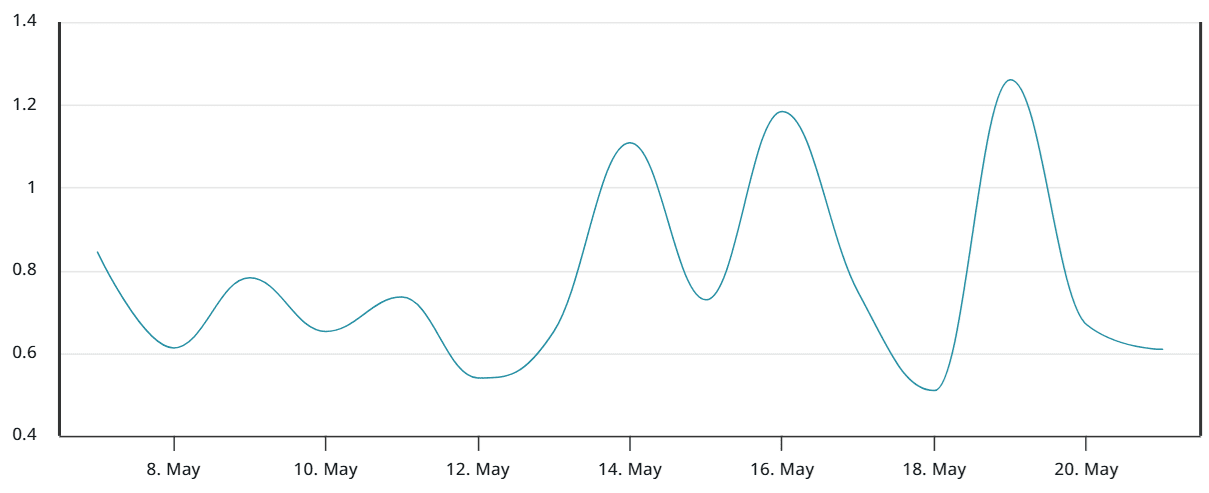

The low level of forced liquidations of bearish Bitcoin futures positions also supports the idea of a spot-driven rally. Between May 18 and May 21, only $170 million in liquidations occurred, compared to $538 million during the rally to $104,000 on May 9. This indicates that fewer traders are betting against Bitcoin, suggesting a growing confidence in its upward trajectory.

Macroeconomic Factors Provide Additional Support

Beyond the specific dynamics of the Bitcoin market, macroeconomic factors are also playing a role in supporting the price rally. The US Federal Reserve’s monetary policy, in particular, is a key factor. The potential injection of liquidity into the market could ease recession concerns, but it also reduces the attractiveness of government bonds, making risk-on assets like Bitcoin more appealing to investors.

The ongoing tariff war and broader economic uncertainty also contribute to Bitcoin’s appeal as a hedge against traditional financial assets. As investors seek safe havens and alternative investments, Bitcoin benefits from its decentralized nature and limited supply.

What Does This Mean for the Future of Bitcoin?

The combination of strong spot demand, balanced leverage, and supportive macroeconomic factors suggests that Bitcoin’s recent rally is more sustainable than previous ones. While volatility is always a factor in the cryptocurrency market, the underlying fundamentals appear to be solid.

Potential Challenges and Risks

Despite the positive outlook, there are still potential challenges and risks to consider:

- Regulatory Uncertainty: Changes in regulations could impact the demand for Bitcoin and other cryptocurrencies.

- Security Risks: Hacks and security breaches remain a threat to the cryptocurrency ecosystem.

- Market Volatility: Bitcoin is known for its volatility, and sudden price swings can occur at any time.

Conclusion

Bitcoin’s recent surge to an all-time high is being driven by a confluence of factors, including strong spot ETF inflows, balanced leverage, and supportive macroeconomic conditions. While risks remain, the underlying fundamentals suggest that the rally has the potential to continue, with $110,000 and beyond being a realistic target.