Bitcoin (BTC) has demonstrated resilience, hovering around $110,000 despite persistent global recession fears and volatility in traditional markets. This performance is attributed to several factors, including increased institutional investor demand, corporate adoption, and its perception as an inflation hedge. Let’s delve into the key elements influencing Bitcoin’s price and its potential future trajectory.

Key Factors Supporting Bitcoin’s Price

- Institutional Investor Demand and Corporate Adoption: Major players like Trump Media are increasingly viewing Bitcoin as a strategic asset, contributing to its value beyond speculative trading.

- Inflation Hedge Narrative: Investors perceive Bitcoin as a store of value that can protect against inflation, especially if the US Federal Reserve maintains lower interest rates or injects liquidity into the market.

- Potential Fed Actions: The expectation that the Fed might hold rates steady or implement liquidity measures supports Bitcoin’s price, as lower rates generally favor risk-on assets.

Bitcoin’s Antifragility in Uncertain Times

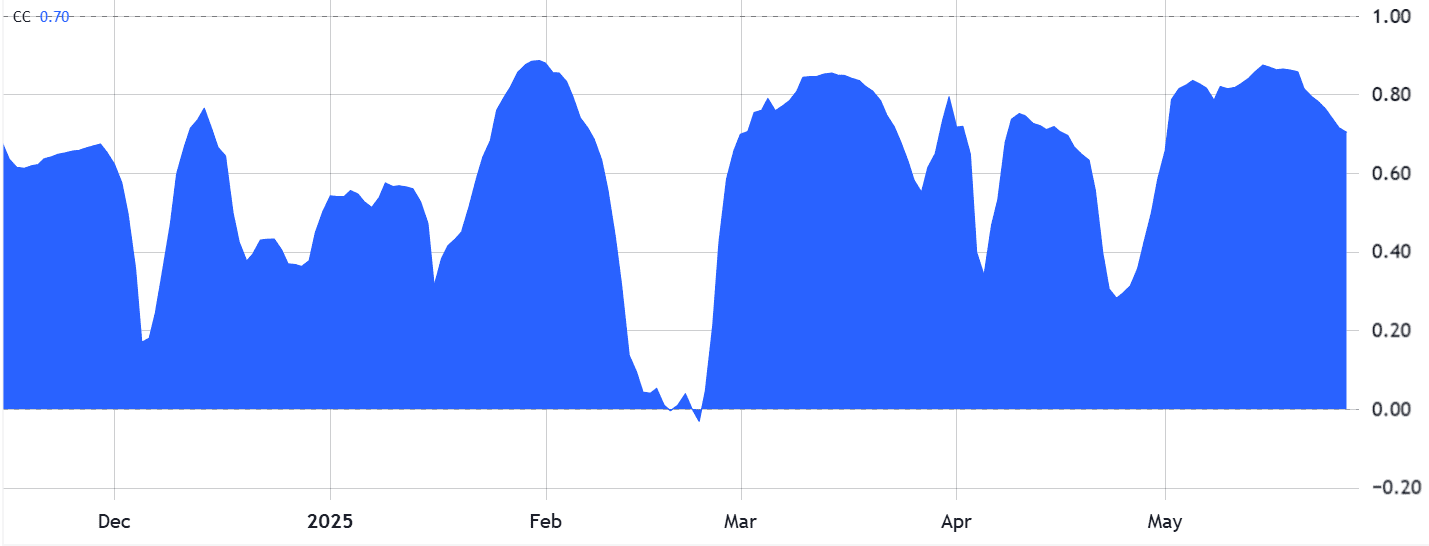

The question arises: Is Bitcoin becoming an antifragile asset, capable of thriving in volatile economic conditions? While Bitcoin remains correlated with the S&P 500 to some extent, its growing adoption by corporations and its perception as a hedge against financial risk suggest a potential for divergence.

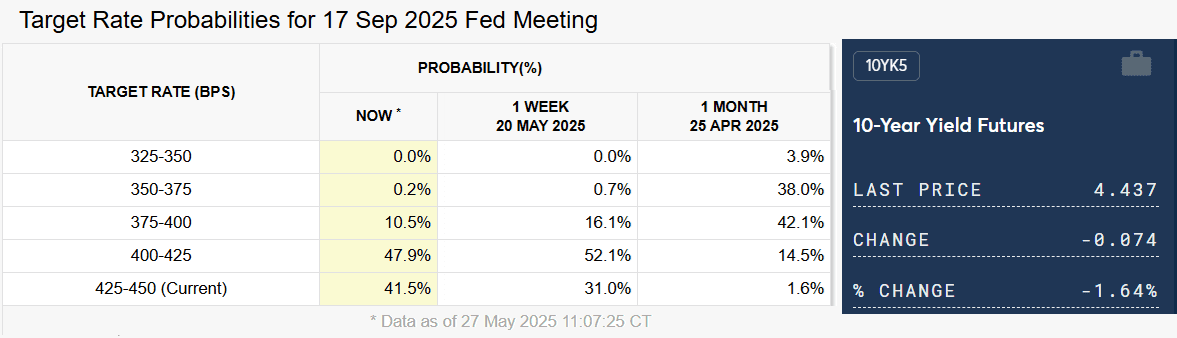

Traders estimate a 41% chance that the US Federal Reserve (Fed) will maintain interest rates through September, a significant increase from just 2% a month ago. This expectation influences Bitcoin’s market dynamics.

Typically, higher capital costs negatively impact risk-on assets like Bitcoin. However, in the current context, it suggests possible liquidity injections by the Fed, given the challenging US fiscal outlook where spending outpaces revenue.

Bitcoin vs. Traditional Markets: Correlation and Divergence

While Bitcoin’s market capitalization surpasses that of giants like Google and Meta, it’s essential to acknowledge its correlation with traditional markets. A significant correlation with the S&P 500 means that a bear market in equities could negatively impact Bitcoin.

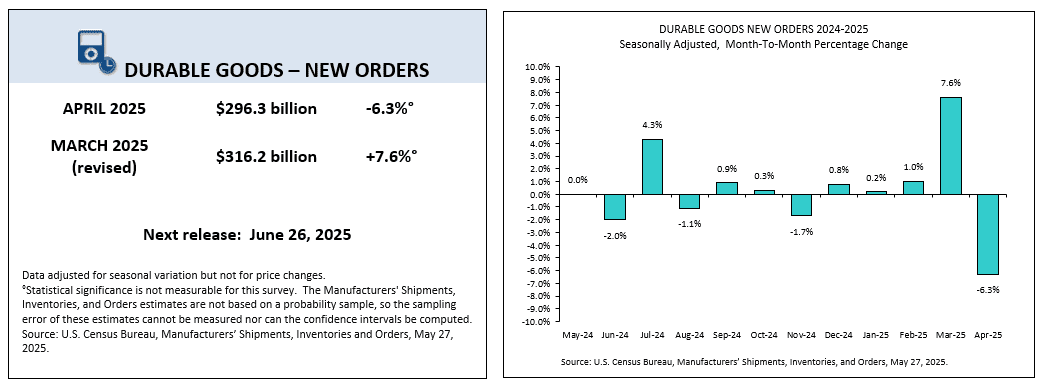

Recent macroeconomic indicators, such as the drop in US durable goods orders, point to a potentially weakening economy. These factors influence market sentiment and can impact both traditional assets and cryptocurrencies.

Disappointing corporate earnings could lead to faster interest rate cuts, benefitting companies through lower financing costs and stimulated consumer demand.

Trump Media’s Bitcoin Acquisition: A Strategic Move

Trump Media’s plan to acquire Bitcoin signifies a shift in how major corporations perceive cryptocurrency. Their view of Bitcoin as a strategic asset and a tool for financial freedom highlights its growing acceptance in the business world.

According to Reuters, Trump Media CEO Devin Nunes stated that they view Bitcoin as an “apex instrument of financial freedom”. This development suggests that Bitcoin’s trajectory towards $112,000 is not solely tied to broader economic growth.

Bitcoin’s Future Outlook

Bitcoin’s upside potential hinges on monetary policy, institutional positioning, and its role as a hedge against systemic financial risk. Factors such as the Fed’s interest rate decisions, increasing corporate adoption, and its ability to function as a store of value will play crucial roles in shaping its future performance.

The increasing institutional and corporate interest adds a new dimension to Bitcoin’s market behavior. While macroeconomic trends and correlations with traditional assets still matter, Bitcoin is increasingly being framed as a strategic asset with utility beyond speculation.

In summary, while traditional markets remain susceptible to macro data and earnings surprises, Bitcoin’s future appears tied to a complex interplay of monetary policy, institutional investment, and its rising status as a safety net against financial uncertainty. Understanding these factors is critical for investors navigating the dynamic world of cryptocurrency.