Bitcoin (BTC) has exhibited remarkable resilience against a backdrop of macroeconomic uncertainty, leading some analysts to suggest a potential decoupling from traditional financial markets. However, experts at Bitfinex caution that while this strength is evident, its long-term structural integrity remains to be proven.

Key Takeaways:

- Relative Strength: Bitcoin has outperformed US equities in recent weeks, suggesting a potential shift in market dynamics.

- Decoupling Narrative: Analysts are watching to see if Bitcoin’s strength persists through upcoming CPI data releases and earnings volatility. A shift from ‘temporary divergence’ to ‘regime change’ will become clear.

- Macroeconomic Risks: The crypto market is currently navigating a ‘hybrid state’ influenced by both rising macroeconomic risks and increased inflows into spot Bitcoin ETFs.

- CPI Impact: The upcoming Consumer Price Index (CPI) data will be crucial in determining the short-term trajectory of Bitcoin.

Bitcoin’s Performance Amid Market Volatility

The analysts’ note highlighted that while Bitcoin’s outperformance against US equities is noticeable, it’s essential to avoid premature conclusions. Previous instances of short-term outperformance have been followed by a return to alignment with the broader market.

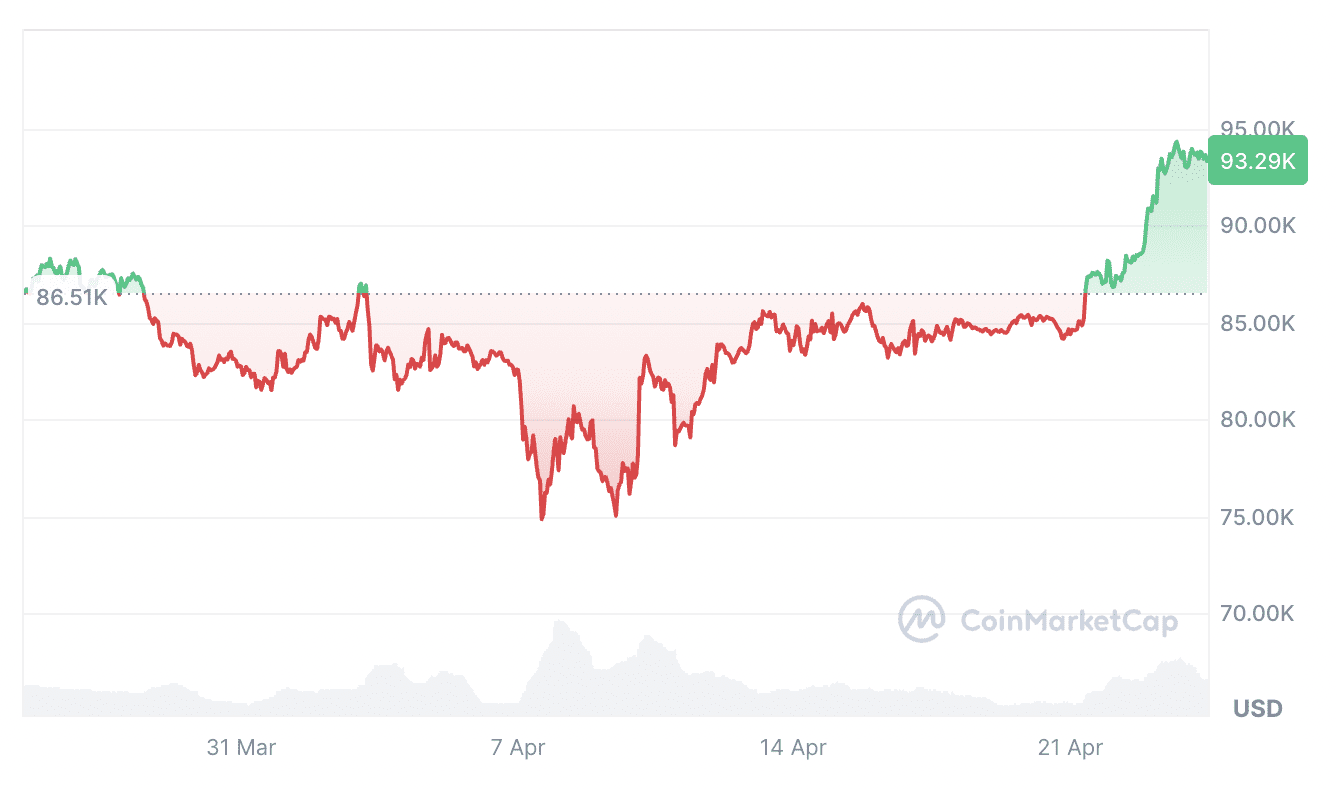

Recent data supports the observation of Bitcoin’s independent movement. Cointelegraph reported that Bitcoin increasingly mirrors gold’s upside, diverging from its traditional correlation with stock market performance. Over the past 30 days, Bitcoin has gained 7.68%, while the S&P 500 and Nasdaq have declined by 6.79% and 8.14%, respectively.

Notably, Nvidia (NVDA), a stock that previously outperformed Bitcoin over the past decade, experienced a 15.4% decline during the same period. Analysts attribute this decline to restrictions on advanced chip exports to China and the resulting tariff-driven volatility. Cory Klippsten, CEO of Swan Bitcoin, suggested that Nvidia has a ‘near zero chance’ of outperforming Bitcoin over the next decade.

The ‘Cleanest Shirt’ Analogy and ETF Inflows

Bitfinex analysts describe the current crypto market as a ‘hybrid state,’ characterized by rising macroeconomic risks juxtaposed with an increase in spot Bitcoin ETF inflows. April 22 witnessed $913 million in spot Bitcoin ETF inflows, marking the largest influx since late January. This influx of capital contributes to Bitcoin’s appeal as the ‘cleanest shirt in the dirty laundry,’ solidifying its role as a compelling store of value.

Bitcoin’s dominance has surged to levels unseen since late 2021. At the time of publication, Bitcoin’s dominance stood at 64.39%, according to TradingView data.

CPI Data and Future Outlook

Crypto market participants are keenly awaiting the release of April’s Consumer Price Index (CPI) data. March’s CPI data showed a cooling trend, which some analysts interpreted as a bearish signal for Bitcoin. March’s CPI came in at 2.4% year-over-year, down from 2.8% in February, marking the lowest level since February 2023.

However, other indicators suggest that Bitcoin’s current rally may face challenges. Markus Thielen, head of research at 10x Research, cautions that the stablecoin minting indicator has not yet returned to high-activity levels, suggesting a need for continued vigilance regarding the sustainability of Bitcoin’s upward trend.

Factors Influencing Bitcoin’s Price

- Macroeconomic conditions: Inflation, interest rates, and global economic growth all play a significant role.

- Regulatory environment: Government regulations regarding cryptocurrency can have a major impact on price and adoption.

- Institutional adoption: Increased investment from institutional investors can drive up demand and price.

- Technological developments: Improvements in blockchain technology can increase the utility and value of Bitcoin.

- Market sentiment: Public perception and overall market sentiment can also influence Bitcoin’s price.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risks, and you should conduct your own thorough research before making any investment decisions.