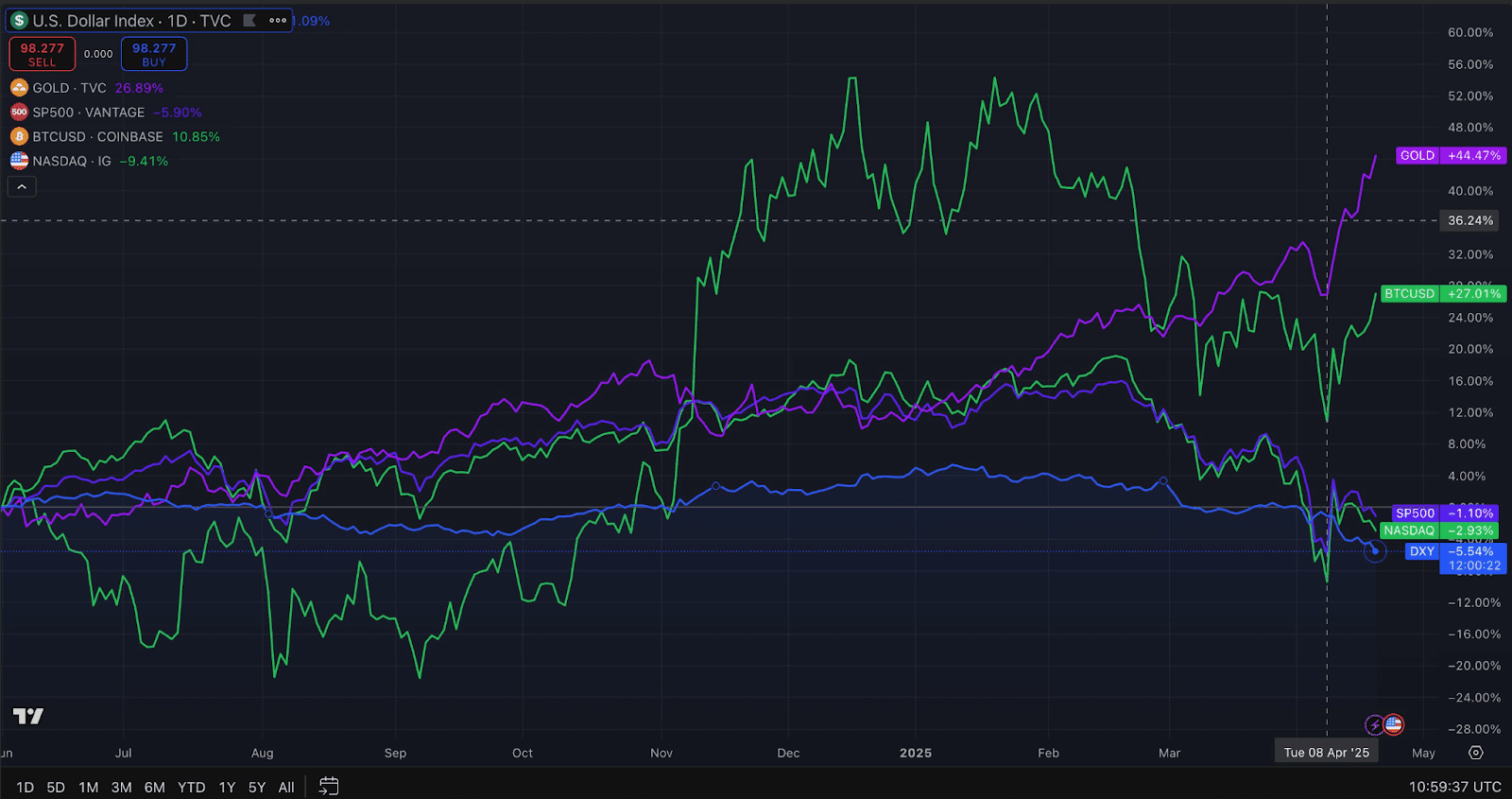

Bitcoin is increasingly being viewed as a safe-haven asset, demonstrating resilience against traditional market volatility and economic uncertainty. Recent analysis indicates a shift in Bitcoin’s behavior, decoupling from the U.S. stock market and aligning more closely with precious metals like gold.

Bitcoin’s Decoupling from Nasdaq

According to Alex Svanevik, co-founder and CEO of Nansen, Bitcoin (BTC) has exhibited a growing maturity, behaving “less Nasdaq — more gold” over the past few weeks. This suggests that Bitcoin is gaining recognition as a store of value, independent of traditional tech stock fluctuations.

This trend was observed even as trade tensions escalated between the U.S. and China. Bitcoin staged a 12% recovery in the two weeks leading up to April 22nd, demonstrating resilience even amidst escalating tariff increases. The US increased reciprocal tariffs on China to 125% as of April 9, while China raised import tariffs from 84% to 125% effective April 12.

Bitcoin’s surprising resilience compared to altcoins and indices like the S&P 500 highlights its potential as a hedge against economic downturns. However, it remains vulnerable to broader economic recession concerns.

Bitcoin vs. Gold: A Safe Haven Comparison

While Bitcoin shows promise as a safe haven, experts believe gold may prove more resilient in the face of investor panic. Gold holdings could potentially be sold to cover margin calls during extreme market downturns. Still, Bitcoin stands to gain from regulatory developments, particularly those concerning the U.S. Bitcoin Reserve.

Developments regarding how the Treasury is exploring avenues to exchange reserves into BTC will be crucial for Bitcoin’s continued growth as a safe haven.

The US Bitcoin Reserve

The U.S. Bitcoin reserve, initially funded with BTC forfeited in government criminal cases, is poised to expand. President Trump’s executive order encourages the development of “budget-neutral strategies” to acquire more Bitcoin, signaling long-term commitment to crypto asset integration.

The U.S. government is exploring innovative methods to fund its Bitcoin investments, including utilizing tariff revenue and reevaluating the Treasury’s gold certificates to create a paper surplus to fund the BTC reserve without selling gold.

Recession Risk: A Potential Threat

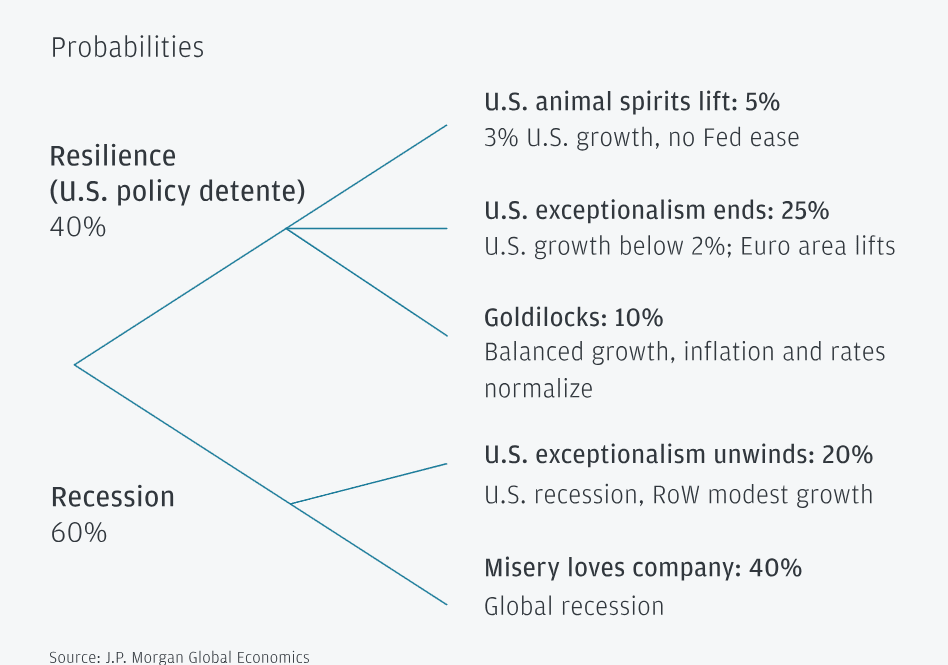

Despite Bitcoin’s resilience against tariff concerns, a looming U.S. recession could negatively impact demand for risk assets, including Bitcoin.JPMorgan has increased the probability of a U.S. recession in 2025 from 40% to 60%.

The unwinding of tariffs provides some relief, but the remaining tariff structure poses a threat to economic growth, contributing to the elevated recession probability.

JPMorgan anticipates the Federal Reserve to begin easing monetary policy in September, with subsequent cuts at each meeting through January 2026, ultimately reaching a 3% policy rate by June 2026. This easing could mitigate some of the negative impacts of a recession on Bitcoin’s price.

Bitcoin’s Bullish Fundamentals: A Summary

Despite potential headwinds from a recession, Bitcoin’s evolving role as a safe haven asset, coupled with increasing regulatory acceptance and government adoption, positions it for long-term growth. Key factors contributing to this bullish outlook include:

- Decoupling from traditional markets: Bitcoin is demonstrating independence from stock market fluctuations.

- Growing adoption: Increasing institutional and government interest is driving demand.

- Safe haven appeal: Bitcoin is viewed as a hedge against inflation and economic uncertainty.

- Regulatory Clarity: Continued regulatory development fostering a more favorable environment for Bitcoin.

While short-term volatility remains a factor, the long-term outlook for Bitcoin appears positive, bolstered by its unique characteristics and its increasing recognition as a legitimate asset class.