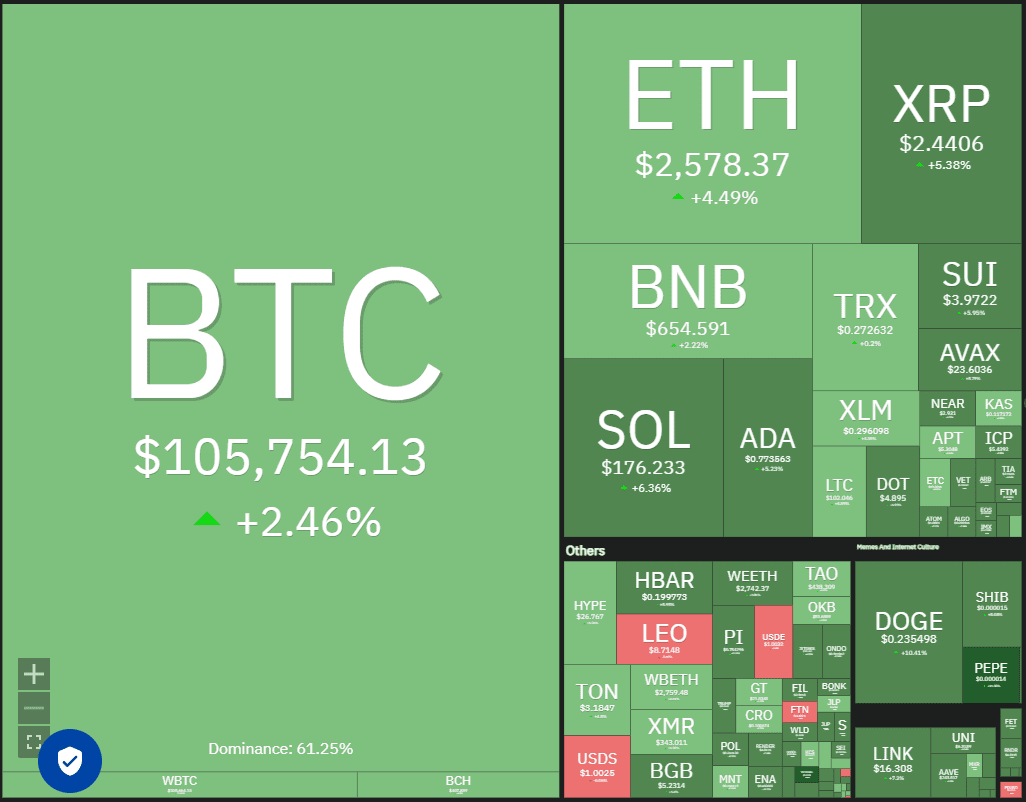

Bitcoin’s recent surge to $105,980 has reignited market excitement, with traders anticipating new all-time highs. This positive momentum could significantly impact altcoins like Ether (ETH), Hyperliquid (HYPE), Monero (XMR), and Aave (AAVE). Let’s delve into the current market analysis and price predictions for each of these cryptocurrencies.

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) has been consolidating within a narrow range, but a recent breakout above $105,500 suggests a potential upside breakout. Technical analysts predict a possible surge to $116,000 in the near term. Furthermore, long-term forecasts remain bullish, with some analysts suggesting Bitcoin could reach $200,000 by the end of 2025, driven by increased institutional demand and a potential supply shock.

Key Takeaways:

- Current Resistance: $105,820

- Potential Target: $116,000 (near-term), $200,000 (end of 2025)

- Support Level: $100,000

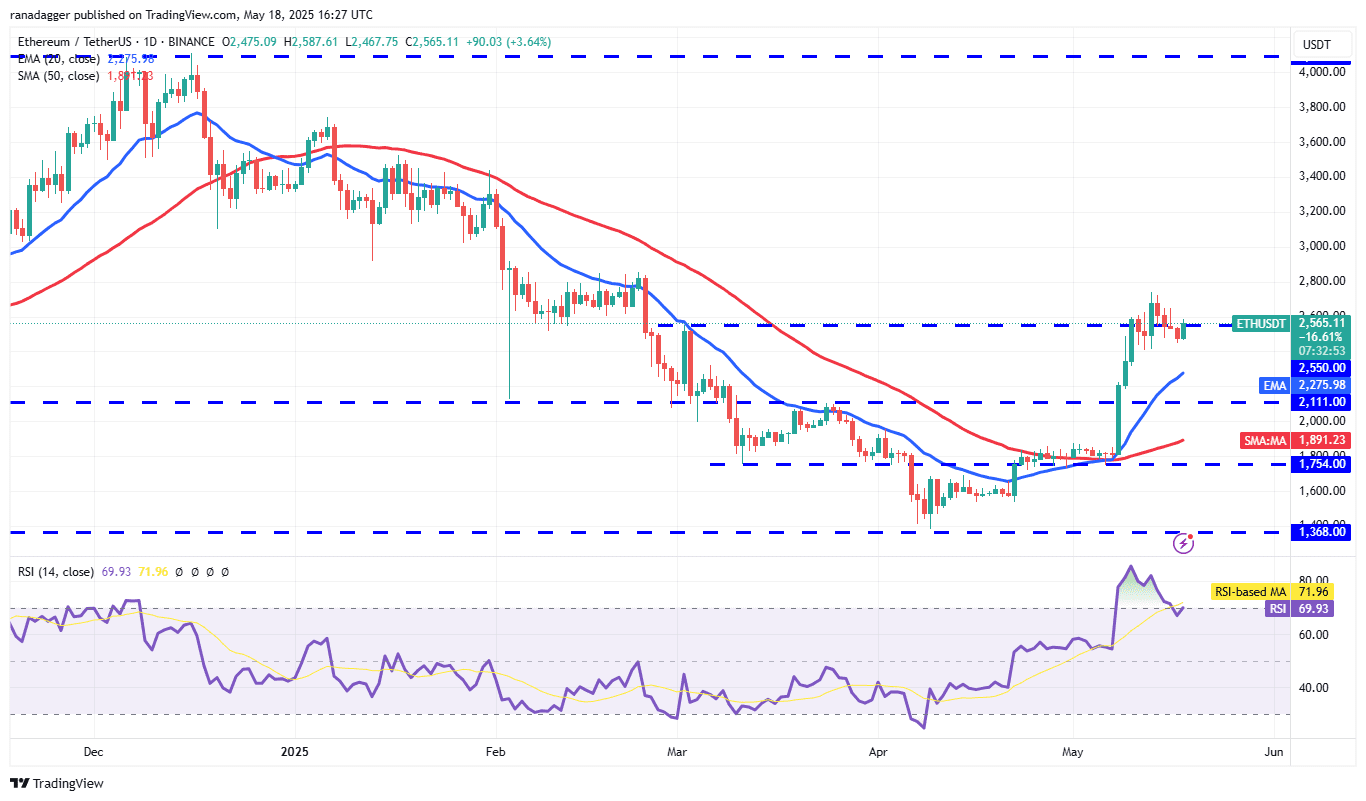

Ether (ETH) Price Analysis

Ether (ETH) experienced a brief dip below the $2,550 breakout level, but bulls are attempting to regain control. Positive indicators include an upward-sloping 20-day exponential moving average (EMA) and a relative strength index (RSI) nearing overbought territory. A successful close above $2,550 could propel ETH towards $3,000.

Key Takeaways:

- Current Resistance: $2,550

- Potential Target: $3,000

- Key Support: $2,400, 20-day EMA ($2,275)

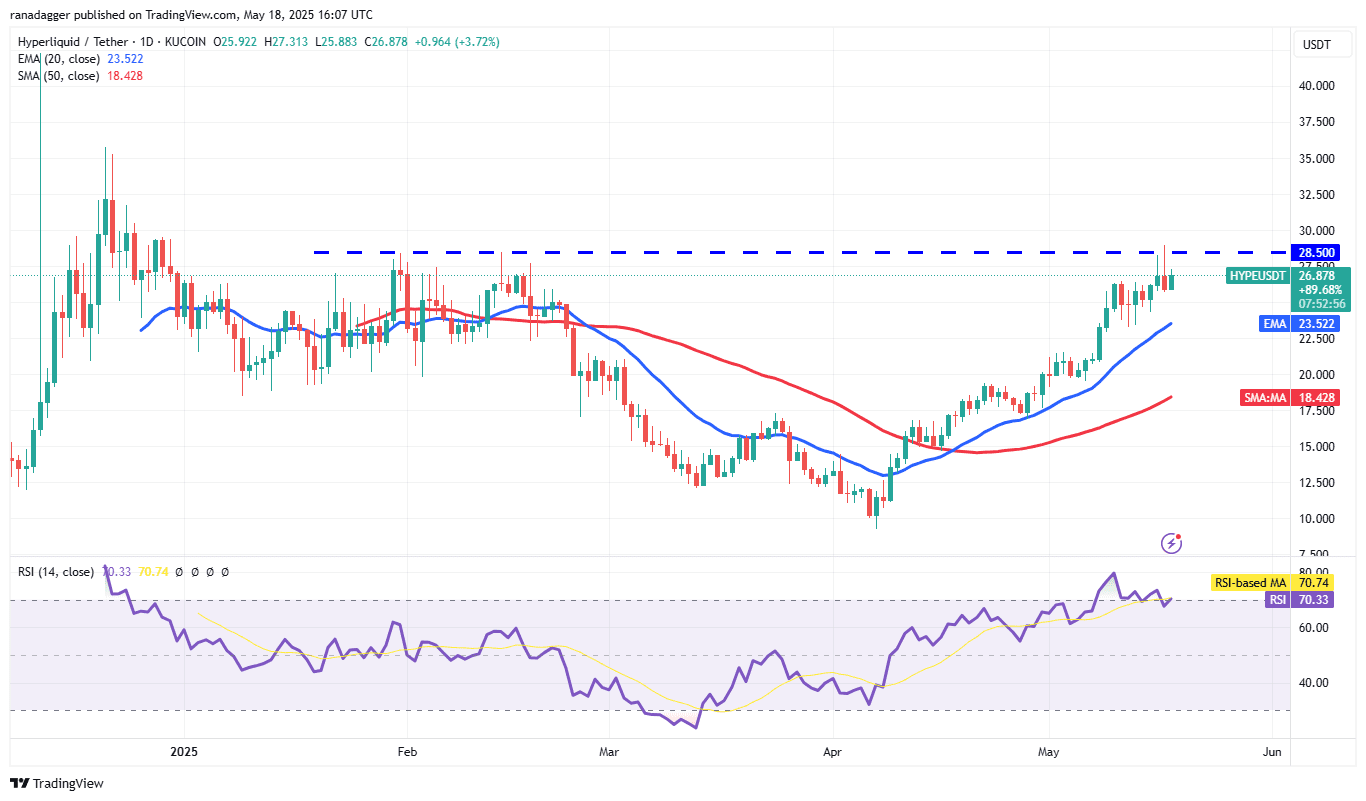

Hyperliquid (HYPE) Price Analysis

Hyperliquid (HYPE) is currently facing resistance at $28.50, but the bulls demonstrate resilience. Upsloping moving averages and an overbought RSI suggest continued bullish momentum. A break above $28.50 could lead to a rally towards $35.73.

Key Takeaways:

- Current Resistance: $28.50

- Potential Target: $35.73

- Key Support: 20-day EMA ($23.52)

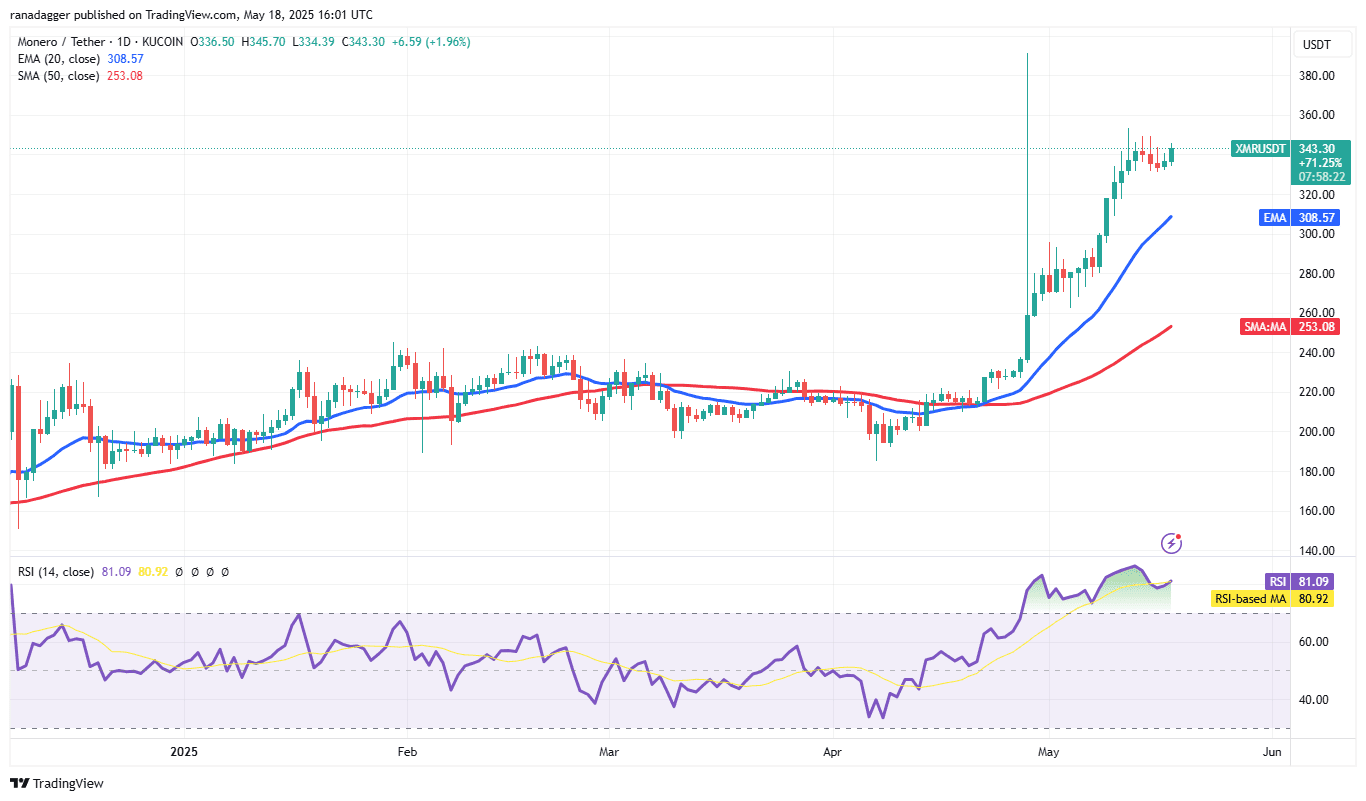

Monero (XMR) Price Analysis

Monero (XMR) recently surged to $353, indicating strong buying pressure. A shallow pullback suggests bulls are holding positions in anticipation of further gains. A sustained break above $353 could propel XMR towards $391, with a potential target of $422.

Key Takeaways:

- Current Resistance: $353

- Potential Target: $391, $422

- Key Support: $331, 20-day EMA ($308)

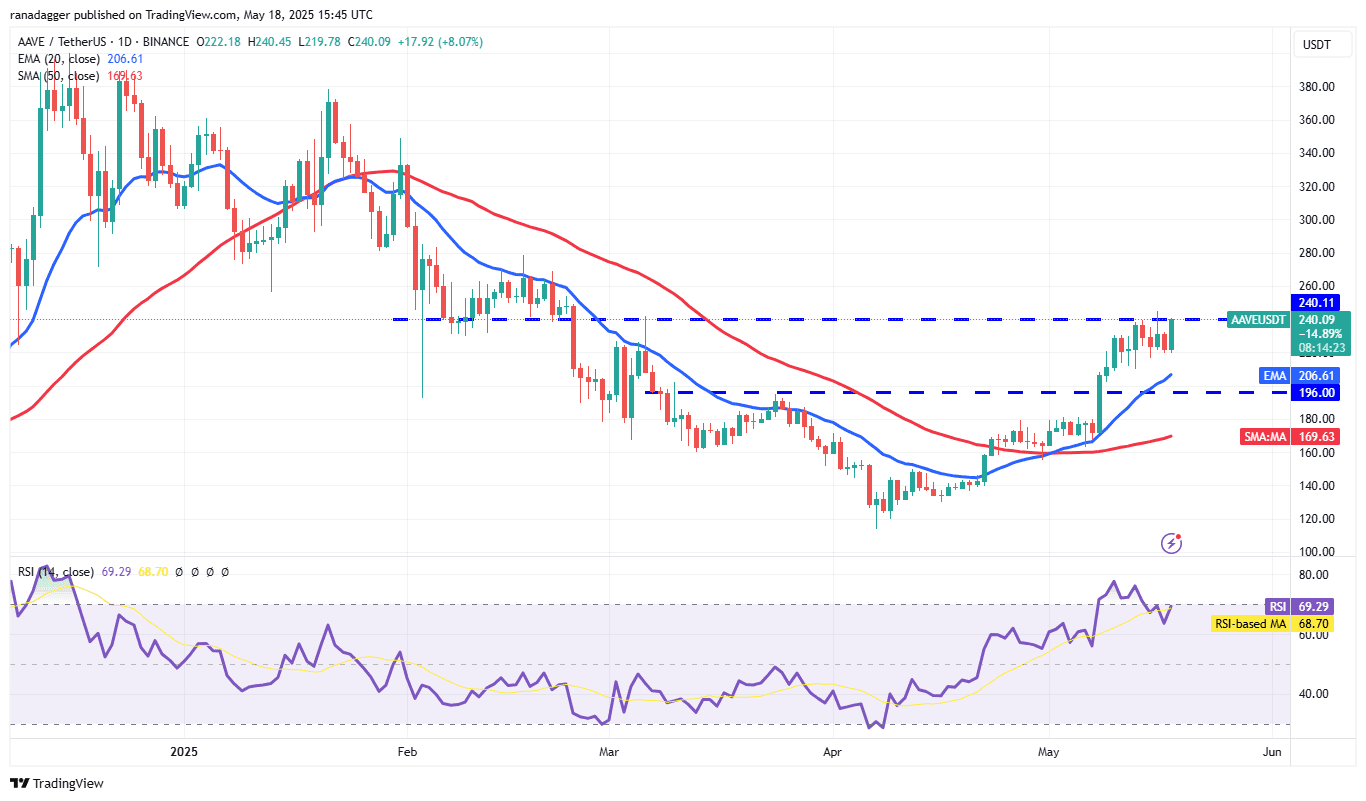

Aave (AAVE) Price Analysis

Aave (AAVE) is encountering resistance at $240, with bulls showing strength by preventing dips to the 20-day EMA. A decisive close above $240 could initiate the next upward leg, potentially reaching $280 and then $300.

Key Takeaways:

- Current Resistance: $240

- Potential Target: $280, $300

- Key Support: 20-day EMA ($206), $196

Factors Influencing the Market

Several factors contribute to the current bullish sentiment in the cryptocurrency market:

- Institutional Adoption: Increased investment from institutional investors is driving demand for Bitcoin and other cryptocurrencies.

- Technical Analysis: Positive technical indicators suggest continued upward momentum for several cryptocurrencies.

- Altcoin Season: Some analysts believe we are entering an altcoin season, where altcoins outperform Bitcoin.

Conclusion

Bitcoin’s recent surge has created a positive outlook for the cryptocurrency market, potentially benefiting altcoins like ETH, HYPE, XMR, and AAVE. While market volatility remains a factor, current trends suggest continued upward momentum for these cryptocurrencies in the near term. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.