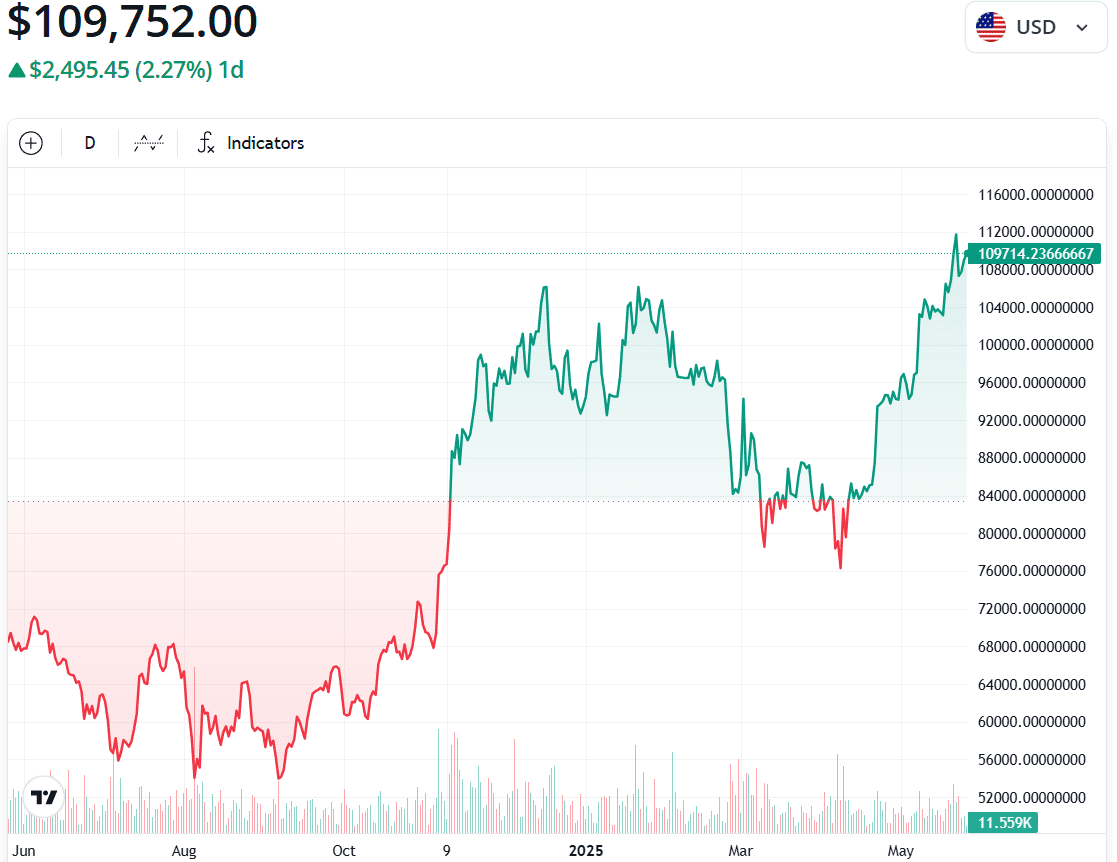

Bitcoin’s (BTC) recent surge to an all-time high of $112,000 on May 22, before settling above $109,700 on May 26, has sparked considerable debate regarding its underlying drivers. While geopolitical factors were initially considered, growing concerns surrounding Japan’s sovereign credit outlook and its impact on bond yields appear to be playing a significant role.

This article delves into the potential connection between the Japanese bond market crisis and Bitcoin’s rising appeal as a safe-haven asset.

Understanding the Japanese Bond Market Crisis

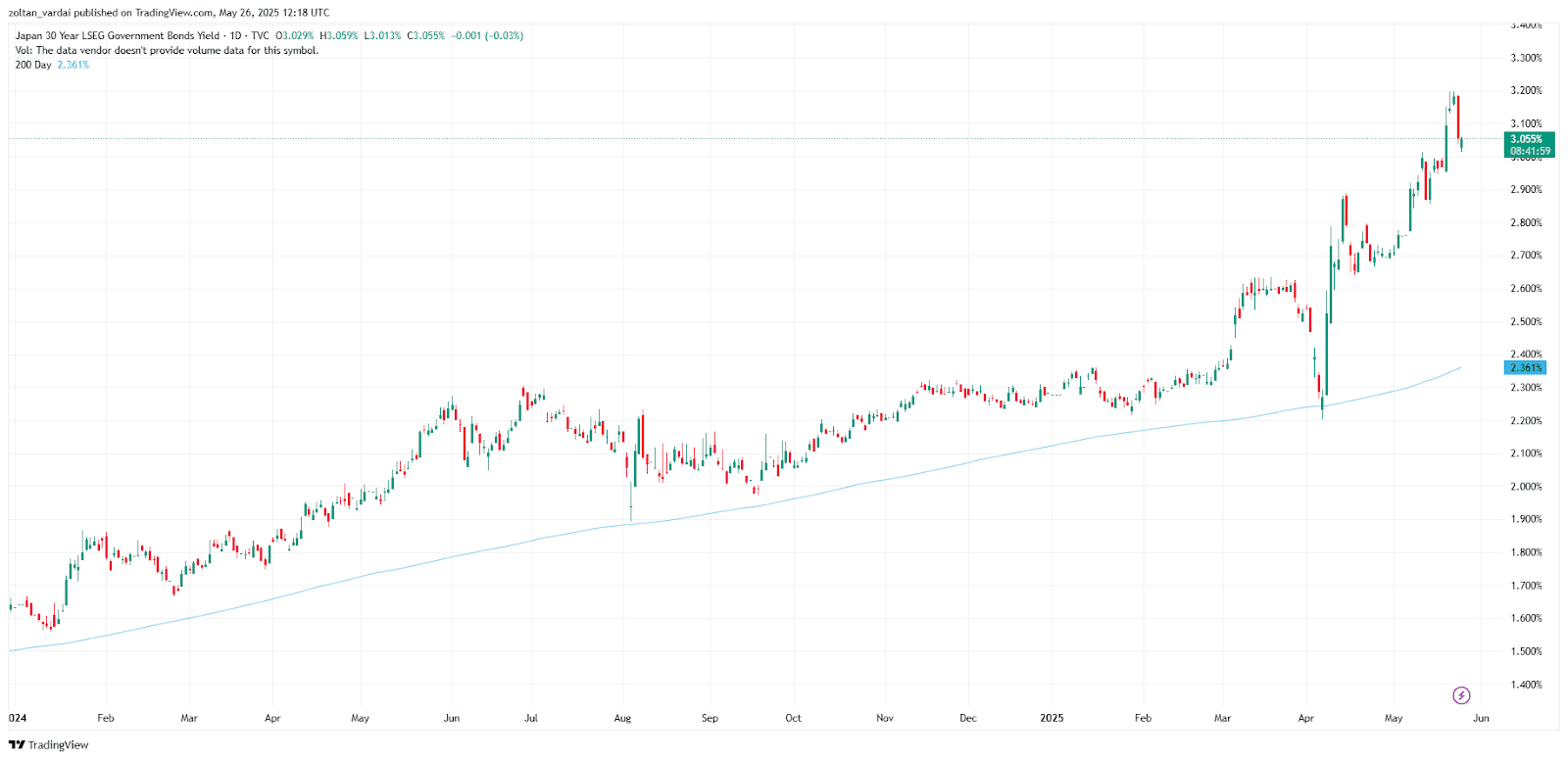

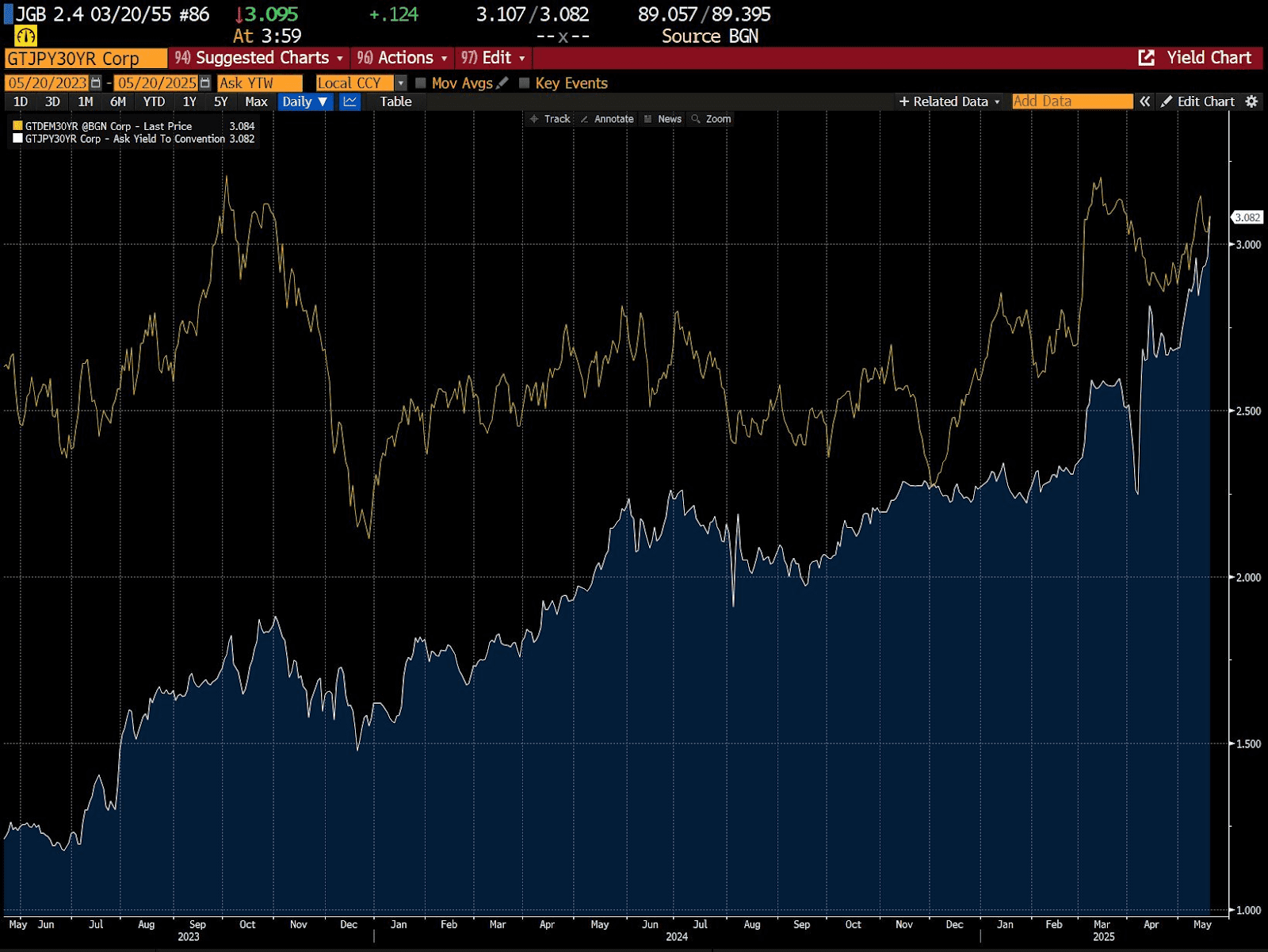

Bitwise’s head of European research, André Dragosch, highlighted the growing unease surrounding Japan’s sovereign creditworthiness, evidenced by a significant spike in the country’s long-term bond yields. The 30-year yield on Japanese bonds reached a record high of 3.185% on May 20, 2025, before slightly retreating.

Typically, government bonds are considered safe-haven investments. However, a sharp increase in yields often indicates investor apprehension about fiscal sustainability and the risk of default. Japan’s debt-to-GDP ratio, exceeding 250%, raises concerns, especially when compared to countries like Germany.

Dragosch explained that rising yields can create a ‘fiscal debt doom loop,’ where increased yields raise sustainability concerns, leading to higher credit risk and further yield increases.

Bitcoin as a Hedge Against Sovereign Risk

The instability in the Japanese bond market has prompted some institutional investors to reassess Bitcoin’s potential as a hedge against sovereign default risk. Bitcoin’s immutable nature and lack of counterparty risk make it an attractive alternative during times of financial uncertainty.

Dragosch argues that as perceived default risk rises, yields continue to climb, potentially driving Bitcoin towards $200,000. This projection, however, depends on continued Bitcoin accumulation by corporations and exchange-traded fund (ETF) holders.

The Role of Bitcoin ETFs

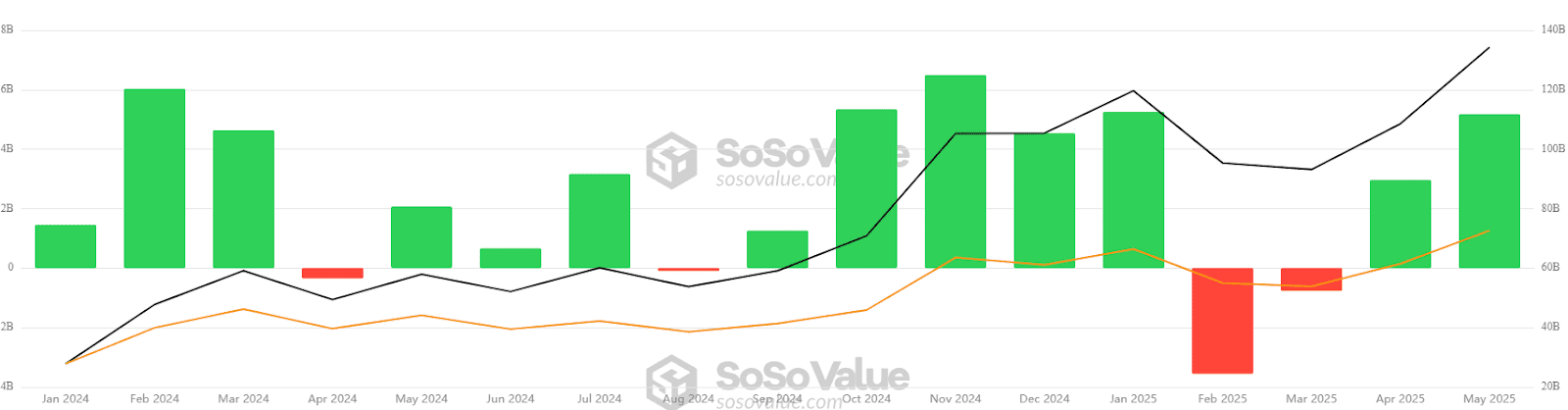

The increasing popularity of Bitcoin ETFs further reinforces Bitcoin’s legitimacy as an investment asset. US spot Bitcoin ETFs are rapidly approaching a monthly inflow record, signaling strong institutional interest and confidence in Bitcoin’s long-term value.

Key Takeaways:

- Japanese Bond Market Instability: Concerns surrounding Japan’s sovereign credit outlook are driving volatility in its bond market.

- Bitcoin as a Safe Haven: Bitcoin is increasingly viewed as a hedge against sovereign risk and financial instability.

- Institutional Adoption: Continued accumulation of Bitcoin by corporations and ETFs is crucial for its price appreciation.

- ETF Inflows: The strong inflows into Bitcoin ETFs highlight growing institutional interest in the cryptocurrency.

Expert Opinions

Several analysts have echoed the sentiment that macroeconomic factors are significantly influencing Bitcoin’s price movements. The growing acceptance of Bitcoin as a legitimate asset class, coupled with its decentralized nature, makes it an attractive alternative to traditional financial systems during times of crisis.

The Future of Bitcoin

As global economic uncertainties persist, Bitcoin’s role as a store of value and a hedge against inflation is likely to strengthen. The convergence of factors, including sovereign debt concerns, institutional adoption, and technological advancements, paints a promising picture for Bitcoin’s future.

However, it is important to note that the cryptocurrency market remains volatile and subject to regulatory changes. Investors should conduct thorough research and exercise caution before investing in Bitcoin or any other cryptocurrency.