Bitcoin’s recent ascent to new all-time highs has sparked considerable discussion, but unlike previous rallies, this one is characterized by a distinct lack of euphoria and excessive leverage. Several factors point to the potential for further price appreciation, making it crucial for investors to understand the underlying dynamics.

Key Factors Driving Bitcoin’s Continued Growth

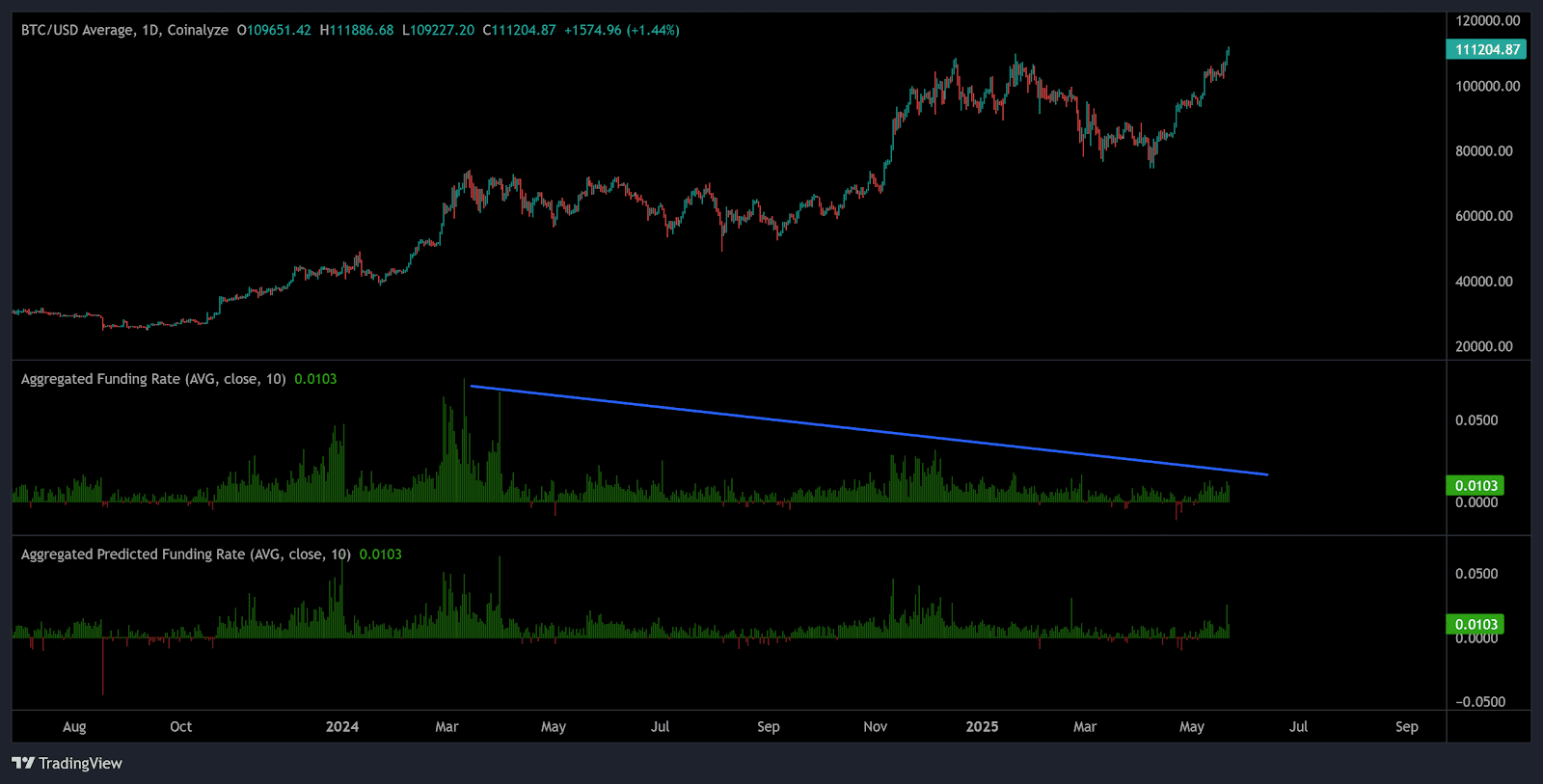

- Subdued Funding Rates: Unlike past rallies, the current Bitcoin surge is not driven by highly leveraged futures trading. Funding rates on exchanges remain significantly lower than previous highs, indicating a more organic, spot-market-driven rally.

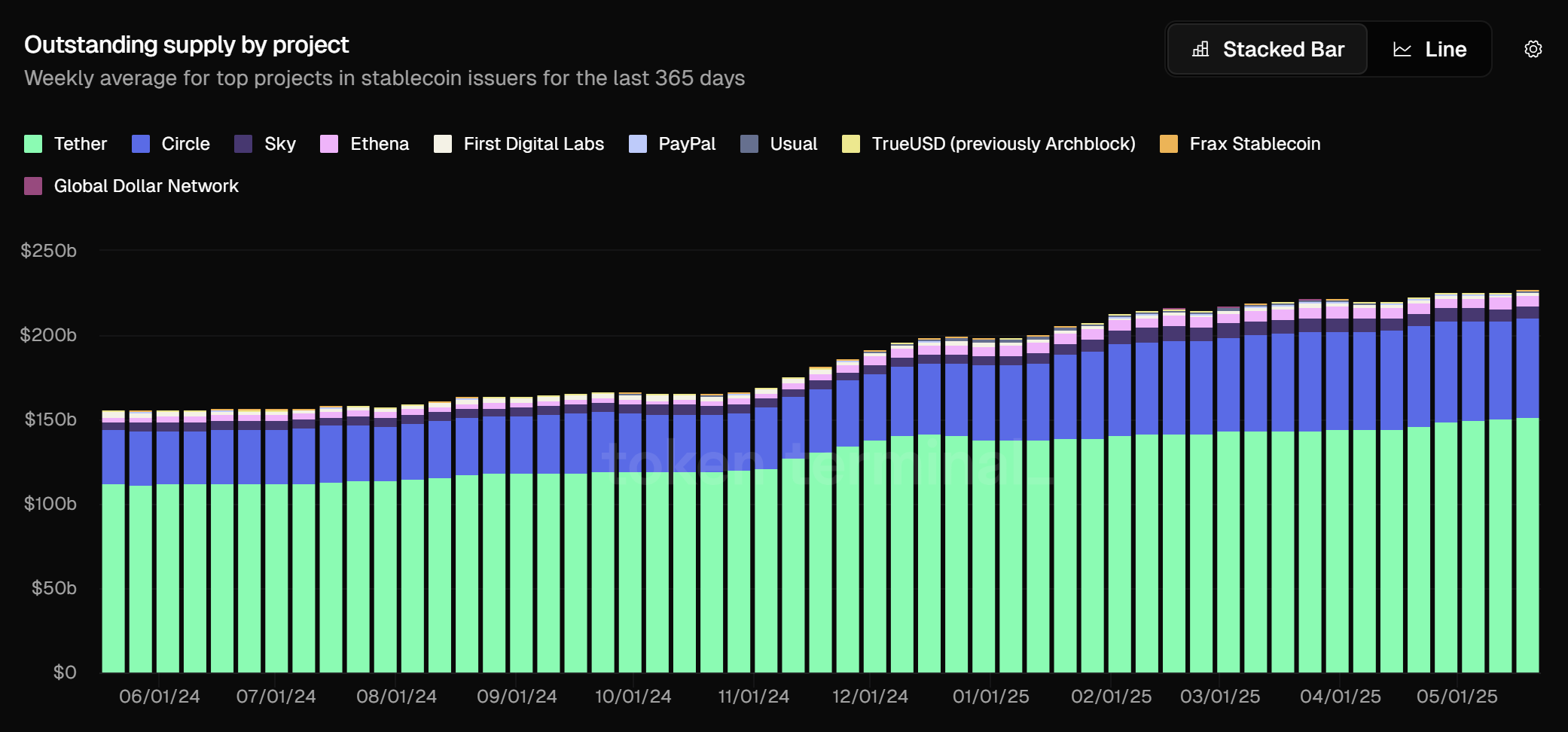

- Rising Stablecoin Supply: An increase in the market capitalization of stablecoins like Tether (USDT) and USDC signals an influx of new capital waiting to be deployed into the crypto market.

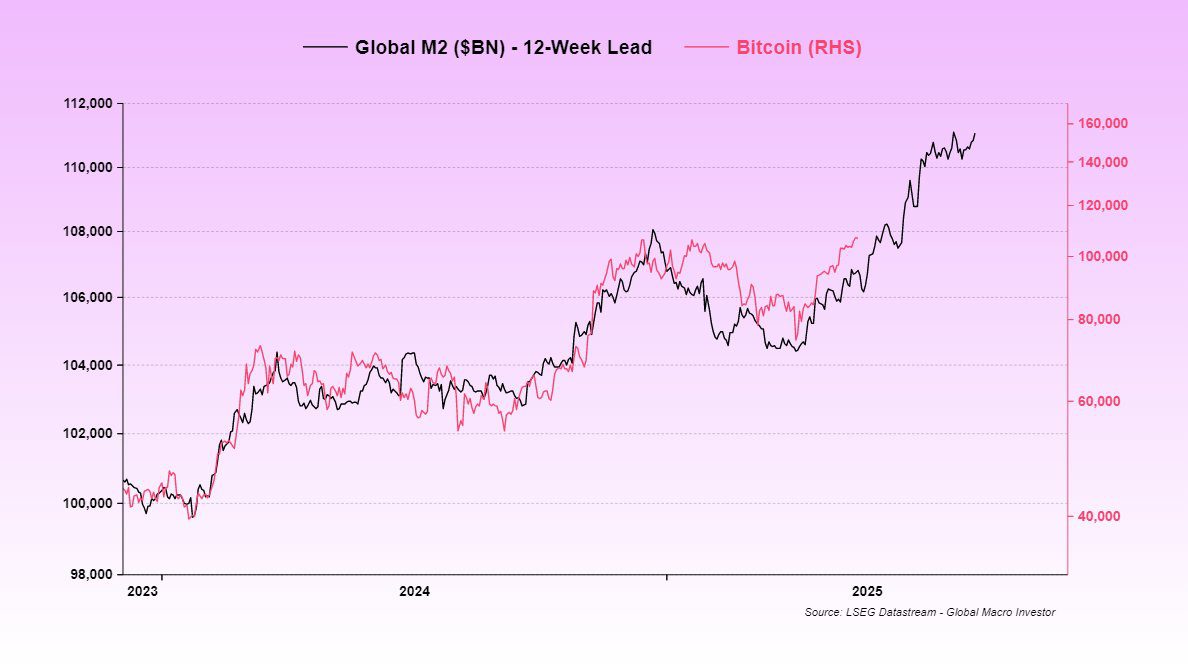

- Global Liquidity: Global M2 money supply growth, driven by monetary policy adjustments in major economies, correlates positively with Bitcoin’s price.

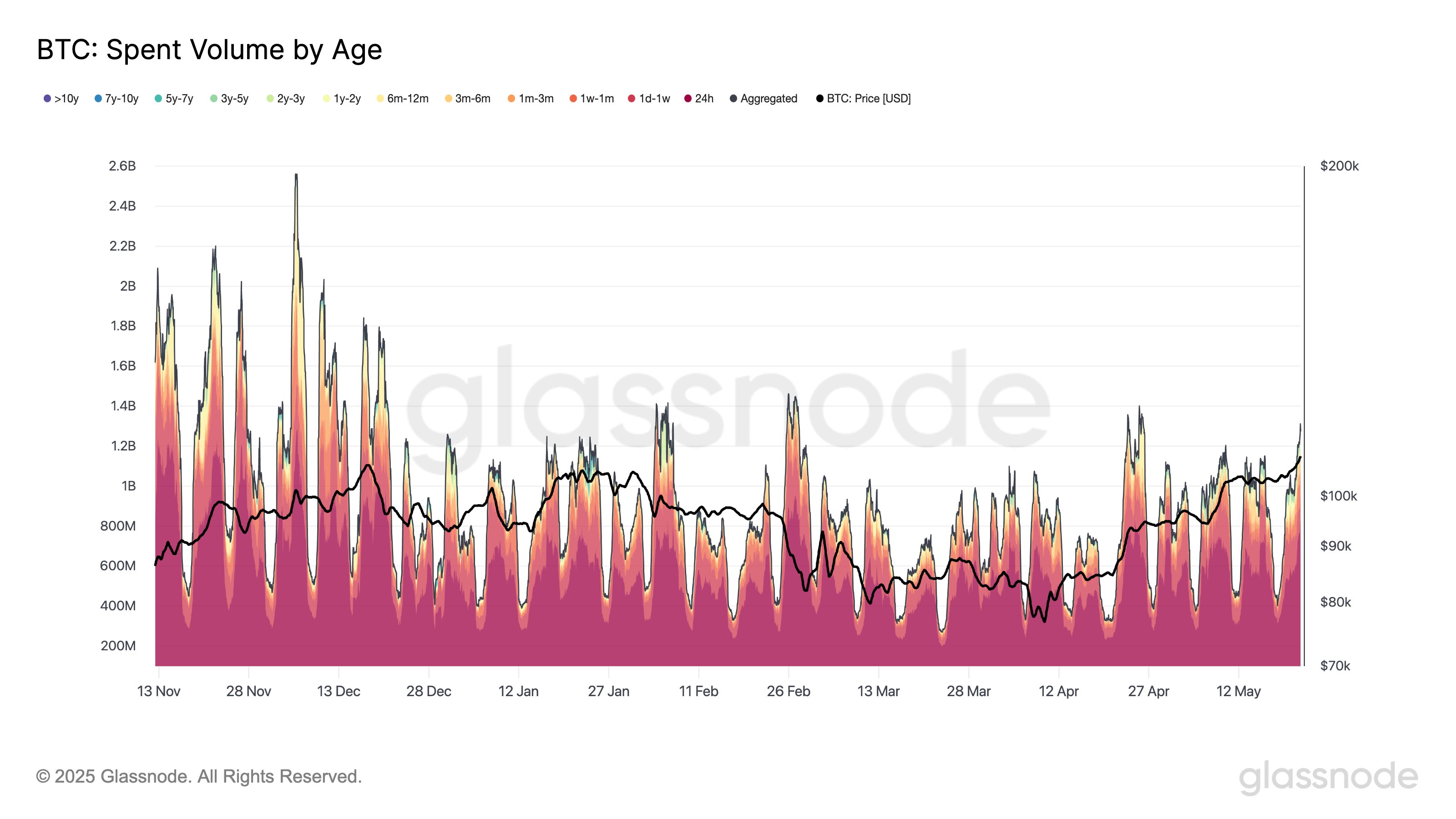

- Restrained Profit-Taking: Long-term Bitcoin holders are not aggressively selling their holdings, suggesting confidence in future price increases.

Analyzing the Current Market Dynamics

Economist Alex Krüger noted that this is the “least euphoric new all-time highs” for Bitcoin, highlighting the subdued funding rates across crypto exchanges. This contrasts sharply with previous market peaks where speculative activity was rampant.

The chart illustrates that the current BTC funding rate is significantly below previous market highs observed during March and November 2024. These low rates suggest that the rally is primarily driven by spot buyers rather than leveraged traders, reducing the risk of a sharp correction.

The Role of Stablecoins and Global Liquidity

Stablecoins act as a gateway for new capital entering the crypto market. The market cap jumped to $152 billion from $139 billion in January, while Circle’s USDC supply has increased by 35% to $58 billion. Their growth indicates a substantial pool of liquidity that has yet to be fully deployed into Bitcoin and other crypto assets.

Moreover, global liquidity trends provide further tailwinds. The global M2 money supply grew by 5% in Q1 2025, driven by monetary policy adjustments in the US, EU, and Japan. There’s a strong correlation between Bitcoin’s price and global liquidity, typically with a 60-day lag, pointing to further buying pressure in the coming months.

Long-Term Holders and Muted Profit-Taking

Data from Glassnode reveals that profit-taking among Bitcoin holders remains restrained, despite the new highs. When Bitcoin hit its all-time high, total profit-taking volume was around $1.00B – less than half the amount realized when Bitcoin first crossed $100K last December, which hit $2.10B. This suggests that long-term holders are not rushing to cash out, reflecting confidence in further price appreciation.

Expert Predictions and Market Outlook

Analysts suggest that Bitcoin’s rally could continue, driven by several factors:

- Institutional Adoption: Increased institutional interest and investment in Bitcoin contribute to its stability and long-term growth potential.

- Halving Events: The periodic halving of Bitcoin’s block reward reduces the rate at which new bitcoins are created, potentially leading to supply shortages and price increases.

- Geopolitical Factors: Economic instability and geopolitical uncertainty in some regions can drive demand for Bitcoin as a safe-haven asset.

Conclusion: Bitcoin’s Potential for Continued Growth

The current Bitcoin rally is fundamentally different from previous surges. The absence of widespread euphoria, coupled with strong underlying factors like rising stablecoin supply, global liquidity, and restrained profit-taking, suggests that Bitcoin’s upward trajectory may continue. While market volatility remains a factor, the overall outlook for Bitcoin appears positive, with the potential for further price appreciation in the coming months.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.