Bitdeer Technologies Group, a prominent Bitcoin mining company, experienced a significant downturn in revenue for the first quarter of 2025. The company reported a 41% year-over-year decrease, bringing revenue down to $70.1 million. This financial disclosure, made on May 15th, highlights the challenges faced by Bitcoin miners in a rapidly evolving landscape.

Despite the revenue decline, Bitdeer reported a net income of over $400 million for the quarter. This was primarily driven by gains on convertible notes and warrants issued to stablecoin issuer Tether in 2024, showcasing the impact of strategic financial instruments on the company’s bottom line.

However, the core mining operations faced headwinds, resulting in an operating loss of $3.2 million for the quarter, a stark contrast to the $34.1 million profit recorded during the same period last year. This underlines the increasing pressures on Bitcoin mining businesses.

The Shift Towards High-Performance Computing (HPC) and AI

Bitdeer’s revenue struggles coincide with a broader trend in the cryptocurrency mining industry: diversification. Many miners are expanding beyond Bitcoin mining and venturing into the realm of high-performance computing (HPC) to support artificial intelligence (AI) applications. This shift is driven by the increasing demand for computational power to train and run AI models.

Matt Kong, Bitdeer’s chief business officer, emphasized this strategic pivot, stating, “As we scale self-mining and execute on our ASIC [mining hardware] roadmap, we are also advancing plans for U.S.-based HPC and AI infrastructure.” This indicates a long-term commitment to diversifying revenue streams and capitalizing on the growing AI market.

Impact of the Bitcoin Halving Event

The Bitcoin network’s April 2024 halving event further compounded the challenges faced by miners. This event, which occurs approximately every four years, effectively cuts mining revenue in half by reducing the block reward. As a result, miners are forced to become more efficient and seek alternative revenue sources to remain profitable.

Bitdeer has been proactively addressing this issue by selling its own energy-efficient Bitcoin mining hardware. While sales are growing, they have not yet fully compensated for the lost mining income, highlighting the ongoing transition and adaptation required in the post-halving environment.

Self-Mining Expansion

In addition to diversifying into HPC and AI, Bitdeer is also focusing on expanding its self-mining activities. Self-mining involves using the company’s own mining hardware to directly accumulate Bitcoin. This strategy allows Bitdeer to retain more control over its mining operations and potentially increase profitability.

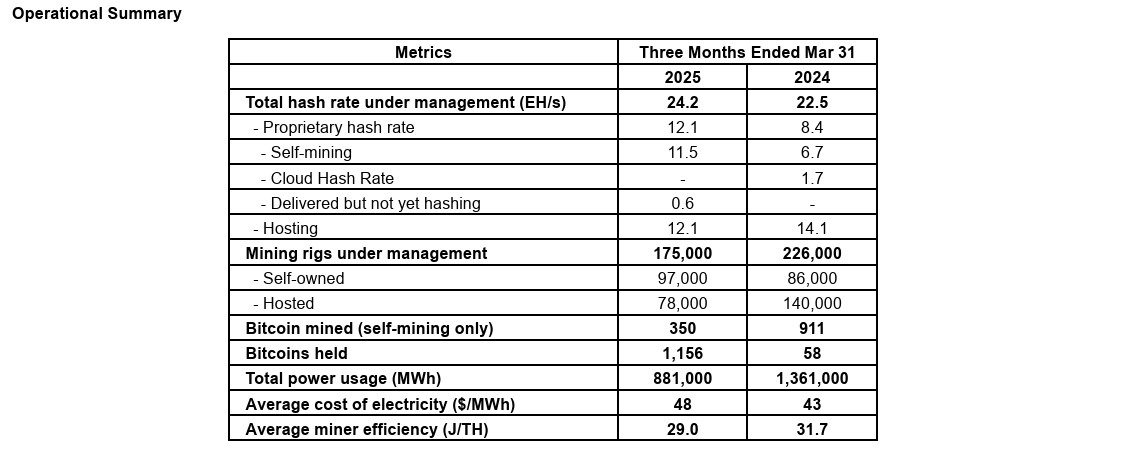

Bitdeer anticipates its self-mining hashrate to reach 40 exahashes per second (EH/s) by the end of 2025. Hashrate is a crucial metric that measures the computing power dedicated to securing the Bitcoin network. A higher hashrate indicates a greater ability to mine Bitcoin and secure the network.

“With our SEALMINER mining rigs quickly coming off the production line and ample global power capacity available, we expect to achieve rapid growth in our self-mining hashrate,” Kong explained, underscoring the company’s confidence in its self-mining expansion plans.

Tether’s Stake in Bitdeer

The relationship between Bitdeer and Tether is noteworthy. As of March 2025, Tether owned a 21% stake in Bitdeer, according to US regulatory filings. This significant investment reflects Tether’s interest in the Bitcoin mining industry and its potential for growth.

US Expansion as a Strategic Hedge

Bitdeer is also strategically investing in its US expansion as a hedge against potential trade wars. By establishing operations in the United States, the company aims to mitigate the risks associated with international trade tensions and ensure a more stable operating environment. This move showcases a proactive approach to risk management and long-term sustainability.

Key Takeaways from Bitdeer’s Q1 2025 Report:

- Revenue Decline: Bitdeer experienced a 41% year-over-year drop in revenue, reaching $70.1 million.

- Net Income Boost: Gains from Tether investments drove a net income of over $400 million.

- Operating Loss: Core mining operations resulted in an operating loss of $3.2 million.

- Strategic Shift to AI: The company is diversifying into high-performance computing (HPC) for AI applications.

- Self-Mining Expansion: Bitdeer aims to reach a self-mining hashrate of 40 EH/s by the end of 2025.

- Tether’s Investment: Tether holds a 21% stake in Bitdeer.

- US Expansion: Bitdeer is investing in its US expansion as a hedge against trade wars.

In conclusion, Bitdeer’s Q1 2025 report reveals a company in transition, facing challenges in its core Bitcoin mining operations but proactively adapting to the changing landscape by diversifying into AI, expanding self-mining activities, and strategically hedging against geopolitical risks. The company’s future success hinges on its ability to execute these strategic initiatives effectively.