Bitfarms, a prominent player in the Bitcoin mining industry, has announced a net loss of $36 million in the first quarter of 2024. This financial setback, a significant increase from the $6 million loss in the same period last year, has accelerated the company’s strategic pivot towards high-performance computing (HPC) for artificial intelligence (AI) applications.

Key Takeaways:

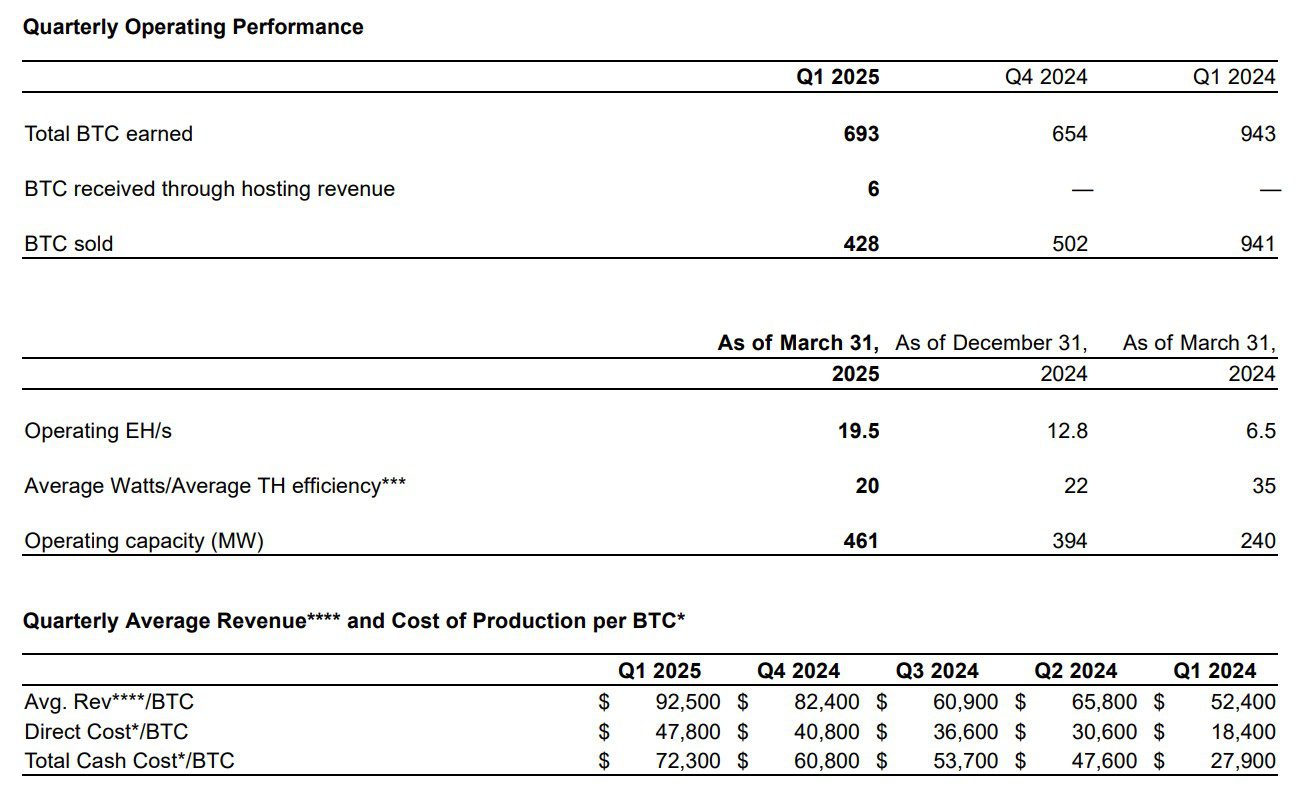

- Financial Performance: Bitfarms reported $67 million in sales for Q1 2024, a 33% increase year-over-year. However, the gross profit margin from mining operations decreased to 43% from 63% due to Bitcoin’s halving and price volatility.

- Strategic Pivot: The company is actively investing in HPC and expanding its presence in the U.S. to leverage the growing demand for AI computing power.

- HPC Infrastructure: Bitfarms aims to repurpose its existing infrastructure, initially designed for Bitcoin mining, for AI-related applications, capitalizing on synergies between the two.

- Funding and Expansion: Bitfarms has secured a $300 million line of credit to finance the expansion of its HPC facility in Pennsylvania and has sold a Bitcoin mining facility in Paraguay for $85 million to fund its U.S. expansion.

Challenges in Bitcoin Mining

Several factors contributed to Bitfarms’ financial challenges in the first quarter of 2024:

- Bitcoin Halving: The Bitcoin halving event in April 2024 reduced the rewards for mining new blocks by 50%, directly impacting miners’ profitability.

- Price Volatility: Bitcoin’s price experienced significant fluctuations during the quarter, swinging from over $100,000 in January to below $80,000 in March. This volatility created uncertainty and affected mining revenue.

The Strategic Shift to AI Computing

Recognizing the challenges and opportunities in the evolving landscape, Bitfarms has made a strategic decision to diversify its operations into AI computing. This pivot involves:

- Investing in HPC: Bitfarms is investing in high-performance computing infrastructure capable of handling the demanding workloads of AI applications.

- Leveraging Existing Infrastructure: The company is repurposing its existing Bitcoin mining hardware and electrical power supplies for AI use cases, maximizing the value of its assets.

- Expanding US Presence: Bitfarms is expanding its operations in the United States to capitalize on the growing demand for AI computing power and to hedge against potential trade-related risks.

Rationale Behind the Pivot

The decision to shift towards AI computing is driven by several factors:

- Diversification of Revenue Streams: By entering the AI computing market, Bitfarms aims to diversify its revenue streams and reduce its reliance on Bitcoin mining.

- Synergies with Existing Infrastructure: The company’s existing infrastructure and expertise in managing high-power computing facilities provide a competitive advantage in the AI computing space.

- Growing Demand for AI: The AI market is experiencing rapid growth, creating significant demand for HPC resources and services.

Bitfarms’ HPC Expansion

Bitfarms is actively pursuing its HPC expansion plans:

- Pennsylvania Facility: The company is expanding its HPC facility in Pennsylvania, financed by a $300 million line of credit from Macquarie.

- US Expansion Strategy: Bitfarms is strategically focusing on U.S. expansion to capitalize on favorable market conditions and access a larger customer base.

Industry Perspective

Bitfarms’ strategic pivot reflects a broader trend in the Bitcoin mining industry, where miners are exploring alternative revenue streams and diversifying their operations:

- Diversification into AI Data Centers: Many Bitcoin miners are diversifying into AI data center hosting to expand revenue and repurpose existing infrastructure.

- Demand for HPC: Companies like CoreWeave, an AI computing provider, are experiencing strong investor demand, highlighting the growing interest in AI-related businesses.

Bitfarms’ strategic shift from Bitcoin mining to high-performance computing represents a proactive response to the changing market dynamics. By investing in AI infrastructure and diversifying its revenue streams, Bitfarms aims to position itself for long-term growth and success in the evolving technology landscape. The company’s performance in the coming quarters will be closely watched as it continues to execute its strategic pivot and navigate the challenges and opportunities in both the Bitcoin mining and AI computing sectors.