Key Takeaways:

- Bitfinex margin longs decreased by 18% despite Bitcoin’s 24% price increase over 30 days.

- Significant long positions ($6.8 billion) heavily outweigh short positions ($25 million), indicating bullish sentiment.

- Bitcoin options positioning and substantial spot BTC ETF inflows support confidence among institutional investors.

Bitcoin (BTC) has experienced a notable surge in price, climbing approximately 24% in the last month. However, data from Bitfinex reveals a reduction in leveraged long positions, sparking debate about the conviction of professional traders at the current price level, hovering around $104,000.

Analyzing the Bitfinex Long/Short Ratio

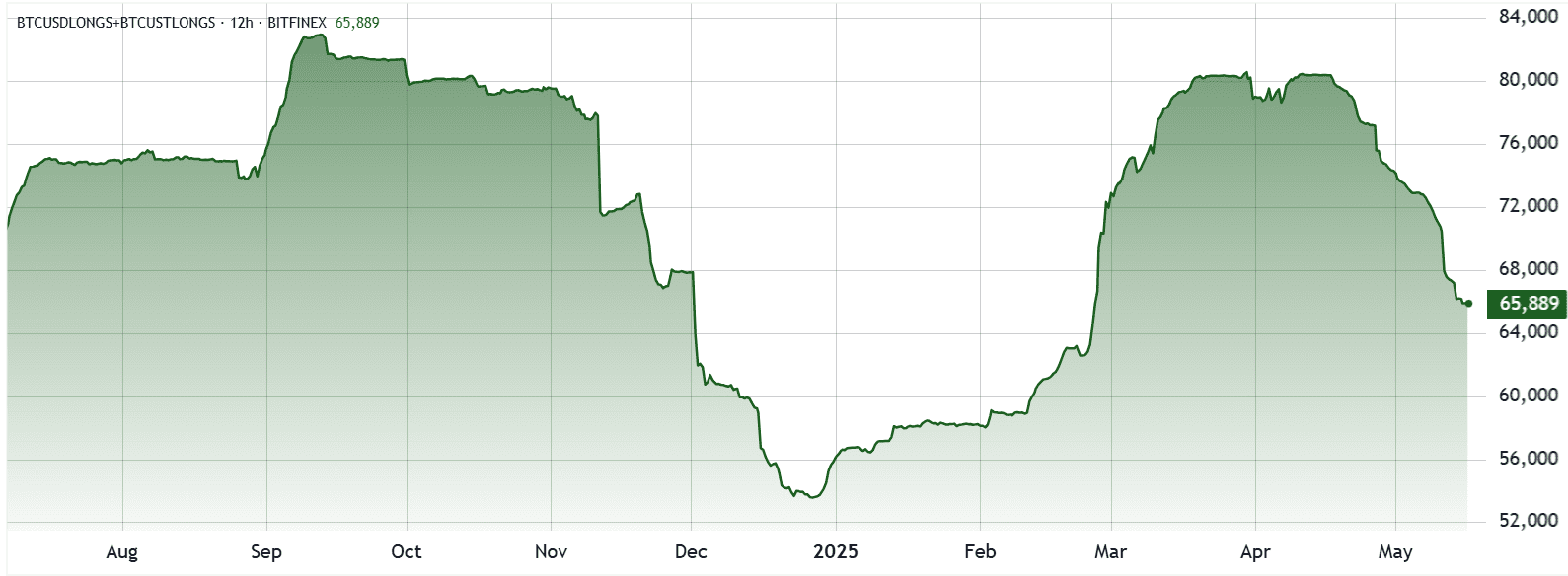

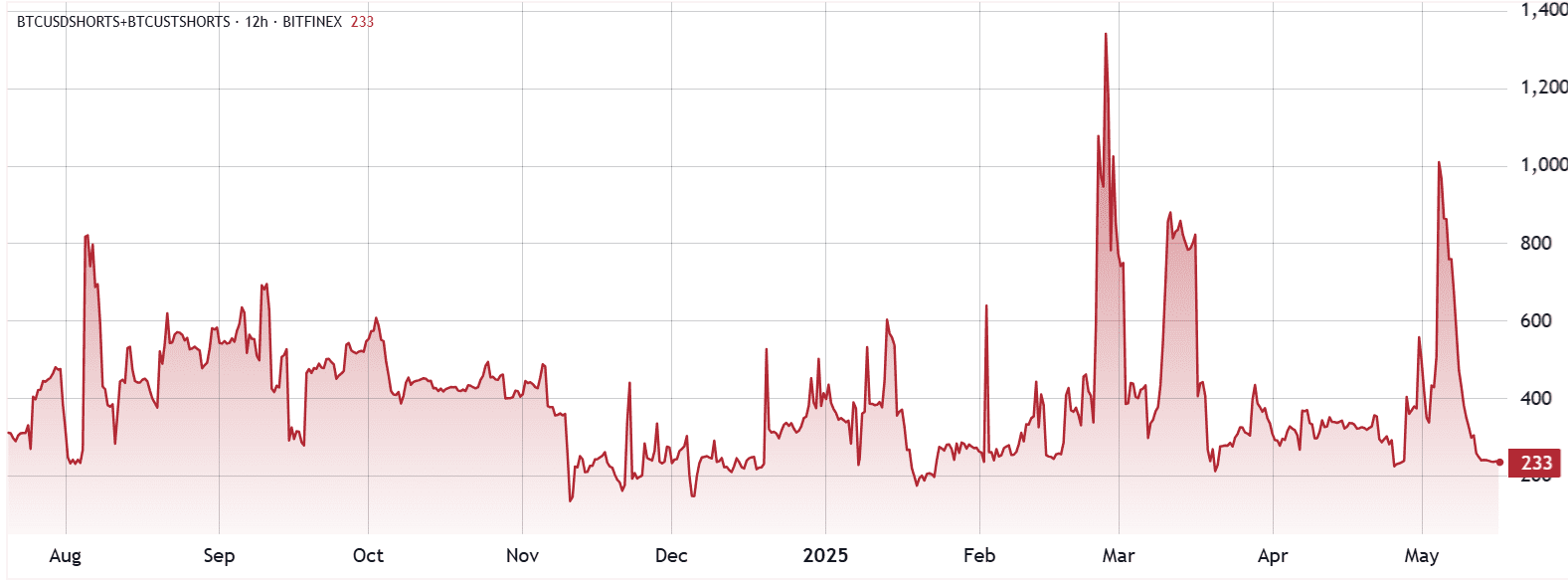

The number of Bitfinex margin longs has fallen from 80,387 BTC on April 16 to 65,889 BTC by May 16. This represents a cooling off from the strong bullish demand observed earlier in the year when Bitcoin’s price corrected. This pullback suggests healthy profit-taking rather than an outright shift toward bearish sentiment.

While the reduction in longs might raise eyebrows, it’s crucial to consider the overall context. Bitcoin surpassed $100,000 on May 8, approximately three weeks after the long positions reached their peak. Furthermore, the current positioning of Bitfinex whales suggests continued optimism. The total value of long positions stands at a substantial $6.8 billion, dwarfing the $25 million in short positions. This disparity highlights a significant imbalance favoring bullish expectations.

The Role of Arbitrage and Margin Trading

The dominance of long positions on Bitfinex can partially be attributed to the exchange’s competitive 0.7% annual interest rate for margin trading. This contrasts sharply with the 6.3% annualized premium for 90-day Bitcoin futures, creating arbitrage opportunities. Traders can capitalize on this difference by simultaneously opening long margin positions and selling equivalent BTC futures, profiting from the rate differential. Moreover, margin traders generally possess longer investment horizons and higher risk tolerance, making them less susceptible to short-term price fluctuations.

Whale Confidence and Bitcoin ETF Inflows

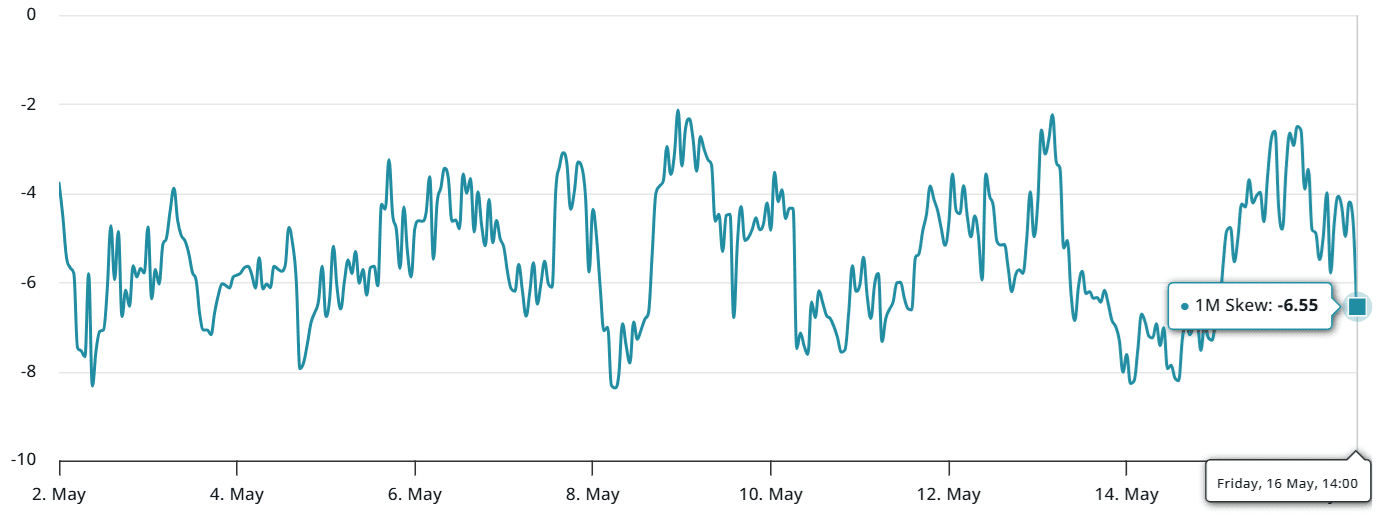

Beyond margin markets, examining Bitcoin options activity provides further insights into market sentiment. An increase in demand for put options (sell orders) suggests expectations of a price correction, typically driving the 25% delta skew above 6%. Conversely, bullish periods see this metric drop below -6%.

The current options delta skew of -6% indicates confidence in Bitcoin’s price stability, despite recent challenges in breaching the $105,000 resistance level. This suggests that whales and market makers are not overly concerned about repeated failures to surpass this barrier.

The sustained optimism observed in the market, even amidst reduced leveraged long demand, is further fueled by the substantial $2.4 billion net inflows into US spot Bitcoin exchange-traded funds (ETFs) between May 1 and May 15. These inflows demonstrate strong institutional interest and appetite for Bitcoin exposure.

Bitcoin ETF Impact

The introduction of Bitcoin ETFs has fundamentally altered the investment landscape. They provide a regulated and accessible avenue for traditional investors to gain exposure to Bitcoin, thereby increasing demand and legitimizing the asset class. The consistent inflows into these ETFs demonstrate a long-term bullish outlook from institutional investors.

Technical Analysis and Price Prediction

From a technical analysis perspective, Bitcoin faces immediate resistance at $105,000. A decisive break above this level could pave the way for further gains towards $110,000 and potentially new all-time highs. Support levels to watch include $100,000 and $95,000. Failure to hold these levels could trigger a deeper correction.

Expert Opinions and Future Outlook

Analysts remain divided on Bitcoin’s short-term trajectory. Some predict a continued consolidation phase before a breakout, while others anticipate a more immediate rally driven by positive news flow and increased institutional adoption. The long-term outlook, however, remains overwhelmingly positive, with many experts forecasting Bitcoin to reach significantly higher prices in the coming years.

Conclusion: Weighing the Factors

While the decrease in Bitfinex margin longs initially suggests a waning bullish sentiment, a deeper analysis reveals a more nuanced picture. The vast disparity between long and short positions, coupled with positive Bitcoin options data and robust ETF inflows, paints a portrait of continued optimism among professional traders and institutional investors. Although the $105,000 resistance remains a hurdle, the underlying fundamentals support a potential Bitcoin rally. The strength of the ETF inflows, combined with favorable regulatory developments, may continue to drive price appreciation and reinforce positive investor sentiment. Therefore, while caution is always warranted in the volatile cryptocurrency market, the indicators point towards a potential continuation of the bull market for Bitcoin.