BlackRock Eyes Telegram’s $1.5B Bond Offering: What It Means for Crypto

BlackRock, one of the world’s largest Bitcoin holders, is reportedly participating in a bond raise by crypto-friendly messenger Telegram.

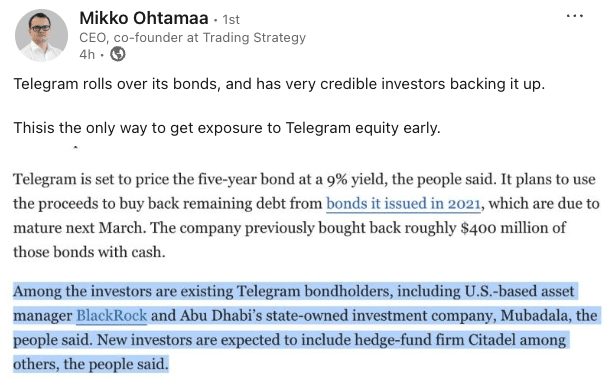

Telegram is expected to raise at least $1.5 billion in a bond issue on May 28, with support from existing backers like BlackRock and Abu Dhabi’s investment firm Mubadala, The Wall Street Journal reported.

As part of the sale, Telegram is offering investors five-year bonds at a 9% yield, the report said, citing sources familiar with the matter.

Telegram plans to use the proceeds to buy back remaining debt from bonds issued in 2021, which are due to mature in March 2026.

Quick Summary of the News

- Telegram aims to raise $1.5 billion through a bond sale on May 28.

- BlackRock, a known Bitcoin investor, is reportedly participating.

- The bonds offer a 9% yield over five years.

- Proceeds will be used to refinance existing debt from 2021.

- Investors may get a discount on a potential Telegram IPO.

Why It Matters

This news is significant for several reasons. Firstly, it demonstrates continued institutional interest in companies operating within or adjacent to the cryptocurrency space. BlackRock’s participation, in particular, adds credibility and legitimacy to Telegram’s financial endeavors. Secondly, the bond offering structure, potentially including IPO discounts, highlights a strategic approach by Telegram to attract long-term investors. Finally, Telegram’s active engagement with both traditional financial instruments (bonds) and cutting-edge technologies (AI integration) positions it as a forward-thinking platform with diverse revenue streams.

Market Impact

While the direct impact on Bitcoin’s price may be minimal, this event signals a broader trend of established financial institutions exploring opportunities within the crypto ecosystem. Here’s a simplified view:

| Entity | Action | Significance |

|---|---|---|

| BlackRock | Participating in Telegram bond sale | Validates Telegram’s business model; Shows institutional appetite for crypto-related investments. |

| Telegram | Raising $1.5B via bonds | Secures funding for growth and innovation; Potentially paving the way for a future IPO. |

| Crypto Market | Indirectly benefits | Increased institutional involvement often leads to greater market stability and maturity. |

Expert Take or Personal Insight

The involvement of BlackRock in Telegram’s bond offering is a strong vote of confidence. It suggests that institutional investors are becoming more comfortable with the risks associated with crypto-adjacent businesses, especially those with large user bases and strong growth potential. I believe this trend will continue, with more traditional financial players seeking strategic partnerships and investments in the digital asset space. The potential IPO discount tied to the bond offering is a clever incentive, essentially giving early investors a head start on potential future gains.

Actionable Insight

Traders and investors should monitor Telegram’s progress towards its potential IPO. The performance of these bonds in the secondary market could also provide valuable insights into investor sentiment towards Telegram and the broader crypto landscape. Keep an eye on news regarding Telegram’s user growth, revenue generation, and regulatory developments, as these factors will likely influence its valuation. For those interested in fixed income, analyzing the risk-reward profile of these bonds (9% yield) is crucial.

Conclusion

BlackRock’s participation in Telegram’s bond sale underscores the blurring lines between traditional finance and the crypto world. As institutional investors continue to explore and invest in promising crypto-related ventures, we can expect further maturation and integration of digital assets into the global financial system. The road to Telegram’s potential IPO will be an interesting journey to follow, with possible ramifications for the whole crypto space.