BlackRock’s Bitcoin ETF Outflow, MEXC Fraud Surge, and OpenSea’s Expansion: Crypto News Analysis

Today in crypto, BlackRock posts its largest spot Bitcoin ETF outflow day ever, crypto exchange MEXC reports a 200% spike in fraud attempts during Q1 2025, and NFT marketplace OpenSea rolls out a new platform.

BlackRock’s Bitcoin ETF Ends 31-Day Inflow Streak with Biggest Outflow Ever

The world’s largest asset manager, BlackRock, has ended its 31-day spot Bitcoin exchange-traded fund (ETF) inflow streak with its biggest recorded outflow day since the product launched in January 2024.

On May 30, BlackRock’s spot Bitcoin ETF (IBIT) ended its significant inflow streak with its largest daily outflow of $430.8 million, according to Farside data. Before this, IBIT’s largest outflow day was on Feb. 26, with $418.1 million in outflows.

ETF analyst Nate Geraci said in a May 31 X post, “What a run over the past 30+ days, though.” Geraci highlighted that BlackRock is “now pushing” approximately $70 billion in Bitcoin holdings since it launched. “Not sure I have words to describe how ridiculous this is,” Geraci said.

MEXC Exchange Detects 200% Surge in Fraudulent Activity in Q1

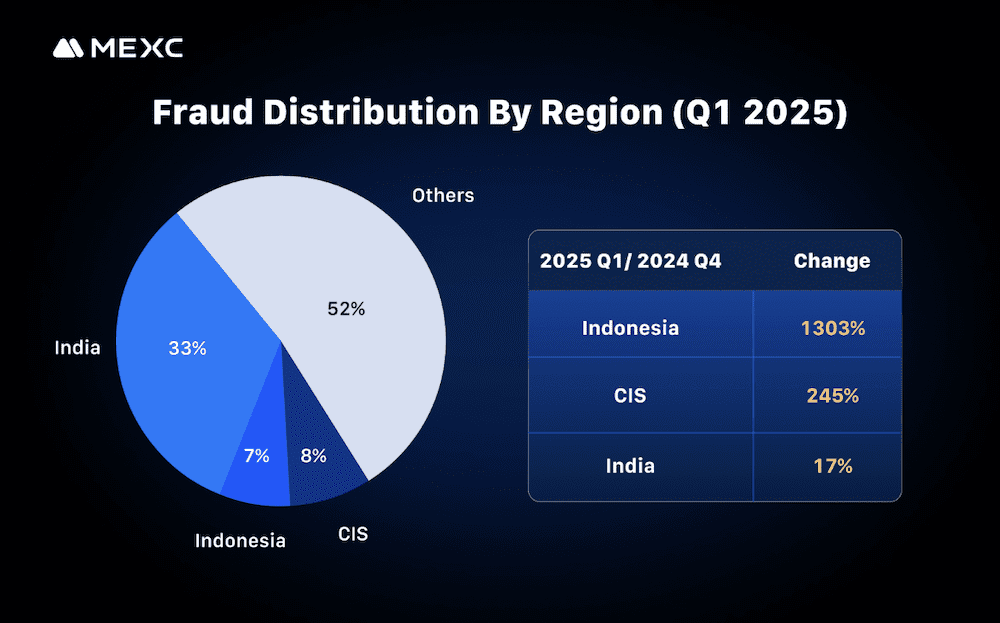

The MEXC crypto exchange observed a 200% quarter-over-quarter surge in fraudulent trading activity between January and March 2025, it said in its quarterly report.

According to the exchange, 80,057 organized fraud attempts from over 3,000 fraud syndicates were identified in Q1. The fraudulent activity included market manipulation, wash trading, and automated trading bots exploiting users through “unfair” trading execution.

MEXC said that the rise in fraud was most pronounced in India, with the exchange flagging nearly 27,000 accounts for suspicious activity, followed by the Commonwealth of Independent States (CIS) region and Indonesia, which had 6,404 and 5,603 accounts flagged, respectively.

Tracy Jin, chief operating officer at MEXC, said the fraudulent activity was fueled by a steady stream of unsuspecting victims funneled through social engineering scams.

OpenSea Expands Beyond NFTs with OS2 Public Rollout

Non-fungible token (NFT) marketplace OpenSea has launched its new platform, OS2, concluding its beta phase.

The company said the updated platform allows full token trading across 14 blockchains, including support for fungible tokens on Solana. It also introduces tools that aim to enhance crosschain functionality. These changes signal a shift for OpenSea, positioning it as a more comprehensive platform beyond NFTs.

OpenSea chief marketing officer Adam Hollander told Cointelegraph that the platform always believed in a broader idea that everything onchain should be liquid and discoverable in one place.

“OS2 lets a collector mint an NFT on Solana, swap a gaming token on Ronin and buy a memecoin that was just created, all from a single wallet flow,” Hollander said. “Users were already juggling half a dozen DApps and bridges; we streamlined that experience.”

Despite a broader market cooling, OpenSea sees promising signs of user retention and growth. Hollander told Cointelegraph that while volumes may be down from its 2021 to 2022 peak, weekly unique collectors on OpenSea are up by 40% since January. He added:

“That tells us the tourists left, but the true users stayed, and they’re participating in more chains than ever.”