BlackRock’s IBIT Crowned ‘Best New ETF’

BlackRock’s iShares Bitcoin Trust (IBIT) has received the prestigious ‘Best New ETF’ award from etf.com, marking a significant milestone for the spot Bitcoin ETF. This recognition coincided with IBIT experiencing its highest inflows since January 21st, signaling strong investor interest.

IBIT’s Record-Breaking Inflows

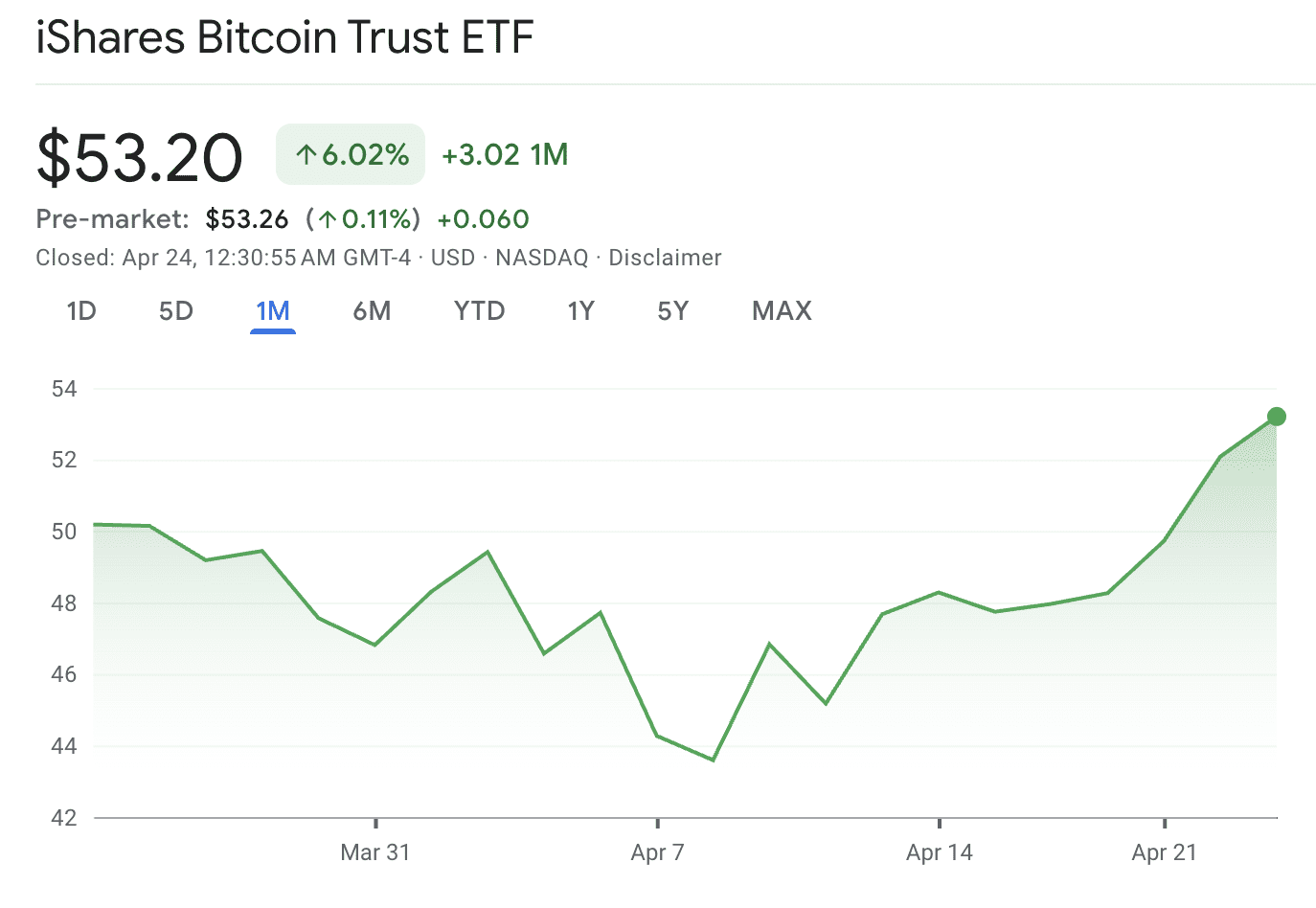

On the same day as the award announcement, IBIT recorded a substantial $643.2 million in inflows, according to data from Farside. This figure represents the highest inflow since January 21st, when the ETF saw $661.9 million enter the fund. These substantial inflows highlight the growing adoption of Bitcoin ETFs as a means for investors to gain exposure to Bitcoin.

Expert Commentary

Bloomberg ETF analyst Eric Balchunas lauded the award, stating that it ‘feels right.’ He also acknowledged the Vanguard S&P 500 ETF (VOO), which won the ‘ETF of the Year’ award. Bitcoin commentator Vivek described the inflows as ‘massive,’ while Apollo Sats co-founder Thomas Fahrer simply stated, ‘Huge inflow.’

IBIT’s Performance and Holdings

Launched in January 2024 alongside ten other US-based spot Bitcoin ETFs, IBIT has quickly amassed net assets of approximately $53.77 billion, according to BlackRock data. The ETF has traded an average of 45.02 million shares per day over the past 30 days. As of the time of this writing, a single IBIT share is trading at $53.20, as per Google Finance data.

Other ETF Award Winners

VanEck Bitcoin ETF (HODL) was also recognized, receiving the award for ‘Best New ETF ticker.’

Broader Market Implications

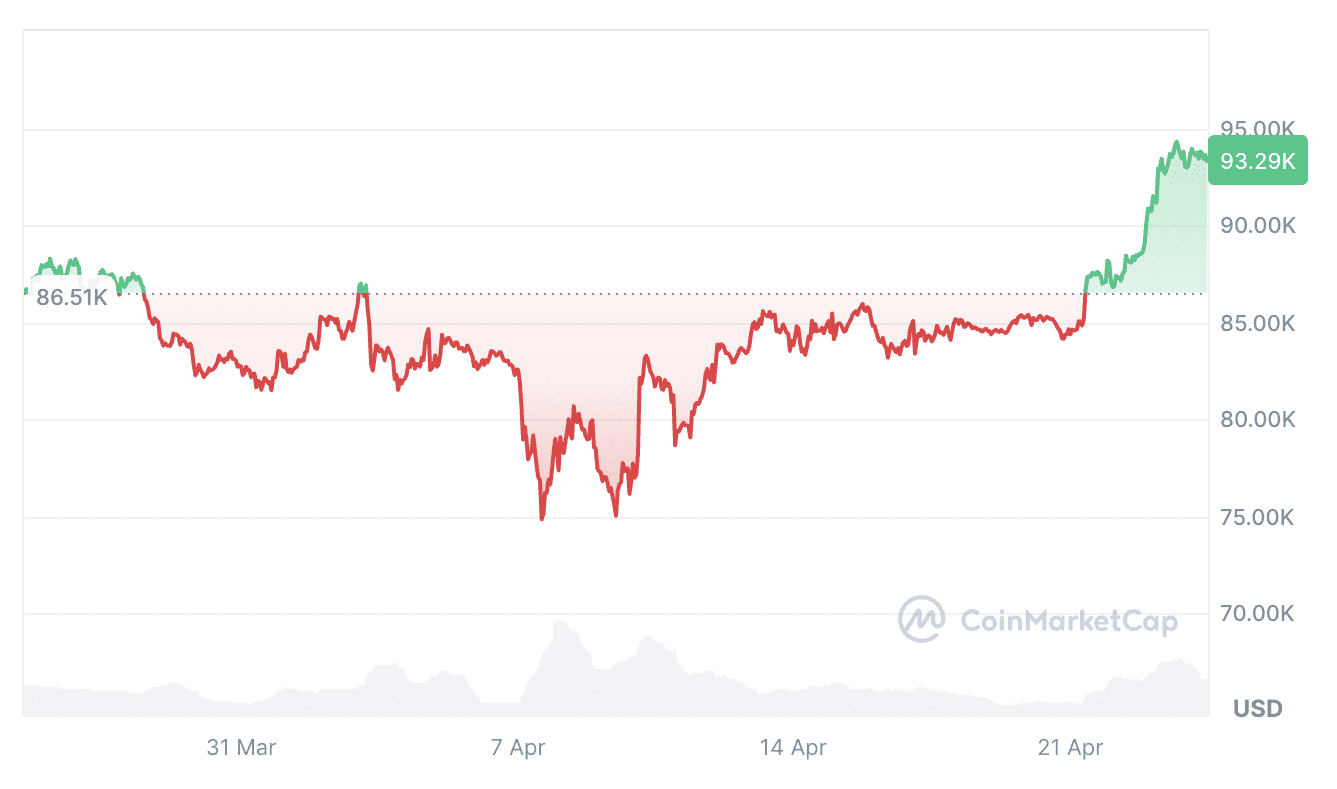

IBIT’s significant inflow on April 23rd constituted a large portion of the $917 million seen across all 11 spot Bitcoin ETFs that day. The resurgence of inflows across the Bitcoin ETF market indicates renewed investor confidence.

Understanding Bitcoin ETFs

A Bitcoin ETF (Exchange Traded Fund) is a type of investment fund that tracks the price of Bitcoin. It allows investors to gain exposure to Bitcoin without directly owning the cryptocurrency. Bitcoin ETFs are traded on traditional stock exchanges, making them accessible to a broader range of investors. The emergence of spot Bitcoin ETFs has been a game-changer for the crypto market, providing a regulated and convenient way for institutional and retail investors to participate in the growth of Bitcoin.

Key Benefits of Bitcoin ETFs:

- Accessibility: Bitcoin ETFs are easily accessible through traditional brokerage accounts.

- Regulation: Bitcoin ETFs are subject to regulatory oversight, providing a level of security and transparency.

- Liquidity: Bitcoin ETFs offer high liquidity, allowing investors to easily buy and sell shares.

- Diversification: Bitcoin ETFs can provide diversification to investment portfolios.

The Future of Bitcoin ETFs

The success of IBIT and other Bitcoin ETFs suggests a bright future for these investment vehicles. As the cryptocurrency market matures, Bitcoin ETFs are likely to play an increasingly important role in attracting institutional capital and driving broader adoption of Bitcoin. The ‘Best New ETF’ award for IBIT is a testament to the growing legitimacy and mainstream acceptance of Bitcoin as an asset class.

Potential Risks Associated with Bitcoin ETFs

While Bitcoin ETFs offer several benefits, it’s important to be aware of the potential risks involved. These risks include:

- Volatility: Bitcoin is known for its price volatility, which can impact the value of Bitcoin ETFs.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies and Bitcoin ETFs is still evolving, which could create uncertainty for investors.

- Security Risks: While Bitcoin ETFs eliminate the need to directly hold Bitcoin, there are still security risks associated with the ETF’s holdings.

Conclusion

BlackRock’s IBIT winning the ‘Best New ETF’ award is a significant validation of Bitcoin ETFs and their growing role in the cryptocurrency market. With record-breaking inflows and increasing investor interest, Bitcoin ETFs are poised to reshape the landscape of Bitcoin investing. However, investors should carefully consider the potential risks before investing in Bitcoin ETFs.