Why Finance Professionals Are Cautious About Blockchain

Blockchain technology has been a topic of discussion in the finance sector for over a decade, yet skepticism persists among many professionals. Concerns often revolve around blockchain’s practical application and necessity within existing financial systems.

Key Skepticisms:

- Uncertainty About Practical Applications: Despite promises of faster settlements and enhanced security, implementing blockchain in banking and accounting remains complex.

- Doubts About Necessity: Some professionals question the need for blockchain, citing a lack of clear ROI and trust issues.

- Lack of Understanding: Limited knowledge about blockchain among financial advisors and the absence of standardized compliance frameworks hinder adoption.

The 2025 Blockchain Landscape: Key Developments

Blockchain is transitioning from experimental to essential in finance, driven by regulatory changes, the rise of stablecoins, and institutional investment in on-chain infrastructure.

Key Developments:

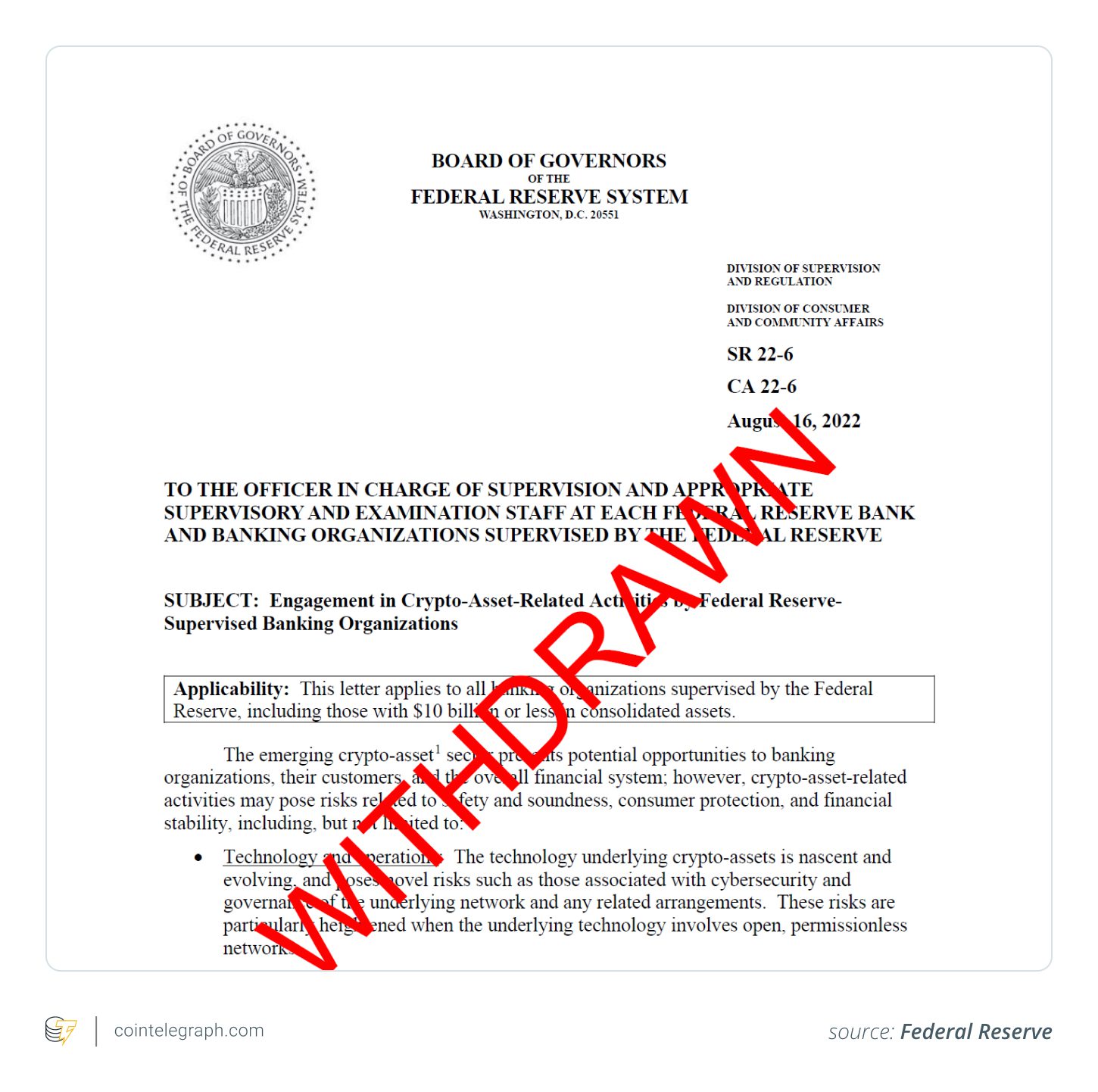

- Regulatory Shifts: The US Federal Reserve has relaxed its stance on crypto services, signaling a more accepting regulatory environment.

- Stablecoin Growth: The stablecoin market capitalization has surged, with regulators globally establishing frameworks like the Markets in Crypto-Assets (MiCA) in Europe.

- Institutional Adoption: Major banks like JPMorgan and Citigroup are investing in blockchain infrastructure for tokenization and digital asset settlement.

Blockchain in Banking Operations

Blockchain is streamlining settlements, enhancing compliance, and transforming cross-border payments in banking.

Key Applications:

- Real-Time Settlement and Clearing: Blockchain enables near-instant settlement by eliminating intermediaries, as demonstrated by JPMorgan’s Kinexys platform.

- Enhanced KYC and AML Compliance: Blockchain facilitates secure storage and sharing of customer information, speeding up audits and reducing compliance burdens.

- Cheaper, Faster Cross-Border Payments: Blockchain reduces transaction times and fees, with examples from HSBC, Ant Group, and Wells Fargo showcasing real-world improvements.

Considerations for Banks:

- Integration: Blockchain systems must integrate with existing banking infrastructure.

- Training: Banks need to upskill teams in compliance, operations, and IT.

- Customer Experience: Clients need to perceive the benefits of blockchain adoption.

Blockchain in Accounting and Auditing

Blockchain is transforming financial data management, verification, and reporting in accounting and auditing.

Key Benefits:

- Improved Data Security: Blockchain’s immutability reduces the risk of fraud and strengthens the integrity of financial records.

- Enhanced Transparency: Auditors gain access to a single, real-time, tamper-proof transaction trail.

- Streamlined Reconciliation and Reporting: Authorized parties have access to a shared, automatically updating record.

Adoption Challenges:

- Lack of Standardization: Absence of universal rules for blockchain accounting.

- Integration Issues: Difficulties integrating with legacy enterprise resource planning (ERP) systems.

- Regulatory Uncertainty: Evolving regulations around digital assets.

Blockchain for CFOs and Treasurers

Blockchain provides CFOs and treasurers with tools to improve financial reporting, operational efficiency, and risk controls.

Strategic Applications:

- Real-Time Financial Reporting: Instant access to financial performance data.

- Smart Contracts: Automation of compliance checks and payment executions.

- Tokenization: Capital raising and asset management through fractional ownership models.

Risk Management Considerations:

- Access Controls: Implement strong access controls and regular audits.

- Contingency Plans: Develop off-chain fallback procedures.

- Regulatory Engagement: Stay engaged with legal teams and regulators.

Best Practices for Blockchain Compliance

Operating in blockchain environments requires adherence to specific compliance practices.

Key Practices:

- Robust Internal Controls: Enforce segregation of duties, role-based access, and transaction validation.

- Early Regulator Engagement: Proactively engage with regulatory bodies.

- Ongoing Compliance Training: Provide regular training on blockchain fundamentals and regulatory updates.

Actionable Steps for Finance Professionals

Blockchain’s relevance in finance is growing, necessitating action from different professionals.

Recommendations:

- For Bankers: Focus on practical operational improvements and pilot small initiatives.

- For CPAs and Auditors: Stay updated on evolving standards and build technical expertise in blockchain auditing.

- For CFOs and Treasurers: Evaluate blockchain initiatives through a financial lens and engage with industry networks.