Brightpool is a decentralized finance (DeFi) platform aiming to revolutionize options trading by making it more accessible and user-friendly. It simplifies the complexities of traditional options trading, making it easier for users to navigate the volatile cryptocurrency market.

The Challenge of Crypto Volatility

Cryptocurrencies are known for their volatility, presenting both opportunities and risks. While rapid price increases can be profitable, sharp drops can lead to significant losses. Options trading can help manage this volatility, allowing investors to hedge against risk or speculate on price movements with limited capital.

Brightpool’s Solution: Invisible Options

Brightpool addresses the challenges of traditional options trading by building an “invisible options engine.” This engine simplifies the trading process, allowing users to utilize sophisticated financial instruments without realizing they are trading options. Key features include:

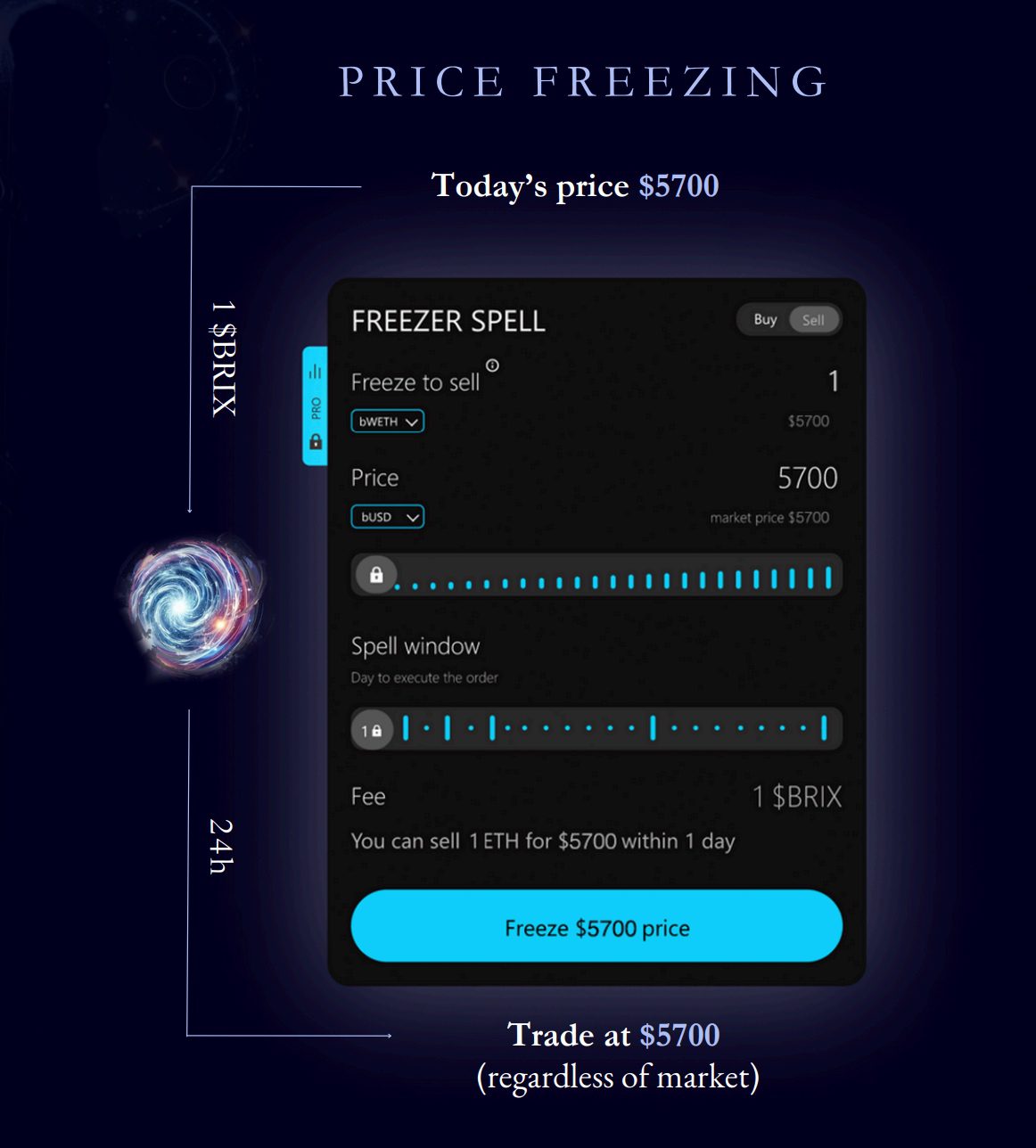

- Price Freezing: Traders can freeze asset prices for a limited period and execute trades later if the price is favorable.

- Yield-Generating Limit Orders: Users can buy or sell assets at a predefined price level and earn yield while waiting for the order to be filled.

How Price Freezing Works

Brightpool’s price freezing feature allows traders to “freeze” the price of an asset, such as Bitcoin, at a specific value for a certain period. For example, a trader could freeze the price of BTC at $100,000 and execute the trade at that price, regardless of whether the actual price rises to $200,000 or falls to $50,000.

AI-Powered Pricing Engine

Brightpool utilizes an AI-managed pricing engine based on the Black-Scholes model, a Nobel Prize-winning formula used in traditional finance. This engine determines the value of each trading opportunity, whether it’s freezing a price or executing a limit order.

BRIX: The Platform’s Native Utility Token

BRIX is Brightpool’s native utility token. Users earn BRIX for placing orders and taking risks, and these tokens can be used to access key features of the platform, including freezing prices and paying fees. BRIX is minted through a novel proof-of-risk consensus mechanism, where tokens are created based on the amount of risk users take on. The profits from this process are stored in the platform’s Treasury, backing every BRIX token with real activity.

BRI: Governance and B2B Settlement Token

Brightpool also offers BRI, a governance and B2B settlement token. While BRIX powers the retail experience, BRI is used by exchanges and partners to access Brightpool’s infrastructure. It also enables governance over key protocol decisions, creating a shared stake in the platform’s long-term evolution.

dNFT Collection with Frozen ETH Prices

To showcase the price-freezing function, Brightpool is launching a unique dNFT collection that comes with frozen ETH prices. Each NFT acts as a “time travel ticket,” giving holders the right to buy or sell at any historical ETH price, depending on the mint outcome. These NFTs are fully tradable and integrate directly with the Brightpool protocol.

Brightpool’s Vision for the Future of DeFi

Brightpool aims to transform how risk and opportunity are accessed in DeFi. By simplifying complex processes and integrating powerful tools into seamless user experiences, the platform lays the groundwork for a more inclusive, intelligent, and risk-optimized DeFi future.

Key Benefits of Brightpool:

- Simplified Options Trading: Makes complex financial instruments accessible to all users.

- AI-Powered Pricing: Uses the Black-Scholes model for accurate and efficient pricing.

- Yield Generation: Allows users to earn yield while waiting for limit orders to be filled.

- Innovative Tokenomics: Utilizes BRIX and BRI tokens to power the platform and incentivize participation.

In summary, Brightpool is paving the way for a more accessible and user-friendly DeFi ecosystem, empowering users to navigate the complexities of cryptocurrency trading with ease.