Understanding Bull and Bear Markets in Crypto

Navigating the cryptocurrency market requires understanding whether you’re in a bull or bear market. These terms describe the overall trend of the market and can significantly impact your investment strategy. Here’s a breakdown to help you distinguish between the two and trade smarter.

What is a Bull Market?

A bull market is characterized by sustained price increases and positive investor sentiment. It reflects a period of economic growth and optimism.

- Sustained Price Increases: Prices consistently rise over weeks or months, with major coins climbing and altcoins following suit. For instance, Bitcoin’s surge from $10,000 to $69,000 in 2020-2021 exemplifies a bull market trend.

- Positive Investor Sentiment: There’s widespread excitement and confidence. New projects launch with high valuations, and money flows in rapidly.

- Favorable Economic Indicators: Bull runs often coincide with low interest rates and easy access to credit, creating a conducive environment for investment.

What is a Bear Market?

A bear market is defined by prolonged price declines, negative investor sentiment, and overall pessimism. It often coincides with economic downturns.

- Prolonged Price Declines: Prices consistently fall, with minor bounces quickly sold off. The “crypto winter” of 2018, when Bitcoin crashed from $20,000 to around $3,000, is a prime example.

- Negative Investor Sentiment: Fear dominates, with grim headlines and social media silence. Funding dries up, and even long-term believers question their investments.

- Adverse Economic Conditions: High interest rates, inflation, and tightening monetary policies exacerbate the downturn.

Fun Fact: The terms “bull” and “bear” originated in 18th-century England. “Bearskin jobbers” sold bearskins they didn’t own, betting on price declines. The term “bull” came later, representing the upward thrust of a bull’s horns.

Key Indicators to Identify Market Phases

While no single indicator is foolproof, several can help you determine the current market phase.

1. Trading Volume

Trading volume reflects the conviction behind price movements. In a bull market, rising prices are supported by strong trading volume. Conversely, bear markets see dwindling volume, indicating weak buying pressure.

Low volume and declining prices signal a potentially prolonged downtrend.

Did you know? During the 2021 bull run, Dogecoin saw nearly $70 billion traded in a single day as its price soared.

2. Market Sentiment

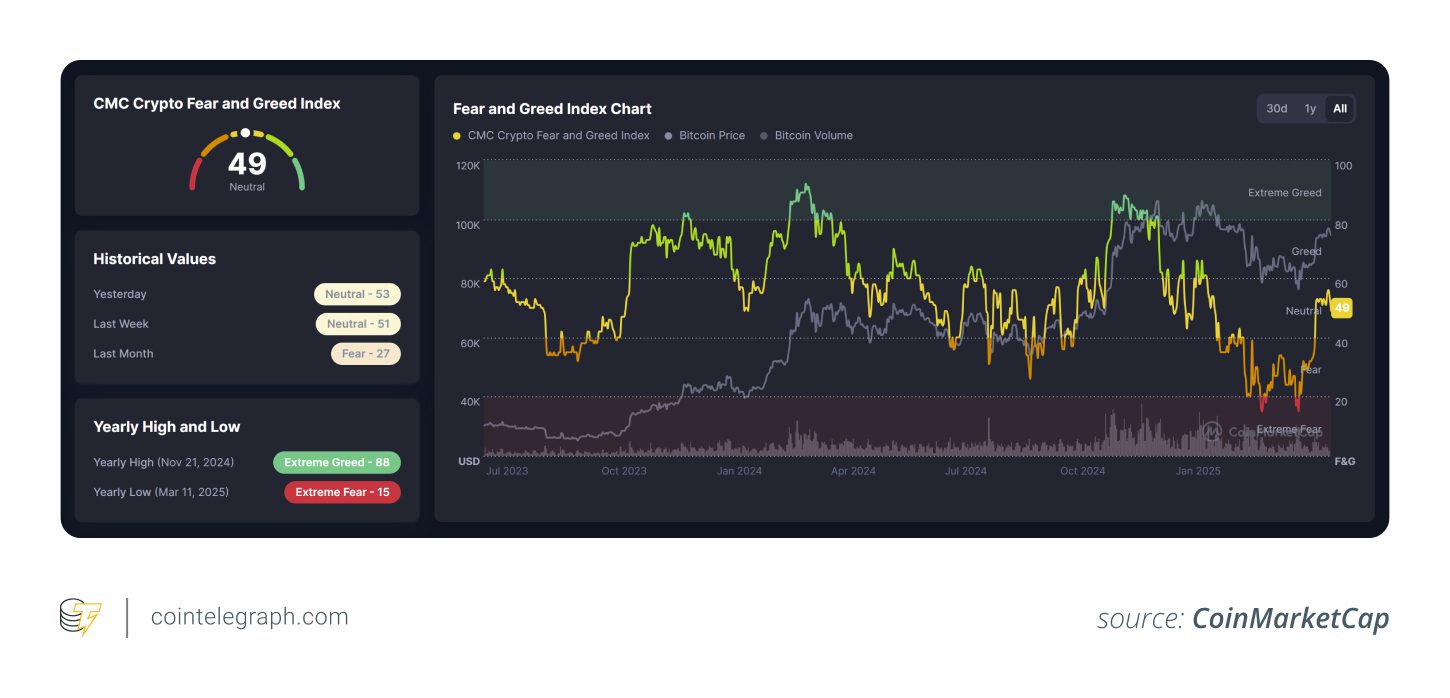

The Crypto Fear & Greed Index gauges investor sentiment by analyzing social media activity, volatility, and search trends. Extreme greed often precedes market tops, while extreme fear can signal bottoms.

3. Technical Indicators

Technical analysis tools can provide insights into market momentum.

- Moving Averages: A price consistently above the 200-day moving average suggests a bullish trend. Conversely, dipping below signals caution.

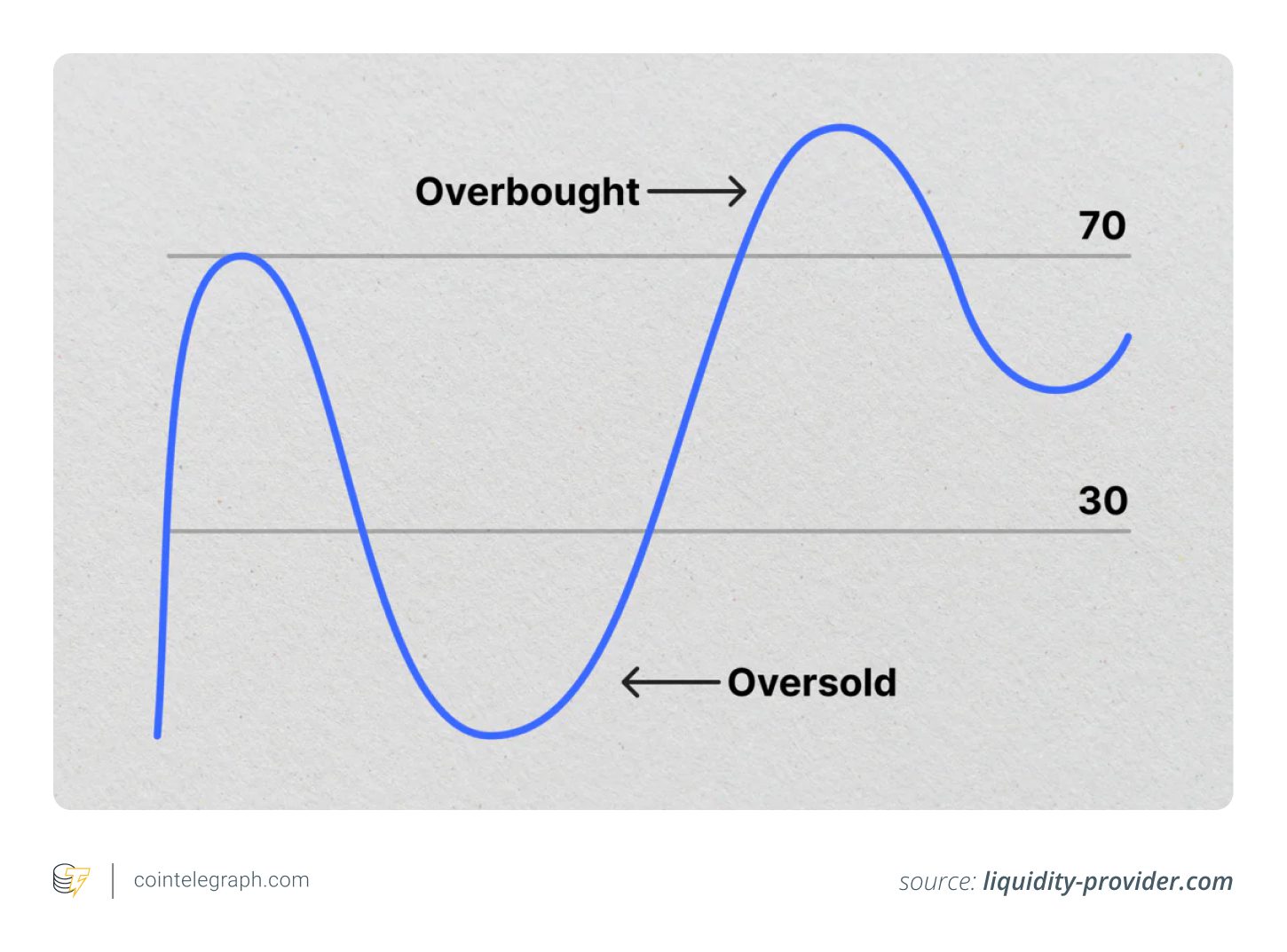

- Relative Strength Index (RSI): RSI measures whether an asset is overbought (above 70) or oversold (below 30), indicating potential pullbacks or bounces.

4. Fundamental Factors

Market movements are often influenced by external factors:

Bullish Signals:

- Institutional adoption (e.g., BlackRock applying for a Bitcoin ETF).

- Favorable regulatory news.

- Major tech upgrades (e.g., Ethereum upgrades).

Bearish Signals:

- Regulatory crackdowns (e.g., SEC targeting major exchanges).

- Security breaches.

- Global economic instability.

Tools for Market Analysis

Leverage these tools to stay informed:

- Charting Platforms: TradingView offers customizable charts and technical indicators.

- Sentiment Analysis: LunarCrush tracks social media activity and trending tokens.

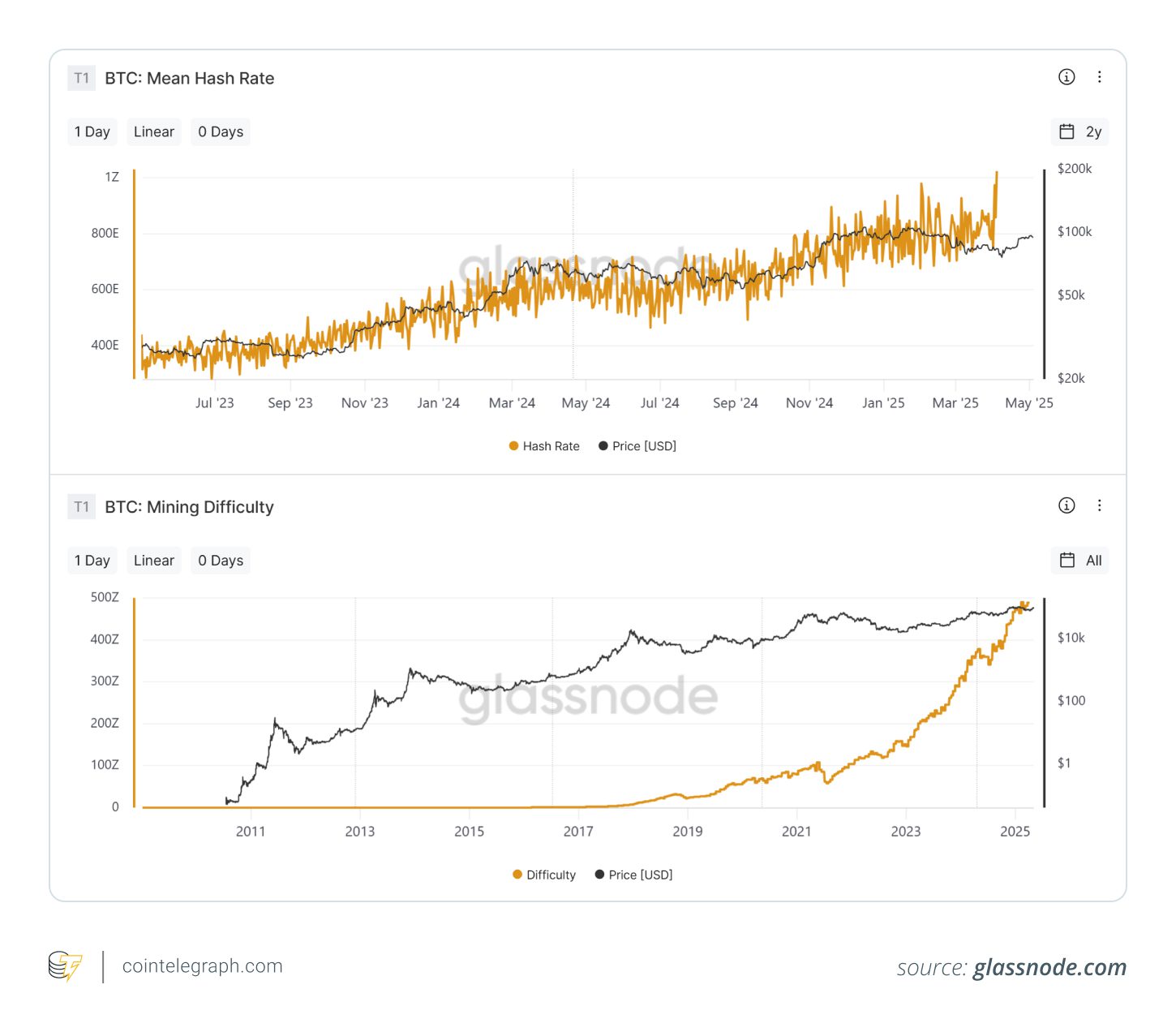

- On-Chain Data: Glassnode and CryptoQuant provide insights into wallet flows and miner activity.

Strategies for Different Market Conditions

Bull Market Strategies

- Trend Following: Focus on assets in strong uptrends.

- Profit-Taking: Set and adhere to profit targets.

- Risk Management: Use stop-losses to protect against reversals.

Bear Market Strategies

- Defensive Positioning: Move part of your portfolio to stablecoins or less volatile assets.

- Dollar-Cost Averaging (DCA): Spread your entries over time to lower your average cost.

- Focus on Fundamentals: Prioritize projects with real use cases and strong teams.

Conclusion

Understanding market cycles, monitoring key indicators, and adapting your strategies are crucial for successful crypto trading. By staying informed and proactive, you can navigate both bull and bear markets effectively.