Bybit, a leading cryptocurrency exchange, has unveiled a series of security enhancements in response to a substantial $1.4 billion hack that occurred earlier this year.

The security breach, which took place in February, involved the theft of liquid-staked Ether (STETH), Mantle Staked ETH (mETH), and other ERC-20 tokens, marking one of the largest security incidents in crypto history.

To mitigate future risks and restore user confidence, Bybit has implemented a three-pronged security upgrade focusing on rigorous security audits, fortified wallet protection, and improved information security protocols.

Here’s a quick rundown of the key developments:

- Security Audits: Bybit completed nine security audits within a month of the breach, employing both in-house experts and independent external specialists.

- Wallet Fortifications: Enhanced cold wallet protocols, revamped operational safety procedures with expert supervision, and adopted multiparty computation (MPC) for added protection.

- Information Security Improvements: Achieved ISO/IEC 27001 certification, encrypting all internal and customer communications and data storage.

- Liquidity Recovery: Bybit has nearly recovered to pre-hack liquidity levels.

- Lazarus Bounty Program: Continuing efforts to trace stolen funds, with over $2.3 million in bounty rewards distributed to date.

Why It Matters

This security overhaul is critical for several reasons:

- Restoring Trust: A major hack can erode user trust. Bybit’s proactive response aims to reassure users and demonstrate a commitment to security.

- Market Stability: Exchange security is paramount for overall market stability. Robust security measures reduce the risk of large-scale disruptions caused by hacks.

- Regulatory Scrutiny: As crypto regulations tighten globally, exchanges must demonstrate robust security practices to comply with regulatory requirements.

Market Impact

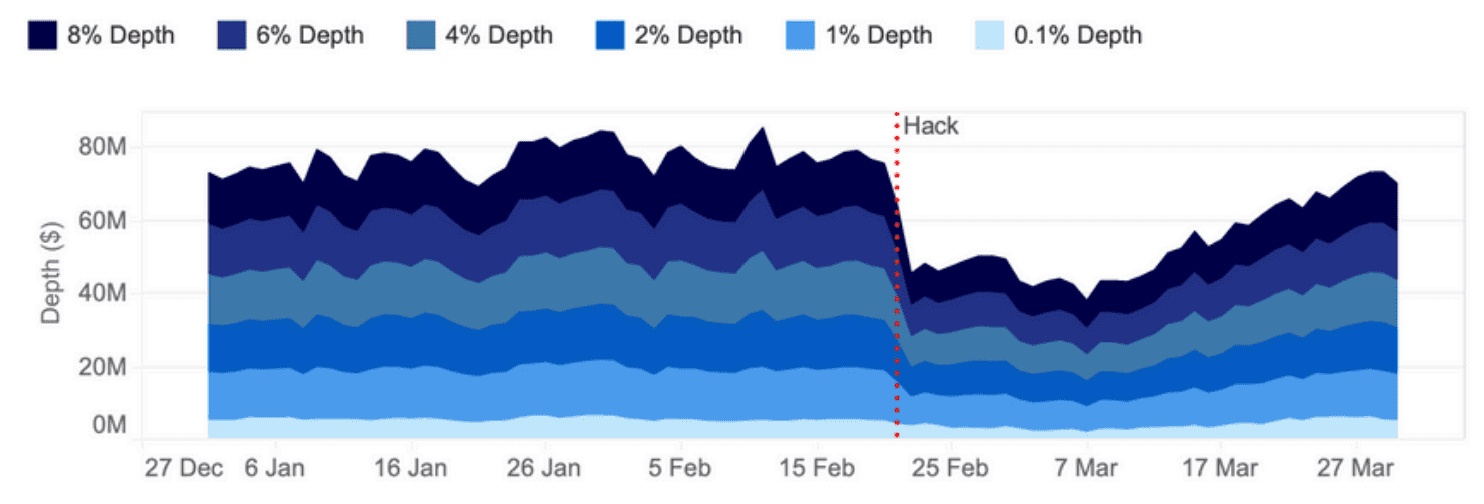

According to a Kaiko report, Bybit’s Bitcoin (BTC) market depth (within 1% of the price) rebounded to an average of $13 million just 30 days after the hack. Altcoin liquidity has also recovered significantly.

This rapid recovery indicates the exchange’s resilience and the effectiveness of its measures to attract institutional liquidity, particularly through Retail Price Improvement (RPI) orders.

Expert Take

While Bybit’s technical upgrades are commendable, the exchange rightly points out the increasing threat of attacks targeting human error. As Ronghui Gu, co-founder of CertiK, noted, attackers are increasingly exploiting human behavior rather than code. This shift necessitates a greater emphasis on user education and awareness training within the crypto space.

Actionable Insight

Here’s what traders and investors should consider:

- Stay Informed: Keep abreast of security updates from exchanges you use.

- Enhance Personal Security: Use strong, unique passwords, enable two-factor authentication (2FA), and be wary of phishing attempts.

- Diversify: Don’t keep all your crypto assets on a single exchange. Diversify across multiple platforms and consider cold storage for long-term holdings.

- Risk Assessment: Understand the security risks associated with different exchanges and platforms before depositing funds.

Conclusion

Bybit’s response to the $1.4 billion hack is a positive step towards enhancing security within the crypto industry. While technical defenses are crucial, it’s equally important to address the human element. Moving forward, exchanges and users must work together to stay ahead of evolving threats and safeguard the crypto ecosystem.