Cardone Capital’s Innovative Bitcoin and Real Estate Fund

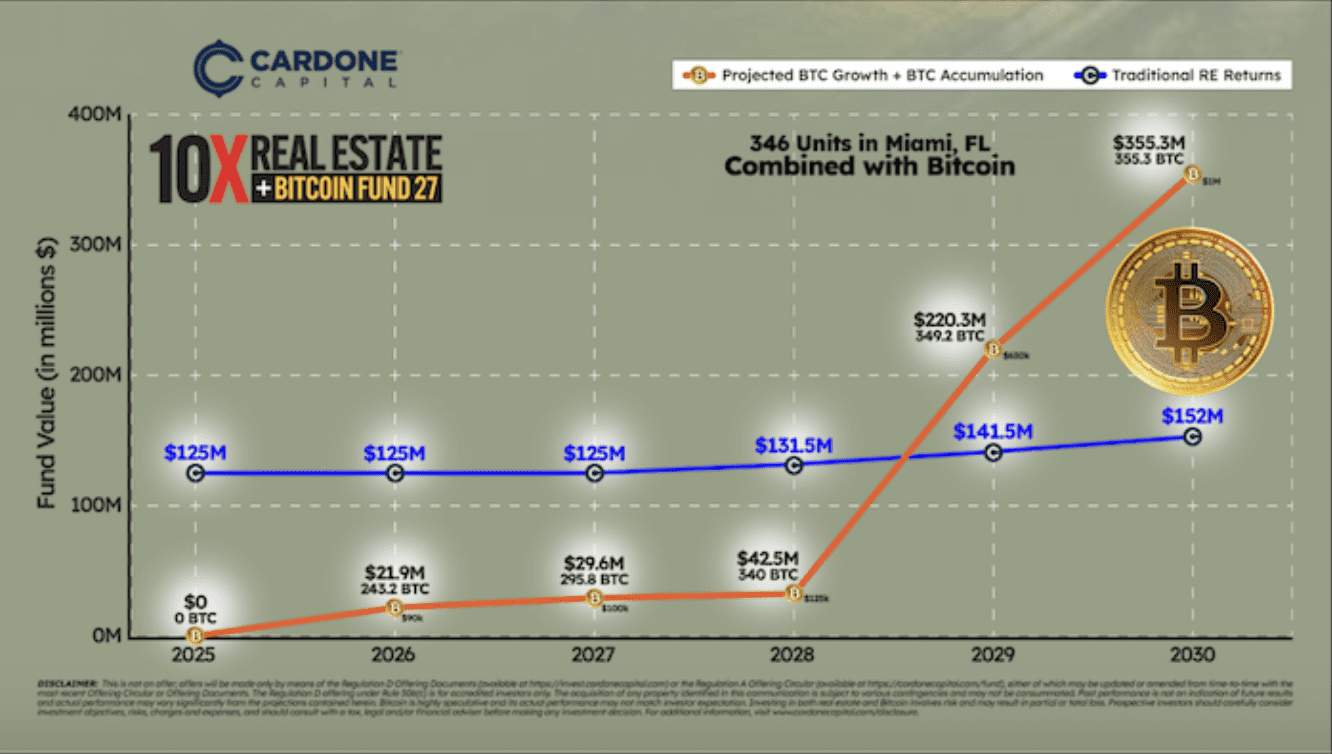

Cardone Capital, a prominent real estate investment firm managing over $5 billion in assets, has recently launched the 10X Miami River Bitcoin Fund. This dual-asset fund combines a 346-unit multifamily commercial property located on the Miami River in Miami, Florida, with a $15 million investment in Bitcoin (BTC). The fund represents Cardone Capital’s fourth venture into blended investment vehicles, strategically mixing BTC with commercial multifamily real estate.

In an interview with Cointelegraph, Cardone Capital founder and CEO Grant Cardone shared the inspiration behind the Miami River Bitcoin Fund, attributing it to a suggestion from his brother. Cardone stated that analyzing the potential returns of converting real estate cash flow into Bitcoin over the past 12 years revealed a substantial opportunity. He noted that a $160 million investment could have grown to approximately $3 billion.

This realization prompted Cardone to create a fund that acquires real estate, incorporates Bitcoin, and uses the cash flow from real estate to further invest in Bitcoin.

Fund Goals and Strategy

Cardone Capital’s long-term objective for its hybrid funds is to accumulate $1 billion in real estate and $200 million in BTC. The company plans to hold the Bitcoin as a treasury asset.

This unique approach of integrating income-producing hard assets with Bitcoin as a store of value has the potential to disrupt the traditional market for real estate investment trusts (REITs) and other commercial real estate investment vehicles. The blended model aims to offer investors a diversified portfolio with both stable income from real estate and potential capital appreciation from Bitcoin.

Onboarding Users to Bitcoin

Beyond financial returns, Cardone aims to introduce both investors and tenants to Bitcoin without requiring them to possess extensive technical knowledge. One proposed initiative involves a rewards program for long-term tenants who consistently pay on time and exhibit responsible renter behavior. These tenants would receive rewards in Satoshis (the smallest unit of Bitcoin).

The hybrid real estate BTC funds are designed to increase Bitcoin adoption by providing investors with exposure to the digital asset within a familiar and understandable real estate investment framework. This approach caters to individuals who might otherwise avoid Bitcoin due to perceived technical complexities.

Cardone emphasizes that they are guiding people into a real estate vehicle that they comprehend while simultaneously investing in Bitcoin on their behalf.

Future Plans: Bitcoin Mortgages

Cardone also revealed plans to collaborate with other financial institutions to develop a hybrid Bitcoin mortgage product. This product would enable clients to borrow against their combined Bitcoin holdings and the equity in their real estate investments, further integrating Bitcoin into the traditional financial system.

Key Takeaways:

- Dual-Asset Fund: Combines real estate and Bitcoin for diversified investment.

- Bitcoin Treasury: Aims to accumulate $200 million in BTC as a treasury asset.

- Bitcoin Adoption: Seeks to onboard investors and tenants to Bitcoin through accessible real estate investments.

- Hybrid Mortgage: Plans to offer Bitcoin-backed mortgages in the future.

- Disruptive Potential: Could challenge traditional REITs by blending income and growth assets.

The Significance of Blending Real Estate and Bitcoin

The creation of the 10X Miami River Bitcoin Fund highlights an innovative approach to investment. By combining the tangible stability of real estate with the growth potential of Bitcoin, Cardone Capital is carving out a unique niche. This strategy not only attracts a wider range of investors but also addresses the evolving landscape of financial markets, where digital assets are increasingly becoming integrated into traditional investment portfolios.

Furthermore, the emphasis on educating and onboarding users to Bitcoin reflects a broader trend in the cryptocurrency industry. Simplifying access and reducing the technical barriers to entry are crucial for driving widespread adoption. Cardone’s initiatives, such as the tenant rewards program, demonstrate a practical approach to integrating Bitcoin into everyday life.

The potential for Bitcoin-backed mortgages represents another significant step toward mainstream acceptance of digital assets. By leveraging Bitcoin holdings as collateral, individuals can unlock new financial opportunities and further integrate cryptocurrency into the traditional financial ecosystem.