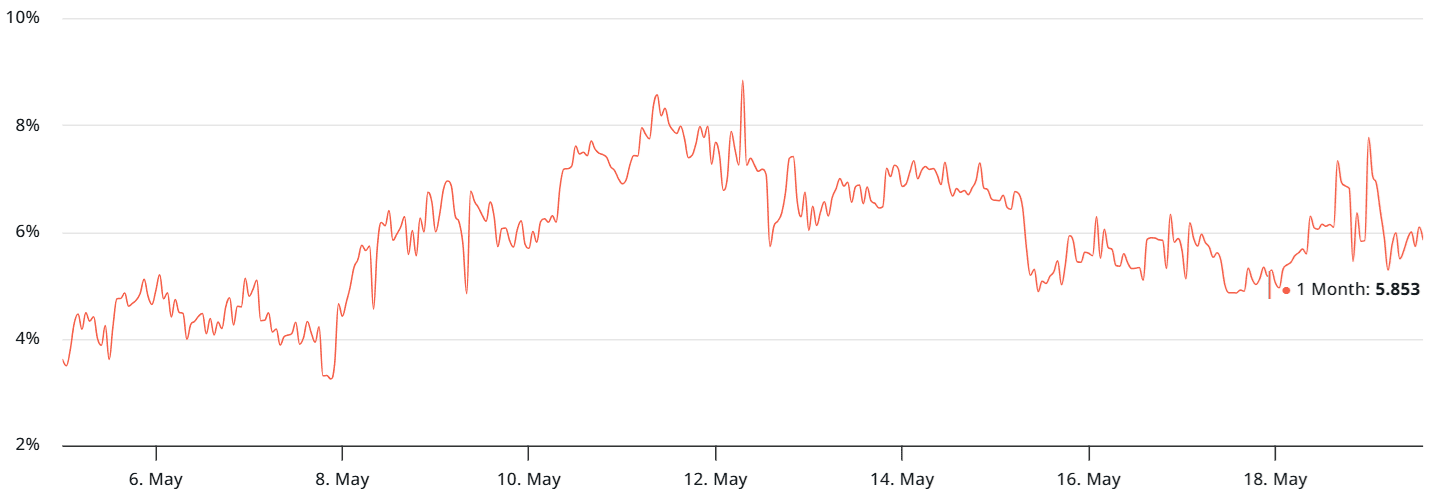

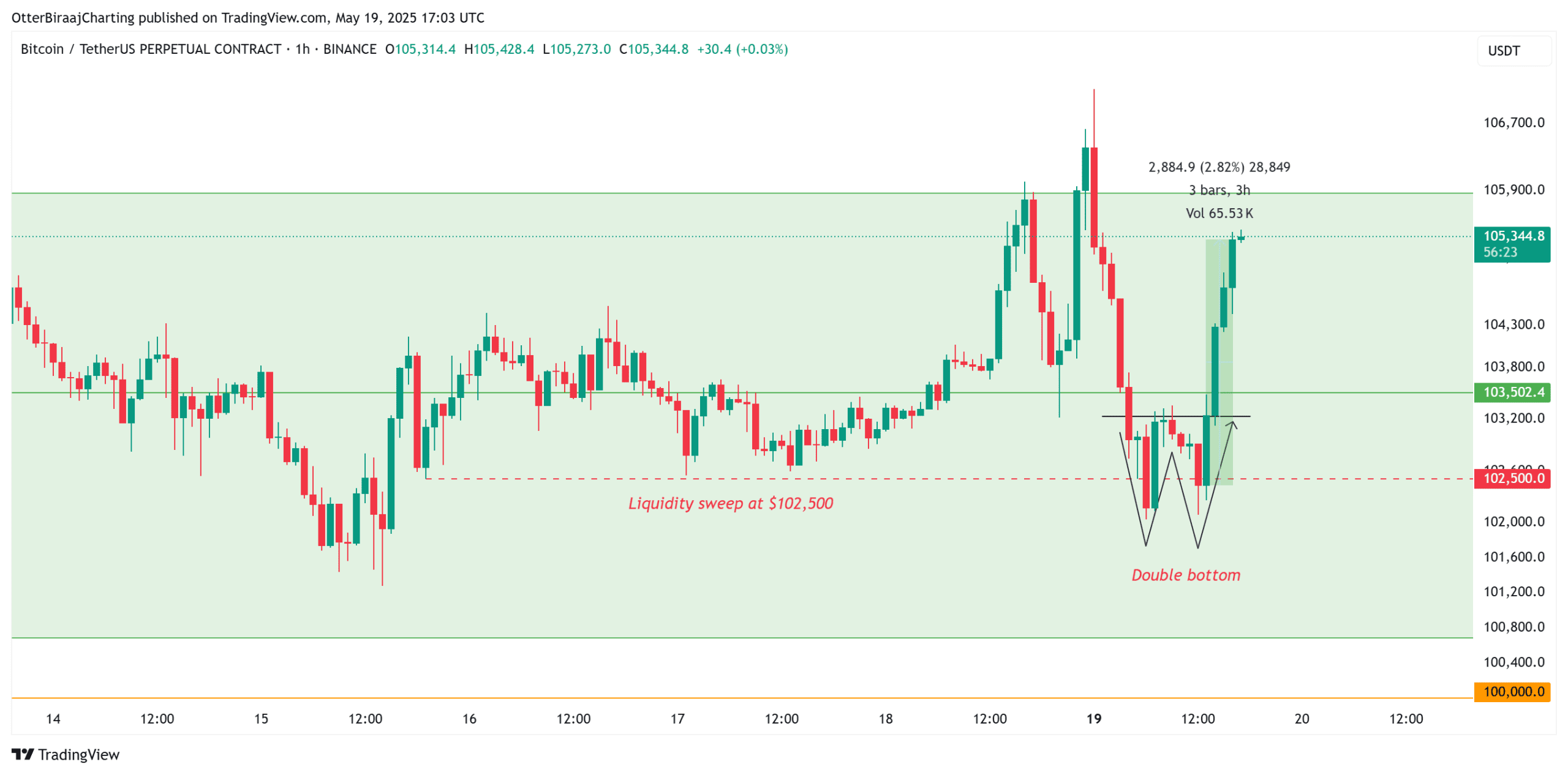

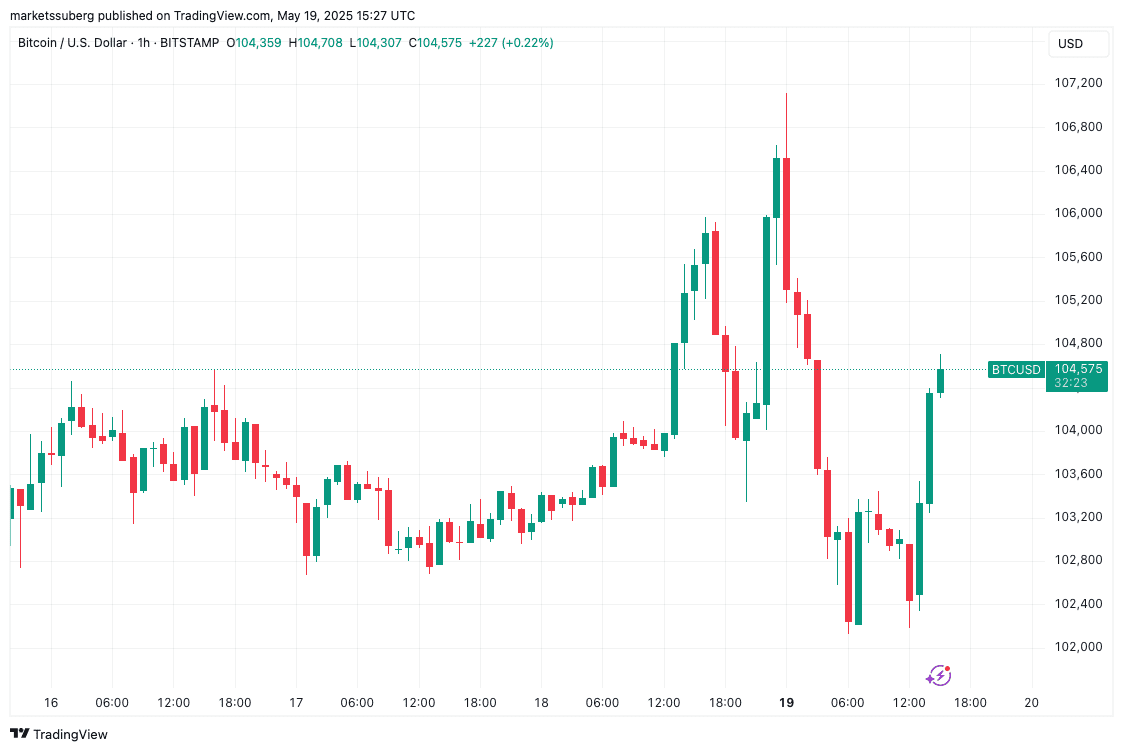

Bitcoin is approaching a potential price discovery phase above $110,000, which could trigger the liquidation of over $3 billion in short positions. Analysis suggests a bullish trend supported by technical indicators and market dynamics.

Category: Markets research

Bitcoin Futures Data Suggests New All-Time Highs Possible Despite Economic Concerns

Analysis of Bitcoin futures, stablecoin demand, and global economic factors indicates a potential for new all-time highs despite recent market volatility and concerns over global economic stability.

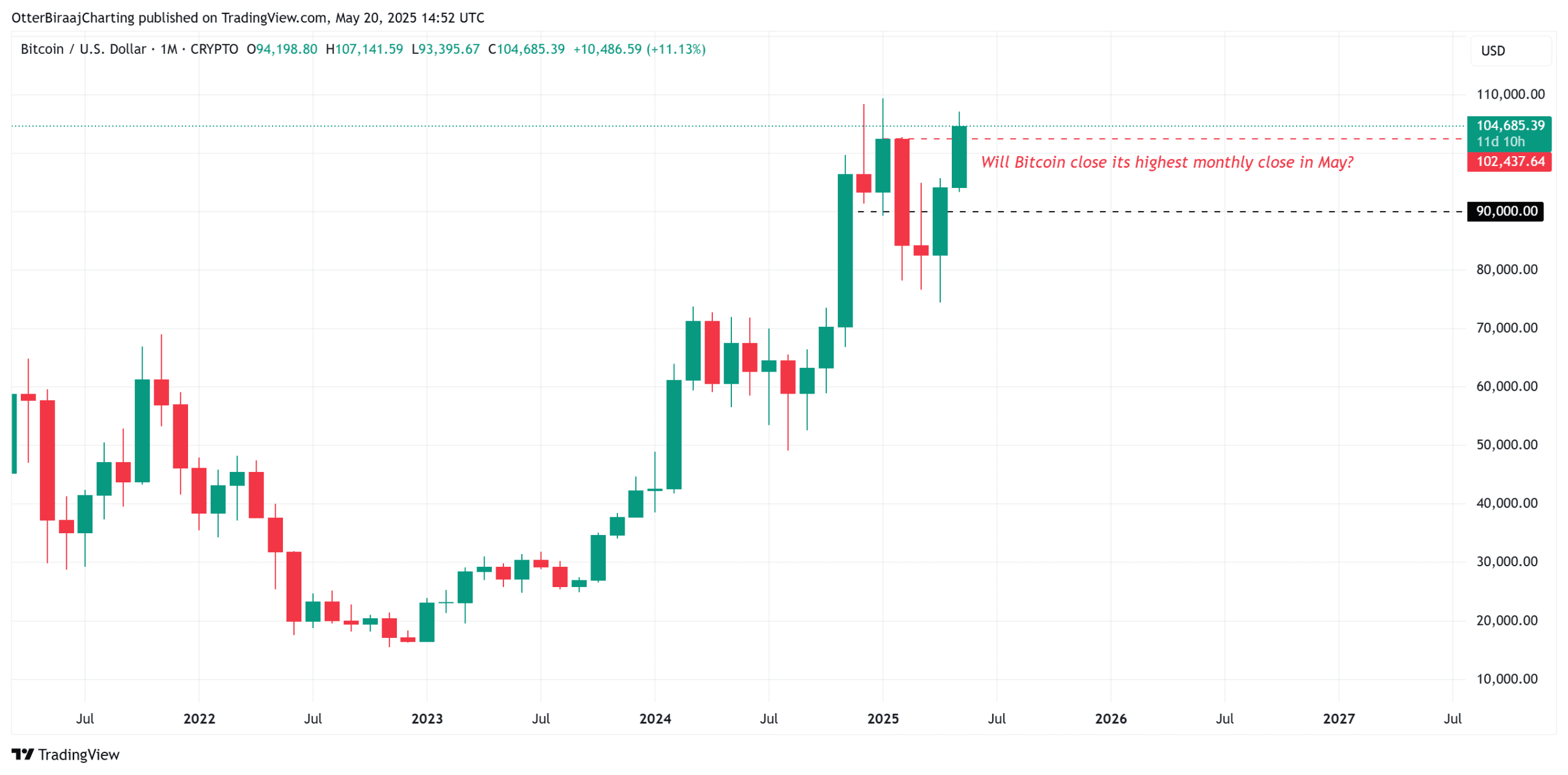

Bitcoin Fractal Analysis: Projecting New All-Time Highs Above $110K

Bitcoin’s price action is exhibiting fractal patterns suggesting a potential surge to new all-time highs above $110,000. This analysis delves into the key technical indicators and on-chain data supporting this forecast, while also considering potential bearish divergences.

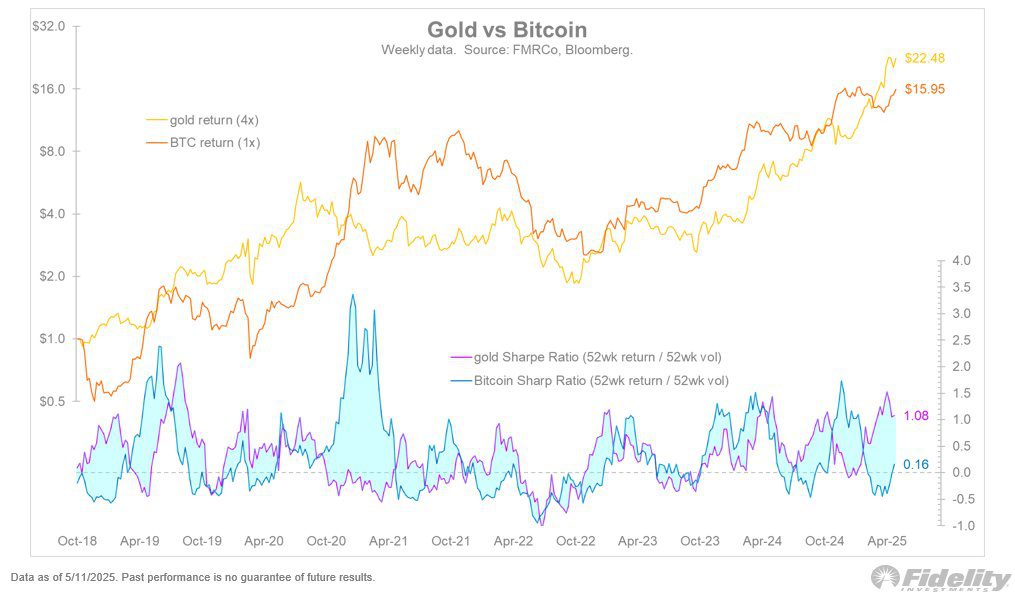

Bitcoin vs. Gold: Is BTC Ready to Take the Store-of-Value Crown? Fidelity Exec Weighs In

Analysis suggests Bitcoin’s risk-adjusted returns are becoming increasingly comparable to gold, potentially signaling a shift in the store-of-value landscape. Experts predict potential price surges for BTC in 2025.

Bitcoin Price Analysis: Bull Market Nearing End or New Highs Incoming?

Bitcoin (BTC) price action faces volatility, with traders debating whether the bull market is ending or if new all-time highs are on the horizon. Key levels and analyst perspectives examined.